Trading Week Ahead: Powell’s Speech & NFP Could Spark Big Moves

The markets are setting up for a busy ride with Powell back at the mic. NFP and fresh ISM data are on deck. Traders are bracing for a week full of setups and surprises. Whether you're trading the dollar, yields, or equities, this week’s data could be the catalyst that sets the tone for summer. Big moves are in play, and the only question is, are you ready to catch the momentum?

Here’s what traders should watch and how it might play out in the price action:

• Fed Chair Powell Speaks

Jerome Powell’s midweek appearance will be scrutinised for clues on the Fed’s monetary stance. Any tilt toward a dovish pivot could weaken the dollar and boost risk assets, while reaffirmed hawkishness may lift yields and support the greenback.

• Non-Farm Payrolls

July’s NFP release (Thursday) is the key macro catalyst, with expectations set for a slowdown in job creation to 120,000 from 139,000 in the prior month. A softer print could ignite dovish Fed speculation and weigh on the USD, while a stronger-than-expected figure may reinforce higher-for-longer rate bets and support dollar strength.

• ISM Manufacturing & Services PMI

Markets will closely track Tuesday's Manufacturing PMI, expected to edge up slightly to 48.8 from 48.5, still below the 50 threshold that separates contraction from expansion. Meanwhile, Thursday’s Services PMI is forecast to rise to 50.8 from 49.9, signalling a possible return to expansion. Upside surprises could lift risk sentiment and dampen Fed cut expectations.

| Date | Time | Instrument | Event |

|---|---|---|---|

| Monday, Jun. 30 | 8:00 AM |  GBP GBP |

GDP |

| 2:00 PM |  EUR EUR |

German CPI | |

| Tuesday, Jul. 1 | 11:00 AM |  EUR EUR |

CPI |

| 3:30 PM |  USD USD |

Fed Chair Powell Speaks | |

| 4:00 PM |  USD USD |

ISM Manufacturing PMI | |

USD USD |

JOLTS Job Openings | ||

| Wednesday, Jul. 2 | 2:15 PM |  USD USD |

ADP Non-Farm Employment Change |

| Thursday, Jul. 3 | 8:30 AM |  CHF CHF |

CPI |

| 2:30 PM |  USD USD |

Average Hourly Earnings | |

USD USD |

Nonfarm Payrolls | ||

USD USD |

Unemployment Rate | ||

| 4:00 PM |  USD USD |

ISM Services PMI |

*All times in the table are in GMT+2

Technical Analysis with FVG Strategy

This trading approach leverages the 20 and 50-period Exponential Moving Averages (EMAs) to assess the prevailing market trend, while the Fair Value Gap (FVG) is used to pinpoint zones of price inefficiency. These gaps, formed during sharp price movements, often highlight optimal entry or exit levels. The strategy is suitable for instruments like EURUSD, GBPJPY, US30, and XAUUSD and provides insights into both last week’s market opportunities and the current one.

