“You will never be able to completely ignore your emotions”

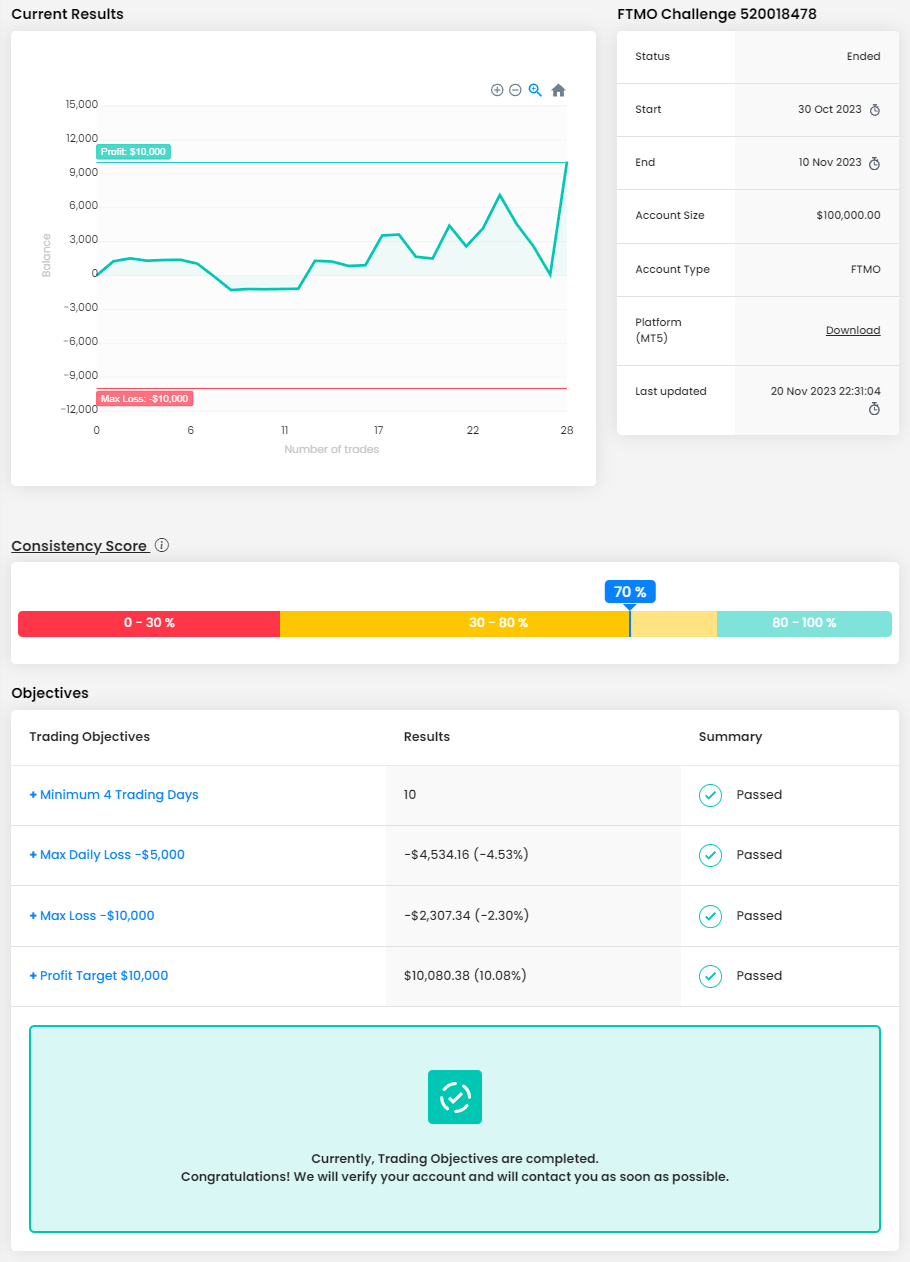

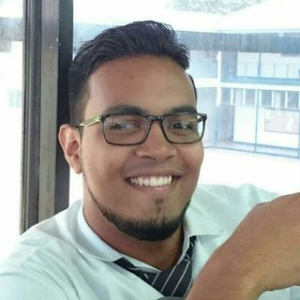

Emotions are an integral part of the trading process and the sooner each trader realizes this, the sooner they will be able to make consistent profits. Realizing this basic principle helped our new FTMO Traders Muhammad, Saleem, Neil and Samuel to successfully complete the Evaluation Process.

Trader Muhammad: “It’s better to slowly grow your account rather than blowing your account in few trades.”

How has passing the FTMO Challenge and Verification changed your life?

It made me more confident and gave me a chance to prove my skills. I am 100% more invested in improving myself after taking the FTMO Challenge. I am more profitable than before, and I am happy I took the test. It will financially help me and enable me to pursue my dreams.

What does your risk management plan look like?

