"Trading isn’t a hobby it’s a way of life"

Trading can be done as a side job. However, if you want to be a successful trader in the long term, you need to spend a lot of time trading, creating a strategy, testing it, or analyzing the trades you make. Full-time trading is just like any other job and cannot be treated as a hobby. It's a way of life. Our new FTMO Traders take the same approach and that is why they are successful.

Trader David: "There is no magic formula, just your edge and playing the probabilities."

What was the hardest obstacle on your trading journey?

Having the mindset to constantly lean into failure as part of the learning process. There are hundreds of moments where you believe you’ve mastered the game, only to be humbled by a string of losses. The truth is, there is no magic formula, just your edge and playing the probabilities.

Has your psychology ever affected your trading plan?

The funding challenges always test your psychology, the closer you get to your profit target, the tendency to make irrational and impulsive mistakes increases. My trading plan always becomes inconsistent when I’m near the target.

How did you manage your emotions when you were in a losing trade?

No one likes drawdown, ultimately the only certain thing about the market is uncertainty. You can’t take losses and drawdowns personally. Adopting a probability mindset is a major way to desensitize yourself from negative emotions. I personally meditate before I trade the London session. I will literally visualize myself being in drawdown and losing trades so I can prepare for it in advance.

Do you plan to take another FTMO Challenge to manage even more capital?

Trading is a marathon, and not a sprint. Early in my trading career I took on FTMO Challenges that I wasn’t mentally equipped to deal with. Progression of capital should be a slow process. I would love to manage larger capital, but based on lessons from my past, avoiding greed will be paramount.

