“Trading really isn't all about the technicals but about psychology”

Having a technical analysis in the palm of one’s hand is one of the basic skills that help a trader to build a trading plan and then execute profitable trades. However, even a perfect knowledge of technical analysis is of no use to a trader if he is unable to handle the psychological burden associated with trading. Psychological resilience also helped our new FTMO Traders to successfully complete the FTMO Challenge and Verification.

Trader Royce: "Trading is a lonely endeavor, but a rewarding one."

What inspires you to pursue trading?

I have always thought of the notion of day traders as the definition of success. To be able to earn money via your own means and be flexible with your own time. It’s just something that has always attracted me.

What was more difficult than expected during your FTMO Challenge or Verification?

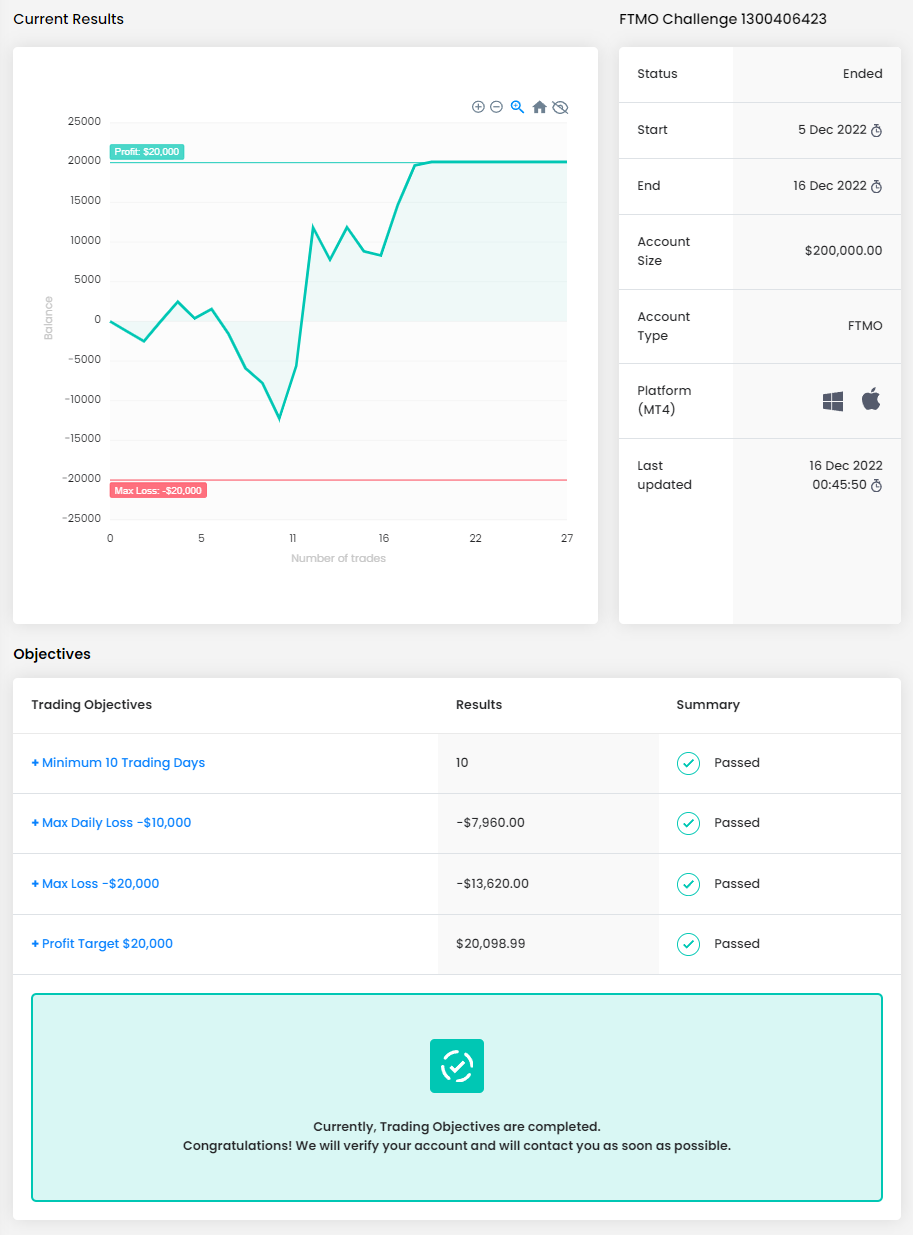

The most difficult part was not knowing when you were making a mistake. Now I fully understand the gravity of my emotions and the part they play. This is my third time passing the challenge and I still feel like the hardest part lies ahead.

