“Trading is a profoundly serious profession and cannot be rushed”

The biggest problem for many traders is a lack of humility. This is especially true for those who have already achieved success in a different field and feel that they will achieve similar results in trading. Trading may look easy at first glance, but it needs to be viewed just like any other job. As it happens, our new FTMO Traders Kovilan, Javier, Rattana, and Raveena Chandra are aware of this.

Trader Kovilan: “I'd often read what other traders said in these interviews and found a lot of them very helpful.”

What inspires you to pursue trading?

After enjoying success in private equity, in consulting, and corporate strategy in London, I (slightly recklessly) joined my partner as she moved to Switzerland on an expat package. I would discover to my dismay that this is a heavily protected job market. My brother suggested trading and I was inspired to pursue it in order to reobtain a career ‘identity’ and also to continue to be an example of success to my son. He was 11 at the time (but he's now a teen).

Do you have a trading plan in place, and do you follow it strictly?

Yes, I do now and live the plan daily. Initially, I had no written plan. Later, I wrote out a plan but treated it as no more than a box-ticking exercise and prioritized placing trades.

What do you think is the most important characteristic/attribute to becoming a profitable trader?

Humility, especially if you’ve already experienced success in other fields. In my case, some skills were not as transferable as I'd have liked and may have hindered me. It took me 3.5 years to get this far and doing so needed me to understand that trading is a profoundly serious profession and cannot be rushed. It will humble you many times if you try to run before you can walk. Unlike other serious professions that require you to jump many hurdles to gain entry (extensive education and years of professional practice), the only prerequisite to start trading is to stumble on the idea to try it. This can cause problems initially.