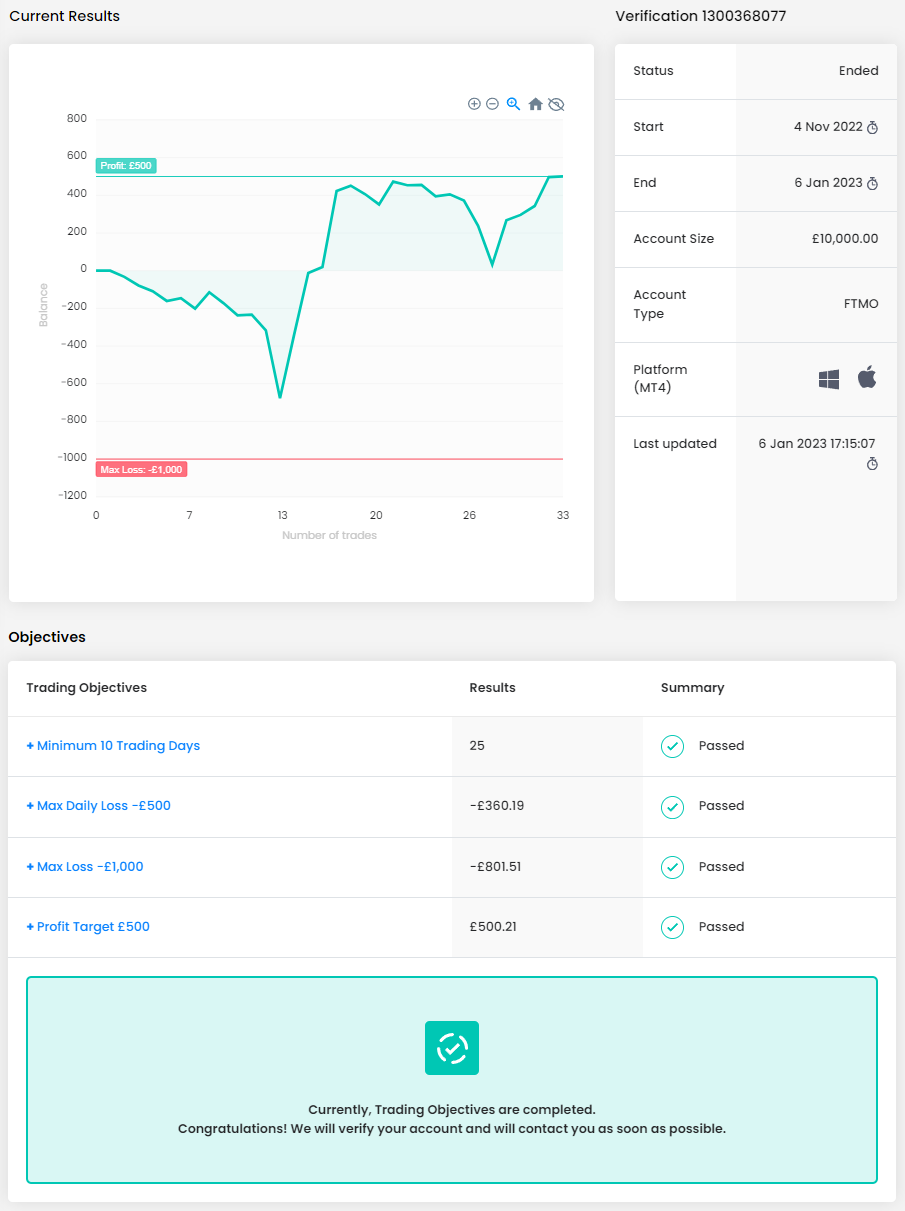

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

During Verification my equity exceeded the 5% profit target for a brief second, however, the take profit didn’t trigger and was 1 pip away. Price then aggressively reversed in the other direction, and I ended up closing the trade. A bad string of trades followed, and my emotions were all over the place. I quite literally had to take some days off to regain my sense of composure and clear my mind.

What would you like to say to other traders that are attempting the FTMO Challenge?

Don’t let fear become your enemy, losing trades are inevitable and will happen in flurries. I still struggle with it now, but let your winners run, or add size to winning trades. Taking a quick profit will sometimes help you in the short term, but over the long run you’ll probably be compromising your profitability. If the average aspiring trader spent less time on technical analysis and more time learning how to master their emotions, a higher percentage of us would be successful. Ultimately, I have no idea whether trading is a sustainable venture for me over the next 5-10 years, but learning how to manage your emotions is transferable to any aspect of life. Executing trades and repeatedly failing will equip you with the grit and strength to better handle adversity.

Trader Manuel: "Once you learn how to not trade when your setup isn’t there you will begin to see consistency."

Do you plan to take another FTMO Challenge to manage even more capital?

Absolutely, I’m aiming for the maximum allocation. Once you become consistently profitable, the next step is to scale up.

What does your risk management plan look like?

I typically risk 0.5-1% per position. Once I started treating risk management as my primary goal my results drastically improved.

What was easier than expected during the FTMO Challenge or Verification?

The Verification was easier than expected. I think a lot of people overthink it. I know I did before. You literally just have to continue off the momentum from the FTMO Challenge phase, nothing changes. It’s actually way easier at this point.

What do you think is the most important characteristic/attribute to become a profitable trader?

Knowing when not to trade. Not trading in unfavorable conditions is actually a skill that not many have, but once you learn how to not trade when your setup isn’t there you will begin to see consistency.

How has passing the FTMO Challenge and Verification changed your life?

