“Trading is me versus myself”

Many traders know very well what to do. In terms of theory, they are well prepared for trading, but when it comes to real trading they are their own worst enemy. Successful traders simply have to change their mindset. What do our FTMO Traders Rachid, Tyree, Jonathan and Terence think about it?

Trader Rachid: "Please be patient and follow your plan and the opportunity will present itself."

How did you manage your emotions when you were in a losing trade?

By simply risking just 1 % of my account per trade and taking 1 trade at a time I can fully be aware of the market and make proper decisions fast without getting swept by any kind of confusion or emotion as such, even if I lose the trade, I will lose 1% and nothing more. This way I keep my emotions and mind clear and in check all the time.

Where have you learnt about FTMO?

From YouTube and Facebook advertisements, Trustpilot and when anyone mentions FTMO is basically talking about the best of all, so I decided to join your ranks.

How did you eliminate the factor of luck in your trading?

There is no luck to begin with! Everything is decided by simply following the market movements while executing the right order with proper money management, just block all interference (internal or external) and you will be good to go.

Do you have a trading plan in place, and do you follow it strictly?

Yes, I do have a strict plan and I follow it with great discipline.

Do you plan to take another FTMO Challenge to manage an even bigger capital?

Yes, my goal is to manage the maximum amount allowed (I will be taking a 200k Challenge after my first paycheck right away!!).

What would you like to say to other traders that are attempting the FTMO Challenge?

Please be patient and follow your plan and the opportunity will present itself. All you need to do is take it!! if you mess up, another one will come by and your money management will protect and secure your profitability over time. Aim to be a consistent kind of trader, not the greedy or the frightened kind.

Trader Tyree: "The ability to realize when your psychology is not where it needs to be & a step away from the markets is essential."

Describe your best trade.

