You don't need to open large positions in a large account

In the next part of our series on successful traders, we will look at the approach of a trader who managed to combine several FTMO Accounts into one FTMO Account of $400,000. As a result, he was able to achieve high returns even with a relatively small number of trades and reasonably sized positions.

Modern prop trading allows you to trade with account sizes that most of you would probably never be able to reach. That doesn't mean that once you reach the FTMO Account you should automatically open the largest possible positions with the goal of making a lot of money in a short period of time. A large account, like the very leverage you trade with in forex, is a good servant but a bad master. High expectations and the desire for a quick profit are devastating in both small and large accounts.

In short, a large account allows you to make higher profits (if you are successful and have a good strategy) with much less stress. Reasonably sized positions in a large account give you the confidence that in the event of a bad period (it happens to everyone), you have a large enough margin for a longer losing streak without the threat of violating our risk management rules. When you are mentally well, you have no need to take trades that are not in line with your strategy and you simply make fewer mistakes.

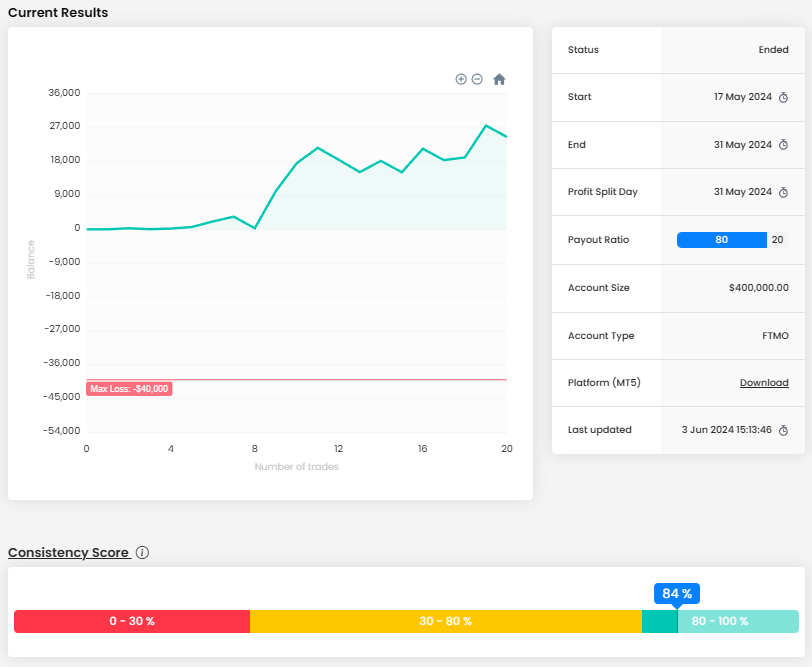

This is also the case for today's trader, who trades in a $400,000 FTMO Account, but at the same time has no need to trade unnecessarily large positions at any cost. His balance curve looks like this, and you can see that he went very "easy" in the beginning. Anyway, he didn't get into the red numbers during the trading period, which certainly helped him mentally as well. The high consistency score is then just the icing on the cake.

Thanks to this, even occasional losing trades were not a problem, so he did not have to deal with loss limits. He didn't even come close to them. The total return of $24,578 is great, although relative to the size of the account it may not look so great. Again, we're going to repeat ourselves here, but there's no play on percentage return.

