“You are not a failure. There is room to grow and learn. It’s a journey”

No one learned from heaven. Trading, like any other activity, is about long-term education, gathering experience and, most importantly, learning from one's own mistakes. Whoever can admit a mistake and eventually recover from it, has half won. Just like our new FTMO Traders Carlos, Tolulope, Putri and Oluwatobi.

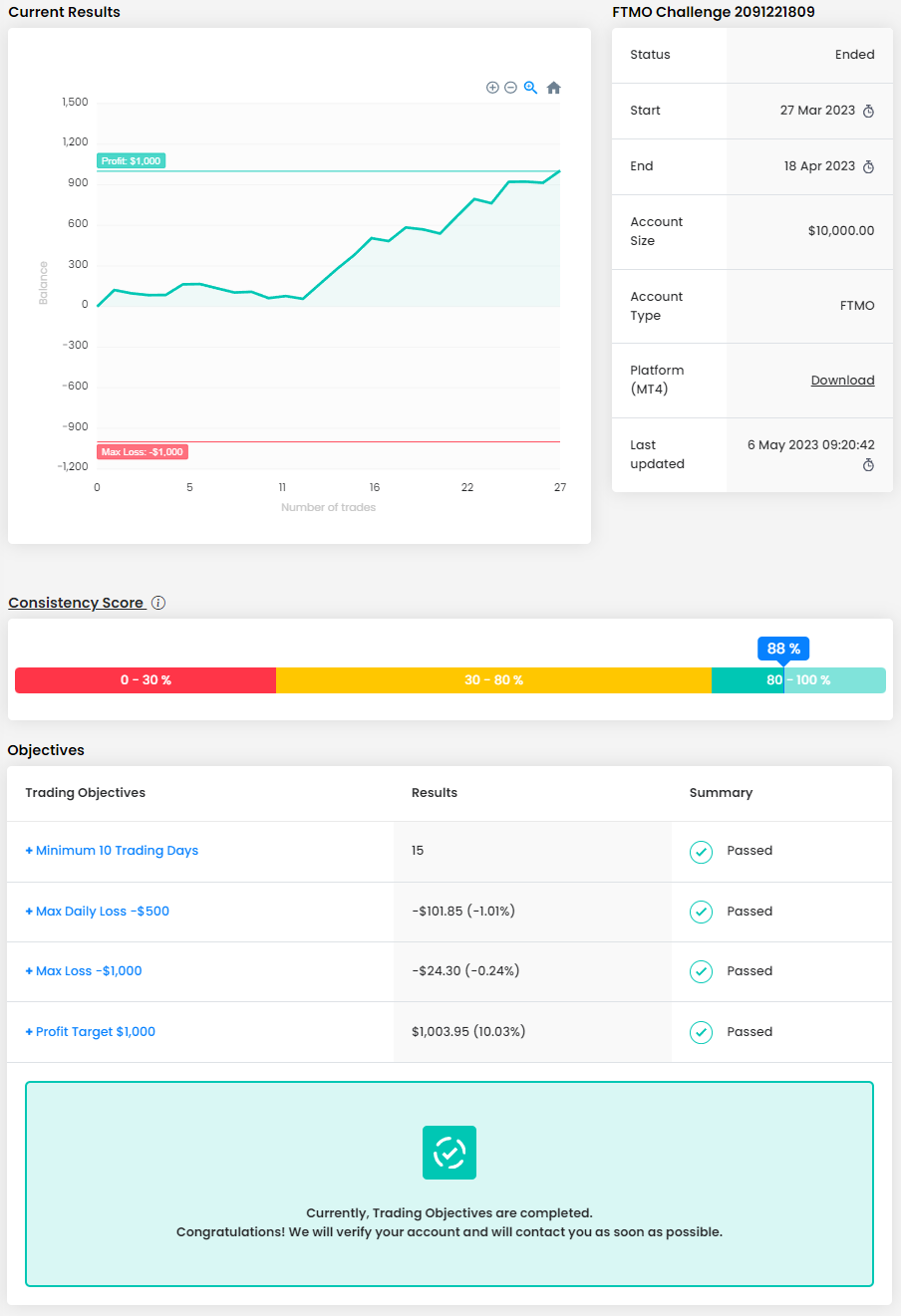

Trader Carlos: “Build your trading plan that suits you.”

What inspires you to pursue trading?

