Focus on trading, not money

The basic motivation for trading for the vast majority of traders is money and the financial freedom that comes with it. Money can work very well as a long-term motivation to achieve good results. But as a short-term goal for individual trades, it is a very poor guide.

Whether we admit it or not, one of the main inspirations that led us to trading Forex is the opportunity to make good money. Creating, testing and fine-tuning a strategy, or writing down executed trades in a trading journal, all of these are indeed a necessity, but no one will do it without adequate results.

You can't do it without money. Really?

Education in economics and knowledge of how markets work or being able to better handle stressful situations are certainly a bonus, however, we won’t enjoy trading in the long run if we do not make any profits from trading. Some people may still be tempted to trade because of the increased adrenaline they feel when placing orders, but in this case we are talking more about gambling than trading and that is something we, as traders, definitely want to avoid.

Money = emotions

However, money should not influence the process of deciding when to enter a position. In fact, the prospect of potential earnings draws emotions into the decision-making process, which we want to avoid in trading. Whether it is the fear of a potential loss or the euphoria of the anticipated profit, emotions are in most cases a road to hell. Emotions lead to mistakes, violations of risk management and money management rules, deviation from the trading plan and, ultimately, to losses.

When we place an order and calculate the size of the Stop Loss and the Take Profit, we should not concentrate on the amount of profits we will make. We should focus on whether the signal to enter the trade is strong, whether our entry is in line with our plan, whether we will reach the right RRR when we open the position, etc. The amount of profits we will make from the trade should be the last motive on the list.

Pips instead of money

You may be asking what else you should focus on if not on earning money. First of all, it would be best to determine the number of pips we want to make and risk on each open position. It’s very simple, but it can be a great way to develop good habits and become a consistently profitable trader.

If we take a fixed RRR strategy, we can determine that a profitable trade will be 20 pips and a losing trade will be 10 pips. Firstly, we don’t have to deal with the position size, the basic idea is to make a profit of 20 pips and to lose 10 pips.

After some time, the results of our trading can look like this:

+20p, -10p, -10p, -10p, +20p, +20p, -10p, +20p, -10p, -10p, -10p, +20p, -10p, +20p, -10p, +20p, +20p.

The key is to make no adjustments and trade "like a machine", without counting money, profits, losses etc. By taking this approach, we can pick up a few habits that may come in handy in the future and have a positive effect on our trading. These include:

- healthy self-confidence,

- confidence in the trading strategy,

- resistance to the influence of unwanted emotions,

- unbiased results of the selected strategy.

Account size (doesn't) matter

With this approach, we can get used to seeing each trade as a number of pips and not as an amount of money we can make or lose. Then it is much easier to move from a smaller account to a larger one, because it won’t matter if we trade in an account with the value of $10,000 or $400,000. Each trade will only represent a number of +20p or -10p to us. It looks simple, but in Forex simple things usually work.

Once we get used to this way of looking at trades, we just need to fine-tune the optimal position size based on the account size and the risk management rules.

