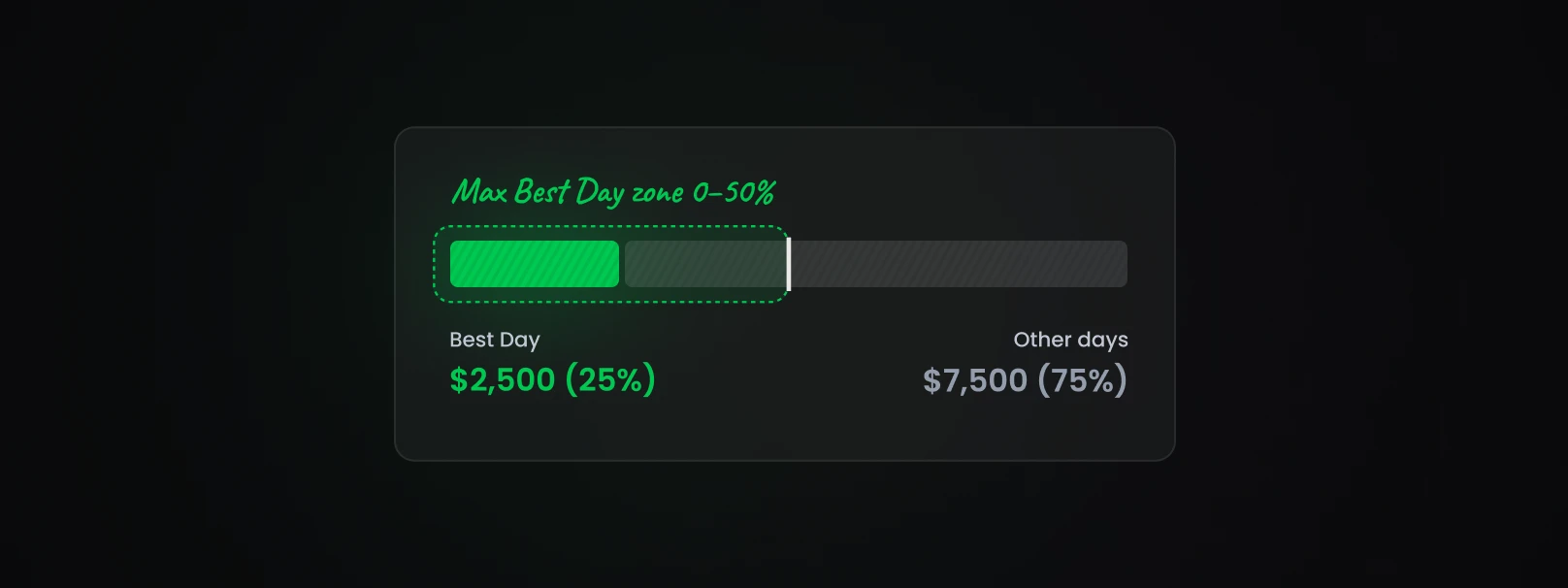

Best Day Rule requires that your most profitable day (“Best Day”) does not exceed 50% of your Positive Days’ Profit on the account.

To pass the FTMO Challenge: 1-Step or to be eligible for a Reward on an FTMO Account, your profit from the Best Day must not represent more than 50% of your Positive Days’ Profit.

The Best Day is a single day with the highest profit, where the profit is calculated from closed trades:

- at the end of the trading day (00:00 CE(S)T), or

- when other Trading Objectives are fulfilled on FTMO Challenge: 1-Step or FTMO Account: 1-Step.

The Positive Days’ Profit is the sum of closed profits from profitable trading days. The Positive Days’ Profit is recalculated at the end of each profitable trading day (00:00 CE(S)T).

Exceeding the Best Day limit is not treated as a rule breach. However, you need to continue trading to generate additional profit until your Best Day (the most profitable day) represents 50% or less of your Positive Days’ Profit on the account.

