Wait for your profits

In the next part of our series on successful FTMO Traders, we take a look at two traders whose journey was not as easy as it might seem at first glance. However, their patience and a consistent approach ultimately led to above-average results.

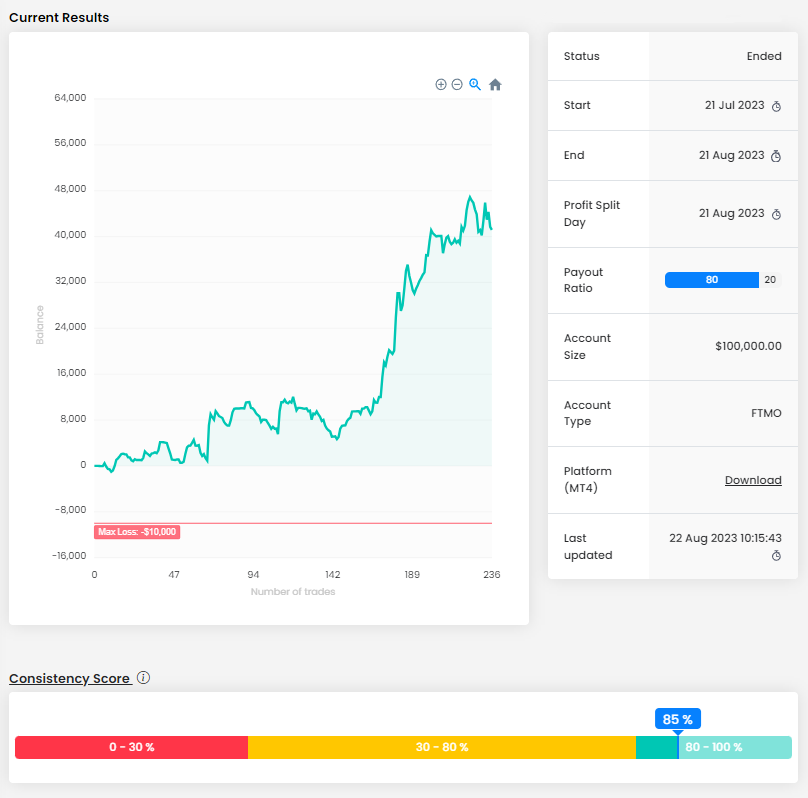

The first trader may not have the best balance curve in our series, but he certainly has one of the highest percentage returns on his FTMO Account among the traders we reviewed. The curve also shows that for a trader to achieve above-average returns, one does not have to be successful over the entire period and must expect to experience some periods of stagnation or drawdowns. But the important thing is to make the most of the times when things are going well.

Thanks to his patience at the beginning of the trading period, the trader managed to make a great profit of over 41 000 USD, which is a fantastic result for an account size of 100 000 USD. In this case, the result is further highlighted by the very high level of consistency, which further supports the theory that the trader can simply wait for the right period and not try to make money at any cost. But we would like to remind you once again that such results cannot be taken for granted and are rather an exception.

However, not everything is ideal for this trader either, which is reflected in the Maximum Daily Loss value. In this respect, the trader is dangerously close to the limit, exceeding which at the end of the trading period would be a real shame. The trader had no problem with the Maximum Loss.

