“Worrying about a losing trade won't magically put you in profit”

Every trader has to accept that sooner or later, they will taste a losing streak. It's up to each trader how to approach such a situation, but the more experienced ones know that crying over spilled milk is never the right solution. Papa-Sam, Damir, Amos, and Abdias know it too and as they are experienced traders who managed to pass our Evaluation Process, we have asked them a couple of questions.

Trader Papa-Sam: "Wishing, worrying, and hoping won't make the sunrise any faster or shine any brighter."

What was the hardest obstacle on your trading journey?

Everyone knows that it's difficult learning the technical skills to trade the markets. I was fortunate enough to have a friend who's also on the same journey as me, directing me to the proper resources to teach me the technical skills. However, the most difficult thing for me – which I don't think is talked about enough – was psychology. A good understanding of the technical skills coupled with a good strategy means absolutely NOTHING if paired with bad psychology and vice versa. They complement each other; sacrificing one for the other creates unnecessary hardship.

What inspires you to pursue trading?

Financial independence philanthropy and education caring for close loved ones using my time how I want to.

Do you have a trading plan in place, and do you follow it strictly?

Yes, I do have a trading plan and I follow it strictly. I risk no more than 1% per trade and no more than 3% per trading day. I trail my SL according to price structure and liquidity, compounding my trades using a pyramid-like approach for anyone given trading instrument. Ex: EURUSD Trade #1: 1% Risk EURUSD Trade #2: 0.5% risk EURUSD Trade #3: 0.25% risk Total risk remaining for the day: 3% - (1% + 0.5% + 0.25%) = 1.25% If I trail my SL to -at the very minimum- breakeven while accounting for commissions, I would then have 3 RISK-FREE trades. Therefore, this would open my 3% risk amount for the day, again. Total risk remaining for the day: 3% - (0% + 0% + 0%) = 3%.