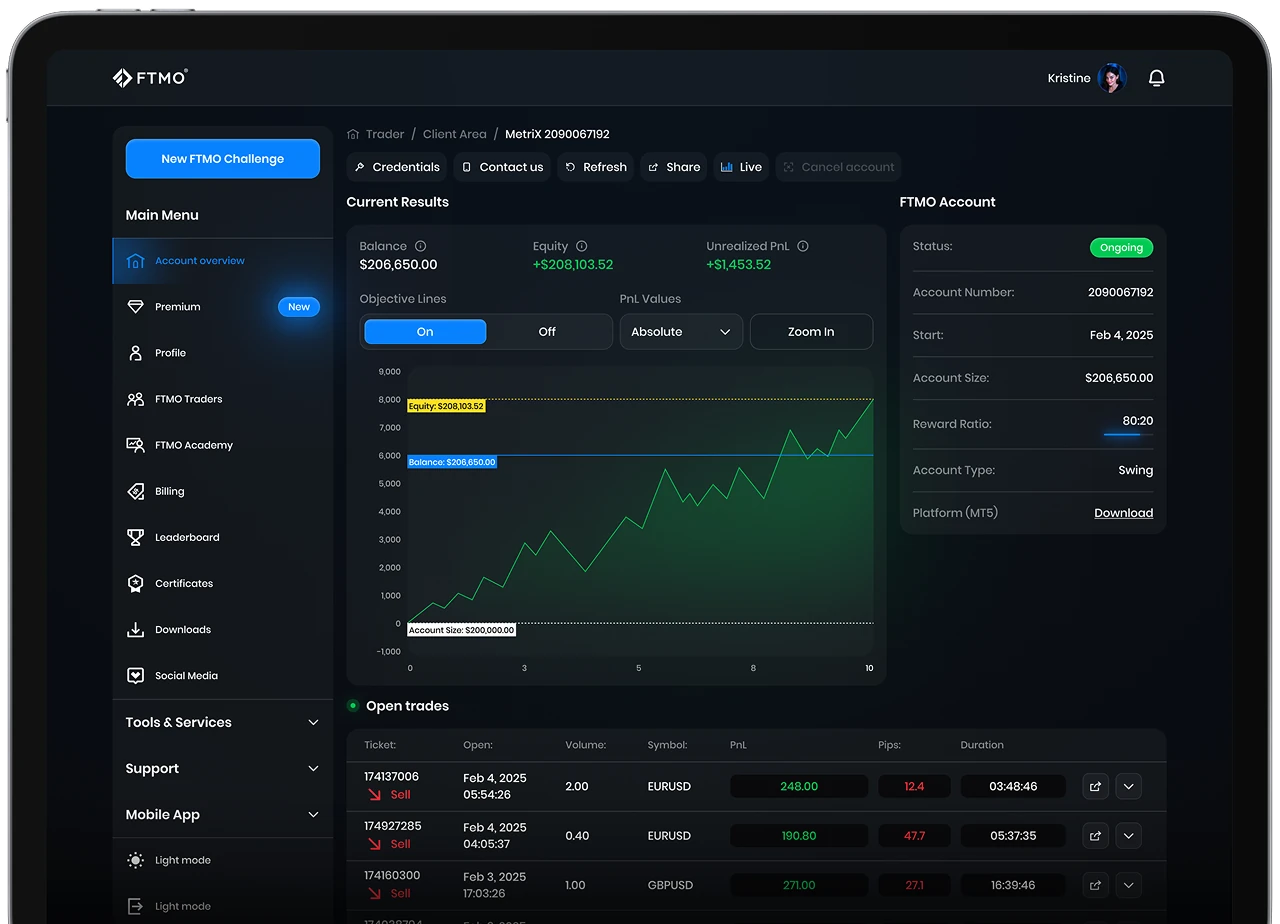

For informative purposes, the Best Day Rule results are displayed in the Account MetriX.

This rule applies to the FTMO Challenge: 1-Step as well as the FTMO Account: 1-Step.