What does your risk management plan look like?

I am always risking 2% for a gain of 2.5% or more. It’s a value that I’ve come to become comfortable with. But if I am at a loss, I will scale it down to 1% until I regain the initial balance of the account.

Has your psychology ever affected your trading plan?

Yes. All. The. Time. It’s really a battle of you against your emotions, i.e. your greed, your fear, your impatience. The thing about trading is to really stick to high probability trades, and only execute on those signals. I have never fully grasped the gravity of the words in the sentence until very recently.

Do you have a trading plan in place, and do you follow it strictly?

Yes. I only trade either during the New York or London session, and during those sessions I will only enter on a retracement after a strong move.

What is the number one advice you would give to a new trader?

Trading is a lonely endeavor, but a rewarding one. The moment it clicks in your head. It’s really a game changer. Stick to what you know works and ignore everything else.

Trader Gatien: "It is important to stay neutral after losses and not to become emotional."

Do you have a trading plan in place, and do you follow it strictly?

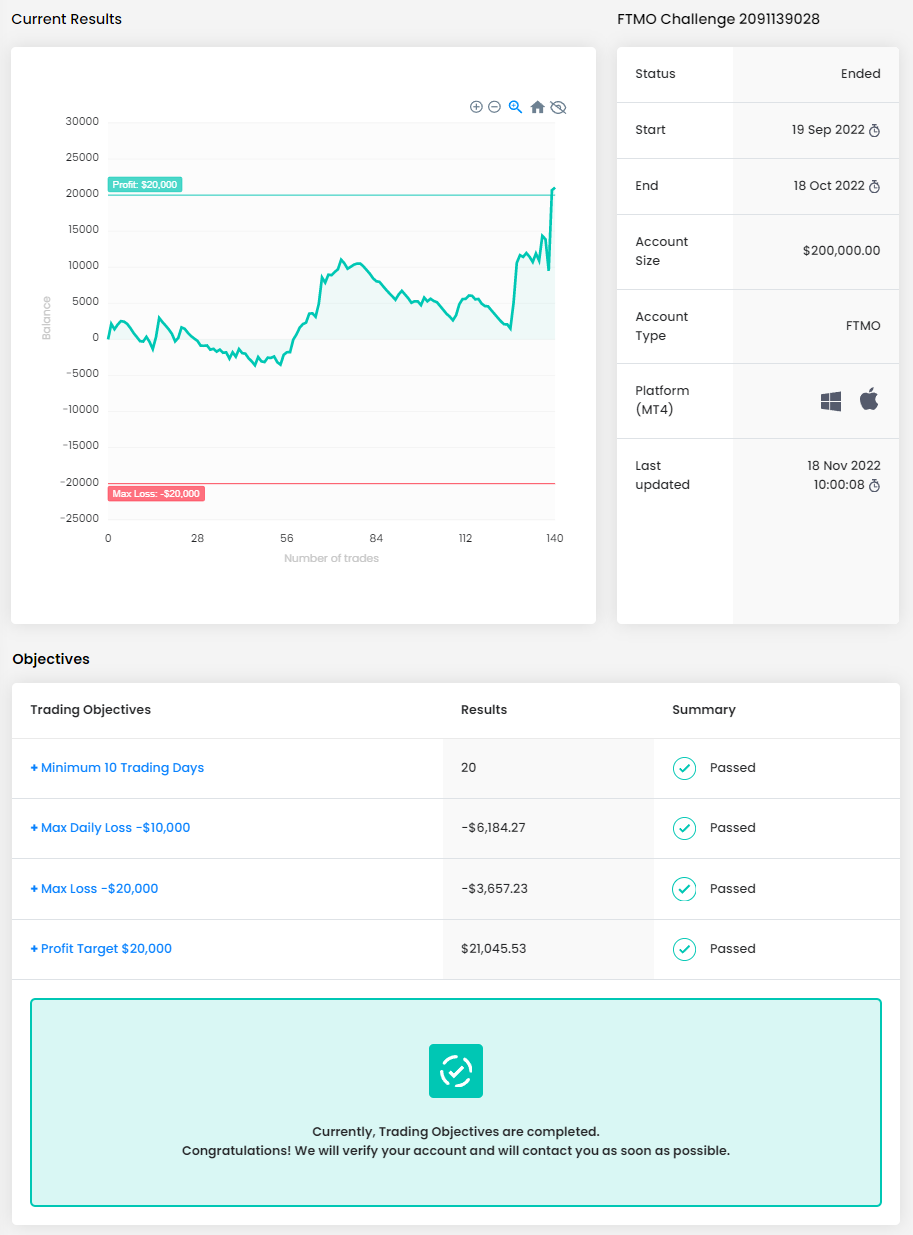

I have been experimenting with my trading plan for several months, by building different algorithms to test out and backtest different strategies. The trading plan uses key concepts of liquidity and resistance/support areas as well as momentum.

What inspires you to pursue trading?

The ability to work flexibly from anywhere in the world while having the ability to earn a significant amount of money if you are good attracted me to trading. The competitiveness in the industry is also a great motivation to consistently improve.

How did loss limits affect your trading style?

The maximum loss limit forced me to constantly reevaluate my trading plan and to be more careful in my trading sizes and stop-losses taken. It is not enough to just win a trade but to be consistent in the concepts employed to be able to have large wins and much tighter losses.

How would you rate your experience with FTMO?

My experience with FTMO was good and has been useful to my overall trading journey. It has helped me to extensively improve my risk-management but also helped me to trade assets that I would not have considered without the platform.

What was the hardest obstacle on your trading journey?

The hardest obstacle in my trading journey was to stay motivated and hopeful after a significant draw-down. Losses in trading can quickly escalate and make you lose the Challenge or the account. It is important to stay neutral after losses and not become emotional, which would make your trading lose significantly in terms of quality.

What would you like to say to other traders that are attempting the FTMO Challenge?

The biggest advice I could give is to always operate with a fixed risk and after taking a loss to take a couple hours without trading to reevaluate. One of my larger mistakes was turning small losses into large ones just by trying to catch up instantly on bad trades. Rather, it is much more efficient to stay out of the market for a bit, and only come back when other trades feel confident in the overall trading strategy developed.

Trader Jazmine: "You can have the most accurate analysis in the world but if you do not manage your risk properly, you are setting yourself up for failure."