Last Week’s Opportunities

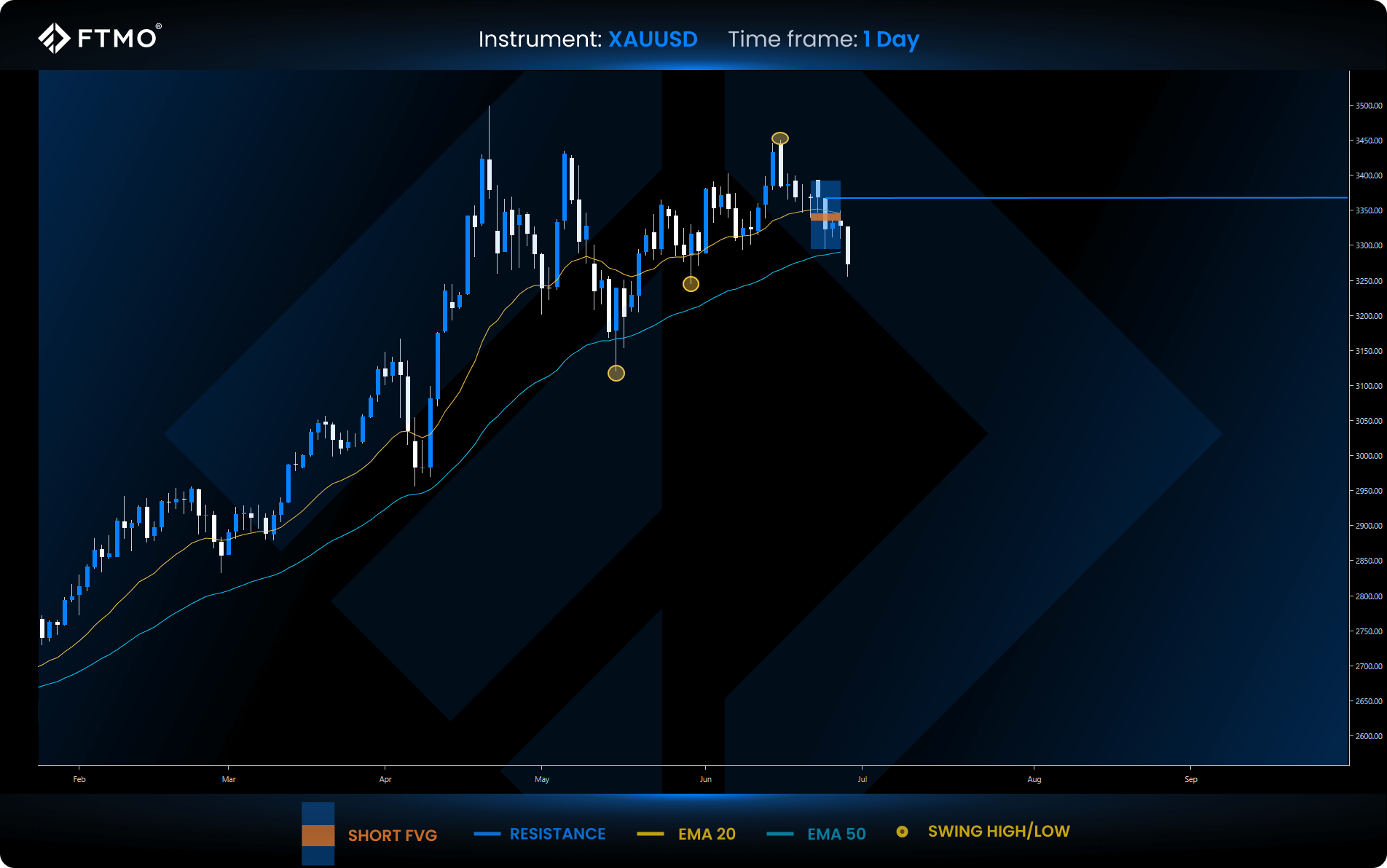

XAUUSD

Market Context: Gold has broken below its previous bullish structure and is now testing the EMA50. The momentum has shifted to the downside in the short term.

Bearish Scenario (Preferred): A continued move lower is expected, targeting the sweep of recent swing lows.

Bullish Scenario (Alternative): If price holds above the EMA50, a short-term bounce into resistance may follow, but the overall bias remains cautious.

Setup: Last week’s bearish FVG reached its 2:1 RRR target. No new setups formed this week.