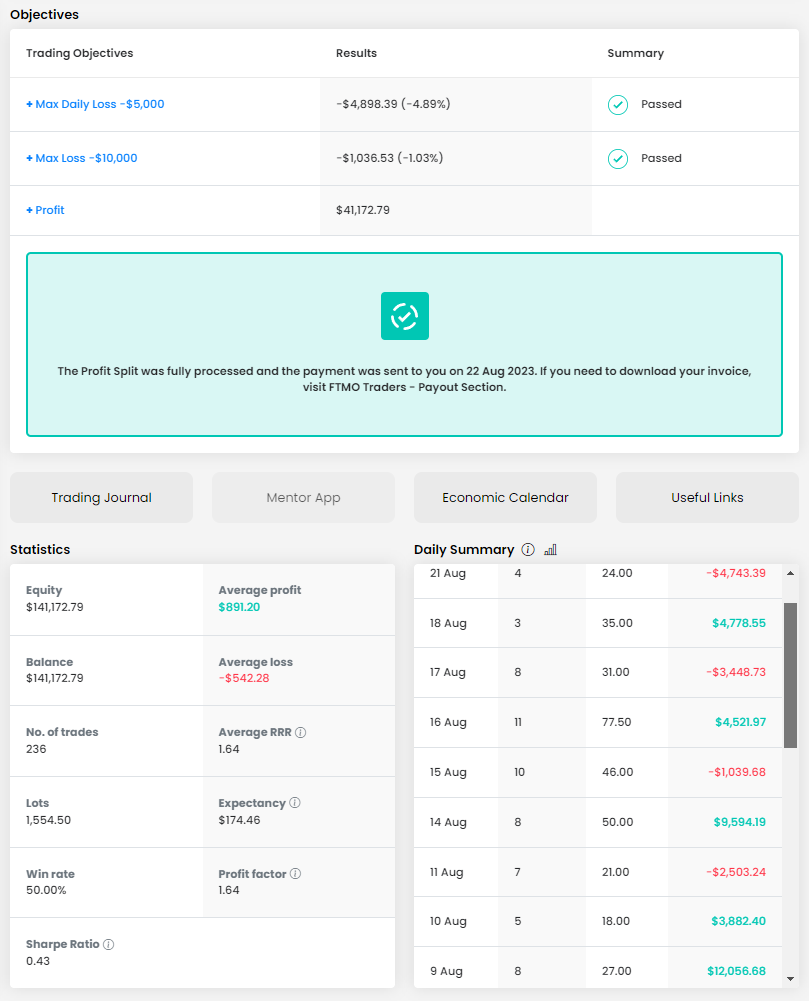

Looking at the other stats, we see a fairly good RRR (1.64), and given the result, a success rate of "only" 50% is a bit surprising. However, given the number of trades, it is not surprising, with 236 trades this combination must already be positive. For this number of trades the trader needed one whole month, i.e. 22 trading days. For the specifiednumber of trades, the trader traded 1,554.5 lots, which is approximately 6.6 lots per position. This is perfectly fine for the size of the account.