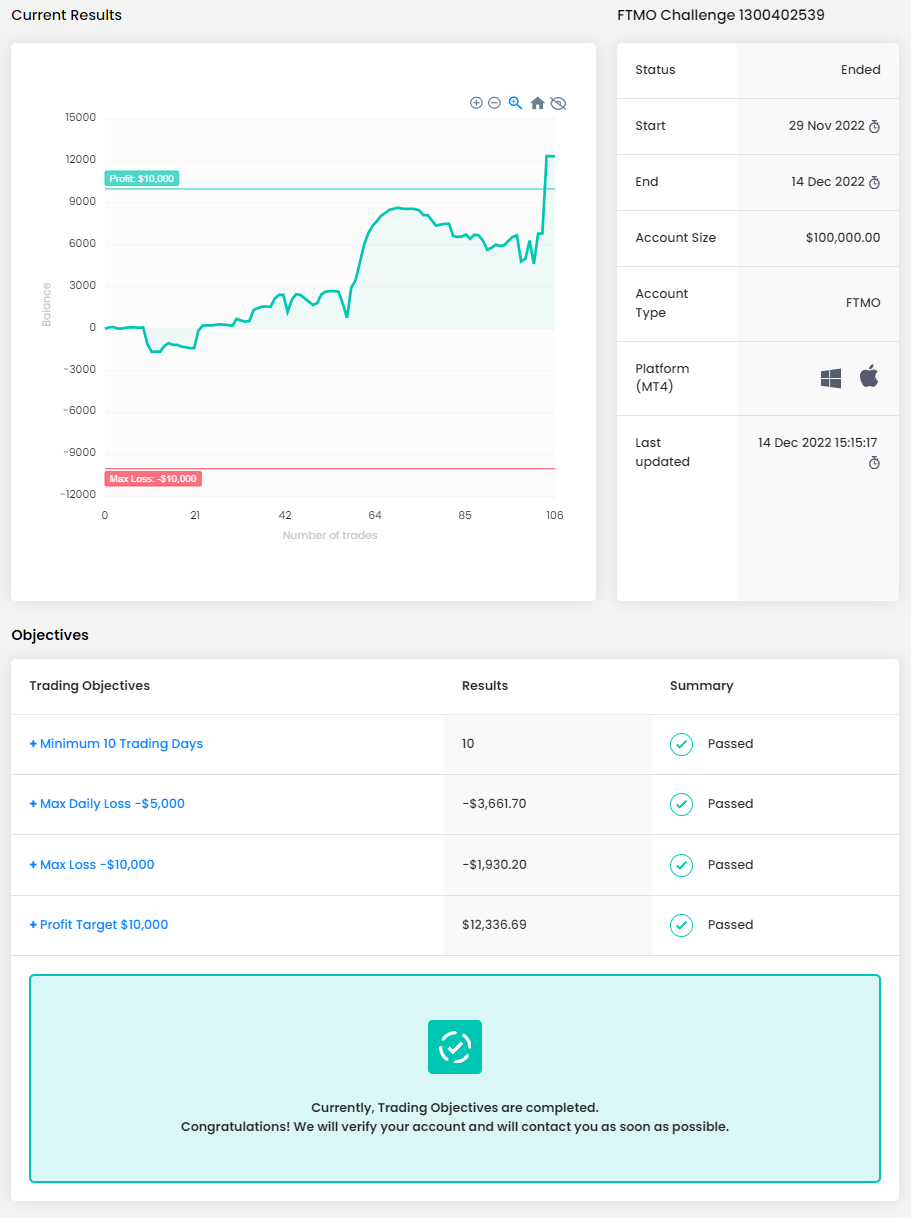

Do you plan to take another FTMO Challenge to manage an even bigger capital?

Absolutely. I think it’s awesome that FTMO allows you to combine your accounts.

What was more difficult than expected during your FTMO Challenge or Verification?

It was the fact of realizing you cannot escape risk management. You can have the most accurate analysis in the world but if you do not manage your risk properly, you are setting yourself up for failure.

How did you manage your emotions when you were in a losing trade?

I have a reminder on my laptop that says, “Let the market tell you when it is enough.” When I am in drawdown, I have learned to be as objective as possible & accepting a loss sooner rather than later, when it hurts.

What was the hardest obstacle on your trading journey?

I believe it was realizing that trading really isn’t all about the technicals but about psychology. I admit I had to overcome so many battles in this area but once you sit there & do the work, you are on a new level. A level that leads you into many breakthroughs.

Has your psychology ever affected your trading plan?

Yes, of course. Especially towards the beginning when I would not focus so much on it. Now, I have rules in place as to when I should trade based on how I am doing on that day.

One piece of advice for people starting the FTMO Challenge now.

It would be what you hear everyone else say. DO NOT GIVE UP. I do not care how long it takes you to pass. You are sitting on a gold mine, do you really want to walk away from this.

Trader Adeev: "Trading is 80% mindset and 20% knowledge."

Do you have a trading plan in place, and do you follow it strictly?

