What a successful bitcoin bet looks like

In the next part of the series on successful FTMO Traders, we will look at a trader who speculated on the movement of bitcoin, where he was able to take full advantage of not only its higher volatility, but also its somewhat unusual trading hours.

At the end of 2024, bitcoin saw a significant increase in value, with its price surpassing the magical $100,000 mark. Somehow, many investors were counting on the fact that breaking this threshold would lead to further strong growth in the price of this most popular cryptocurrency. Unfortunately, the truth is that after reaching the price of $107,000, the growth stalled and bitcoin once again showed why it is not suitable for conservative investors and traders who bet on long-term trends.

For many traders, cryptocurrencies, led by Bitcoin, are relatively hard to read, but on the other hand, it can be said that those who can cope with the increased volatility of Bitcoin and can work with it and benefit from it, trading with this currency can be very profitable. One example is our trader who benefited from bitcoin's intraday volatility.

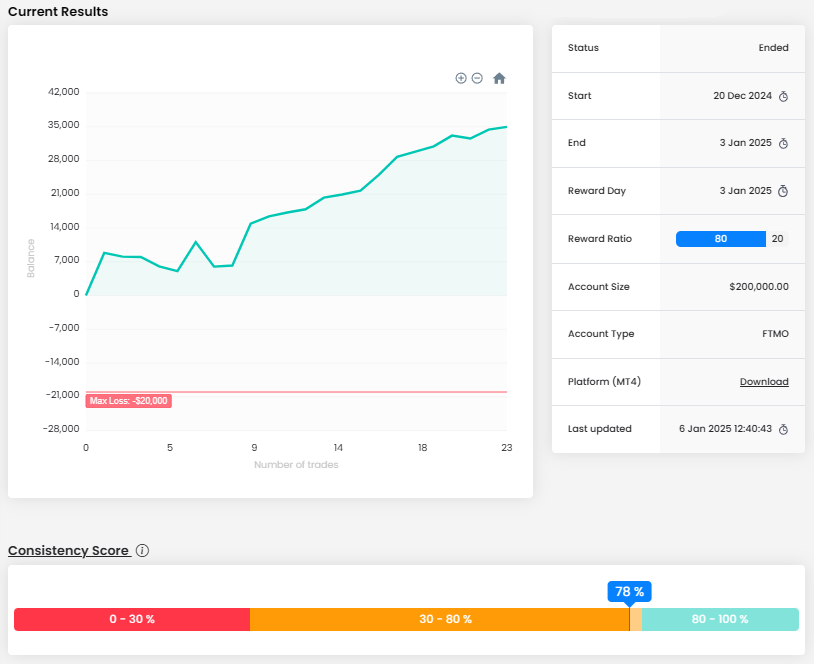

It is clear from the balance curve that the trader's approach is paying off and he was in the green right from the start of the trading period. His very first trade was one of his most successful, which could then provide him with a very valuable psychological advantage in the following days. Moreover, he avoided major swings during the trading period and only experienced a significant loss once, which was then reflected in his high consistency score.