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

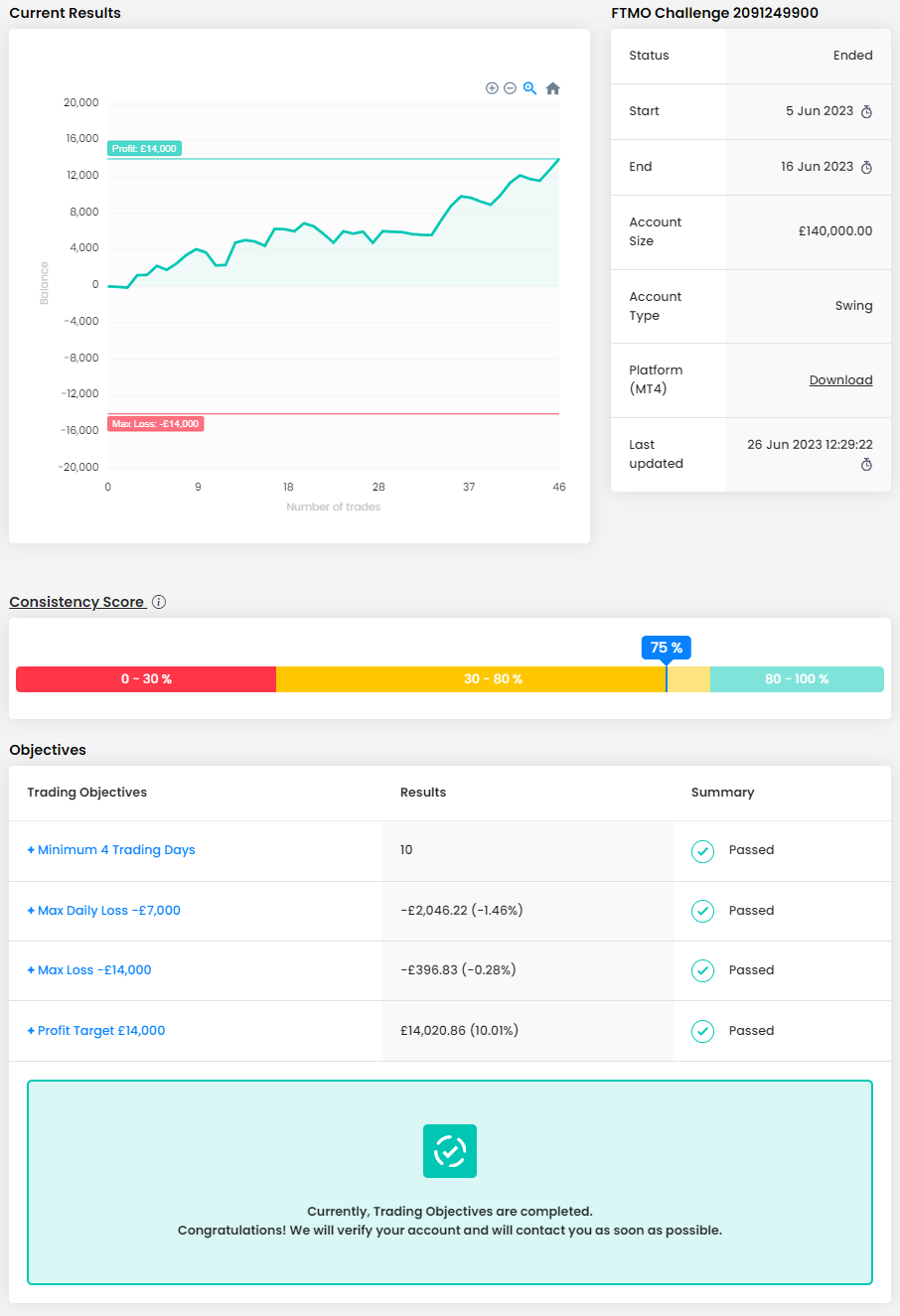

Generally, it was a smooth process thanks to a lot of forward testing to determine how likely it was to see certain predefined worst-case outcomes. But still, the first few trades (no equity cushion) and the final few trades (let’s get this done) were slightly nerve wreck and I found myself taking profits sooner than I’d planned. To help deal with it, I leaned on my years of forward testing and revisiting the probability range of scenarios I can expect from my system. It's definitely an area I continue to work on to gain more mastery.

How did loss limits affect your trading style?

I used to place about 20 trades a day. I now place no more than three simultaneous trades (max concurrent risk of 3%) and make sure the trades are uncorrelated. As I take off risk, I may allow myself to add trades. I usually have about 3-6 trades in a day. I aggressively cut what is beginning to look like losing trades - this does end up reducing my win rate but it works for me, as I just re-enter if the opportunity looks good. I'm also happy to let it go if I'm unconvinced.

What would you like to say to other traders that are attempting an FTMO Challenge?

Figure out how you will objectively know if you are ready. And if you confidently meet your criteria then let that feeling carry you through the Challenge (I told myself that the moment I could easily pass two Free Trials in a row I’d consider myself ready). PS. I'd often read what other traders said in these interviews and found a lot of them very helpful. Do that too to see if you are missing something. Wish you the best!

Trader Javier: “There is no magic wand or Holy Grail in this game.”

How would you rate your experience with FTMO?

Fantastic. Definitely the best place for serious traders.

What does your risk management plan look like?

I have a 2 trades limit per trading day. I adapt my trading size to the account balance, so I'm always comfortable with the risk I take. A system method has 3 parts: signals, risk management, and psychology. Start building up your system by working with your psychological traits. Lots of books recommend a 1:2 or higher risk to reward ratio, but you may not be able to endure the drawdown of a method with a 40-50% win rate. Know yourself and build up from there.

How did you manage your emotions when you were in a losing trade?

With a winning method, how you manage your losses determines your results. You have to learn to monitor, acknowledge and manage your emotions during trading. If you try to ignore your emotions, they will find a way to express themselves and you do not want that. It is like having a pot with boiling water and putting a lid on it to make the problem disappear. You have to learn to accept rejection and learn to be uncomfortable with whatever result you get. That is not easy. It takes time and focused practice. But it can be done.

