“Trading is not a competition or a race”

Trading is essentially an individual sport where the trader must rely on himself and his abilities and concentrate on closely following his strategy and trading plan. Although traders tend to compare their results with others, it is not a competition or a race. Comparison with others can lead to unnecessary stress and mistakes that result in unnecessary losses. If you want to know what other FTMO Traders have to say in our newest FTMO Traders Q&A, continue reading.

Trader Iacopo: "Solve your problems first, especially emotional problems."

Has your psychology ever affected your trading plan?

Psychology always affects when you are trading. I've been through a lot lately and I lost my first account due to my state of mind: I was feeling bad, not clear thinking, upset, emotional and sad. I recommend everyone to not take decision if you're experiencing some hard time in life. Solve your problems first, especially emotional problems as you will react following your emotion and not following your trading strategy.

Describe your best trade.

It was just after some news, where there was a grab of liquidity and I saw this as a clear opportunity. Few days later I took the profit I needed to reach the target.

How did you manage your emotions when you were in a losing trade?

I manage the trade and my emotion pretty easy; I had my stop, and I knew how much I was risking so not too much emotions involved. I just kept checking sometimes and let the market doing its things.

What was more difficult than expected during your FTMO Challenge or Verification?

Definitely the pressure on the verification stage as I almost breach the max daily loss. And I had to be more carefully to find the right moment to reenter the market and get back to the profit target.

Do you have a trading plan in place, and do you follow it strictly?

I have it of course. But sometimes it's difficult to be able to follow the plan strictly as I'm busy with my job and not always we can have the best market conditions to trade. So many times, I apply some adjustment to my trading plan as a contingency plan.

What would you like to say to other traders that are attempting their FTMO Challenge?

Take your time to learn a strategy that you can follow without affecting too much your actual lifestyle. Be patience and ready to experience some pressure, stress, and all kind of new emotions. Trading can be very easy and hard at the same time. I would suggest to have a plan B if the market it's not going your way and take some time off if you're not 100%. It's better not to rush if you're not feeling ready. The market it will be always there, and everything depends on you and your decision making.

Trader Sotirios: "You can do it if you forget about the "get rich quick" mentality."

What was easier than expected during your FTMO Challenge or Verification?

After being able to follow my trading plan everything was fine. I used to struggle and thought that the Challenge was too difficult for me, but it was all in my head. The Challenge is the perfect way to show to the company and yourself most importantly that you are consistent on your results.

Has your psychology ever affected your trading plan?

Being easily panicked has made me lose many potential gains. In addition, FOMO on some occasions has made me open positions that didn't fulfill my requirements.

What do you think is the key to long-term success in trading?

Patience and self-control. There is always another opportunity to make money. Just by sticking to a trading plan and not being affected by the outside "noise" one can be consistently profitable in the long run.

Describe your best trade.

Shorting Bitcoin once. The setup was there, all my rules were followed but it turned in loss right after I opened my position. My risk was 1% and I was ready to panic sell, but I stuck to my rules. I went to sleep and woke up with almost 7% profit.

How did loss limits affect your trading style?

They make me more conservative and help me contain my "bad trader" side. I find the daily max loss very important because if you end up losing close to 5% in a single day maybe then you just need to get away from the screen for that day, recharge and figure out what you did wrong. If that wasn't in place you could just hit the maximum loss limit in a bad day because of the need to make that money back.

What is the number one piece of advice you would give to a new trader?

You can do it if you forget about the "get rich quick" mentality. The journey there might be hard, but in the end, you will feel extremely proud for making it on your own.

Trader Bruce: "Be patient and consistent with following your set of trading rules."

Do you plan to take another FTMO Challenge to manage even bigger capital?

Yes. As soon as I achieve to receive 2 FTMO payouts, I will buy a new Challenge with the capital of €160.000. The most expensive one.

What was easier than expected during your FTMO Challenge or Verification?

To be honest, I can't think of something, but I would not say the journey was super hard.