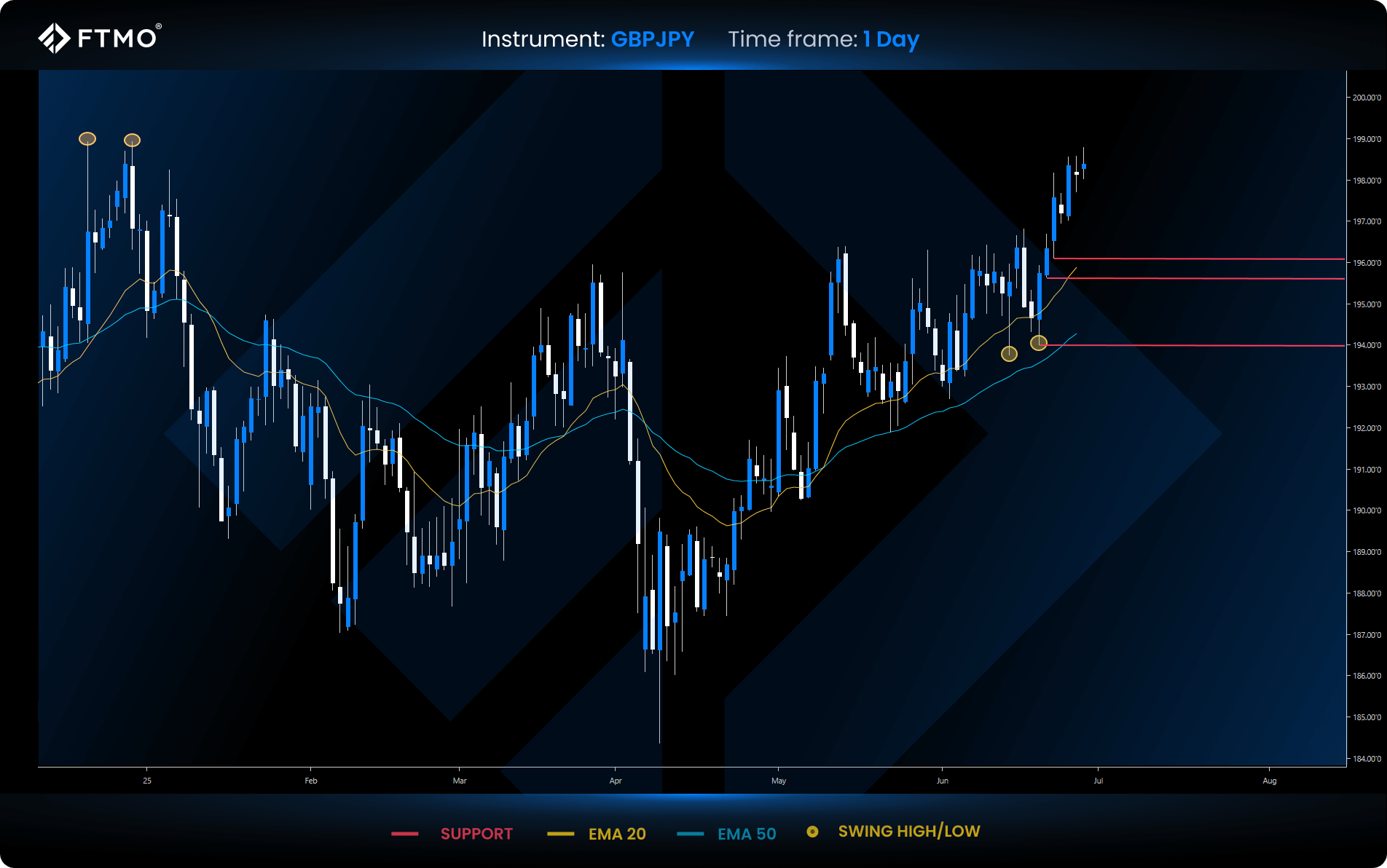

GBPJPY

Market Context: GBPJPY remains in a strong uptrend, trading well above the EMA20 and EMA50. The market is pushing toward prior swing highs where liquidity is likely resting.

Bullish Scenario (Preferred): A move higher into that zone is expected, with the potential for continuation if resistance breaks.

Bearish Scenario (Alternative): Watch for a dip into support. If bulls step in, expect a bounce. If not, the uptrend could stall.

Setup: Last week’s FVG setup was invalidated after no entry signal formed within three candles. No active setup at the moment.

