Trading Week Ahead: Signs of a Softening Economy?

Last week’s busy calendar shook the markets as Fed Chair Jerome Powell signalled more openness to rate cuts. Traders now turn to fresh US data that will test whether this dovish tilt holds. The spotlight falls on US GDP, CB Consumer Confidence and the Core PCE Price Index, each with the power to move the dollar, yields and equities.

• US GDP

The US economy expanded by 3.0% last quarter, and forecasts call for a slight rise to 3.1%. Stronger growth would weaken the case for near-term rate cuts, likely lifting the dollar and Treasury yields. A softer figure could strengthen dovish expectations and boost risk appetite in equities and commodities.

• CB Consumer Confidence

Consumer confidence fell to 97.2 in the previous reading and is expected to slip again to 96.3. A weaker outcome would show households becoming more cautious, which could pressure the dollar while supporting stocks. A stronger result would highlight resilient demand and give the Fed reason to keep rates higher for longer.

• Core PCE Price Index

The Fed’s preferred inflation measure rose 0.3% last month, and analysts expect the same pace again. Another firm result would support the dollar and drive yields higher, reducing demand for equities and gold. A softer print could shift sentiment dovish, weighing on the greenback and lifting risk assets.

| Date | Time | Instrument | Event |

|---|---|---|---|

| Monday, Aug. 25 | 4:00 PM |  USD USD |

New Home Sales |

| Tuesday, Aug. 26 | 2:30 PM |  USD USD |

Durable Goods |

| 4:00 PM |  USD USD |

CB Consumer Confidence | |

| Thursday, Aug. 28 | 9:00 AM |  CHF CHF |

GDP |

| 2:30 PM |  USD USD |

GDP | |

USD USD |

Unemployment Claims | ||

| 4:00 PM |  USD USD |

Pending Home Sales | |

| Friday, Aug. 29 | 2:00 PM |  EUR EUR |

German CPI |

| 2:30 PM |  CAD CAD |

GDP | |

USD USD |

Core PCE Price Index |

*All times in the table are in GMT+2

Technical Analysis with FVG Strategy

This trading approach leverages the 20- and 50-period Exponential Moving Averages (EMAs) to assess the prevailing market trend, while the Fair Value Gap (FVG) is used to pinpoint zones of price inefficiency. These gaps, formed during sharp price movements, often highlight optimal entry or exit levels. The strategy is suitable for instruments like EURUSD, GBPJPY, US30, and XAUUSD and provides insights into both last week’s market opportunities and the current one.