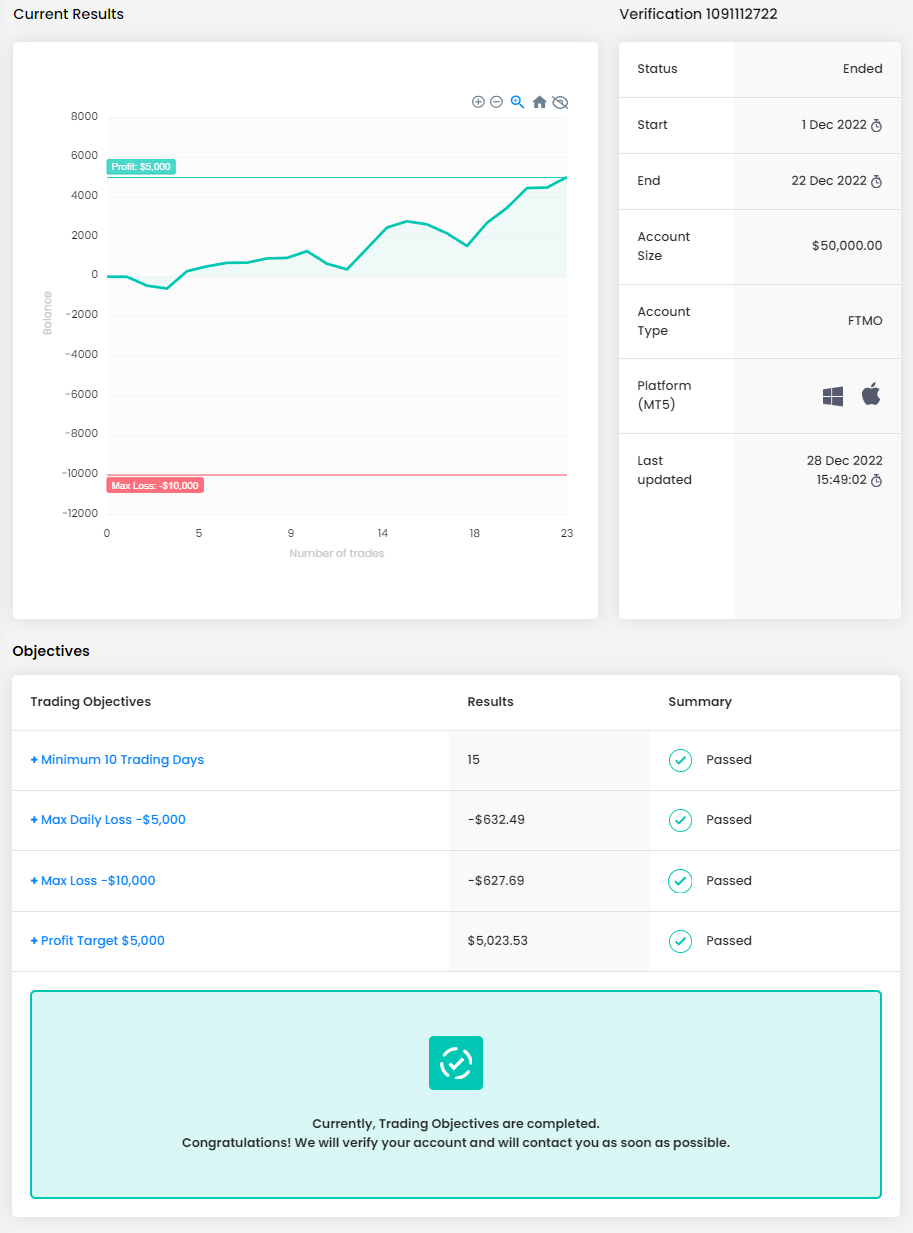

Yes, I follow a strict trading plan. Firstly, I always trade my setups. Even if this means missing a few trades. Following my trading plan gives me an edge in the market. Secondly, I never risk more than 2% of my capital/trade. Usually, my risk is 1% but depending upon the scenario, it could vary between 1%-2% but never over 2%. When I have to take multiple positions, my combined risk never exceeds 2.5%. Also, I’ll usually make my first trade breakeven before executing the second one.

How did you eliminate the factor of luck in your trading?

Luck was never a factor in my trading. Of course, I had several trades, which I won despite the price going against me, at first but I think that is just the probability. I try to always think in probabilities, and stick to my trading plan, even if that means missing a few good trades. Outcome of a trade does not affect my emotional state.

Where have you learnt about FTMO?

I have been following FTMO for a few years now, and it was the first prop firm I saw on the internet. Over the years, I have seen several prop firms, and I can say with certainty that FTMO is the best prop firm out there. FTMO has lowest spreads and commissions along with solid risk parameters. I also like the fact that there are multiple accounts and numerous currencies to choose. I absolutely love your firm.

How has passing the FTMO Challenge and Verification changed your life?

I love trading, and prior to FTMO I was trading with a small account of $500. I lacked motivation to trade because losing or winning a dollar/trade doesn’t make any difference. I really wanted to pursue trading full time but arranging money for a sizeable account is a major roadblock, and even if you have the funds, a retail trader never gets raw spreads. I needed a sizeable account that could cover my salary. So, these things kept me out of trading for a few years. FTMO made it possible for me to trade full time and make a decent living out of it. Passing the FTMO Challenge and Verification made me a better risk manager and a good trader. Really grateful that FTMO exists.

How did you manage your emotions when you were in a losing trade?

Outcome of the trade doesn’t affect my emotions anymore. It took me a lot of time and effort to get to this state of mind, and I know I have a long road in front of me. I am aware that I can’t win all the trades I take and winning or losing is just a probability game. Whenever I enter a trade, I usually write down the logic of executing the trade and the risk associated with the trade. At the end of the day, I read my journal and see if there was something I missed and document my performance.

What is the number one advice you would give to a new trader?

Invest in psychology. In order to be a consistent successful trader, you’ll need a mindset different from 90% of the population. Trading is 80% mindset and 20% knowledge.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.