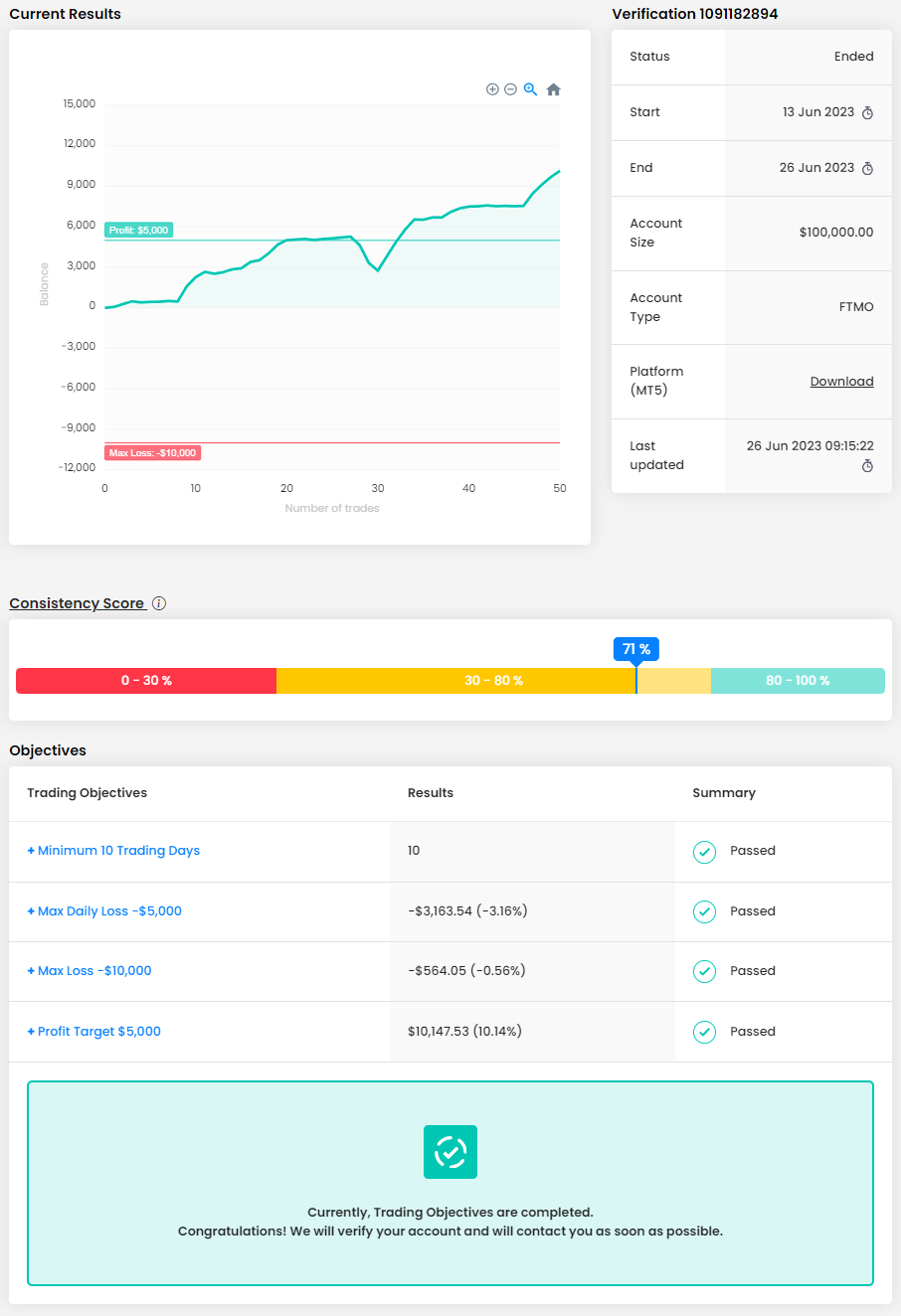

How did passing the FTMO Challenge and Verification change your life?