What inspires me to pursue trading is the freedom and the financial gain that comes from trading. Also, I have a passion for the charts, so it comes in handy when pursuing trading. But the main reason why it inspires me to trade is because of the materialistic things I have been wanting to acquire for years, and thanks to my trading skills I can now be able to afford those things.

What does your risk management plan look like?

I risk less than 1% (.30%) mostly on every trade, depending on what the market structure looks like. I aim for a 3:1 Reward to Risk ratio. If I lose a trade, I give myself another chance, but if I lose again, I step away from the charts and wait until the next day. If I have only placed one trade and it’s a winner, I aim for my desired RRR and I am done for the day. Only one or two trades a day to avoid overtrading and potential big losses.

How did you eliminate the factor of luck in your trading?

Personally, I don't believe in luck in long term trading, so I built my trading plan as solid as possible with good risk management and I am committed to it every trading day.

How has passing the FTMO Challenge and Verification changed your life?

Honestly, it gave me a lot of confidence as a trader and even as a person. A couple of months ago my self-esteem was low since I was failing Challenges left and right...until I revalued my trading plan and back tested all day every day. Now, for the first time in my whole trading career I'm consistent. So yes, passing the FTMO Challenge and Verification really changed my life for the better.

What was the hardest obstacle on your trading journey?

The hardest obstacle in my trading journey was finding a trading plan that suited me. I was trying out various trading plans, until I found one that wasn't complicated for me, and it actually changed how I look at the market(s). I now know what to look for in the charts with confidence. And from there it helped me emotionally by drastically reducing anxiety in trades because I now know that my trading plan works.

What is the number one advice you would give to a new trader?

If you really want it, drop everything, and put your all into your trading plan. Spend your free time studying price action. Build your trading plan that suits you, back test it through old data charts. Commit and execute every trading day and know what days not to trade (News).

