“Trading has to be a passion first”

When we do something we enjoy and we can even make a living out of it, it's the perfect combination. Most traders would like to make a living from trading, but if we try to approach forex as nothing but a source of money, we will probably not succeed. If trading is our true passion however, it will be much easier to overcome losses and it'll be easier to follow basic rules. And our new FTMO Traders, who answered our questions this week, know this too.

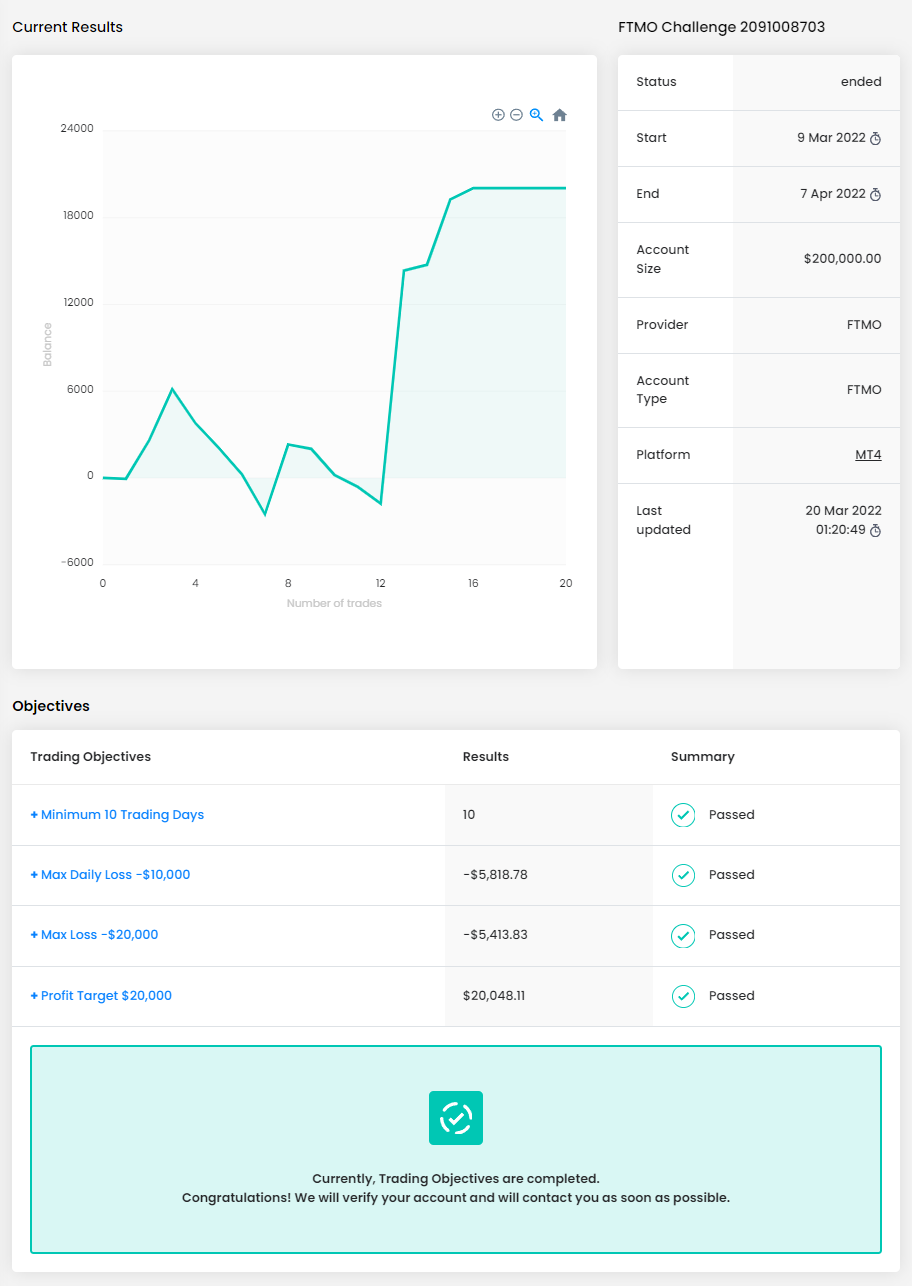

Trader Tamika: “Manage your emotions and greed and develop a trading plan and a set of rules”

What was more difficult than expected during your FTMO Challenge or Verification?

Exhibiting discipline and controlling my impulse to trade were the most challenging during this process. I feel that this challenge has helped me to improve my risk management skills as well as look for better entries and RRR.

Where have you learnt about FTMO?

From other traders taking the challenge. I then visited YouTube to view testimonials as well as the FTMO website.

How did you eliminate the factor of luck in your trading?

By sticking to my trading plan and rules. This includes only trading on certain days during the week, limiting the number of trades I take per day, and going for the sure target and not holding trades beyond those targets being greedy.

What inspires you to pursue trading?

I'm a very analytical person, so I have always had a way with numbers and data. Trading helps me to use this skillset to analyze market data. I also believe that trading will allow me the personal freedom to reclaim my time and spend more of it with my family.

Has your psychology ever affected your trading plan?

Of course. When trades don't go your way, it's easy to get attached to the disappointment and as a result, you find yourself revenge trading. I always access my mood and energy level prior to trading because a tired or grumpy trader will take shortcuts or not be in the mental space to make the best trading decisions which could ultimately harm your outcome.

What would you like to say to other traders that are attempting to pass FTMO Challenge?