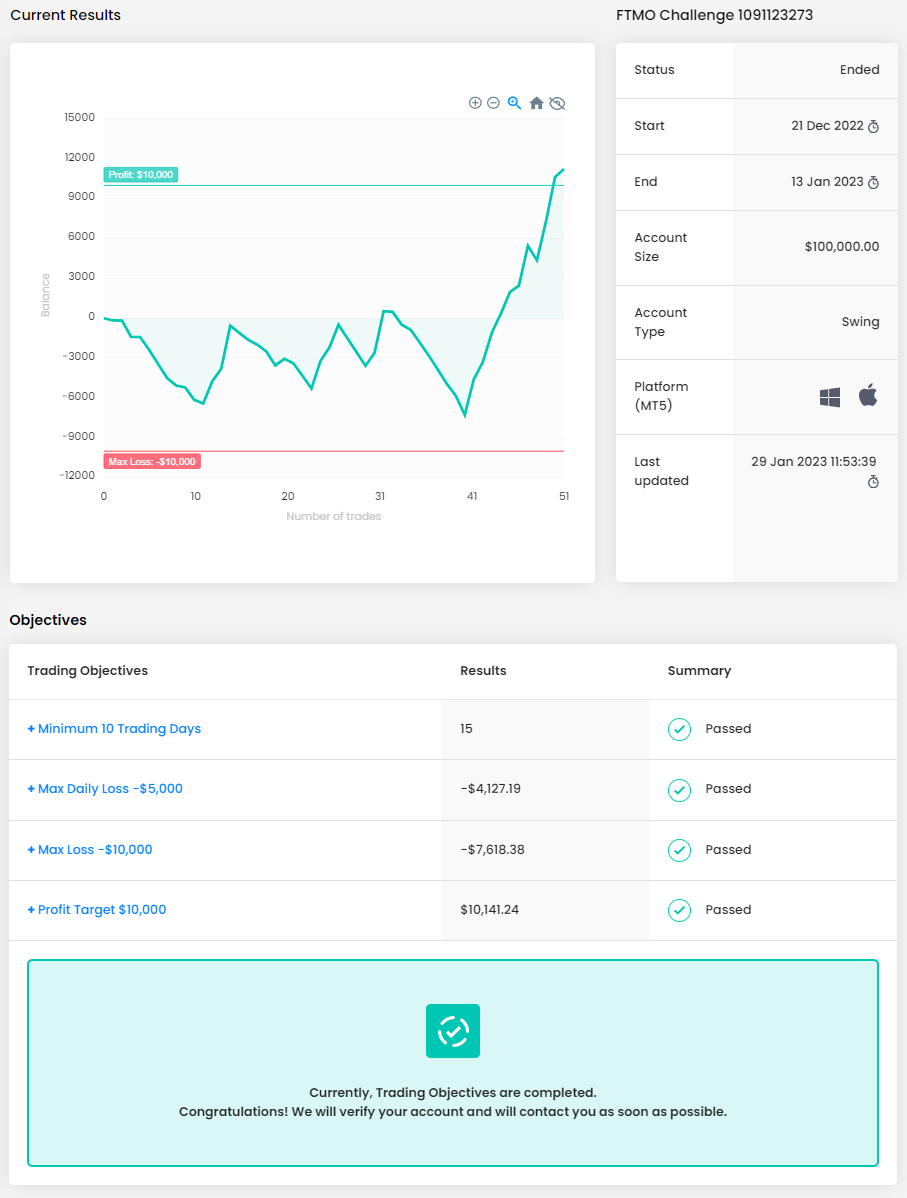

Words can’t explain how life changing this moment is, I am literally getting chills writing this. I’ve been trading for over 7 years, and have tried to get funded with FTMO for 2 years. Over 20+ attempts, but the desire never allowed me to quit. I’m a walking example of persistence and willpower. If you can visualize it, you’ll achieve it. This is going to allow me to reach a wider audience and help others in the way I wish I could. Trading isn’t a hobby, it’s a way of life.

What would you like to say to other traders that are attempting the FTMO Challenge?

You have to know, not just believe that you are a consistently profitable trader. Believing isn’t enough, a belief can be shaken, but knowing is a fact. When you adopt this, you WILL be consistently profitable. Also: We are all self-made, but only the successful ones admit it. When you take accountability for the good and the bad but learn how to change the bad, you’ll become unstoppable. Books that have helped me immensely are “Trading in the zone” by Mark Douglas and “Think and grow rich” by Napoleon Hill.

Trader Vadym: "Don’t get tilted when u have 5-8 losses in row."

Where have you learnt about FTMO?

From a trading course, they talked about their student who passed an FTMO Challenge as a success example.

How would you rate your experience with FTMO?

10/10 :). I love your app with the detailed analytics of my trades.

Do you have a trading plan in place, and do you follow it strictly?

I have a trading plan that consists of concepts like: structure, imbalances, Wyckoff etc. 80-90% of the time I follow my plan. Obv you can be better. Not only did I modify my plan to make it more quantifiable (binary (yes/no) conditions for every action) throughout the Challenge, but also made a list of my 5-7 mistakes that I can make, which I read before every session to know what pitfalls to avoid.

What was the hardest obstacle on your trading journey?

Staying emotionally detached, disciplined, and following my strategy. Don’t get tilted when you have ~5-8 losses in a row. Even though my win rate on average is about 20-25% with 1/10 RR.

Describe your best trade.