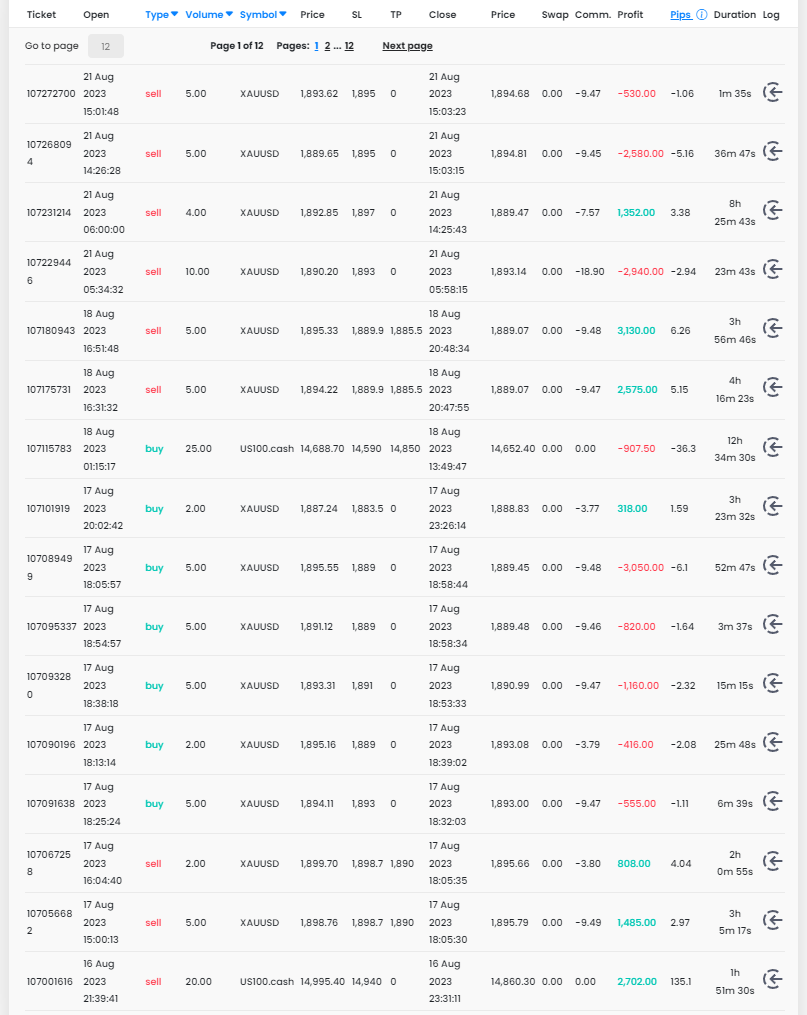

However, this numbercan be a bit misleading as the trader opened positions up to 20 lots in size on more than one occasion. However, even this volume is not that dangerous given the account size, and the trader did not open multiple positions at the same time based on his short-term approach.