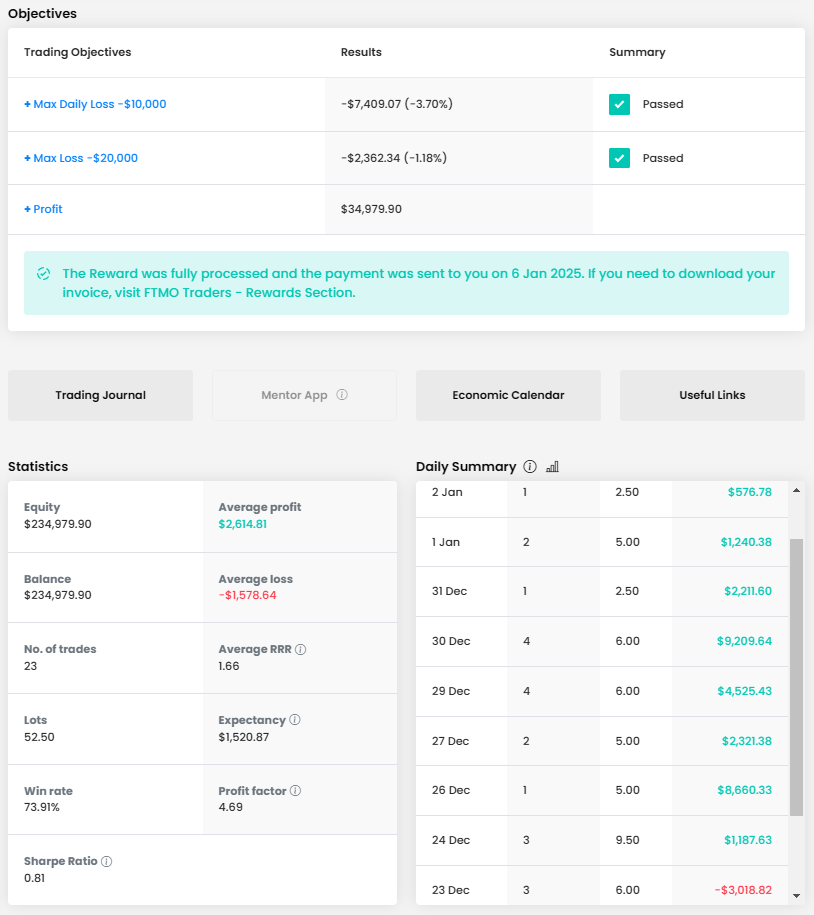

The Maximum Daily Loss and Maximum Loss limits were not a problem for him either, and the total profit of nearly $35,000 is very good for an account size of $200,000. The trader was able to close almost every trading day with a profit, which certainly helped a lot to achieve such a great profit, as well as the combination of a good RRR (1.66) and a very high success rate (73.91%). When a trader manages to maintain an average RRR above 1.5 and a success rate above 70%, success is guaranteed, unfortunately such a combination is not the rule and cannot be counted on to be maintained over the long term.

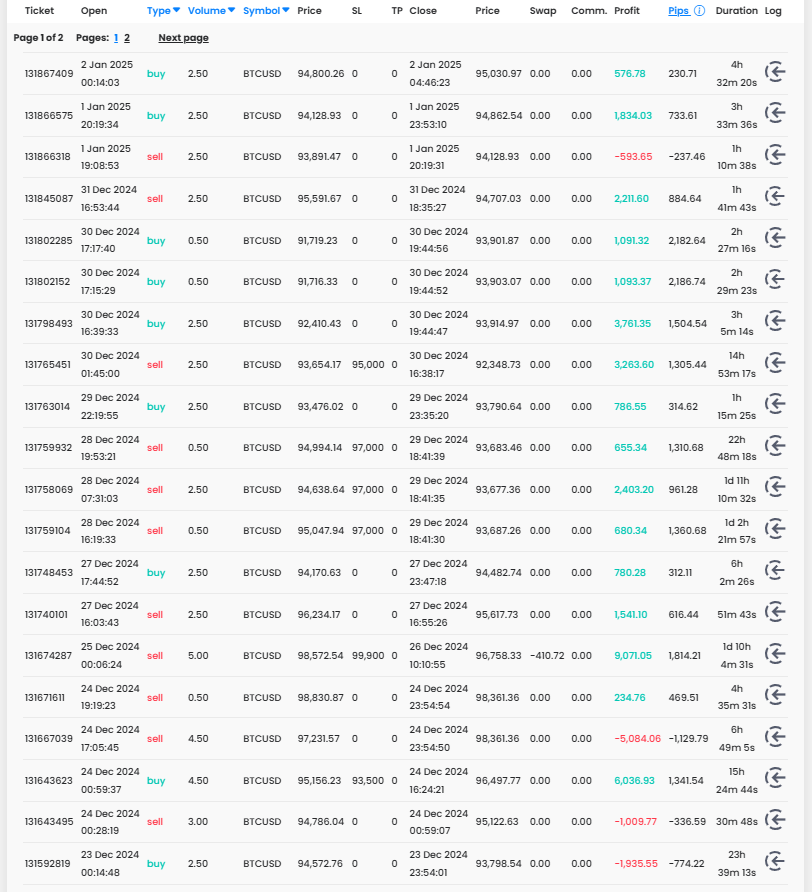

The trader opened 23 positions during the trading period with a total volume of 52.5 lots, which is an average of 2.3 lots per trade, with the largest position being 5 lots, which is already a lot, but the set SL was at a reasonable level, so this can be accepted.

