How to trade gaps in the markets?

Anyone who has been trading in the financial markets for some time has probably encountered a gap. It is a situation when a large space appears between the close price of one candle and the open price of the next candle. These situations can pose an increased risk due to their unpredictability, but also present a good opportunity for a profitable trade.

Gaps appear on the chart as areas where no trade is occurring because there are no orders at those price levels. It simply means that no trader was willing to trade at the given prices. One could say that even those who were willing to trade found no counterparty.

In extreme cases, these areas can be really large and can do a lot of damage, but usually they are relatively small areas with no trades executed and traders can use them to their advantage.

When the gaps occur

Gaps appear quite frequently in the markets and traders need to watch out for them, especially when holding trades open over the weekend or at times of important news announcements. Gaps are less common in forex because it is traded 24 hours a day and mainly weekend gaps are present. For stocks or commodities that have fixed trading hours, gaps may also occur between days when the markets are closed.

The last instance where gaps occur in the market is when important news are announced. Thus, in forex, gaps can occur at the time of macroeconomic data releases, while in equities, gaps can also occur at the time of interesting or unexpected news related to a company's operations. Commodity markets, in turn, can be particularly vulnerable to factors such as geopolitical instability and other related issues.

Many traders have unpleasant experiences with gaps, especially when they occur during the trading day. It happens just when there is some surprising news in the market and if the gap manifests itself by moving the price in the opposite direction to the trader's speculation, significant negative slippage can occur. The danger is that even if the trader has set his stop loss correctly and is not risking too much money on the trade, this slippage caused by the gap can increase his loss significantly. On the other hand, if the gap manifests itself by moving the price in the "right" direction, the trader can make more money with the positive slippage than he would have made with his original Take Profit

Gaps are important for traders using technical analysis because they indicate changes in market sentiment and signify a shift in the balance between supply and demand. Thus, more experienced traders can use them to their advantage, depending on where or at what stage of the trend the gaps occur.

Common Gaps

Common gaps occur in quieter markets and are not very significant to traders because they are not tied to important news or events. They fill relatively quickly (i.e. the price returns to the level where the gap was created) and are not a good indicator of future price movement for traders. They can occur in trends, even when price is moving sideways, and are a relatively short-term manifestation of low liquidity in the markets.

Breakaway Gaps

The name implies that these gaps occur in areas where a certain price level is broken. It can be support or resistance, a trend line or a line that marks a chart formation. Thus, they can signal the beginning of a new trend, as they are an indicator of a significant change in market sentiment and, as a result, they do not get filled. Therefore, they are considered the most profitable gaps among traders.

The larger this gap and the subsequent candle, the more likely the subsequent trend will be strong. The trader should in this case open a trade in the direction of the gap, i.e. above the gap when the market is moving upwards (a case like the one shown in the figure below) and below the gap when price is moving downwards. The stop loss should be placed below the gap in the first case and above the gap in the second case.