Weekly Market Outlook

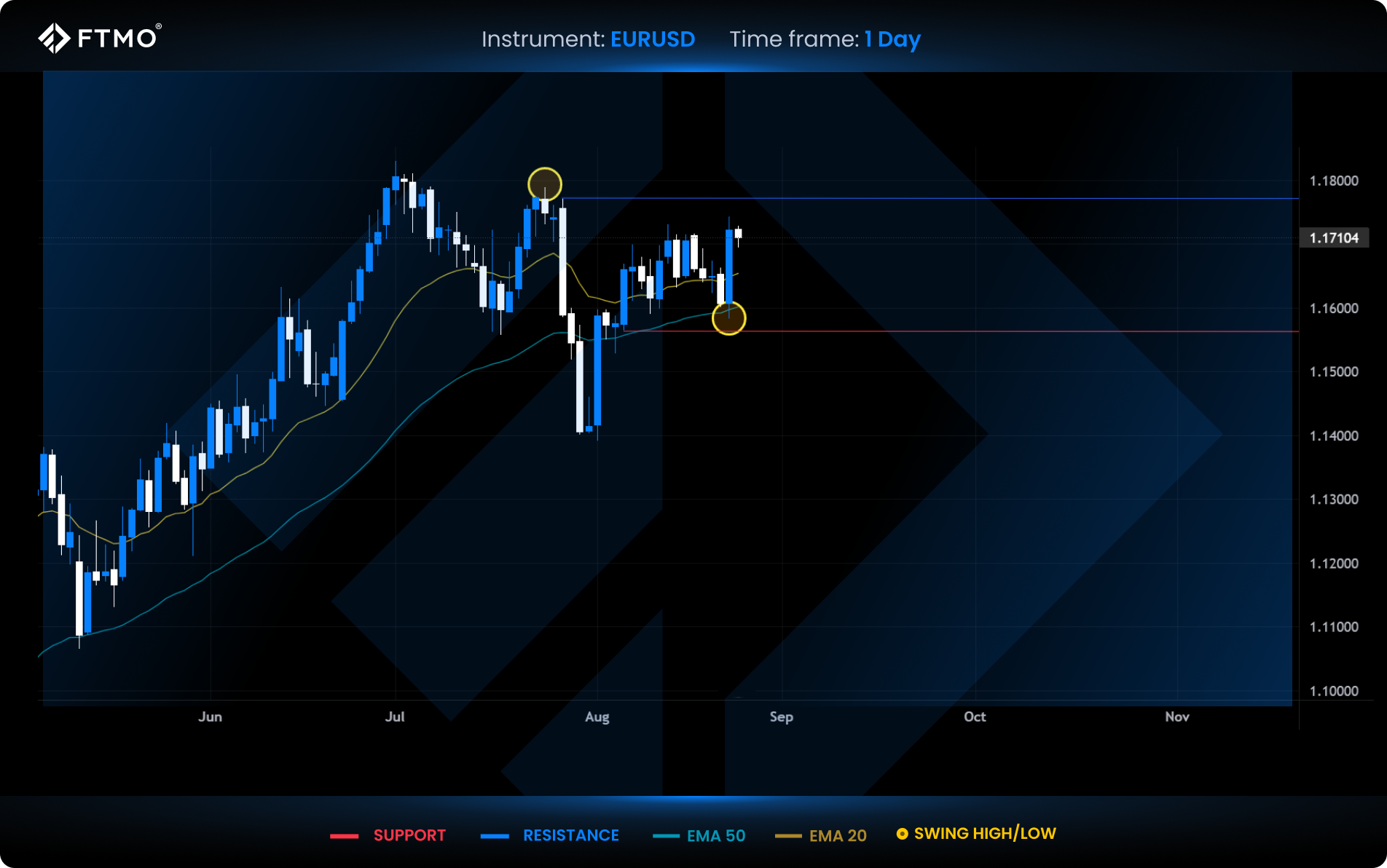

EURUSD

Market Context: EURUSD continues to hold above the 20 and 50 EMA, despite a brief dip last Thursday following a liquidity sweep near the 50 EMA. The broader structure remains constructive.

Bullish Scenario (Preferred): A continuation higher toward resistance, and the recent swing high remains the primary outlook.

Bearish Scenario (Alternative): A drop toward support and the swing low could trigger a fresh round of buying interest.

Setup: No Fair Value Gap (FVG) setups have emerged this week or last.