Opportunities to Watch This Week

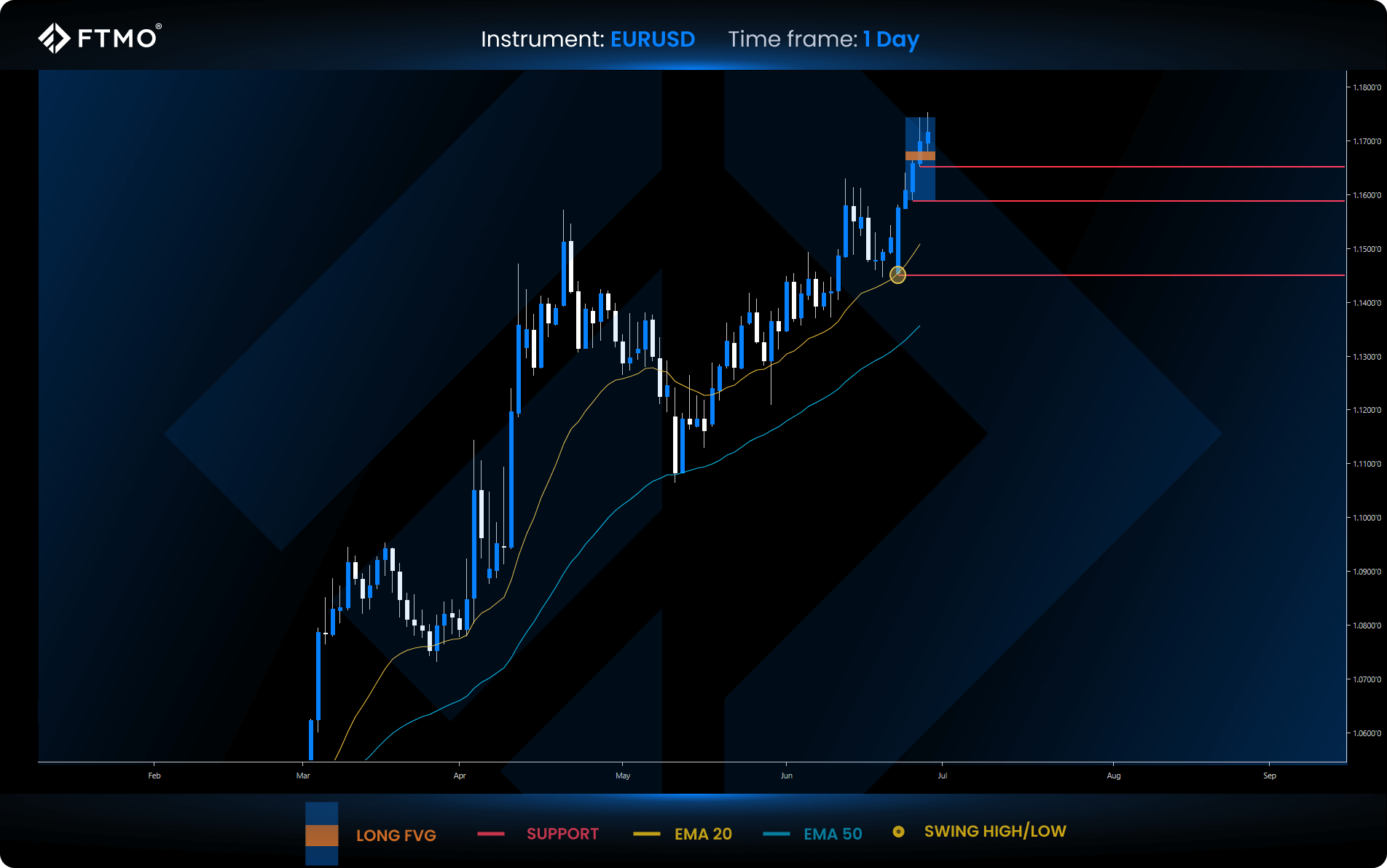

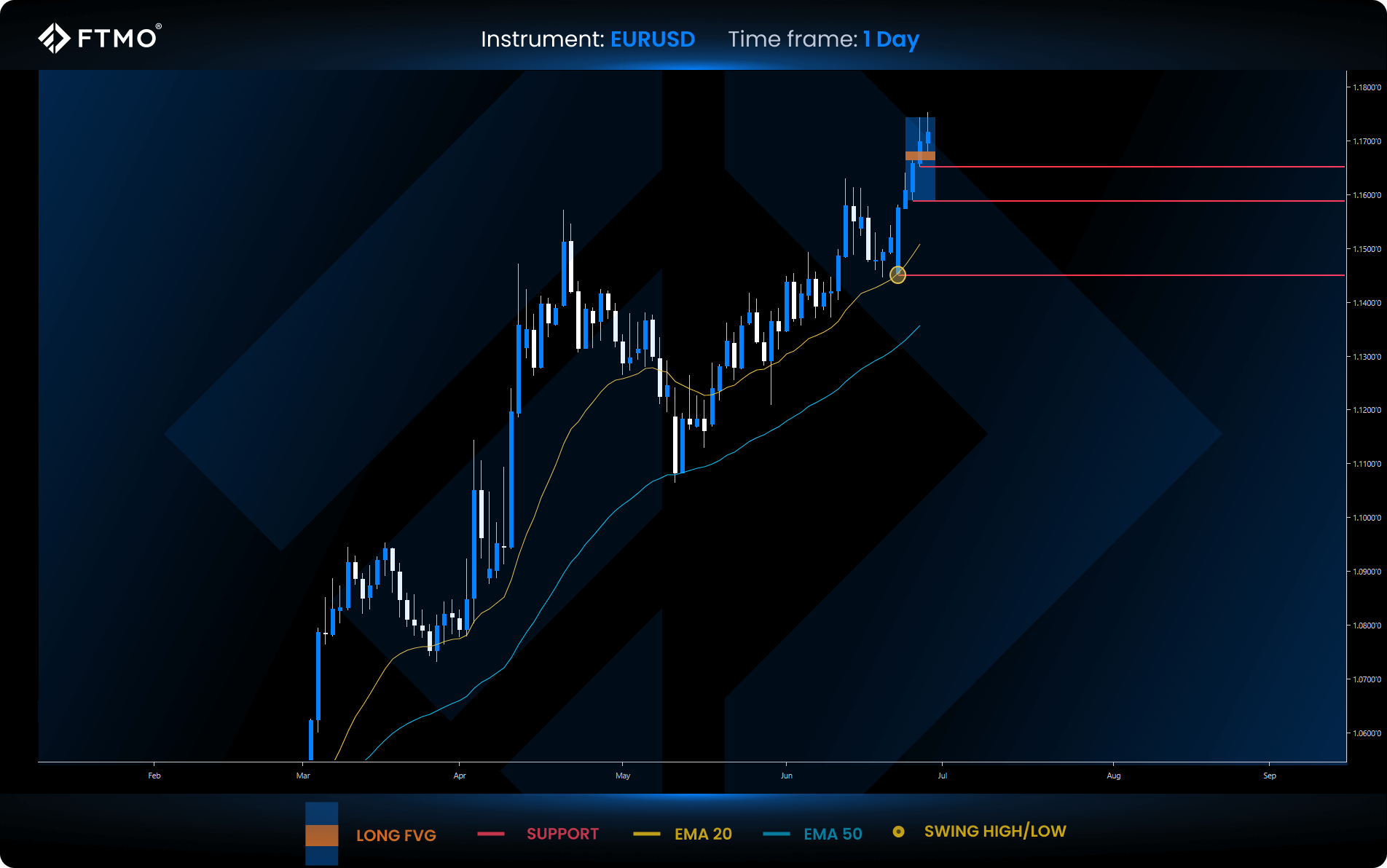

EURUSD

Market Context: The euro is holding strong above the yearly high, showing clear bullish momentum. Several Fair Value Gaps (FVGs) have formed during the recent rally, confirming aggressive buying interest.

Bullish Scenario (Preferred): As long as the price stays above the latest FVG, further upside is expected with a target at 2:1 RRR.

Bearish Scenario (Alternative): A sharp pullback could send the price lower into previous FVG zones, where demand may step in again.

Setup: This week’s bullish FVG remains active and aligns with the current trend, offering a clean opportunity with a potential 2:1 RRR target.

US30

Market Context: US30 is in a strong uptrend, supported by bullish structure and a recent FVG formation. Price is approaching a key resistance zone.

Bullish Scenario (Preferred): Continued upside into the resistance zone is expected. A breakout could lead to further gains.

Bearish Scenario (Alternative): A pullback to support may offer a new buying opportunity if buyers step in and defend the level.

Setup: A new bullish FVG formed this week, offering a valid long setup with a target at 2:1 RRR or the resistance zone.

All information provided on this site is intended solely for educational purposes related to trading on financial markets and does not serve in any way as a specific investment recommendation, business recommendation, investment opportunity analysis or similar general recommendation regarding the trading of investment instruments. FTMO only provides services of simulated trading and educational tools for traders. The information on this site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local laws or regulations. FTMO companies do not act as a broker and do not accept any deposits. The offered technical solution for the FTMO platforms and data feed is powered by liquidity providers.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.