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

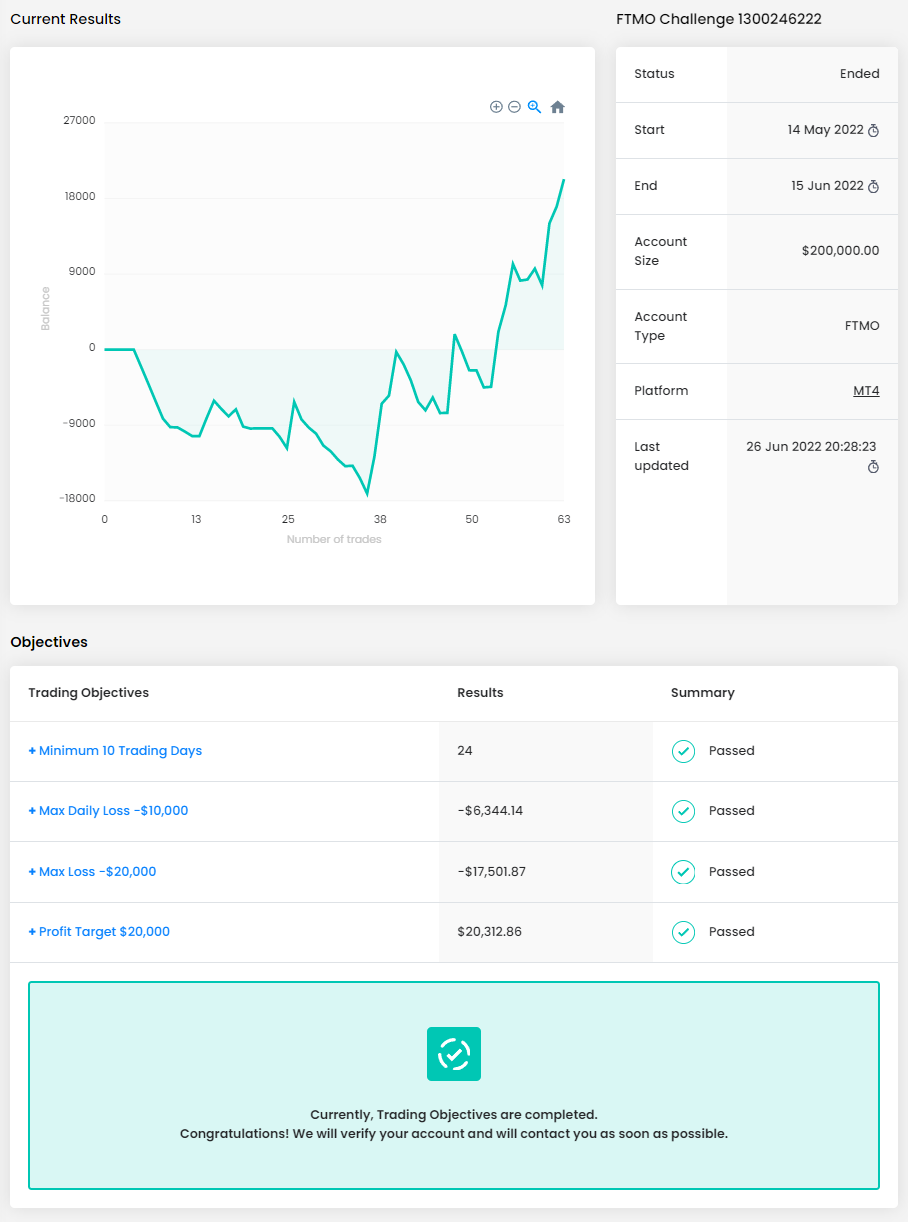

I was up almost 6% on the account while taking the FTMO challenge and was super excited! I was a little more than halfway there towards achieving my goal ... but the market had other plans ... as it tends to do. The following week I had a losing streak taking almost all the profit I made. Passing the challenge seemed like an impossible task for me at that point, but something I read in a book - "Think and Grow Rich by Napoleon Hill"- came to mind. "If you have a goal you are trying to achieve with a certain plan, but that plan is not fruitful, it is time to change your plan." (This is why I stress the importance of psychology to myself!) I went back to the charts, started backtesting, and discovered my issues and missing links. I made 8% the following day, creating a new all-time high for myself on the FTMO challenge. The day after that, I passed the FTMO challenge. The moral of this story is? Never give up on yourself; if your plan isn't currently working, consider tweaking it, and have a goal in mind. I'm not saying jump around from strategy to strategy -a rolling stone gathers no moss after all but consider that there may be gaps in your technical skillset or psychology. Discipline yourself!

How did you manage your emotions when you were in a losing trade?

Wishing, worrying, and hoping won't make the sunrise any faster or shine any brighter ... so why bother? Worrying about a losing trade won't magically put you in profit ... so why worry? Trading requires a degree of relinquished control. When backtesting, you have the command at a click of a button for when the next candle will print. Entering a live market - demo or live trading- relinquishing control and simply trusting your analysis is required. Again, your psychology can really make or break you here. It helps if you put things into a bigger picture perspective. A degree of nonchalance is helpful. "View the market as your teacher/university, you are the student, and losses are tuition." (Not my quote, but I forgot who said it)

What would you like to say to other traders that are attempting their FTMO Challenge?

Balance your lifestyle; being a consistently profitable trader means nothing if you're just glued to your screen all day. Know why you're trading; if you aim at nothing, you'll hit nothing. Know how to trade, create a trading plan, and set weekly and monthly trading goals for yourself. (i.e. 20% per month, 5% per week, 1% per trading day) Emphasize psychology; the best way to solve a problem is to step back from it and do something else, preferably something you enjoy doing! Your subconscious mind will work on it in the background. (I'm not even joking; look up "diffuse and focused thinking". If you'd like to read more about this, the book "Learning How to Learn" by Barbara Oakley, Terrence Sejnowski, and Alistair McConville goes into more detail and is on my personal reading list) Backtesting, journaling, and demo trading is your friend. Don't try to trade like someone else; be yourself and trade how you would. Most importantly, remember to have fun with the process. It may take some time, and that's okay. Switch from an "instant gratification" pursuit to a "delayed gratification" pursuit. Things become easier once you make that transition. (1% better every day)

Trader Damir: "Trading is just a mental game/business."