Most of the time, I am looking for 1:1 RR trades or 1:1.5 RR by risking 1%, and I only increase my risk if I am already up by 3-4% on my A+ setups to aim for 1:3RR. By taking FTMO Challenge I realized, I have been more disciplined and following my trading plan more accurately.

How would you rate your experience with FTMO?

To be honest, when I thought of getting funded, there was no other prop firm that came in my mind other than FTMO because I have been following the FTMO YouTube channel for a while and watching a lot of videos. Initially, I thought I couldn’t pass the test, then I came up with a new strategy and a trading plan to pass the FTMO challenge. During the test, I had some issues and FTMO live chat support solved my issue within minutes. The last 3 weeks of trading with FTMO were the best weeks of my trading journey. Thank you FTMO for such an amazing experience and for letting me know my strengths and weaknesses.

Do you plan to take another FTMO Challenge to manage even bigger capital?

Yes, I want to start another challenge, while managing my funded account from the coming week.

Has your psychology ever affected your trading plan?

I have been practising my strategy in live markets and with more than 4 months of backtesting, I was pretty confident that if I follow my trading plan and aim for only 1% a day, I can easily achieve my daily target. I patiently wait for my entry signals and enter the trade. If I am not comfortable with the setup, I will just skip it and wait for the Perfect setup. So, my psychology hasn’t affected my trading plan so far, and I don't think it will affect it in the future.

What is the number one advice you would give to a new trader?

The number one piece of advice I would like to give to a new trader is - always risk 1% on a trade and be patient for your setup because it’s better to slowly grow your account rather than blowing your account in few trades.

Trader Saleem: “If the risk amount makes you anxious then lower the risk.”

How would you rate your experience with FTMO?

Overall, a good experience. Good spreads and quick fills. Customer service is excellent.

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

Fear of loss. Understanding the risk amount you take when entering a trade, I just the cost of the opportunity to be profitable over a series of trades. If the risk amount makes you anxious then lower the risk. Also, having a simple strategy reduces over analysis and lets you maintain your mental clarity.

What do you think is the most important characteristic/attribute to become a profitable trader?

Understanding that you will never be able to completely ignore your emotions and being able to manage them in a healthy way. Practising patience and having no expectations in trading and general life really allows for better opportunities.

What was easier than expected during the FTMO Challenge or Verification?

Coming into this challenge, I had no expectations besides becoming a better trader through the gained experiences.

What does your risk management plan look like?

Typically, I would risk 1% on the average trade and 2% on the ones I am more confident in. Despite setting a fixed risk percentage, I would observe certain levels where if the price went against me during the trade, I would close it even before it hit my stop loss. While some trades I close may have been winners, it is my belief that the only thing you control in trading is your risk amount, and therefore the only objective you need to have is capital preservation. The profits will take care of themselves.

What would you like to say to other traders that are attempting the FTMO Challenge?

Set no expectations, learn to manage your emotions, and keep it simple.