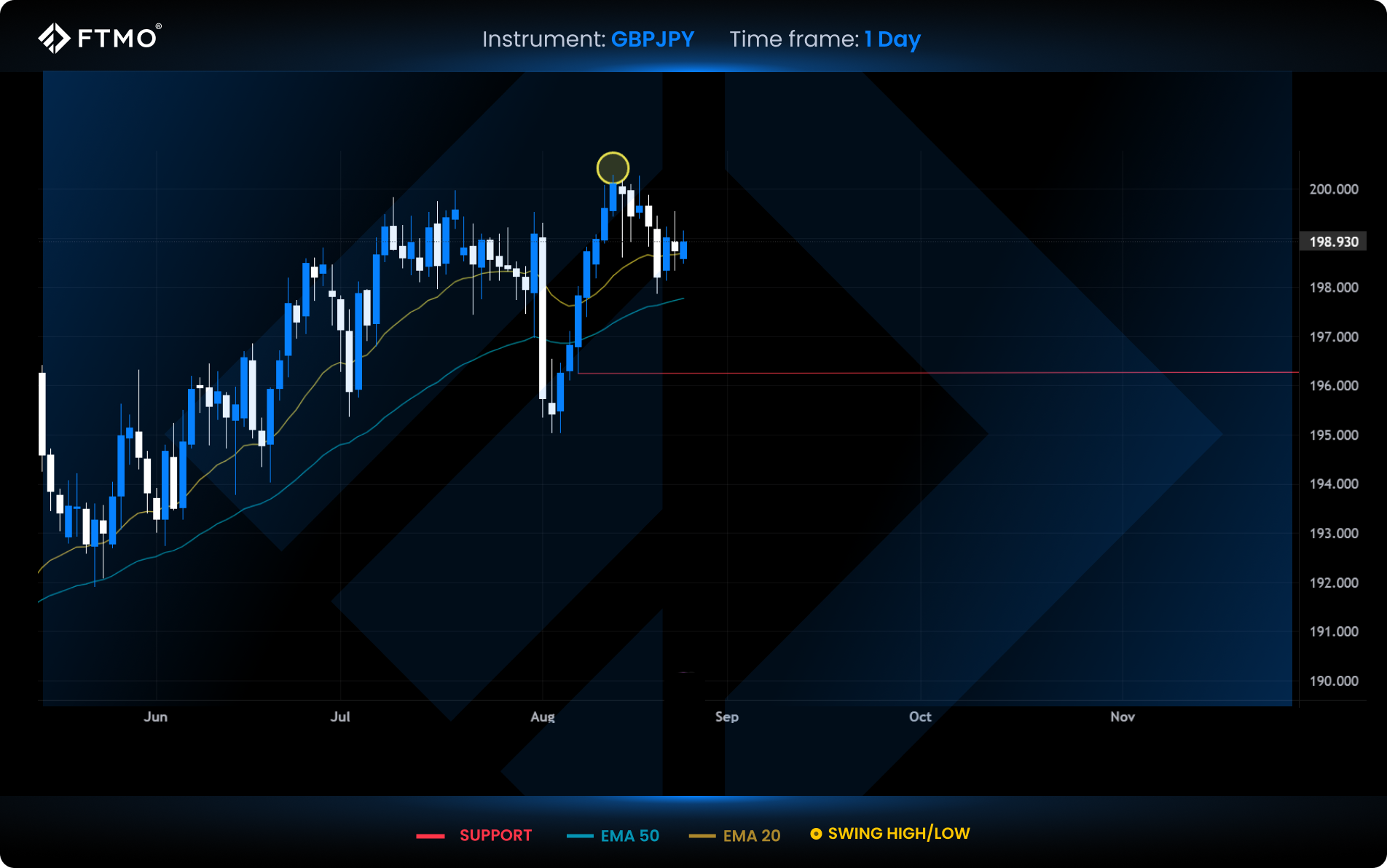

GBPJPY

Market Context: After a strong bullish leg, GBPJPY has entered a mild consolidation phase. Price currently hovers near the 20 EMA and an opposing FVG zone.

Bullish Scenario (Preferred): A bullish reaction from current levels could lead to a liquidity sweep and continuation higher.

Bearish Scenario (Alternative): A deeper pullback into the lower FVG and prior demand zone may offer improved long opportunities.

Setup: No new FVG setups have developed over the past two weeks.