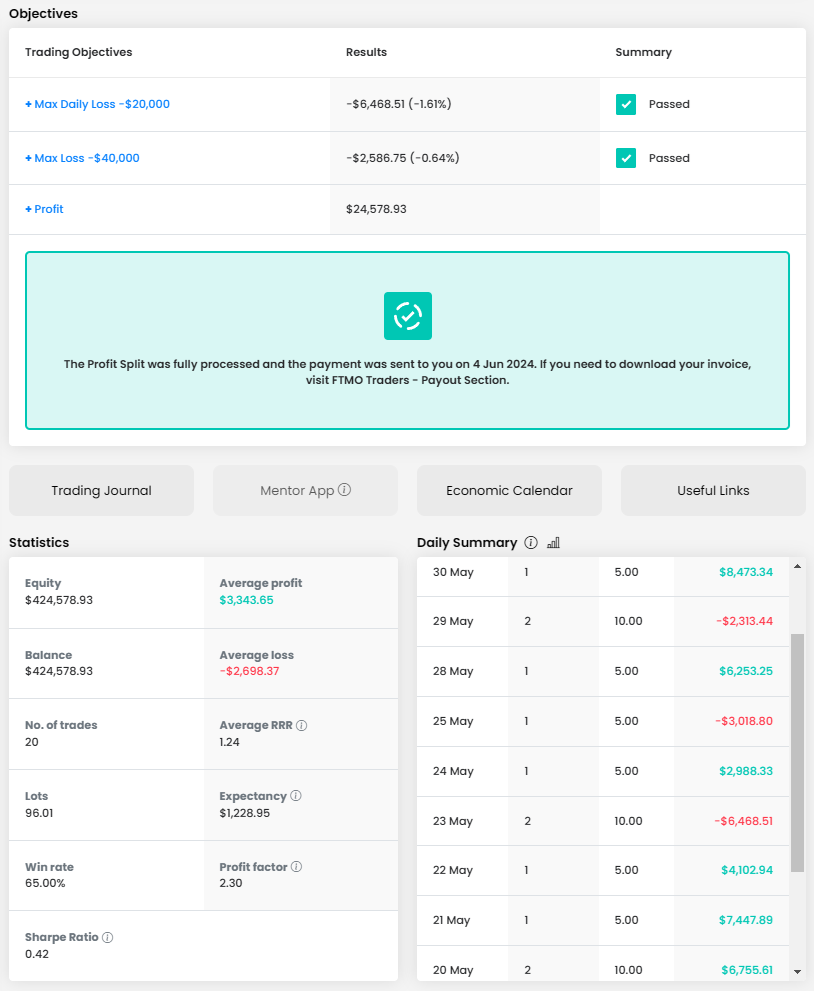

The trader traded for 13 days and in that time executed 20 trades, totalling 96 lots. This means that he usually executed one trade per day and his average position size was around 5 lots. This is a really conservative approach for an account size of $400,000, which is obviously appreciated. The average RRR of 1.24 is not great, but with a trade success rate of 65%, it's quite enough for a good return.

The trading journal shows that he is a classic intraday trader who closes positions during the day and does not hold them overnight. In most cases the trader entered Stop Loss and Take Profit orders, which is positive, but in some cases he did not enter them, which we certainly do not approve of.

Interestingly, it is precisely in the cases where the trader did not set an SL nor a TP that the trades ended up in losses, although we are unlikely to find a correlation between SL and TP settings and the profitability of the trades. However, even in those cases where the trader did not set an SL and TP, the loss was never more than $3,200. This is evidence that the trader was probably in control of his positions.

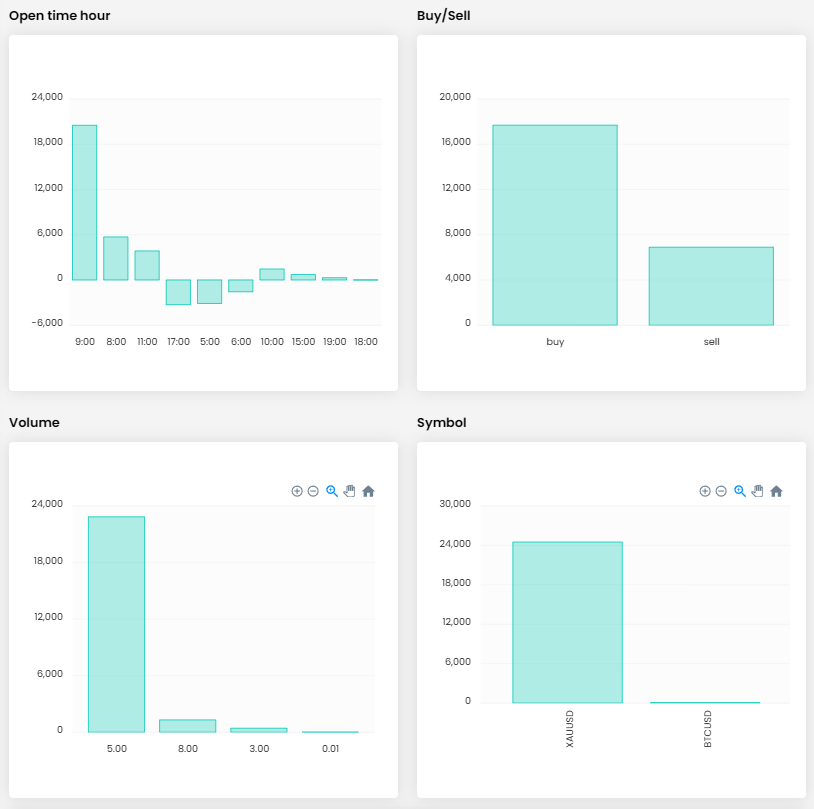

The trader traded on only two instruments, which are gold and bitcoin. The first few days he executed a few trades on bitcoin, but then he focused mainly on gold, on which he eventually recorded most of his profits. He opened most of his positions when the European markets were opening and he also made the biggest profits on these positions.

The trader had no problem with long or short positions, but he made much more money on speculating on the instrument's growth. There is nothing to discuss here, but it is interesting that he made money on gold at the very time when it had reached an all-time high and was in a downtrend. You can see that with intraday trading, you can make money on upside speculation even in a downtrend. It requires good risk management and a certain amount of luck.

In the picture below, we see three trades in which the trader recorded very good profits. All of them were made at a time when gold reached new all-time highs and started the aforementioned downtrend. On the very first trade, the entry looks like an ideally timed position. Unfortunately, the trader's exit was a bit rushed because he didn't let it reach the TP he had set with an RRR of 4.6. Since this is the trade with the highest profit that ended up with an RRR of 3:1, we can consider it a good trade.

In the second case, the trader was speculating on a resumption of the gold price to the upside after swinging down and bouncing off a local support level. Here too he exited the trade a little early, but in this case it paid off as the gold price continued to fall. In the end, he realised a very good profit here as well.

In the third case, the outcome was similar to the first. Again, good input, the original RRR was set to 2.5:1, but finally a premature exit for an RRR of 1.5:1. However, this trade also turned out well and the trader is clearly taking smaller profits rather than waiting for the price to reverse and his trade to end at break even or in the negative. Clearly, in this trading period, it paid off for him.

Note: Since we cannot clearly define the exact trader's strategy from the chart, this is only the private opinion of the author of this article. FTMO Traders are free to choose their strategy and as long as they do not explicitly violate our Terms and Conditions and follow our risk management rules, the choice of strategy and execution of individual trades is up to them.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.