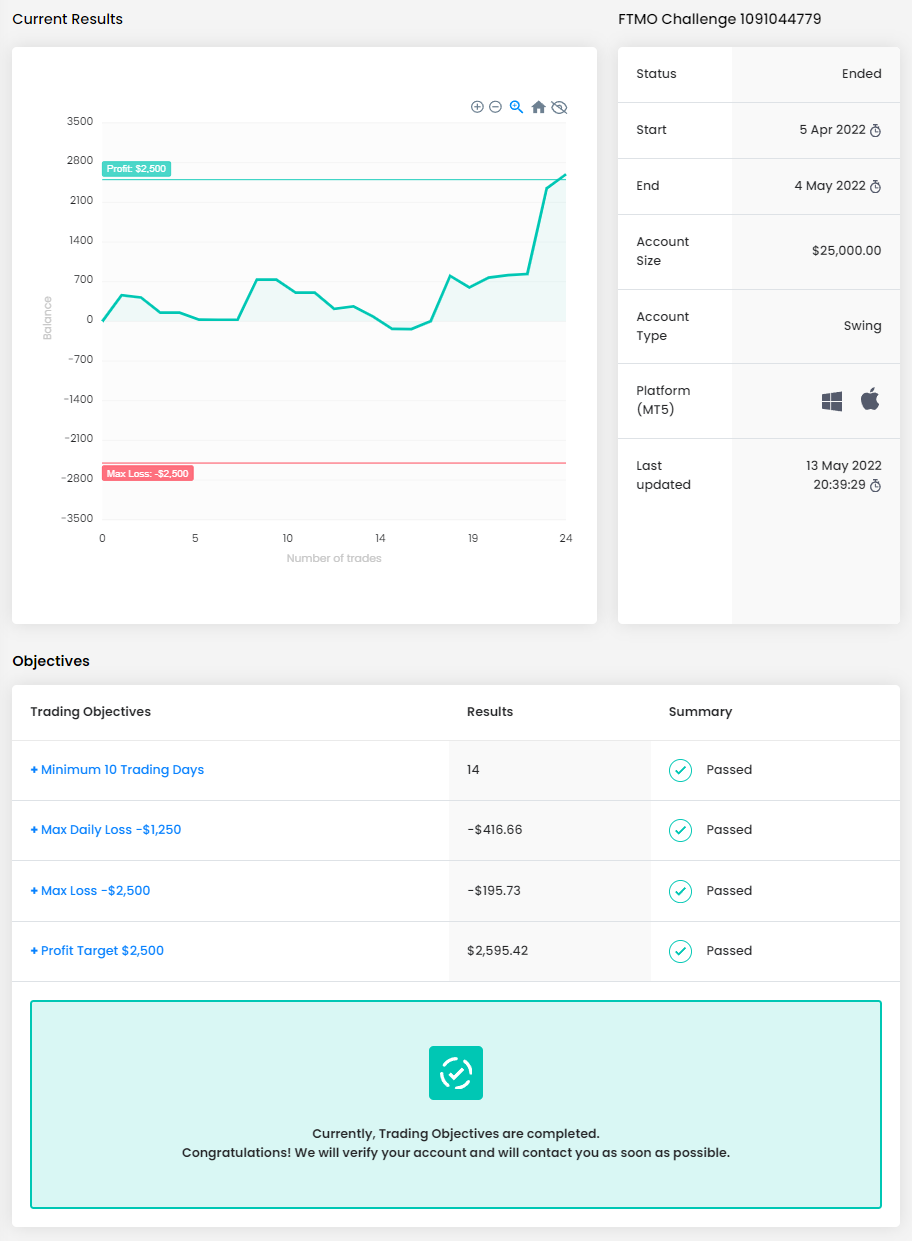

I would say my best trade so far was the last trade I placed to pass the FTMO Verification stage. It was a short position on GBP/AUD for 138 pips. What made this trade so amazing was that it was almost a 1:10 Risk/Reward trade which is way higher than my usual 1:2.5 – 3 trades. Before placing the trade I was down almost 5% on the account (halfway to losing the account with the Maximum Drawdown being 10%). But after winning this trade I made back the 4.5% of drawdown and made over 5% in profit, giving me a total of 9.67% & just enough to pass the Verification stage. This trade will always be significant to me because it is a perfect result of what can happen when you never give up. Keep your psychology in order & see your goals through to the very end.

What do you think is the key for long-term success in trading?

Strong psychology & being disciplined in your risk management.

What was more difficult than expected during your FTMO Challenge or Verification?

The psychological effect of having a smaller profit goal during the Verification stage (5%) compared to the Challenge stage (10%). I feel as though it can cause a bit of overconfidence to set in for the typical trader and gives the challenge of learning to combat that overconfidence with reassessing your psychology to remain neutral in your trading.

Has your psychology ever affected your trading plan?

Yes, but that is where discipline kicks in. The ability to realize when your psychology is not where it needs to be & a step away from the markets is ESSENTIAL.

What do you think is the most important characteristic/attribute to become a profitable trader?

Discipline.

One piece of advice for people starting the FTMO Challenge now.

Utilize the tools given to you by FTMO to its fullest. Such as the MetriX, the ability to retake the Challenge for free as long as you’re in profit, the 14 day extension etc.

Trader Jonathan: "My emotions were the hardest obstacles of my trading journey."

What was more difficult than expected during your FTMO Challenge or Verification?

The Challenge was more difficult due to having a time limit. Although I didn’t use the extension, I felt more at ease knowing the option was available. After passing the Challenge in nearly a months’ time, I had gotten used to the objectives and passed the verification in a week.

What was the hardest obstacle on your trading journey?

My emotions were the hardest obstacles of my trading journey. Situations outside of trading would make me more irrational and I’d make losses. Once my mind was clear, trading became smoother and more successful.

How did loss limits affect your trading style?

The Maximum Loss limits only encouraged me to practice proper risk management. The limits didn’t affect my trading styles necessarily, just my risk with lot sizes mostly.

What inspires you to pursue trading?

Freedom. Trading is me versus myself. I control how much freedom I obtain using trading.

Do you have a trading plan in place, and do you follow it strictly?

I have multiple trading plans in place, and I follow them strictly. Without my plans I would lose confidence in my trades and would feel uneasy on when I should enter and close trades. I do my best to avoid whimsical trading. My success is higher when I stick to my plans firmly.

What is the number one advice you would give to a new trader?

Hey new traders. My number one advice would be to journal every move you make, every discovery you find, every method you backtest. Once you get more advanced, go back to what you’ve recorded, and you’ll discover how you’ve grown and the details you’ve missed. Trading really gets easier over time, like everything else does.