Practice on the platform

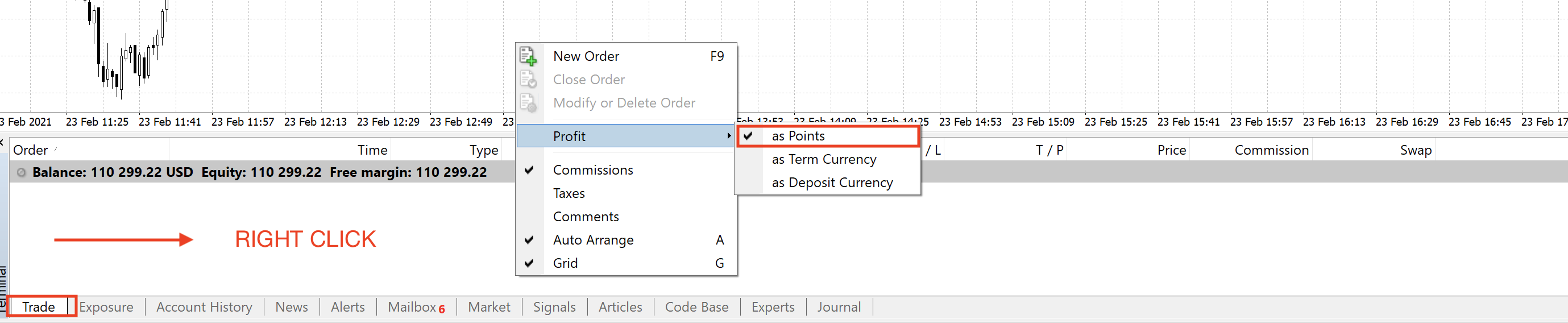

The platforms available for FTMO Accounts also consider this way of trading. Both MetaTrader 4 and 5 as well as cTrader offer the option to display results in other forms other than amounts of money . On the first image you can see the Terminal in MetaTrader, which is displayed below the chart window.

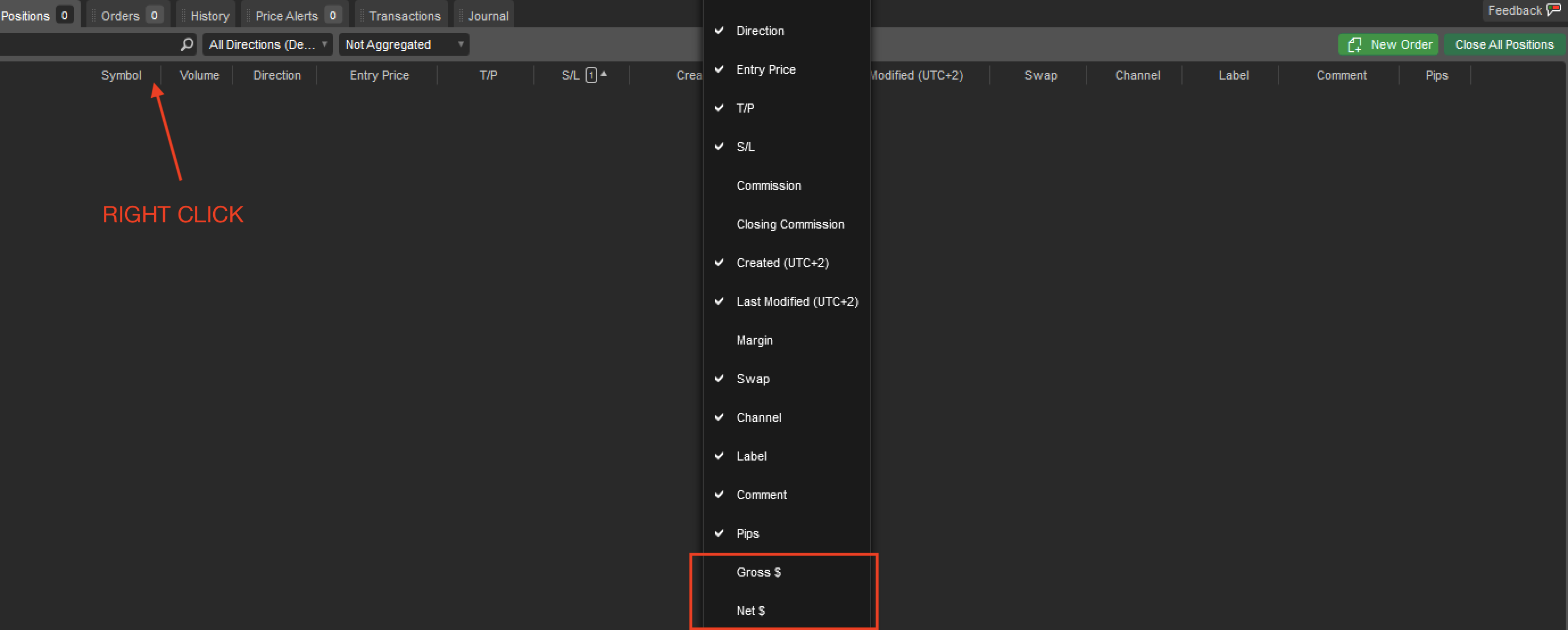

The second image is a similar option available in cTrader, to be specific it is a Tradewatch window, which is also displayed below the chart window.

The last option available not to track the progress of open trades in amounts of money (or not to track it at all) is to turn off the Terminal window, or the Tradewatch.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.