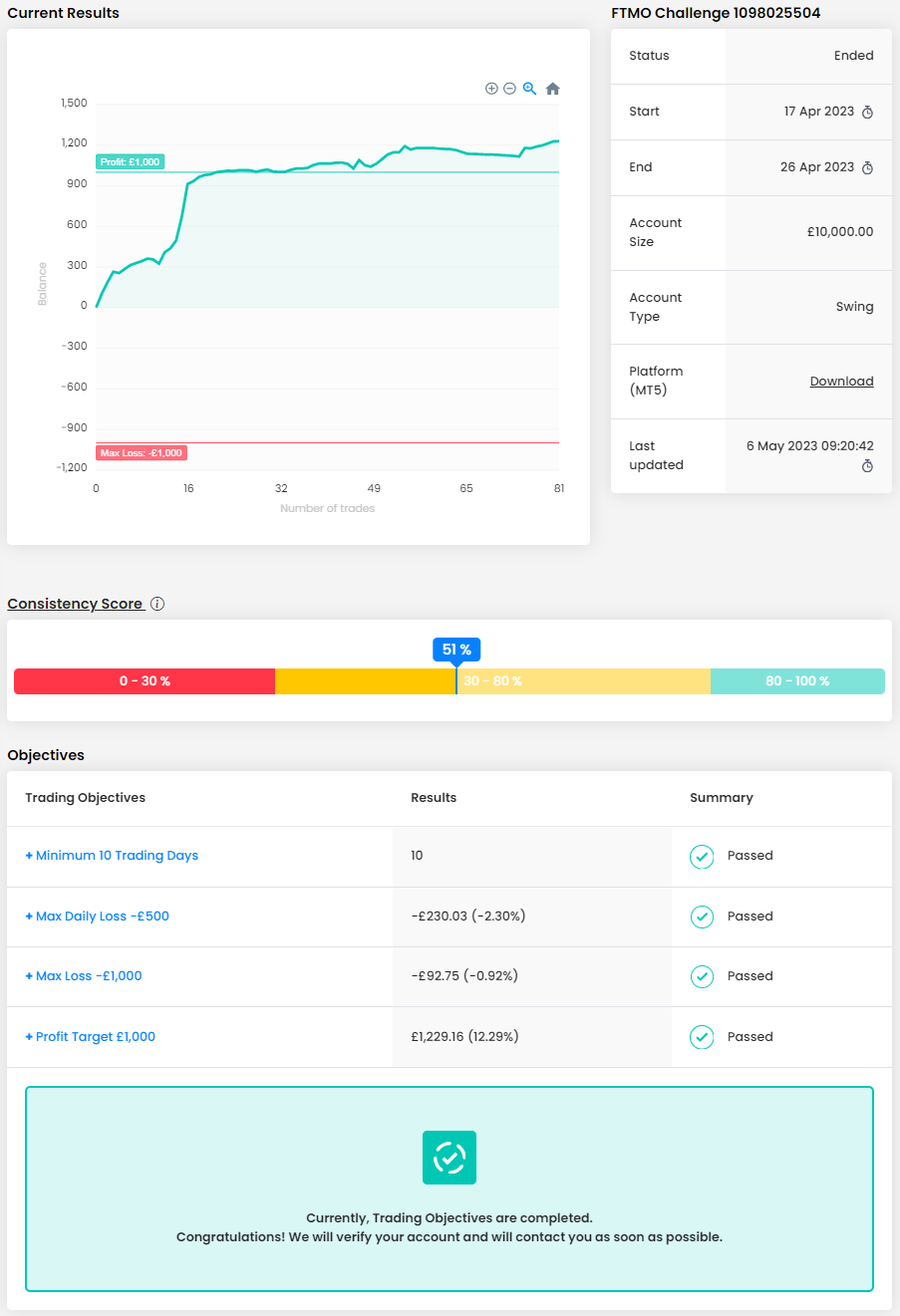

Trader Tolulope: “Dreams are meant to be pursued. Don't run from them, move towards them.”

Describe your best trade.

My best set of trades happened on day 2 of the Challenge where about £620 was realized in profits and the profit target was met. It happens on WTI crude oil. It was that going on a bullish retest of a strong resistance above in order to resume the sell-off, so I decided to scale into the bullish retest and then also into the sell-off afterwards. This alongside the US30 I think are my best sets of trades.

How did loss limits affect your trading style?

It makes me to be more careful in choosing the kind of set up I eventually trade.

What was the hardest obstacle on your trading journey?

Keeping to Daily Loss limit.

What was more difficult than expected during your FTMO Challenge or Verification?

The Verification stage in its entirety was more difficult than I thought. I think overconfidence, euphoria and some sort of emotions took a toll on me along the Verification stage.

What was easier than expected during the FTMO Challenge or Verification?

The Max Loss limit during the FTMO Challenge stage came easier than I'd expected with just about 2 and a half percent to achieve eleven percent, and less than one percent overall deep into the starting capital in closed positions.

What would you like to say to other traders that are attempting an FTMO Challenge?

Traders have to hold on to their dream of becoming an FTMO Trader. You have to keep taking the Challenge to fine-tune your trading skill. The objectives set by FTMO in themself are a dream. Dreams are meant to be pursued. Don't run from them, move towards them. Quit going for a firm that setting an 8% target in phase 1, it only makes you weak. But you want to be strong by staying with the best of the industry standard, the FTMO. You have keep working towards it. All the payments made for the lost Challenges should be seen as the fees you paid while going to school or college. They're not at a loss. I hope this helps someone psychology.

Trader Putri: “Find out your own trading style, you do not need to be the same as the masses.”

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

The most difficult part for me was the discipline to stick to my trading plan, for example, when I was in profit I was tempted to keep on trading even when my personal daily target has been achieved. After each trade, I now make it a habit to review and journal them, making notes on what went wrong, even what went as planned, and keep reminding myself that I already have a solid plan, that as long as I stick to it, I would be more effective and able to preserve my capital, both financially and mentally.

What was easier than expected during the FTMO Challenge or Verification?

The easier part is probably funnily the same as the most difficult part, which is sticking to my trading plan. I now have a solid trading plan, but it does not mean it always saves me from impulsively keeping on trading when I am in profit.

Do you plan to take another FTMO Challenge to manage even bigger capital?

I do.

Has your psychology ever affected your trading plan?

My psychology has definitely been affected, but my eagerness to succeed is greater than that. I'd like to think of trading, especially the losses, as a humbling, learning experience, I embrace losses as the steppingstone to make me even a better trader.

What was more difficult than expected during your FTMO Challenge or Verification?

The more difficult part is to always remember that anything can happen in trading, that the market will always be there, if I do not see my setup then it is ok to wait and wait until it does show up.

What is the number one advice you would give to a new trader?

Find out your own trading style, you do not need to be the same as the masses.

Trader Oluwatobi: “Give yourself grace when you break your rules continually.”

What was easier than expected during the FTMO Challenge or Verification?