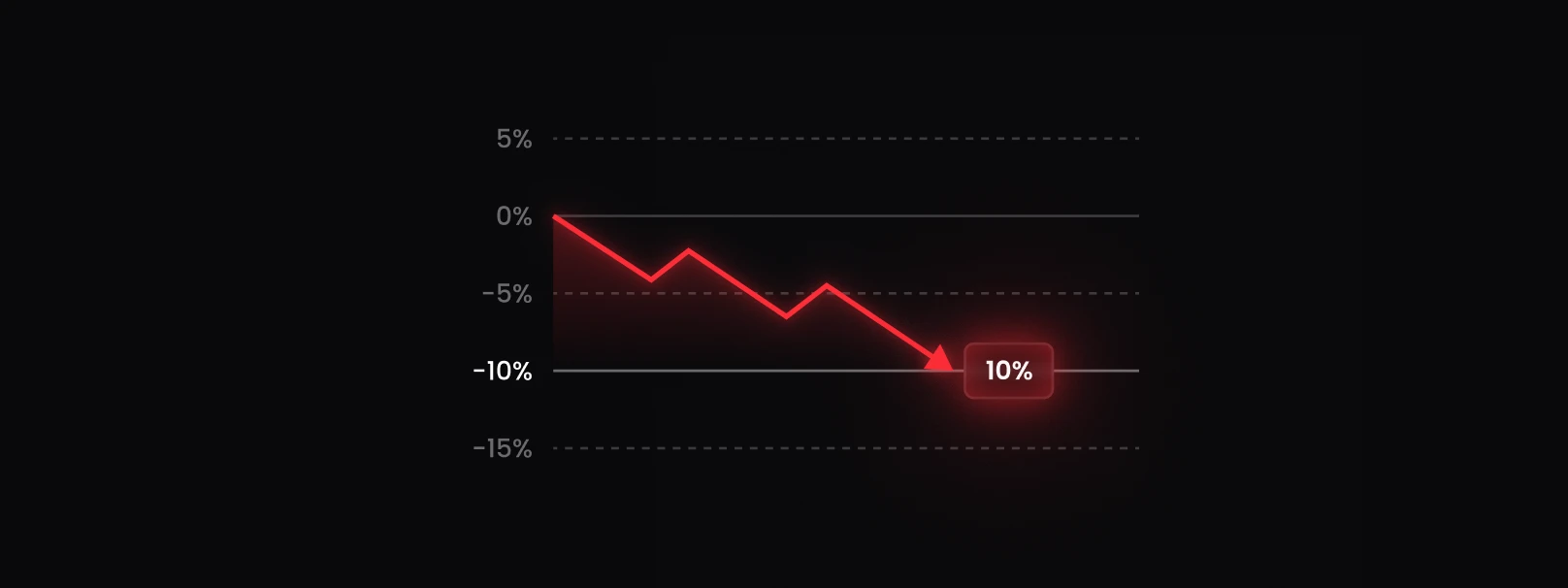

Example (account size does not play a role):

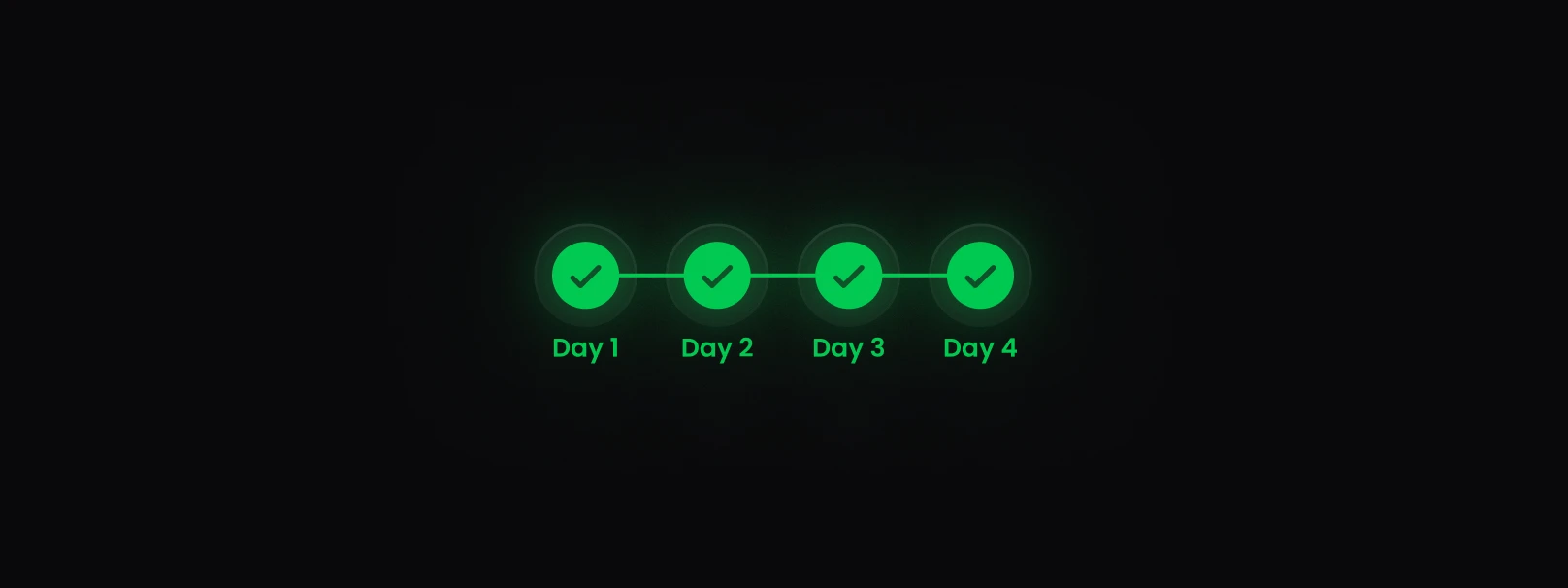

P&L per Day:

- Day 1 = closed loss = $2,000

- Day 2 = closed profit = $10,000

- Day 3 = closed loss = $2,000

- Day 4 = closed loss = $2,000

- Day 5 = closed profit = $6,000

Results at the end of Day 5:

- Positive Days’ Profit = $16,000

The Best Day is Day 2. On this day, 62.5% of the Positive Days’ Profit was achieved ($10,000 of $16,000 = 62.5%).

Because the profit achieved on Best Day exceeds the 50% allowed limit, the Best Day rule is not satisfied. If Day 2 remains your Best Day, your Positive Days’ Profit will have to be at least $20,000.