The trading journal shows that he is an intraday trader who holds positions open for several hours and in rare cases has held a position overnight. Firstly, this avoids paying the swap and secondly, it limits the risk that the price of bitcoin may make unpredictable movements when he is not at the platform, which is no exception for cryptocurrencies.

Since the trader sets Stop Loss only on some trades, this approach is useful, although we do not approve of it. On the other hand, it should be added that in the cases where he held the position overnight, he did set the SL. Take Profit is not set by the trader in any trade, which may indicate that he wants to be in complete control of the trade's exit, but it is a rather time-consuming approach.

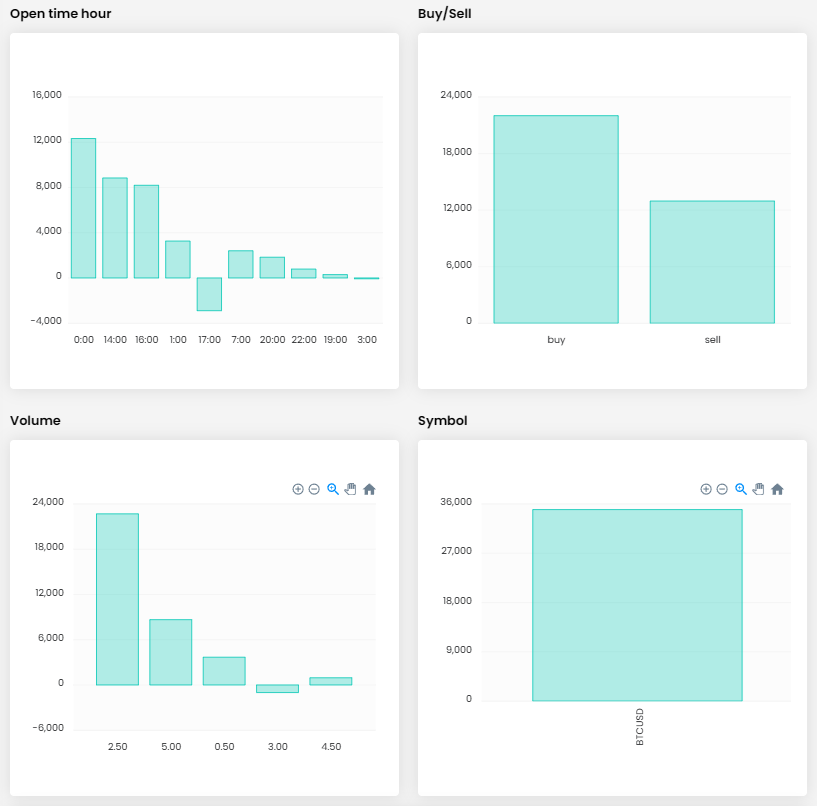

That being said, the trader focused only on trading Bitcoin, and given the price movement, it is not surprising that he opened more positions and made more money on long positions. Overall, however, it cannot be said that he preferred any direction of price movement. It is the same with the time of opening trades, the variance of which is also quite large.

