What profitable swing trading looks like

In the next part of the series on successful traders, we will look at two FTMO Traders who use the swing approach and keep their positions open for several days. This approach may not be followed by many traders here, but today's case is proof that it can be a very profitable way of trading.

The first trader's curve shows that the beginning and the end of the trader's trading period were not very successful, but he managed to make an interesting amount of money in the meantime. If a trader is consistent enough, he can afford several periods of no profit and end up with a very interesting return.

A return of over $74,000 on an account size of $400,000 is a great result. Furthermore, the trader had no problem with loss limits as the biggest loss occurred right at the beginning of his trading period. The combination of a very good average RRR (3.40) and a high trade success rate (66.67%) helped the trader to make a very good profit.

Over the course of thirteen trading days, the trader executed 27 trades with a total size of 180.11 lots, which is just over two trades per day with an average size of 6.67 lots. For an account size of $400,000, this is a fairly conservative figure.

Although the trader sometimes opened multiple positions, the maximum trade size per position was around 30 lots, which is still okay. The trader kept the trades open for several days, so he is not a classic intraday trader but also uses a swing approach. Meanwhile, the trades that the trader held for several days are among the most profitable, so this approach definitely pays off.

We are also positive about the placement of Stop Loss orders, but on the other hand, we see that the trader sometimes opened additional positions at a loss, which we do not recommend to most traders. However, the maximum loss per trade did not exceed $4,000, which is one percent of the account, so there is not much to worry about.

Interestingly, the trader only opened long positions, which may indicate some mental block or that the trader does not feel comfortable with short positions. Since the trader only opens long positions, it is good that he does not focus on just one instrument. The trader traded three currency pairs, with the biggest gains on the relatively exotic USD MXN pair. We even recently wrote about how it is an interesting alternative for traders looking for an alternative to the most commonly traded currency pairs.

Our second trader took a completely different approach than most traders we have covered so far in this. Again, this is a swing trader, but he took his long-term approach very seriously and only executed two trades during the trading period. This is also why his curve is not much of a curve, but rather a broken diagonal.

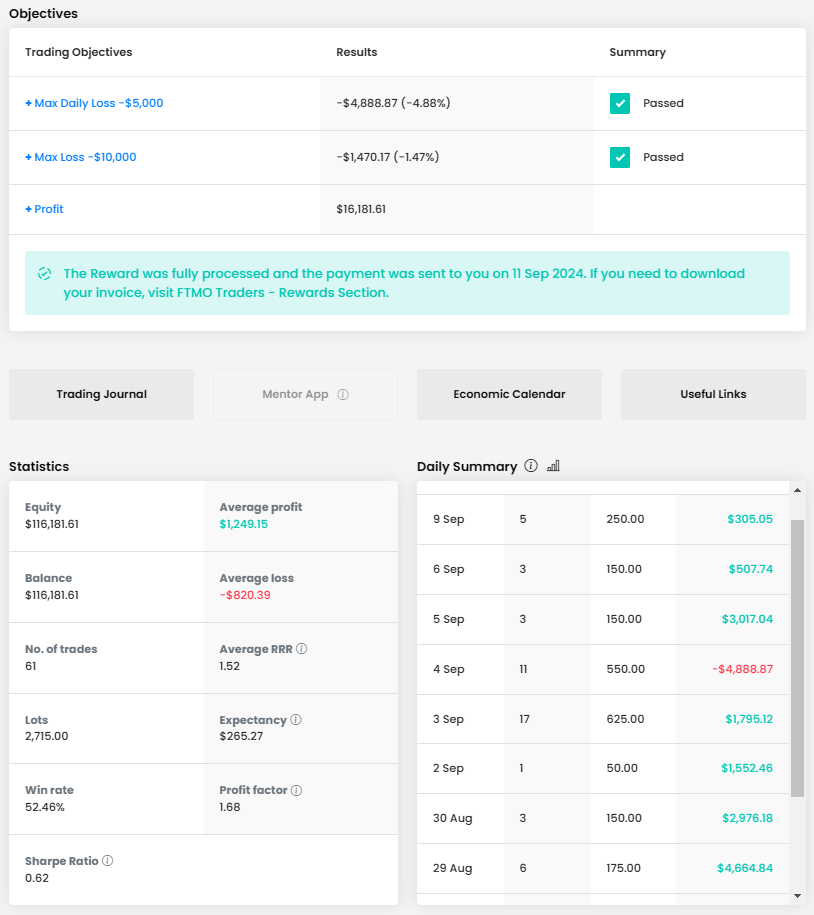

A profit of over $16,000 on an account size of $100,000 is very nice, and the trader had no problem with loss limits during trading. Unfortunately, the consistency score cannot be calculated using the number of trades, but in this case, it probably won't be a problem.