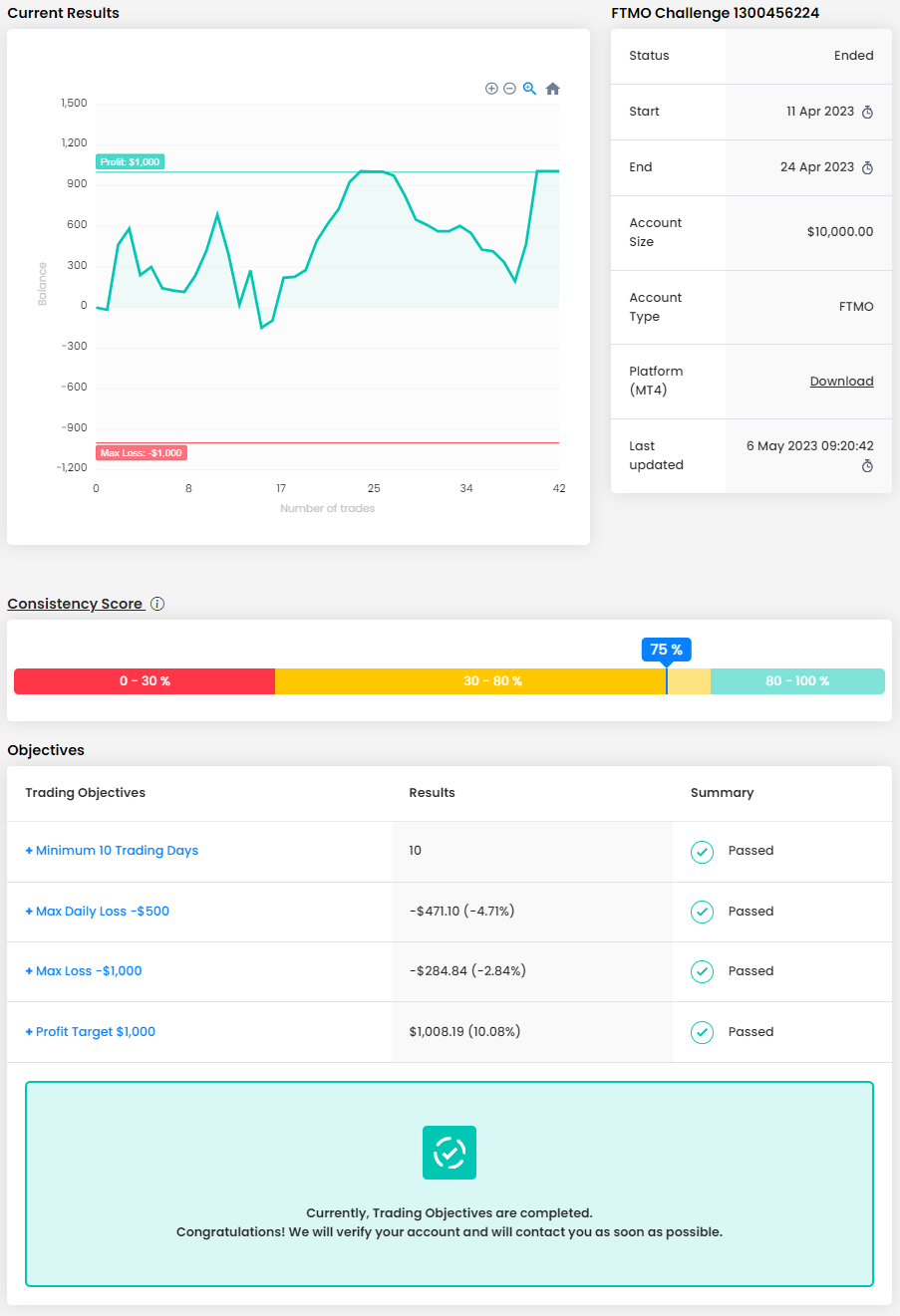

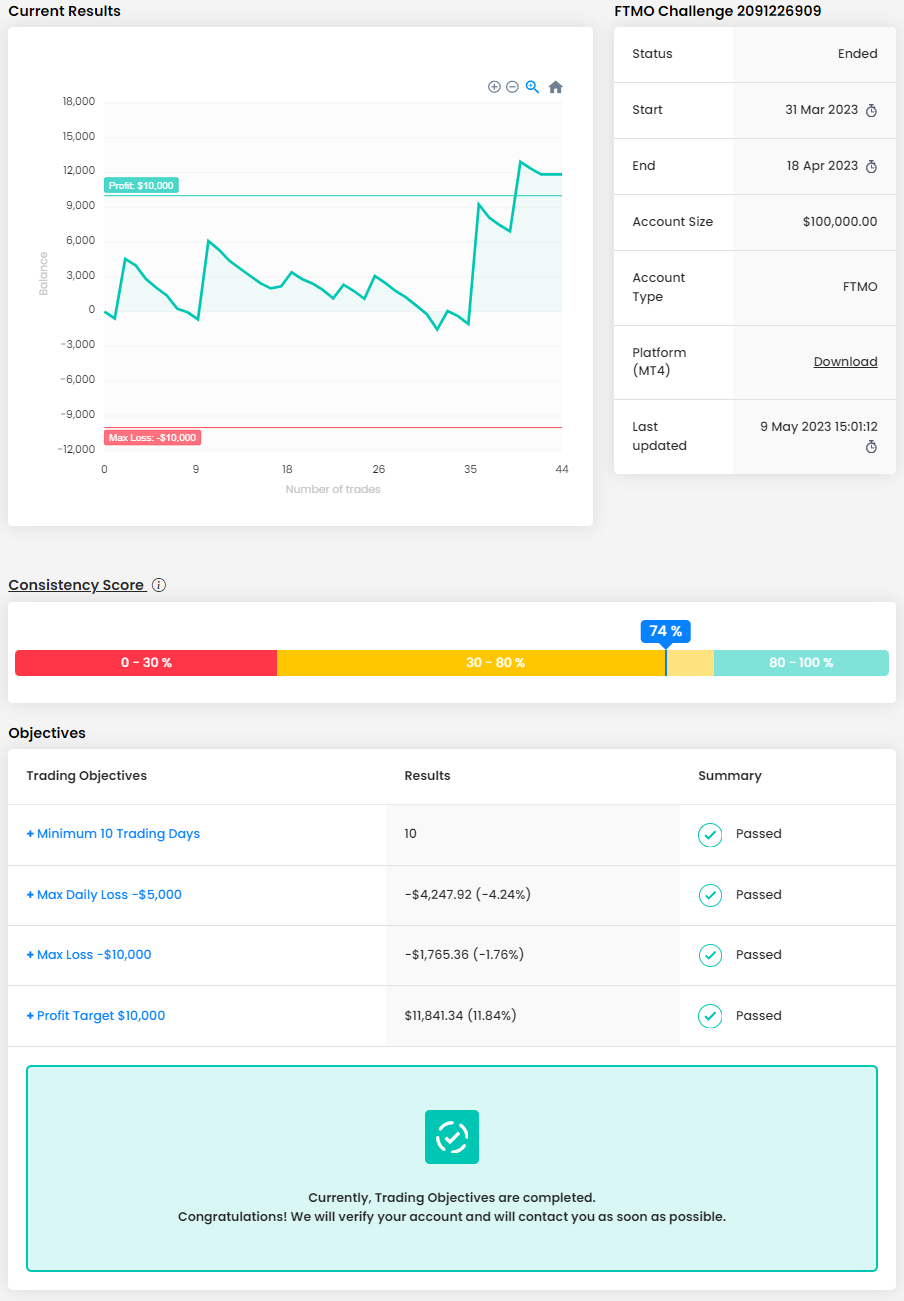

Reaching the Profit Target was easy in both stages of the Evaluation. I found it easy to realise a 10% profit in a single trade when trading Gold Spot/US Dollar (XAUUSD). My trading system produces a high risk to reward ratio (RRR), so I was able to pass the Profit Target objective much earlier on in both the FTMO Challenge and Verification.

How would you rate your experience with FTMO?

My experience with FTMO throughout the Evaluation Process has been great. I am excited to begin the journey as an FTMO Trader. I look forward to building a long-lasting business rapport with a renowned company. Cheers to FTMO!

How did you eliminate the factor of luck in your trading?