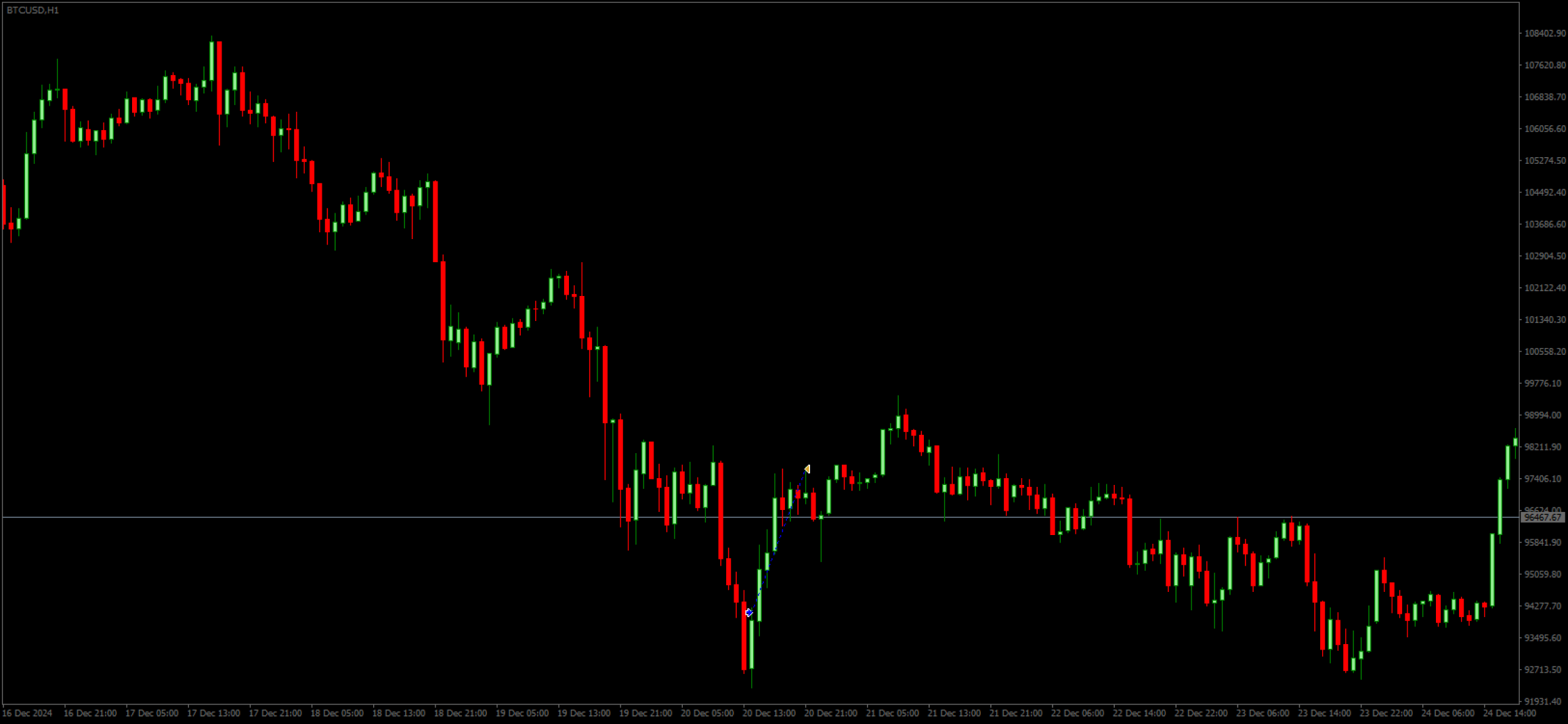

Finally, let's take a look at a couple of trader's trades. The first one will be the aforementioned opening trade of the trading period, which kind of characterized the trader's entire tenure on this account. In this trade, the trader took advantage of the price bounce from the level around $92,200, which had served as a support level several times before.

The trade entry and exit fell in almost perfectly, so after a few hours the trader was able to close the position with a very interesting profit of over $8,000. The price did rise slightly more after a couple of hours, but in the longer term, holding the trade would have been pointless and at the given yield, any criticism of the exit is completely unnecessary.