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

Most difficult was to control myself. Once I realized what I was doing was wrong (with wrong I mean sometimes I wasn't being patient, consistent, waking up on time, asking myself if I should take the trade or not, risk management, what to do if it goes back down to your SL while you were just up on a 1:5 or more RRR, etc.) Every time I almost stepped off the edge, I controlled myself by saying 'what are you doing?' You know it's not part of your trading plan. Follow the rules accordingly, be patient, if it's not today, it's tomorrow, the SLs don't bother me because my returns are always higher. Be consistent with waking up, with taking the right trades.

How did you eliminate the factor of luck in your trading?

There is no such thing as luck. If you have a very well-structured trading plan with your strategy explained, then it's based on a set of rules. I have mastered 3 strategies over 2 years and I am very aware now that it's the strategies that make the %'s. Not luck.

How did loss limits affect your trading style?

In the beginning a lot since I risked with 1%. That was very bad but now I have thought myself over the months that 0.25% per trade is more than enough. Since I can make that easily each week. I know I'm not quite there yet when I say easily but it will happen. I'm sure.

What would you like to say to other traders that are attempting their FTMO Challenge?

Be patient and consistent with following your set of trading rules according to your strategies. Trading is based on your set of rules, not your emotions. (Regarding the picture I picked below, it's the first photo I took when I decided to pursue Forex as my dream career. 2 years later I have achieved this goal of getting my FTMO live account. Now it's up to me to reach this new goal of making bi-weekly payouts!)

Trader Nazim: "Trading is not a competition, and it is definitely not a race."

How did you eliminate the factor of luck in your trading?

Trusting your strategy eliminates the factor of luck. Usually, I start out by drawing out a Fibonacci Retracement on the higher time frame (4hr or Day chart) and then look to enter a trading position on the lower time frames (1mins - 15mins). The Fib retracement tool helps me to create a picture of the direction in which the market is gravitating towards. You cannot simply guess what will happen and it's imperative that you do not trade by luck as sooner or later that luck will run out.

How did you manage your emotions when you were in a losing trade?

It's important to stay relaxed and to avoid stressing whilst in a losing trade or a growing draw-down. Markets can often be volatile especially during the recent outbreak of the Russia-Ukraine war and consequently, rising inflation and interest rates. Therefore, it's important to take every loss as a learning curve and seek to understand what went wrong rather than revenge trading. I have been a victim of revenge trading in previous failed challenges and have had to learn the hard way! Revenge trading often leads to total chaos and therefore, it's important to self-reflect and at times, walk away from the market when you are feeling overwhelmed.

Do you plan to take another FTMO Challenge to manage even bigger capital?