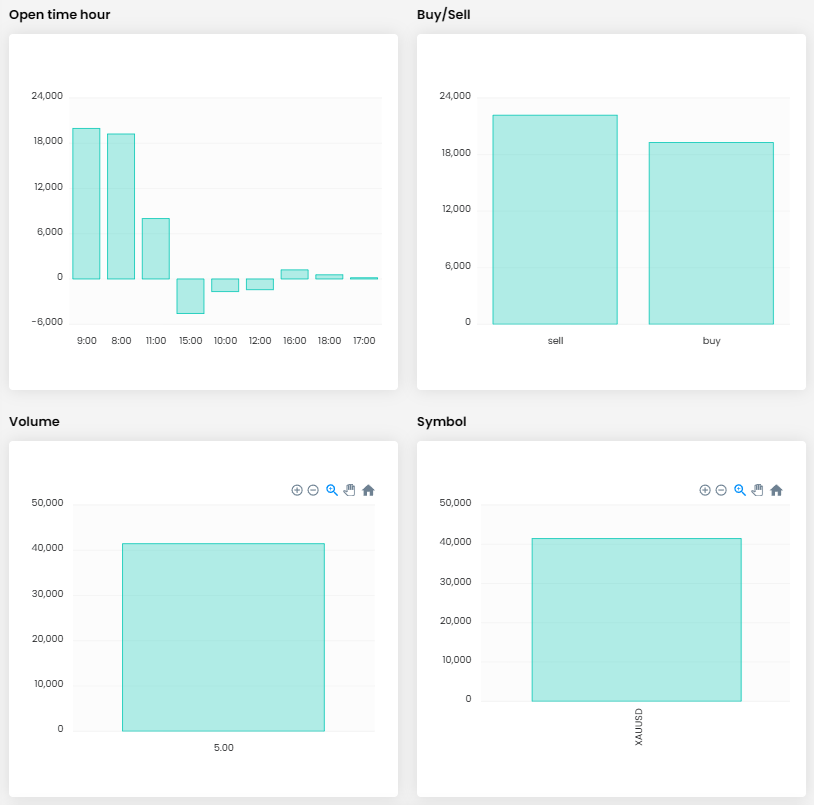

The trader opened only two trades, so we lack data on the average RRR and of course, the success rate of hid trades is 100%. Two trades with a total size of 20 lots are perfectly fine given the account size, so there is nothing to complain about here. Meanwhile, the trader has been using this style on his other accounts as well and is doing well, so there probably is not much reason for a radical change.

On the contrary, it can be said that this trader is a great example of how to use the freedom in trading style and strategy (and no limitation in the number of trading days) once a trader gets to FTMO Account. The trader took advantage of the strong downtrend and increased his position, which was trading in profit during the duration of the first trade (this is also called pyramiding). Traders who can apply this approach can increase their profit potential by increasing their positions without unnecessarily increasing their risk. So he held the first position for almost twelve days and the second for seven days. We appreciate setting both Stop Loss and Take Profit, which of course can protect the investor from unpredictable losses. Rather, the problem lies in the size, which represents 10% of the account, which we cannot evaluate very positively.

The other statistics are also rather monotonous as we do not have enough data on this account. The trader opened both positions on the US DJIA index (US30.cash), he did not need another instrument. Again, we can only conclude that the trader is following a similar strategy in other accounts, but the interesting thing is the strict limitation to only short positions. This can be an attractive approach in times of market sell-offs, but can be a problem in the event of a trend reversal. Then it is a good idea to try long positions as well, or try out one of the currency pairs, which was the case in one of his previous accounts.

In today's article, we showed that trading is not just about short-term speculation and hundreds of trades per month. Even a long-term approach, where a trader holds positions for several days, can work and bring interesting profits. It is not simply about quantity, but about quality.

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?