AND HOLIDAY SCHEDULE

Released regularly on Thursday afternoon or as needed in case of urgent matters.

Trading Update – 7 Nov 2024

All times hereafter are expressed in the MetaTrader platform time – GMT+2 (CET+1).

Maintenance

There is no maintenance scheduled for this weekend.

cTrader trading default unit convention change

On the cTrader platform, each symbol group can be presented with either ‘Lots’ or ‘Units’ volume notations. Based on the platform asset settings, the related calculations appear in the cTrader User Interface.

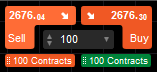

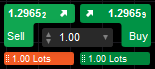

Currently, XAUUSD displays volume in contracts⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀Forex displays in lots

⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀

⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀

Starting Sunday, 17 Nov 2024, any newly created cTrader accounts will, by default, display volumes of all symbols in ‘Lots’. Note that this is just a default account setting that can be changed in the platform itself. If you prefer displaying the volume in contracts, you can change the settings in the cTrader platform in Settings/Assets.

This GUI change will not affect any open positions, however, this change might affect any Expert Advisors (cBots) that rely on the trading units convention. If you use algorithmic trading tools on cTrader, please make sure you review your settings and confirm the correct functionality before running it unsupervised.

Listing of NATGAS.cash on all accounts

After having natural gas on Free Trial accounts for a few weeks, we are excited to announce full listing of the NATGAS.cash symbol to all FTMO Platforms and account types. The symbol will be fully listed on Monday, 11 Nov 2024.

NATGAS.cash is a spot CFD symbol designed to track the spot price of natural gas. The contract size is 1000. The commission is 0.001% of the position’s notional value per round-trip. The default trade hours are the same as US indices, so under normal circumstances, holding positions during Monday to Friday sessions will be allowed on all account types. Therefore, all accounts can be held open Monday-Friday, but traders trading on non-Swing FTMO Accounts will have to close positions before the weekend. As always, make sure you keep an eye out for any announced holidays or maintenance windows.

Overnight rollover swaps are subject to regular changes and adjustments, reflecting, among other things, interest rate differentials and dividend adjustments. If you are holding positions overnight, please be reminded that it is your responsibility to check these swaps in the contract specification for each symbol, and to adjust (if needed) and manage your positions accordingly. FTMO is not responsible for trading results affected by swap changes or adjustments.

The situation in Ukraine - geopolitical development, sanctions, and markets

Due to the war in Ukraine, traders can experience increased uncertainty in the markets, accompanied by increased volatility on many assets, along with the possibility of price spikes, whipsaws, flash crashes, spread widening and liquidity supply issues. Traders are advised to pay extra caution while trading during these times. Risk management and capital preservation should be the key focus of every trader, just as being aware and adaptive to the market conditions that might be unpredictable or risky.

Unfortunately, at this time, we are not allowed to process payments to regions of Crimea, Sevastopol, Donetsk, Kherson, Luhansk, and Zaporizhzhia in Ukraine and our clients from there, as per the latest sanctions imposed in connection with the war in Ukraine. There are also sanctions targeting some Russian banks and high-profile individuals. We are not allowed to process any payouts to clients and banks on the sanction list. Payouts to our clients from/in the subject locations, or being subject to the sanctions list, will be possible once the imposed sanctions are lifted. Crypto payouts are included in the restrictions.