I have completed two steps, but I haven't achieved anything yet. The best is still to come.

What do you think is the most important characteristic/attribute to becoming a profitable trader?

Honesty to be able to get to know you better. Focus and determination to improve the skills you need to develop. Patience and perseverance to carry out the work you must do, mainly on yourself.

What would you like to say to other traders that are attempting an FTMO Challenge?

You are going to start losing. There is no magic wand or Holy Grail in this game. The only secret is to look inside you, work on yourself and be patient. But whatever the stage of the path you are in at the moment, remember this is a very difficult task where only a few are successful consistently. Do it for the challenge of becoming a better version of yourself and enjoy the process. Freedom and money will come, but you have to do the work and love the game in the first place. You will get there!

Trader Rattana: “No trade is still a winner because you preserve capital.”

What do you think is the most important characteristic/attribute to becoming a profitable trader?

As a trader, you must have discipline, you must have a trading plan that is executed without emotions. The trading plan must have rules / setups for the entry, Target, and Stops.

Has your psychology ever affected your trading plan?

I have been trading since 2006, I've had to learn to master my psychology in this business. I have learned to ask myself every morning before trading, how do I feel this morning? Secondly, to be patient, and wait for the setup. Pull the trigger and take my conservative targets. I don't care if the instrument moves further than my target. There will be another setup. My little drips have kept me in this business.

What was more difficult than expected during your FTMO Challenge or Verification?