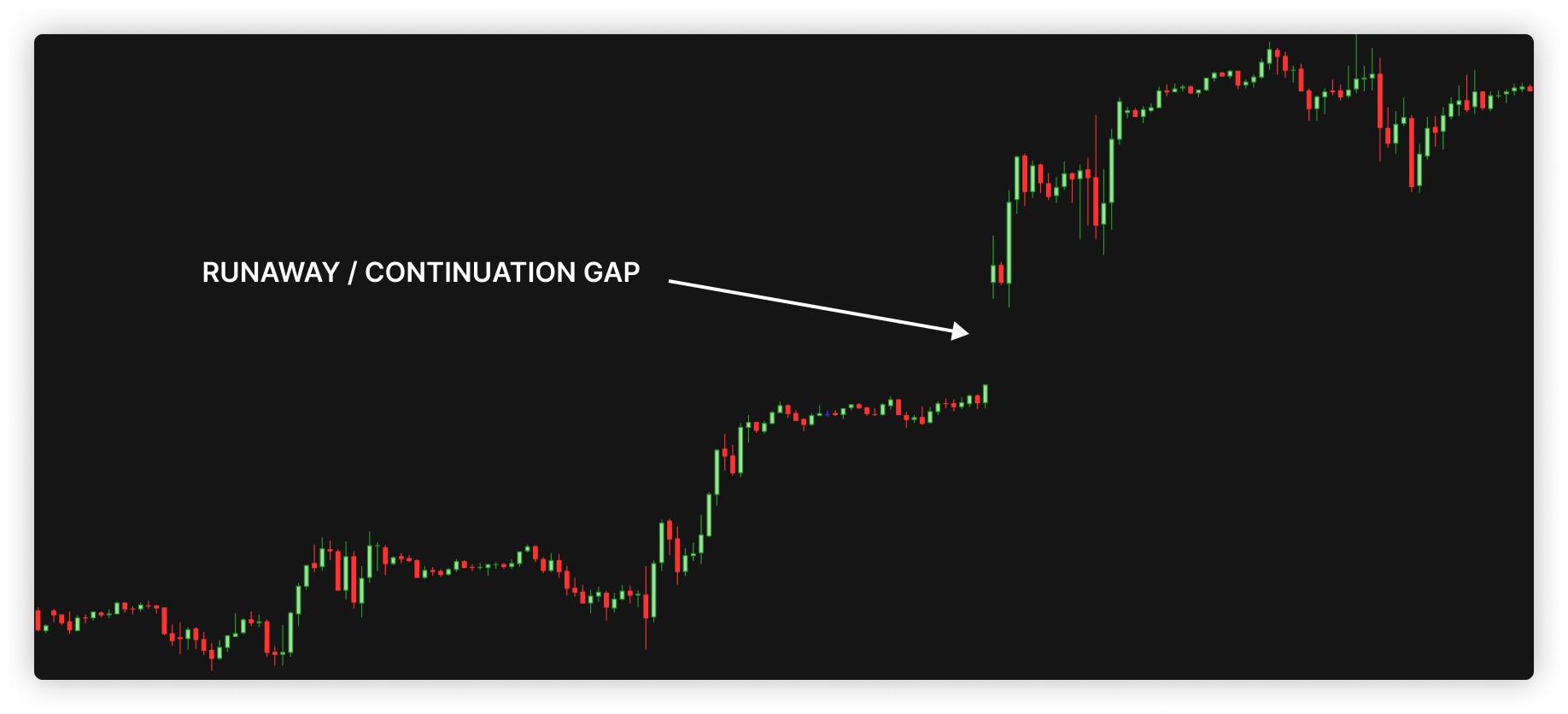

Runaway/Continuation Gaps

These types of gaps occur in strong trends with few corrections. They are similar to breakaway gaps, so they do not fill either, but differ only in the location of their occurrence. Unlike the previous type, this gap signals a rising trend and appears in the middle of that trend. It may be caused by a news report confirming the trend or simply by the growing interest of traders who have caught up with the trend and missed the beginning of it and want to "feed" on it.

As in the previous case, the trade should be opened in the direction of the gap and the Stop Loss should be placed below the gap in the case of a bullish trend (in the picture below) and above the gap in the case of a bearish trend. Since this gap very often occurs in the middle of a given trend, it can be a good indicator of how much longer the trend will last.

Exhaustion Gaps

As the name suggests, exhaustion gaps occur at the end of a trend or at a significant price level marking support or resistance. Inexperienced traders may confuse it with a runaway gap, as it is formed in the direction of the current trend and new highs (in a bull trend) or lows (in a bear trend) may be formed after it. These are caused, as in the previous case, by the increasing interest of traders that enter late into the trend.

However, unlike the previous types of gaps, in this case the gap is filled and the trend reverses. One of the fundamental differences from a runaway gap in this case is the extremely high volume, but it disappears in a short period of time. Therefore, more experienced traders monitor not only the price, but also the trading volume and expect a reversal of the current trend if the volume of the gap increases significantly. They then place their orders accordingly, placing stop losses above the gap if the market is heading down (figure below), or below the gap if the market is heading up.

Gap charts can be a valuable source of information about changes in market sentiment and subsequent price movements, but are not suitable for less experienced traders. More experienced traders who can distinguish between the different types of gaps and understand their origins and potential impacts can use gaps to their advantage very well. However, even with gap trading, it is essential to follow the rules of risk management, as these are relatively unpredictable situations associated with increasing volatility. Trade safe!

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?