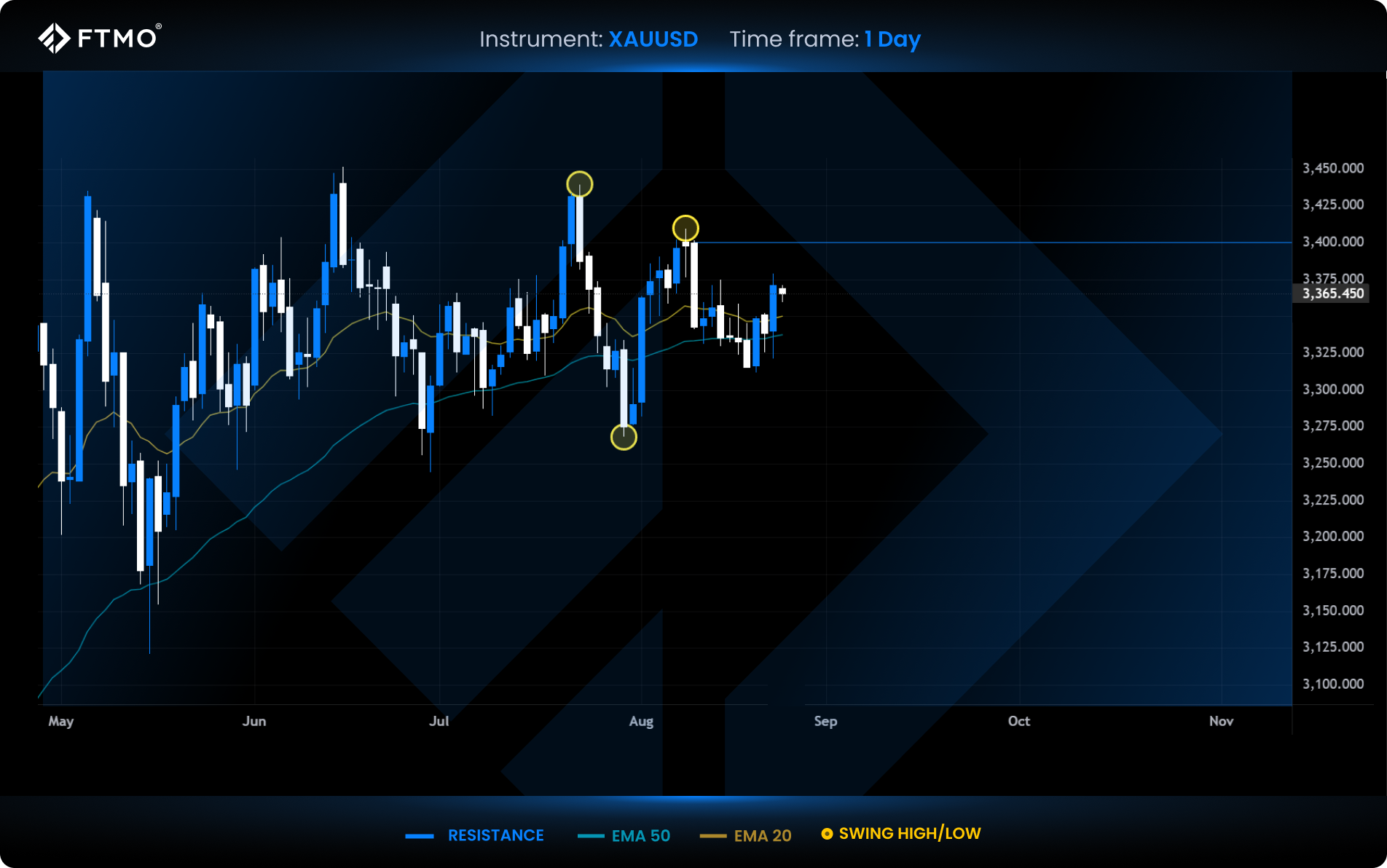

XAUUSD

Market Context: Gold continues to trade with a lack of clear direction. Price is holding near the edge of a bearish FVG created by a strong sell-off, which now acts as resistance. Liquidity remains balanced on both sides.

Bullish Scenario (Preferred): A bounce from the 20 and 50 EMA, combined with a positive Monday open, suggests potential for a move toward the swing high.

Bearish Scenario (Alternative): Rejection from the FVG edge and a break below the EMAs could shift momentum to the downside.

Setup: No FVG setups have formed in the last two weeks, highlighting market indecision.

US30

Market Context: US30 holds a bullish structure following last week’s strong performance. Thursday’s candle retested a long-side FVG, with Friday confirming the move through a strong bullish close.

Bullish Scenario (Preferred): A push toward new swing highs remains in play, supported by current momentum.

Bearish Scenario (Alternative): A shallow pullback into the previous range could offer another opportunity for buyers to step in.

Setup: No FVG setups have formed this week or last.

All information provided on this site is intended solely for educational purposes related to trading on financial markets and does not serve in any way as a specific investment recommendation, business recommendation, investment opportunity analysis, or similar general recommendation regarding the trading of investment instruments. FTMO only provides services of simulated trading and educational tools for traders.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.