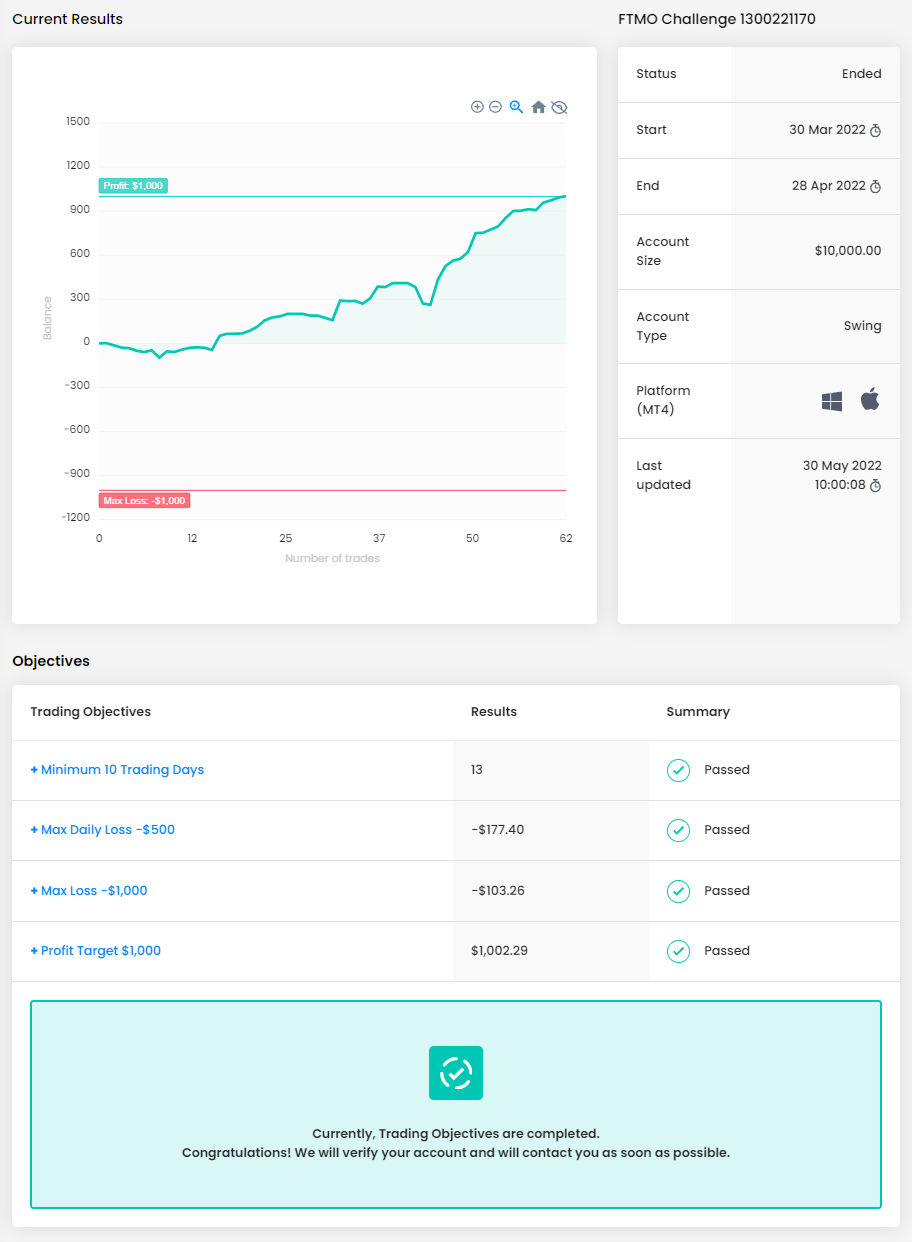

Trader Terence: "Take time to refine your trading plan."

What was the hardest obstacle on your trading journey?

Truly accepting the concept of proper risk management after making so much money in the past not considering risk management like a professional does.

Do you have a trading plan in place, and do you follow it strictly?

Yes, I mostly trade one pair, and I have certain hours I stay away from trading the pair (you can trade it 24/7). I always intend to go for more than I am risking in an overall idea and have rules on profit taking.

Has your psychology ever affected your trading plan?

For sure. At one point when I thought there was an effective risk/growth % to ensure 100% success (toxic thinking), I refined and completely changed my trading plan to decide my true risk tolerance and started to project the possibilities without pressuring myself to hit certain goals in a given time frame.

What do you think is the key for long-term success in trading?

Discipline and always remaining a student.

What does your risk management plan look like?

For an FTMO Account with the rules I ensure I am only risking 0.5-1% in a high time frame idea, and on the lower time frames I risk a fraction of that, essentially scaling in. I take profit as I go to ensure I get something out of the trade when it goes my way and mitigate my risk.

One piece of advice for people starting the FTMO Challenge now.

FTMO is a great opportunity, but it is useless if you don’t have a plan that you believe in and you will follow strictly. Take time to refine your trading plan and make minor tweaks to it if you need to ensure it will work within the FTMO guidelines. Take as long as you need. If you show consistent profitability, you will have a home here and a life changing opportunity. Good luck and safe trading!

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.