Trading Journal? It's a must.

Trading is no different from any other business. You risk some money to make more money. But since retail trading is in most cases done from home, traders tend to have a very lazy attitude to keeping records about their trading activities. In this article, we will have a look at why journaling is so important and how you can journal for free with our FTMO Trading Journal.

Why you should be keeping a Trading Journal

We know that journaling might not be the most fun activity to do, but we as traders tend to do a lot of mistakes and in order to fix them, we have to document them so we won't forget about them easily.

Another reason for keeping a journal is to keep statistics on different strategies and markets you are trading.

If you are for example profitable on EURUSD, there is no certainty that the same strategy will work on Gold.

Or if you trade the two completely different strategies, your journal can show you some very interesting statistics.

For example, the first strategy can have 80% strike rate and the second one only 50%.

If this was the case, would it make sense to risk the same % amount on these tho strategies? Not really.

It makes perfect sense to increase your risk a little bit if you know that the given strategy will perform better.

Journaling is the same as any other habit, you will get used to it.

There are generally two types of trading journals you can keep.

Journaling for swing traders

If you are a swing trader and you try to hold your trade for at least a whole trading day, you probably won't open more than 5-10 trades in a day.

If this is your case, you really should journal all your positions.

You will quickly find out that putting down a few notes about your trade doesn't take that much time and you will get excellent value from it.

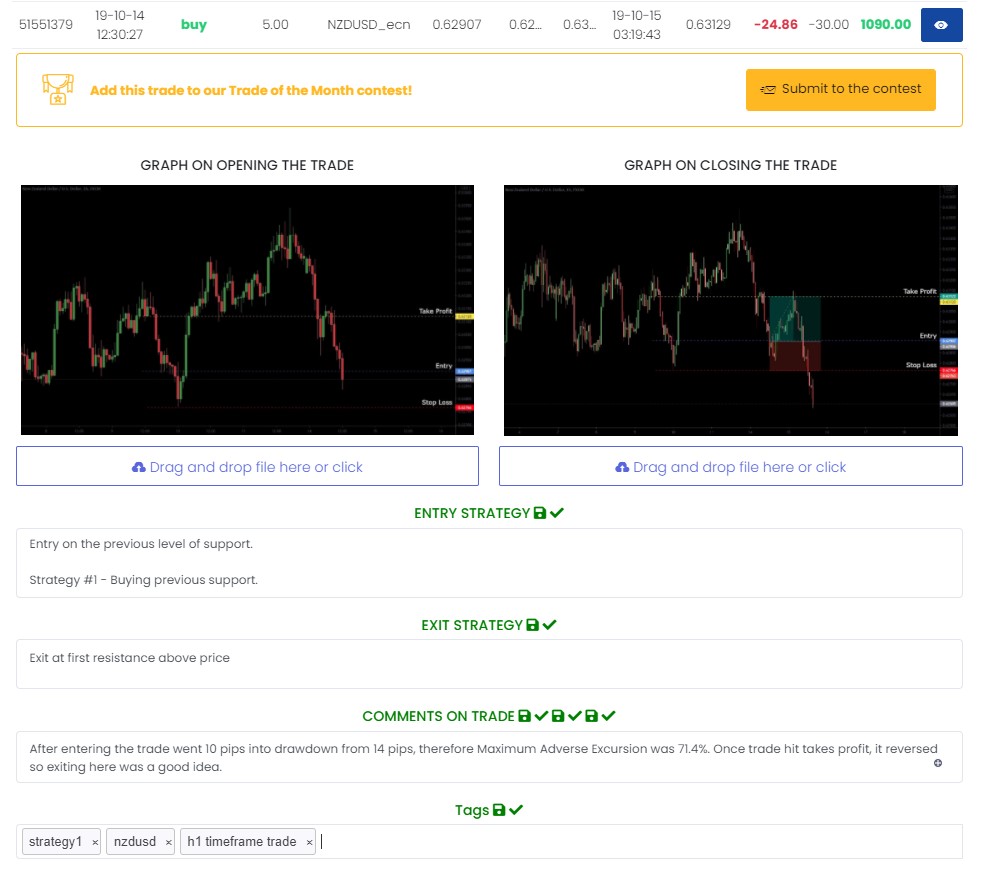

Here is a chart screenshot example of how your trade can look like.

Before the Entry:

After the Entry:

All you have to do once the trade is closed is document it inside the FTMO Trading Journal.

As you can see, besides the option to upload your screenshots, you can also add a free text to your entry and exit strategy.

On entry strategy, you should write down the exact strategy you used for entering the trade and on an exit strategy, you should document why you exited and also how the price behaved after you closed the position.

This can give you useful insight into future trades as you can find out if you are not exiting trades too early or too late.

Comments on trade are useful for any other insights about your trade. It is crucially essential that you also record your emotions while being in the trade or any kind of hesitation or urge to diverge from the trade plan. Matters of psychology recorded in the journal are very important for later self-analysis and development.

One of the great tools for measuring your performance is Maximum Adverse Excursion (MAE), which measures how far into drawdown your trade went after you've entered it.

If you for example find out that most of the trades only go 20% in direction of your stop loss, your stop losses might probably be too wide.

You can also add tags for easier navigation in your trades.

Journaling for daytraders and scalpers

If you are day trading or scalping and you open 20 or 50 small trades a day, journaling every single one can be a tedious process.

But you can highly benefit from our FTMO Account Analysis.

Account Analysis will show you your most traded volume, instrument, trading hours, and direction - all in one place.

By keeping a close eye on these statistics, you can get rid of things that are not working for you very easily.

This is something traders without this type of insight could never do.

Conclusion

Keeping a trading journal and tracking your trading performance is an extremely important aspect of your trading business.

It is something every professional trader should do and if you want to sustain a long-lasting trading career, you should focus on analysing your inputs and develop yourself based on outcomes of this analysis.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.