How did passing FTMO Challenge and Verification change your life?

It is changing my life in a way that I'm finally able to make some changes in my personal life and progress financially. That is a big step forward and I'm thankful for that. Also, big thanks to FTMO.

What does your risk management plan look like?

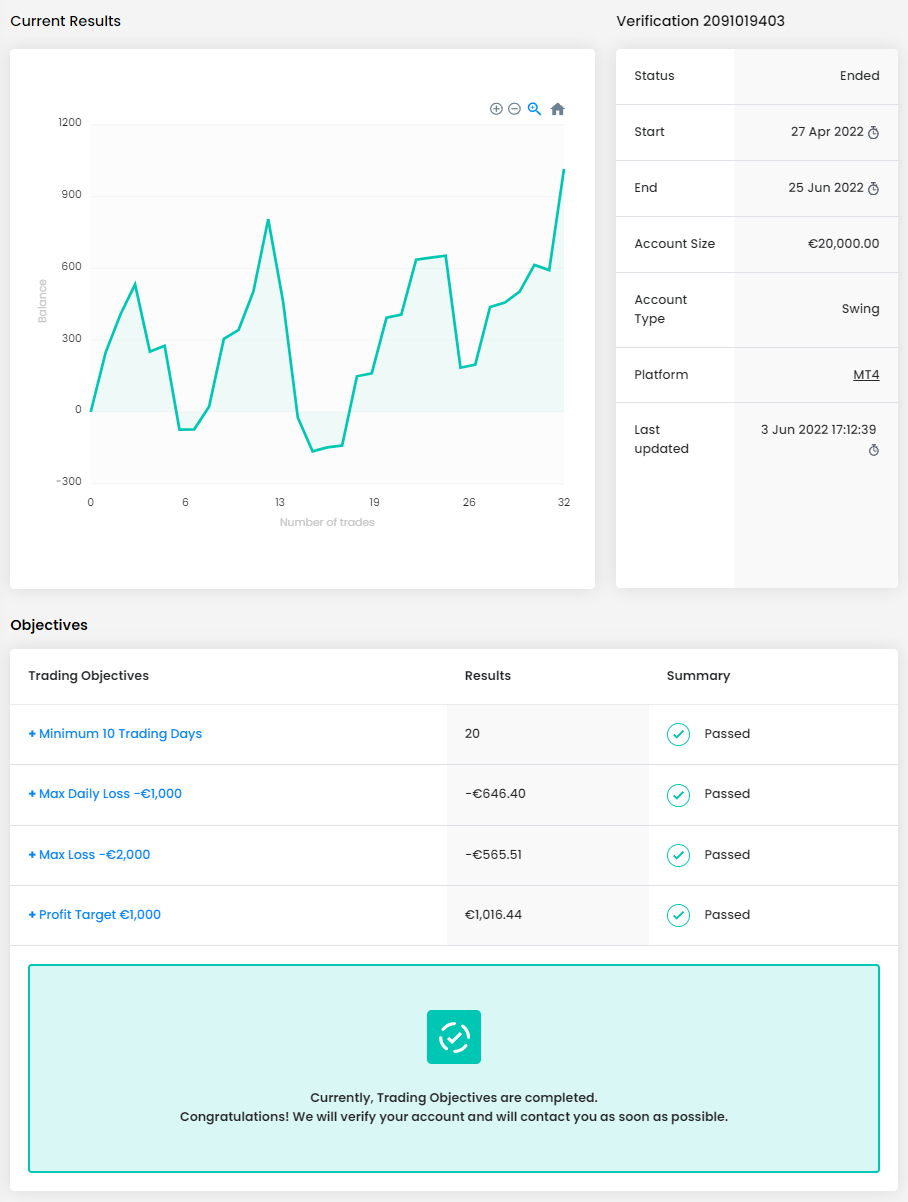

Well, although I feel comfortable dealing with risk, I have swing account type which is not that risky. I used to have aggressive accounts but that is just too much risk. I prefer calm trading with smaller profit and smaller loss and holding trades over night and weekends if necessary. Also, managing SL is very important.