I’ve been trading for nearly four years. Luck rules and excites the mind of the novice trader. As a result, the novice gambles, incurring deep financial, emotional, and psychological pain. I went through that painful cycle for two and a half years and knew if I wanted to win in this game, I needed to dig much deeper. I eliminated luck by fundamentally understanding trading is a long-term probabilities game. Understanding this inherent nature was not easy at first. I’ve welcomed a great reset in my mind where ill-existing attitudes, beliefs, perceptions, and behaviourisms in trading had to be challenged, eliminated, reconciled, rewired, engineered, you name it! Trading in the Zone by Mark Douglas provided the paradigm shift and my foundation in Jesus Christ was and remains the catalyst. My no-luck approach goes like this: Firstly, I come to the markets with a probabilistic mindset coupled with a positive winning attitude. My trading plan and system are very methodical. It kind of forces me to identify the best high probability set-ups, always with a pre-defined risk of 0.5% per trade. My daily drawdown limit is 1% so after two losses I am done for the day. I know I can return confidently and objectively to the market the following day. I remind myself to never focus on the outcome of any individual trade but if I allow my edges to materialise over a series of trades, I will be profitable. It’s all about executing my system flawlessly which gets easier as I advance in my trading career. I journal my trades on Notion and monitor my emotions/behaviour/thoughts throughout the entire process. Thinking long-term with a confidence in your trading system will dissipate the feeling of luck as it reinforces the inherent probabilistic nature to permeate your mind and regulate your emotions. It’s not easy to adapt this way of thinking but if you want to succeed you must rewire your attitudes and beliefs about trading. Unlearn to re-learn that trading is probabilities comprised of edges. You really must play like the casinos. Work on your edge in the market and test it over a large sample size. From that data, identify your average RRR, expectancy, profit factor, win rate, avg. loss and profit and exploit these metrics in your system then refine your trading rules to suit your personality and manage your behaviour. Luck will have no dominance in your trading because your proven system and rules will ultimately give you confidence to trade!

What was more difficult than expected during your FTMO Challenge or Verification?

Whenever I reached the FTMO Verification, I got hyperexcited and deviated from my plan. I’ve failed two Verifications in the past because of uncontrolled emotions and a deviation from my plan. Having passed this FTMO Verification (third time blessed), I did grow restless and emotional which led to poor-trading decisions and mental fatigue hence why I sustained two losing streaks. You are so close to the finish line but remember it's paramount to follow your rules. I found myself executing low-probability set-ups and revenge trading. I forgave myself after this. Give yourself grace when you break your rules continually. You are not a failure. There is space to grow and learn. It’s a journey.

Describe your best trade.

My best trade was during the FTMO Verification. Following a string of emotional trades that ended in an approximately 5% drawdown, I identified a sell opportunity in XAUUSD. The trade realised a profit of 17% ($17,000), RRR 1:24. Yes, the number is crazy, but I wasn’t fazed at the monetary value. The reason why this was one of my best trades is because a) it was a high probability set-up I hypothesised, b) I predefined the risk and accepted it fully. C) I allowed the edge to materialise. The trade was held for 24 hours. High impact news was scheduled for release at 14:30pm. If you know anything about XAUUSD, she is superrrrrr volatile! I kept my higher time frame bias in mind despite the transient manipulation ensuing in the New York session. I was proud because this trade affirmed that I am a disciplined and focused trader. Mark Douglas said consistency is in the mind. I loved how I prioritised the process and regulated my emotions. Trades like this affirm my confidence in myself and my system. I was flowing in sync with the market. It’s a skill you home in as you advance. As a novice trader in year one and two, I would be glued to the charts, distorting information, closing out the minute price comes near to the entry. Year 4 me as a disciplined trader is focused on the process now more than profits. The market is an endless stream of opportunities. The market is not the adversary. Year 4 me as a trader monitors her behaviour, emotions, and thoughts to understand the market is holding a mirror so I can see my reflection clearly. Trading is 90% psychology. It’s you against you. Trading is also spiritual too so whenever I spiral out of control, I check in with Jesus to renew my mind and spirit with the Word of God. I mediate on the Word because it calms my soul and affirms my identity.

What would you like to say to other traders that are attempting the FTMO Challenge?

Attempt the Challenge when ideally you have solid years of experience under your belt. The reason I say years is because when you start off in trading, one thinks learning about the markets (indicators, technical analysis etc) is going to make you a consistently profitable trader. Yes, analysis is important, but the market is erratic and unpredictable. No amount of analysis can guarantee you a winning trade every single time. In fact, you will lose much more than you win in the beginning of your journey. Remember, losses are completely normal and are ultimately unfavoured edges. How do you react to losses? Are you seeking revenge against the markets? If yes, you will find yourself in a never-ending perilous cycle. Trust me, I’ve been there! You must work on managing your emotions. You must document, lay out and investigate the behaviours and self-sabotaging habits early on so you can begin the great reset to build the psychological, mental, and spiritual fortitude that will protect you long enough in this game. You need to dedicate the start of your journey to learning about yourself. I wish someone told me this at the start. Secondly, plan your trade. Trade your plan. Thirdly, risk management is your bestie! Finally, you don’t have to in the markets every single day. Wait for those high-probable set-ups.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.