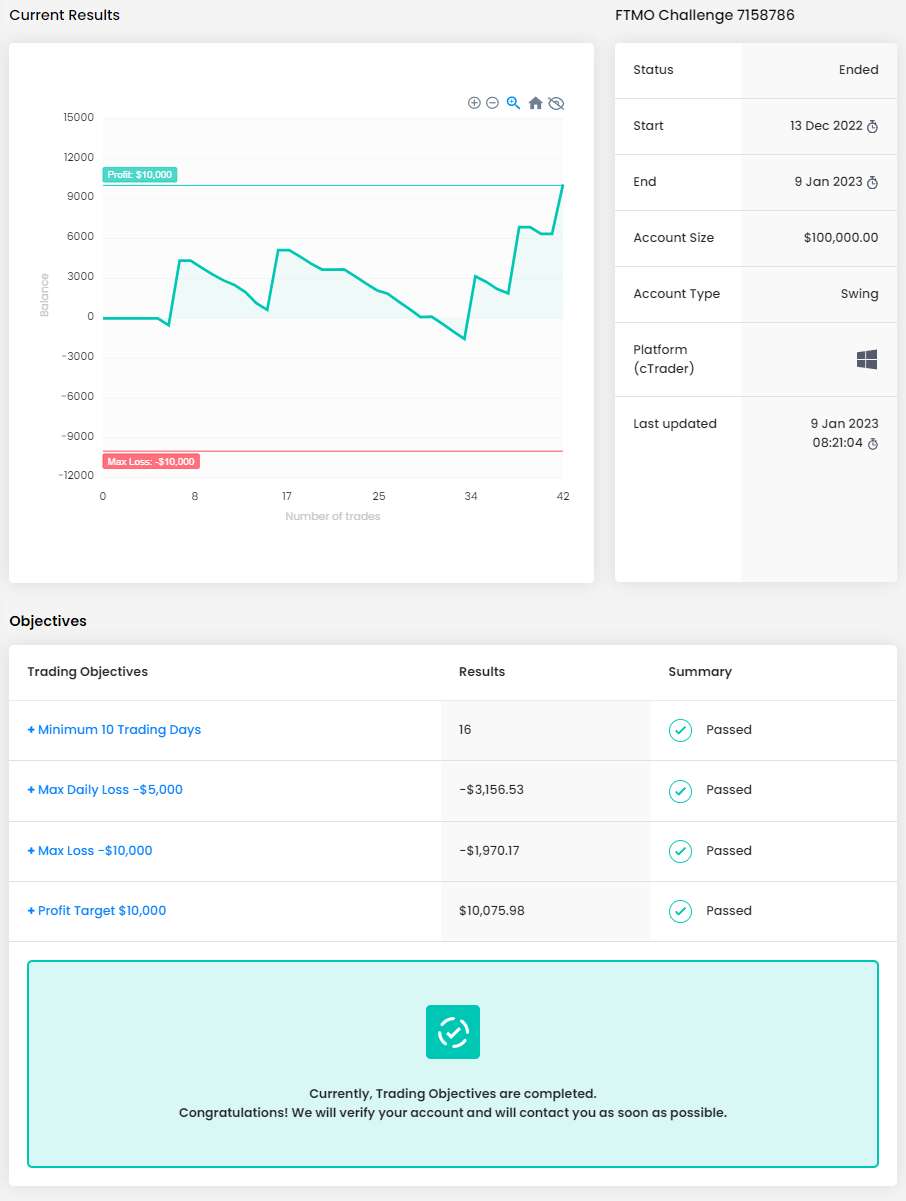

Best trade is the one that ticks almost every box. Because even if it fails, I’m still proud of myself because I did it strictly according to my strategy. Description: AUD/JPY Asian session/second half -> Thursday 19 Jan 23 -> D1 TF local bullish structure after a big fall on Dec 20 2022 -> retraces to test the very last down candle before up BOS on D1 -> price switched bullish (now going along with the structure on H1 -M15) -> BOS up on M15 during my session -> comes back to retest last unmitigated candle before BOS of a M15 structure, coupled with MITIGATING IMB -> when came back to my POI, re-accumulated as a Wyckoff type 2 schematic on M1 TF -> and after it made M1 BOS of a spring, I picked an entry area as the last down move before the up move on M1 -> price returned there, and flew up during the Asian/London overlap.

What would you like to say to other traders that are attempting the FTMO Challenge?

To save your nerve cells – create a plan, where steps are binary, repeatable and your analysis as objective (quantifiable) as possible, because you can’t repeat subjective decisions on a constant basis. And backtest it. Because this will be your only reason to believe that you won’t fail and be confident. Assuming you strictly follow your own plan.

Trader Indianna: "Let good trade set ups come to you and don’t force it!"