What do you think is the most important characteristic/attribute of a profitable trader?

By far the most important is mental stability. Trading is just a mental game/business. Also discipline and consistency are very important.

Describe your best trade.

My best trade is one which brings me big profit during big market move. If the market makes a big move and my trade goes all the way (without small TP or closing it early) with it then that's the best trade.

How would you rate your experience with FTMO?

Very good. Great trading conditions. I think the best out there. And I also had a chance to learn, grow and improve more.

One piece of advice for people starting their FTMO Challenge now.

Be calm, disciplined, and do not fear risk. If you don't succeed at first, just keep trying.

Trader Abdias: "Without proper risk management, even a great strategy with a high win rate can result in losses."

Where have you learnt about FTMO?

I first learned about FTMO from a trading group I once belonged to. FTMO was a popular discussion topic amongst the group, and I then became curious. I learned about it from the group and then I sought to learn more about it on the web page.

How did loss limits affect your trading style?

The loss limits are effective in helping me manage my trading account by creating a system that helps prevent overtrading, overleveraging, and properly managing my risk.

How did you manage your emotions when you were in a losing trade?

Before I trade for the day, I compose myself through prayer and keeping my mind attuned to positive vibes, stay attuned to virtues that are important to me. I have spent a lot of time trying to reign in my emotions and it is no easy task. We are emotionally driven creatures, and it takes a lot of mental fortitude to shut that part out. I concluded that for me to succeed and be the kind of trader that I so desire to be I have to allow the strategy to play out. A successful strategy will be successful without my interrupting it. A successful strategy should make room for losing trades and still result in success as the end result.

How did passing FTMO Challenge and Verification change your life?

It is too early to tell, but I have been envisioning this moment for a long, long time. I want to be able to gain the kind of financial freedom that trading affords. I definitely like the idea of being able to work from home on my own time.

What do you think is the most important characteristic/attribute of a profitable trader?

A profitable trader should have been able to manage risk and understand the importance of risk management in trading. It is one of the most important aspects of trading. Without proper risk management, even a great strategy with a high win rate can result in losses that can decimate your trading account. A risk to reward ratio is one part of the whole, but also a defined risk per trade, and knowing your average win rate. It's important to understand the parallel and inverse ratio between the two.

What would you like to say to other traders that are attempting their FTMO Challenge?

If you are going to attempt the challenge, I think the most important thing to do is to back test your strategy. I can't emphasize enough how critically important backtesting is to creating successful outcomes. I have spent hours backtesting my strategy. Backtesting is for traders what practicing is for athletes. If you really want to succeed, and be the best, then you have to dedicate the time.

Trader Amos: "Sometimes taking no action is an action in itself."

Where have you learnt about FTMO?

I stumbled upon it on YouTube

What inspires you to pursue trading?

My inspiration is my family, I want to be able to live a fun filled life with them without being shackled to a 9-5 job and asking “permission” to take time off when it is my life, and through trading you can do that, you can have all the time freedom in the world through trading, that’s why I love it.

Describe your best trade.

My best trade that I ever had was when I was first learning about Fibonacci, I saw a couple confluences on USDJPY and pulled out a fib to test it out and I secured about 300 pips. This was when I was first starting out about 2 years ago, now I mostly look for bullish or bearish flags on NAS100 with a nice strong momentum candle.

What was easier than expected during your FTMO Challenge or Verification?

The FTMO challenge was easier than I expected.

What was more difficult than expected during your FTMO Challenge or Verification?

The verification was definitely harder for me, I completed the challenge while I had Covid, so I was about to analyze the charts and trade in my specific time slot. When the verification came around, I was super nervous because I went back to work, then I experienced a draw down and was straying away from my rules, so I took a deep breath came back and stuck to my plan and it all worked out.

What is the number one piece of advice you would give to a new trader?

Sometimes taking no action is an action in itself, be patient be disciplined and remember your “why”.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.