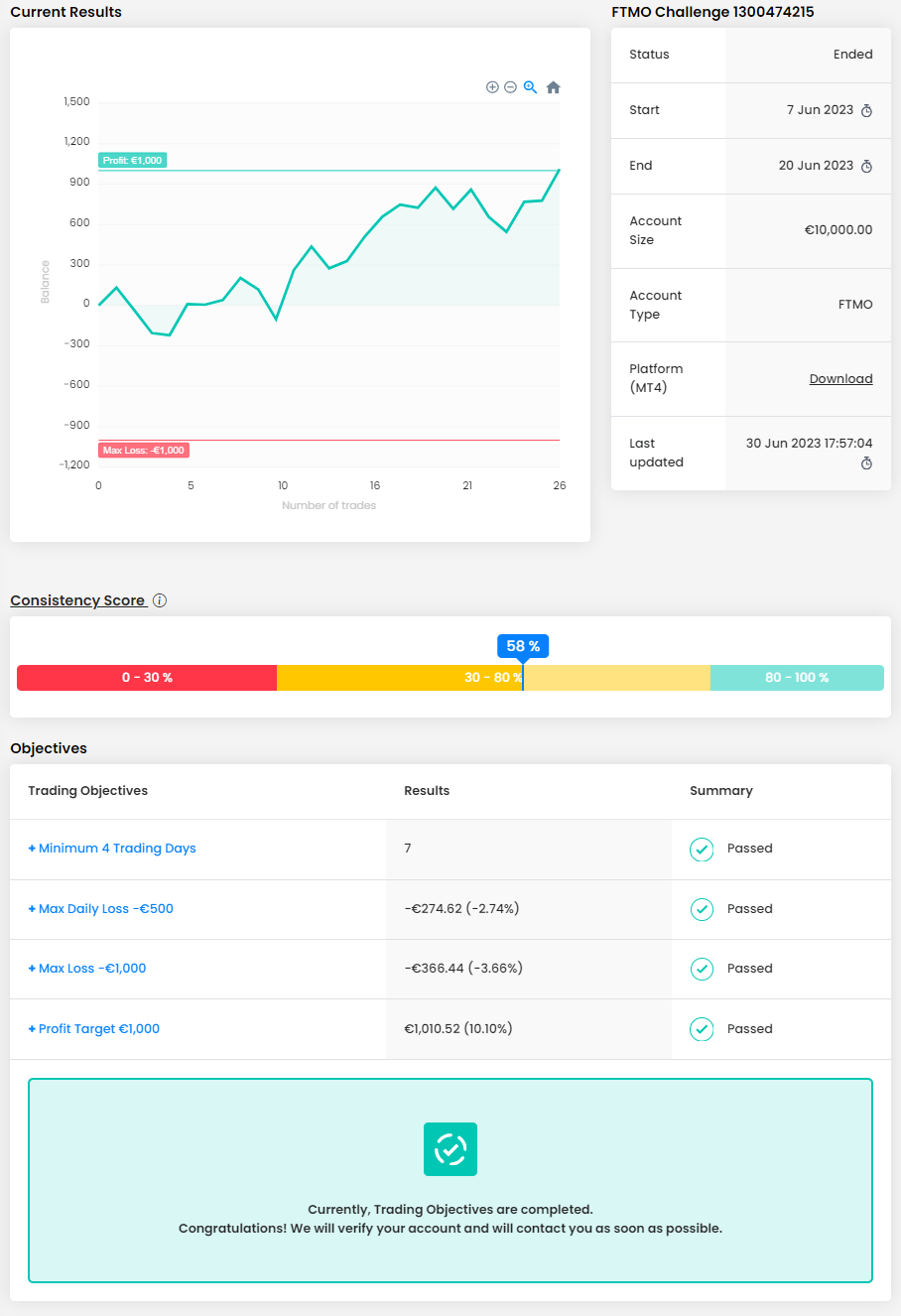

The FTMO Challenge and Verification to me were identical. I didn't care what was the profit target, I just focused on the setups and the number of trading days required.

How did passing the FTMO Challenge and Verification change your life?

Passing both phases verified that I am a good trader by FTMO offering me to be a part of FTMO's Traders. I realize that only a handful of traders can be qualified. For this, I am humbled and grateful for the opportunity.

How did you eliminate the factor of luck in your trading?

There is no luck in this business. If you are relying on luck, you are doomed to fail in the long run. It's all about reading the chart and applying my setup rules and targets and Stop Loss. If all checks, then execute the trade without emotions. Because I have learned that by sticking to my rules, the trades do not affect my psychology.

What is the number one piece of advice you would give to a new trader?

Patience and wait for your setups and execute the plan. It's okay if you don't see the trade today, there will be tomorrow. Bulls make money, Bears make money, Pigs get slaughtered. No trade is still a winner because you preserve capital.

Trader Raveena Chandra: “Focus on your strategy and always look for development and growth.”

Do you plan to take another FTMO Challenge to manage even bigger capital?

Yes, I would like to achieve the max allocation.

What do you think is the most important characteristic/attribute to becoming a profitable trader?

For me, it's definitely having a specific and concrete trading strategy that takes time to develop. But if you really want to succeed and you are not giving up, you will undoubtedly reach your goal.

What inspires you to pursue trading?

The freedom and the fact that it enables me to reach my dreams. Since I was little, I had a really strong calling for interior design and real estate. So strong that I regularly dreamed about walking in beautiful homes that were styled in an amazing way, and I always checked the homes that were for sale in my local newspaper when I was only 10 years old. So, the capital that I can get from trading will create the possibility to invest in real estate and to be my own interior stylist.

What does your risk management plan look like?

Not taking more risk than 2% per trade.

What was more difficult than expected during your FTMO Challenge or Verification?

My emotional state. Completing the FTMO Challenge and Verification was something that I wanted to achieve for the last 3 years. So, when I was close to my Profit Target, I became impatient and wasn't thinking rationally, and due to that executed the wrong trades that were not in line with my confirmations.

One piece of advice for people starting an FTMO Challenge now.

Focus on your strategy and always look for development and growth. In this way, the wanted results will soon be a reality.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.