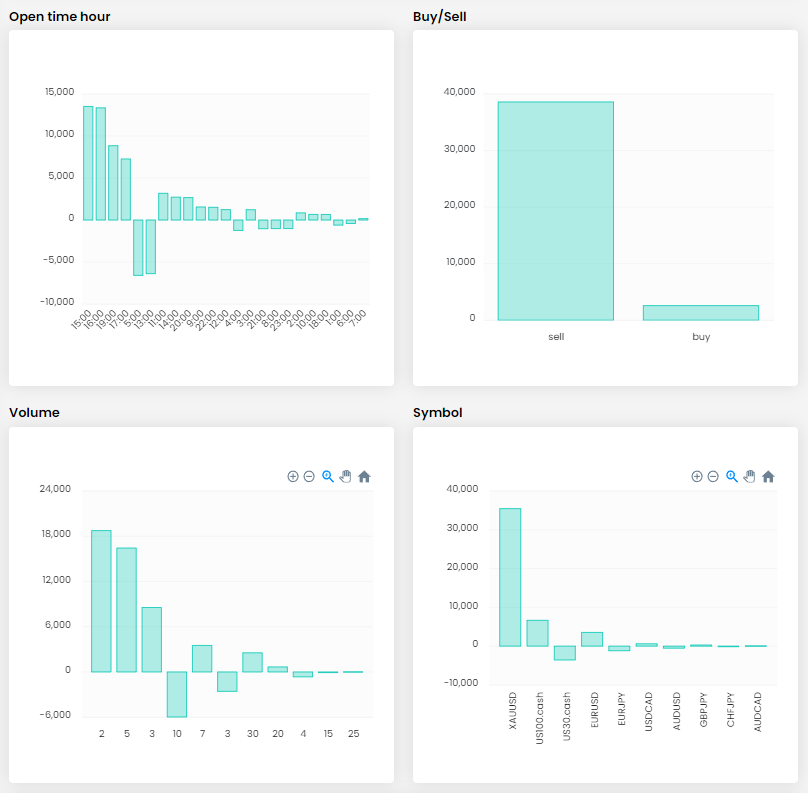

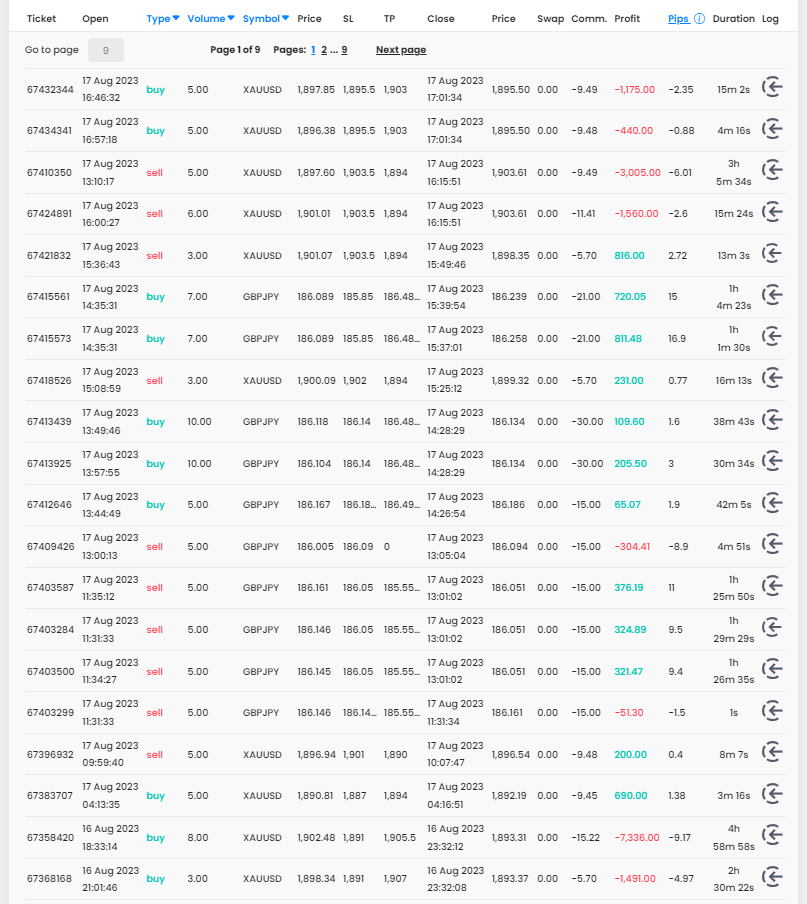

The trader is one of the intraday traders, sometimes with a tendency to scalping. His trades typically last a few minutes, with almost half of his trades lasting no more than an hour. Only once did the trader hold a trade for more than 24 hours. Interestingly, the trades that lasted the longest are among his most profitable, so it might be worth reconsidering his approach in the future. We positively evaluate the setting of stop loss orders on all trades, the trader was not overly concerned about setting Take Profit orders.

The range of time intervals in which he opened trades is quite wide for a trader, which may be related to the fact that he traded a fairly wide range of investment instruments. However, most of his trades were made on gold, which has long been one of the most traded instruments at FTMO. Indices tracking US stocks were also popular instruments. Here, he split it quite "fairly" between blue chips (US30.cash) and technology (US100.cash). He tried the rest of the tradeson a few currency pairs and overall we can say that we have nothing to complain about with diversification.

The second trader’s balance curve looks similar to the first trader’s at first glance, but there are quite a few differences between them. This trader also had to wait a bit for his most profitable phase, but in the end it paid off. And he also lost part of his profits at the end of the trading period, which cost him a better result.

The second trader's profit is lower in number and percentage, but still, nearly $36,000 on a $200,000 account is a great result. Again, the trader came close to violating the Maximum Daily Loss limit (-4.53%), but unlike the first case, this was at the beginning of the trading period.

And the differences continue. It took the second trader only 10 trading days to achieve this result, but his success rate was as high as 71.35%. This enabled him to achieve an RRR of less than 1 (0.73%). Logically, the number of positions was also lower (171) and overall the trader traded 775.32 lots, which is about 4.5 lots per position.

In this case, the trader often opened multiple positions, so even for him the total size of his position could be 15 to 20 lots. This in itself is not bad, but the bigger problem we see is that this trader was not afraid to add to his positions at a loss, which fortunately did not happen very often. We keep reminding ourselves and repeating it again and again: this approach is by no means recommended for inexperienced traders.

This trader also closed most of his positions within an hour and only held an open position overnight on five occasions. Here we must also positively evaluate the entry of Stop Loss orders for all positions and in the vast majority of cases this trader had also set Take Profit orders. On the other hand, he was often impatient and closed positions before they reached the Take Profit.

Although the trader opened a similar number of long and short positions, he ended up with a much better result on the short positions. With his primary investment instrument being gold, the trader appeared to be taking advantage of the strong downtrend that this metal had sustained from the beginning until mid-August. In addition, the trader continued to trade the GBPJPY currency pair and also opened a couple of trades on the GBPUSD pair.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.