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

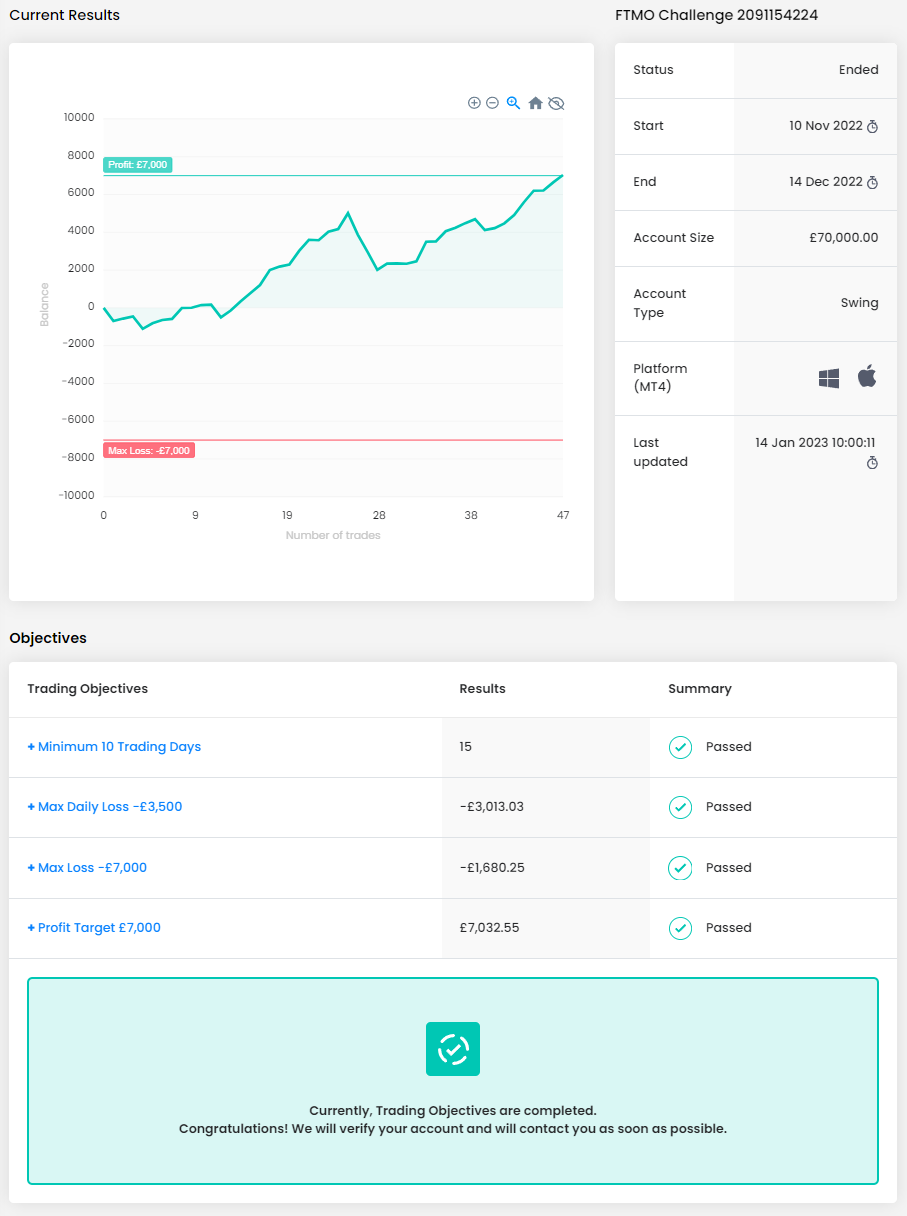

Not entering more than 5 trades at once! This was a rule I set for myself as my Max Daily Loss was 5% so if I stick to 1% risk on each trade it would mean all 5 trades would have to hit SL to blow my account which is very unlikely. Making my account safe and a little chance of accidentally blowing my account without realizing. This has got me into a good habit of being careful and disciplined with risk management.

What was the hardest obstacle on your trading journey?

Being patient with my trades and not being afraid of missing out which results in entering early and having a poor entry.

How did loss limits affect your trading style?

Max Loss Limits helped me so much with being disciplined. It is very easy as a trader to “chase a loss” and keep moving your SL in hope the trade comes back your direction. When you have a Max loss limit it’s impossible to do this which forces you to let go of the trade at SL and move on and accept the loss/lesson.

Has your psychology ever affected your trading plan?

No.

What do you think is the key for long term success in trading?

PATIENCE! Or PAYtience I should say. Traders are paid to wait! Let the trade make its move, let good trade set ups come to you and don’t force it!

One piece of advice for people starting the FTMO Challenge now.

Work out your risk! Decide how much you want to risk on each trade and stick to it (I do 1% on each trade). I use a position size calculator to work out what lot size to use so I stick to this. So if you risk 1% per trade you know you can’t be in more than 5 trades at once, otherwise you could blow your Max Daily Loss (5%). On my first Challenge I didn’t do this, and I risked 1% on each trade and was in about 8 positions at one time and they were all in heavy drawdown and it blew the Challenge as it exceeded the 5% Max Daily Loss. Remember that open trades in drawdown count towards the Max Daily Loss!!

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.