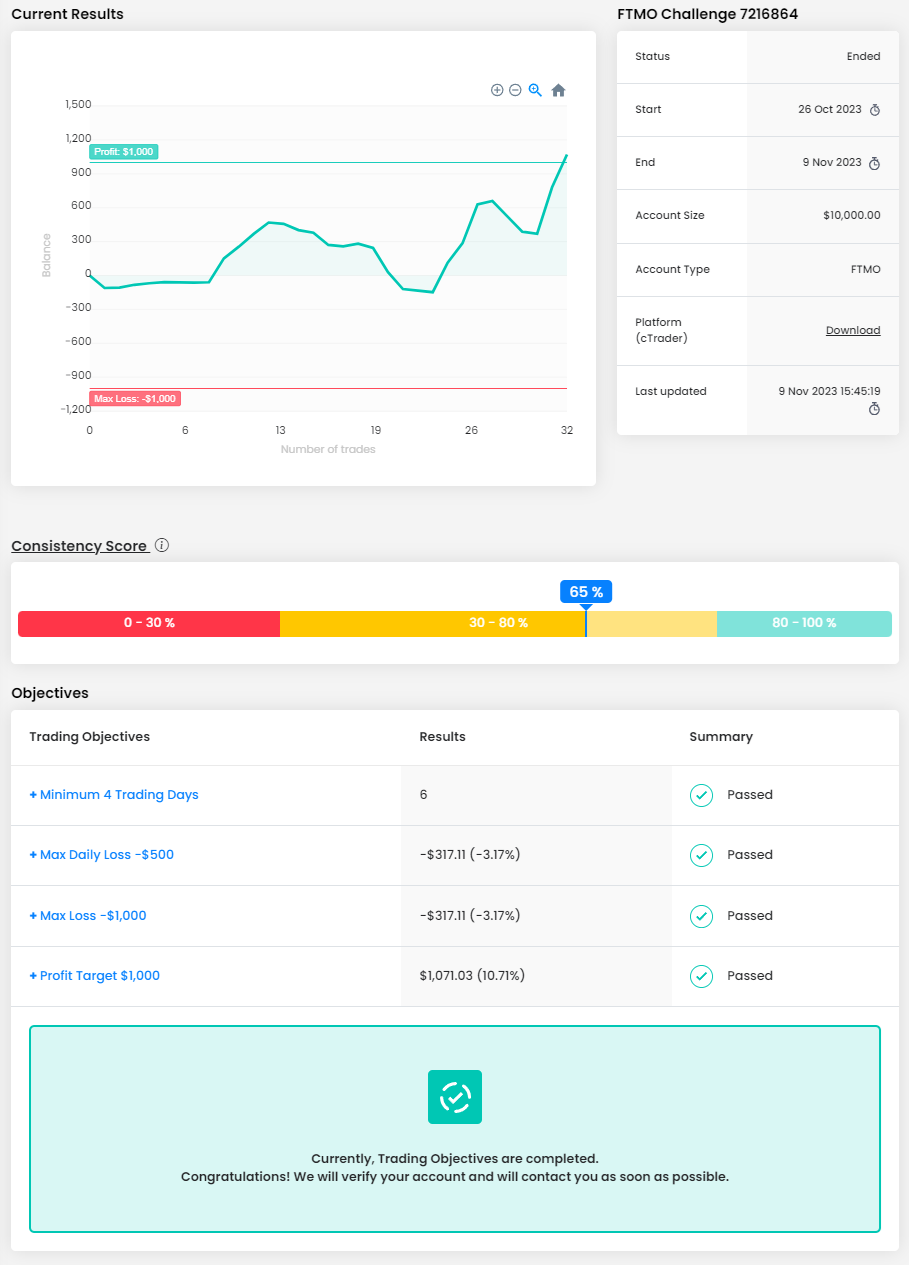

Trader Neil: “Trading is 10% strategy, 20% risk and money management and 70% mindset.”

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

During the verification stage, and at the worst possible time, just 1% away from reaching the target, I went on a terrible down swing. It took me from +4% up back down to -7.5%. I knew that if I continued at this rate, I would blow the account and end up back at square one. Although I wanted to trade my way out of it, I just wasn’t in the right state of mind. So, I decided to take a week off, clear my mind, slow everything down and then head back to the charts with a better mindset. It worked “Yes.”

What was the hardest obstacle on your trading journey?

Strategies come and go, risk management is key, but getting and staying in the right frame of mind while trading is quite possibly the most difficult thing I’ve ever had to overcome. But with my faith, meditation, and mind exercises before each trading session, I have mostly been able to overcome the worst of it.

How did loss limits affect your trading style?

It took some getting used to, so I decided to take advantage of the free trials until I had it under control. In fact, I am proud to say that having these limits has actually improved my trading style and focused my mindset on one of the most important parts of trading “Always protect your downside.”

Do you plan to take another FTMO Challenge to manage even bigger capital?

Yes. Definitely. 100% Lol.

How has passing the FTMO Challenge and Verification changed your life?

Well, outside the obvious of more money and doing what I love, it will also give me the opportunity to work from home. My family and I have sacrificed so much and now I will be able to spend more time with them, and we can share this dream together.

What would you like to say to other traders that are attempting the FTMO Challenge?

The challenge is tough but doable. Trading is 10% strategy, 20% risk and money management and 70% mindset. Focus on these areas in that proportion and you will be there most of the way. Good luck.