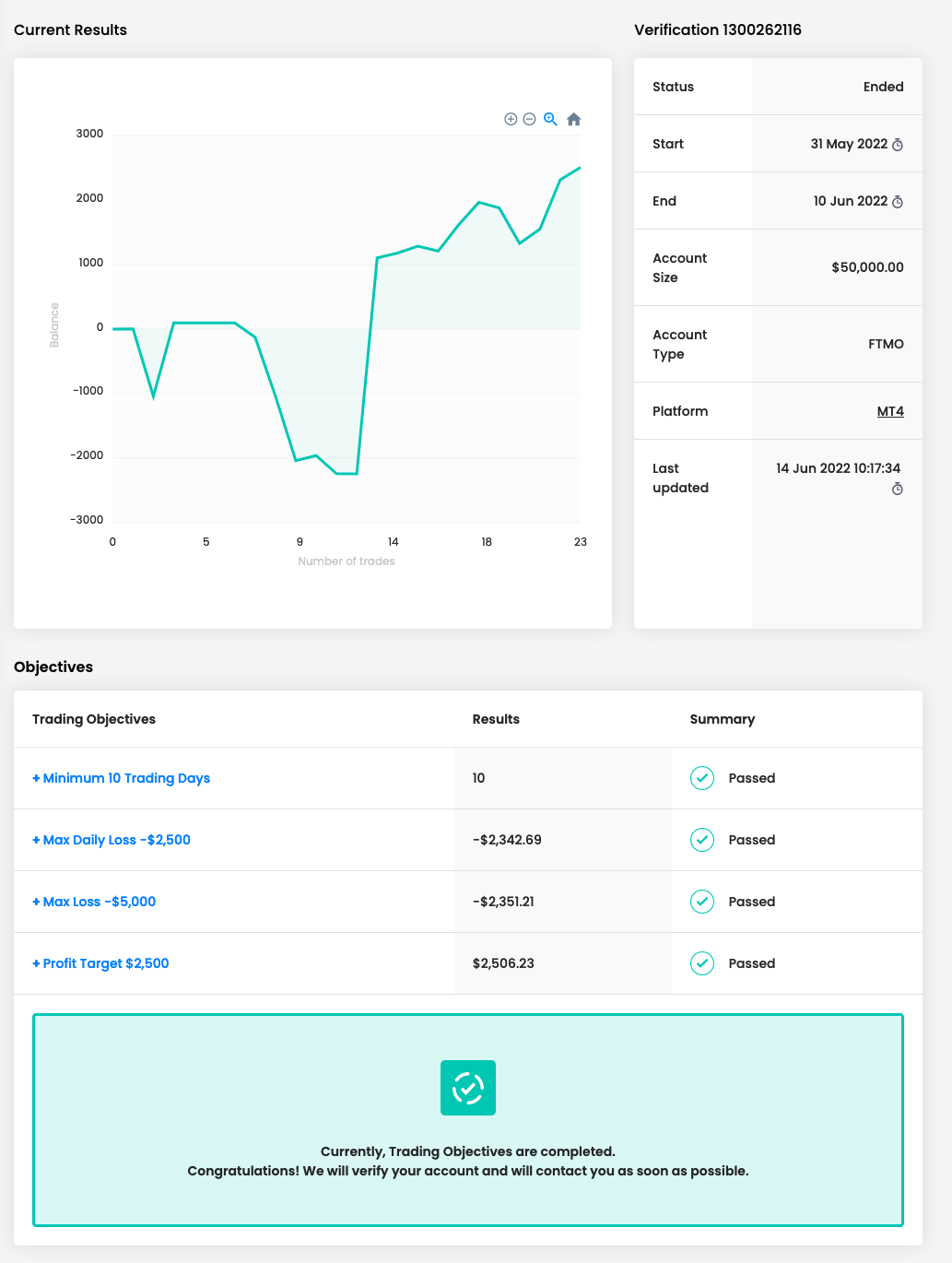

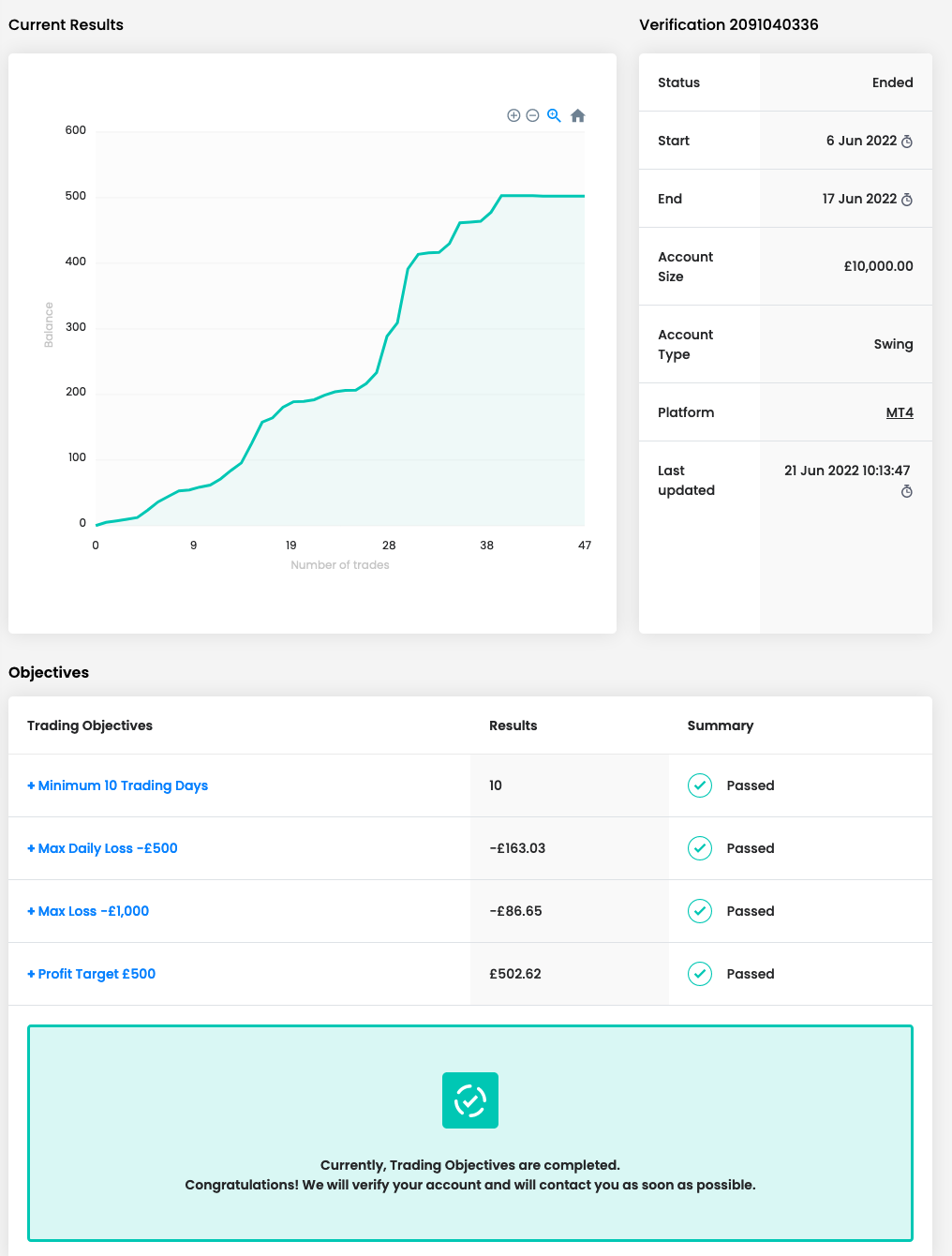

Yes, I have also passed a £70,000 Challenge & Verification (1300239093) and will be looking to combine with this account in a Master £90,000 account. I have also started a further £10,000 FTMO Challenge and currently 8.5% up on the Challenge. My hope is to add this onto the Master account which will give me a funded trading capital of £100,000. At the point, I would like to stop with the Challenges - I have taken quite a few and failed them also :( and I would like to focus on earning some real profits. If I can demonstrate 6 months of profit on my £100k account, I will then look to take the £140,000 FTMO Challenge.

What inspires you to pursue trading?

Financial freedom and technical analysis. I currently work an IT Project Manager and although my role can be interesting, it's not something which I would like to pursue for the foreseeable future. Trading forex allows you to recognise profits which I'm hoping in the long-term can help me to drop my full-time job. I also relish the thrill of trading - I enjoy carrying out my technical analysis and setting up my trading positions. This requires a level of intelligence, integrity and independence which is highly motivating.

What do you think is the most important characteristic/attribute of a profitable trader?

Risk management and consistency. It's better to trade small and realise consistent profits over the long-run rather than opening aggressive positions to chase big profits. Technical analysis is also essential and being able to demonstrate the knowledge and intelligence of moving markets - this can be developed over time and with experience. Having a risk management strategy in place in which you only trade x amount of positions per day with a total of x lot sizes can also be a major element of becoming a profitable trader. This is because it enforces a level of discipline within your schedule and avoids the possibility of overtrading or revenge trading.

What is the number one piece of advice you would give to a new trader?

Take it easy and trust the process! Trading is not a competition, and it is definitely not a race. Everybody learns at their own pace and it's important to seek the fundamental knowledge prior to trading at any level. I would definitely recommend BabyPips.com and overall, try not to rush. If you rush and try to chase the profits - you will end up losing which psychologically could put people off trading in the long-term.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.