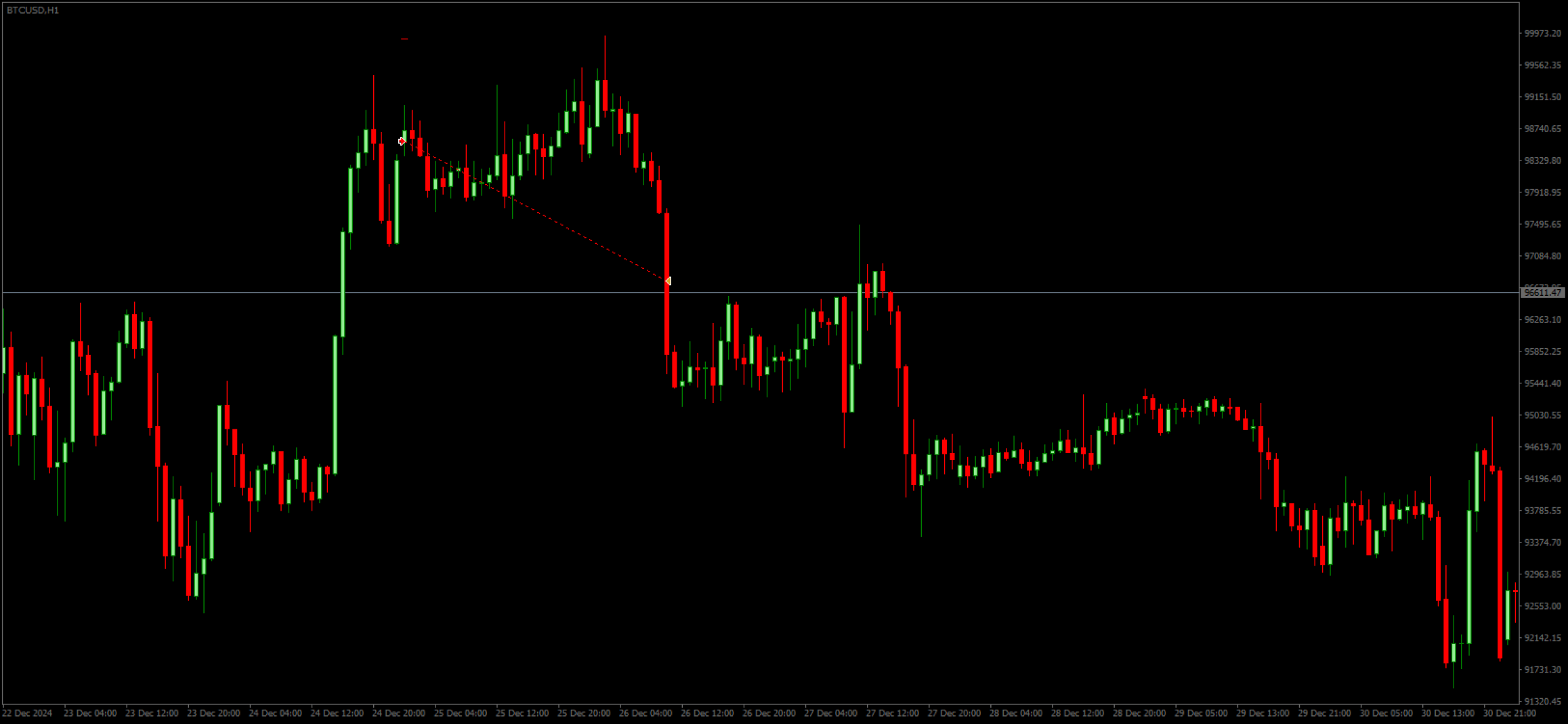

A few days later, the trader gave himself a Christmas present in the form of the most profitable trade, taking advantage of the fact that bitcoin was one of the few instruments that could be traded during the holidays, i.e. on December 25. Here too, the trader took advantage of a price bounce, this time from local resistance. Although he missed the original direction of movement by a narrow margin, his patience paid off in the end and he closed the trade with a profit of over $9,000 on the subsequent swing downwards.

In this case, closing the trade may have been a little hasty, but evaluating the trade in hindsight is still easier than managing risk live. The bottom line here is that the trader was not greedy and closed the trade with a very good profit, so again there is not much to fault.

Note: Since we cannot clearly define the exact trader's strategy from the chart, this is only the private opinion of the author of this article. FTMO Traders are free to choose their strategy and as long as they do not explicitly violate our Terms and Conditions and follow our risk management rules, the choice of strategy and execution of individual trades is up to them.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.