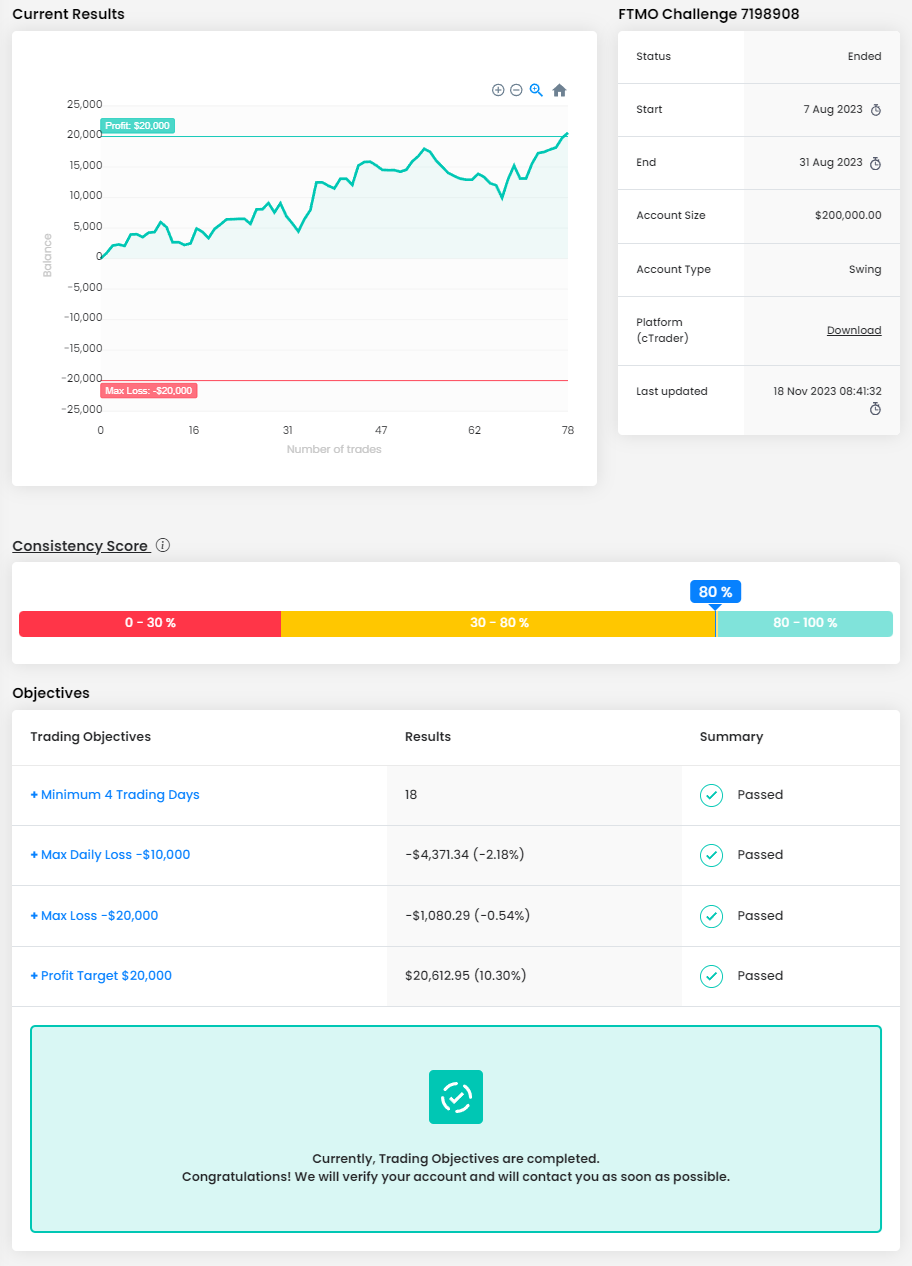

Trader Samuel: “There is nothing I set my mind to achieve I cannot achieve.”

How has passing the FTMO Challenge and Verification changed your life?

I feel fulfilled. 18 months of practice paid off. Now I believe there is nothing I set my mind to achieve I cannot achieve. I look forward to a great time with FTMO.

Describe your best trade.

I regard myself as intra-day trader. I love a trending markets, obviously. I use the 1-Day timeframe to mark out zones for TP or reversal points. I used the 4H and 1H to know the current trend of the market. I make sure my trades are in line with the trend. My best trade is when all my confluences align: demand or supply zone, liquidity sweep, price on 200EMA or 50EMA, daily Pivot level. On the lower time frame: change of character.

What does your risk management plan look like?

I focus more on New York session. My standard risk is 1%. However, if all my confluences all align, I can push it up above 1%, but less than 2%. If I find a setup, however in London session, I risk 0.5%. If all my confluences align, I can push it above 0.5% but not more than 1%. This risk management structure is because I see London as more volatile and less liquid and New York less volatile and more liquid. I only trade XAUUSD.

What was more difficult than expected during your FTMO Challenge or Verification?

I started the challenge well by making 2% profit. However, for whatever reason my SL of about 1% was not respected, so I lost about 3.5% on the trade, taking me to drawdown. This messed up with my psychology. I struggled to bring quickly break even, I went down further, till like -8%. I advised myself to focus on trading like a professional and not just passing the Challenge. I was able to bring it back up to break even, then from there it was easier to keep pushing it up and up, not without losses though. Verification was easier because I had built confidence from passing the Challenge and the experience gathered along the way.

How did you manage your emotions while you were in a losing trade?

Trading in the Zone is a book that helped me a lot. Also, I belonged to a forex support group focused on trading psychology. People post nuggets daily that helps us see the market in a realistic way. I realize I do not need 100% rate to be profitable, but a SOLID risk management and good trading edge so when losses came, I took it as part of the journey, resisting the temptation of revenge trading or over-leveraging. This paid off over time.

What would you like to say to other traders that are attempting the FTMO Challenge?

Before you start, demo trade for 2 weeks on the FTMO Free Trial. Get used to the platform and all. Make sure you have your trading edge and a solid risk management plan. Take your time, do not rush. Thank God, you now have more than 30 days.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.