If you have the experience, the discipline and can manage risk, then I say go for it! It is said that Trading is 90% mental and 10% skill. Learn the fundamentals of technical analysis for the market. Manage your emotions and greed and develop a trading plan and a set of rules, and you can be well on your way to joining the FTMO family such as me.

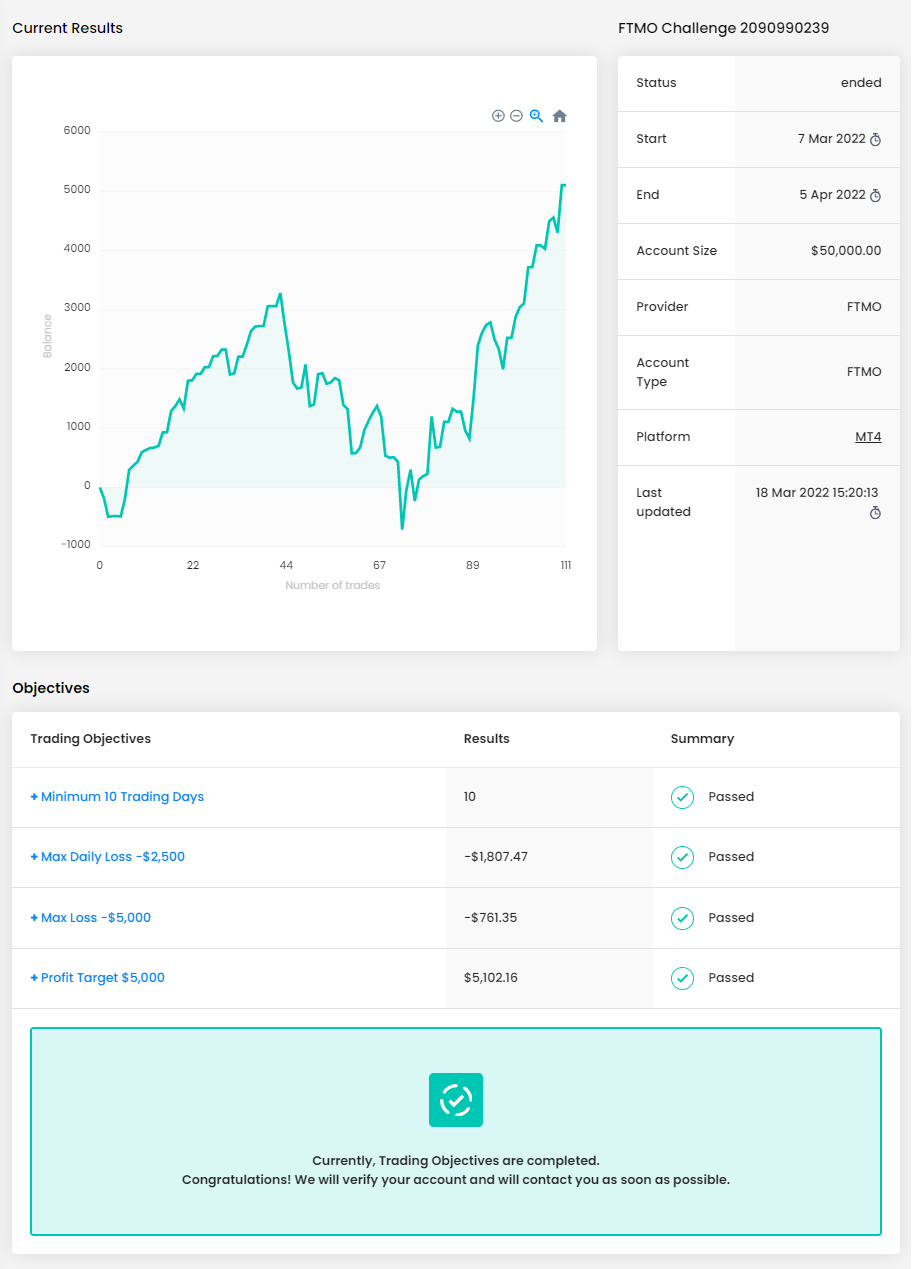

Trader Roderick: “Set the trade and go on with your life for the day.”

What do you think is the key to long-term success in trading?

I believe the key to long term success in trading is risk management, following your rules, and controlling your emotions. You also have to keep learning and keep practicing daily. These things lead up to consistency! There are a lot of things that must be done to stay in this game long term. I will end it with saying trading has to be a passion first!

What does your risk management plan look like?

My risk management is usually 1:3 ratio sometimes 1:7 depending on my entry. After my top-down analysis is done and I see a good setup I can go in with a tight SL. If I get wicked out twice, I am done for the day and trade another day because one right trade can make up those 2 loses.

What was the hardest obstacle on your trading journey?

The hardest obstacle was figuring out a winning strategy for me, staying discipline with the one session to trade, and stopped trying to flip small accounts.

How did you manage your emotions when you were in a losing trade?

When it comes to trading with emotions it does not work out well. Backtesting helps with building confidence and knowing you can make up those loses as long as your risk management. I trade with way less emotions now. Set the trade and go on with your life for the day.

What was easier than expected during your FTMO Challenge or Verification?

I believe it was easier once you gain some profits to give more room from hitting Max daily loss or Max loss.

One piece of advice for people starting FTMO Challenge now.

Take your time and not to rush to hit the target on the first day or 3rd because you could slack on your win percentage if you hit the target too early. Trade smart and safe.

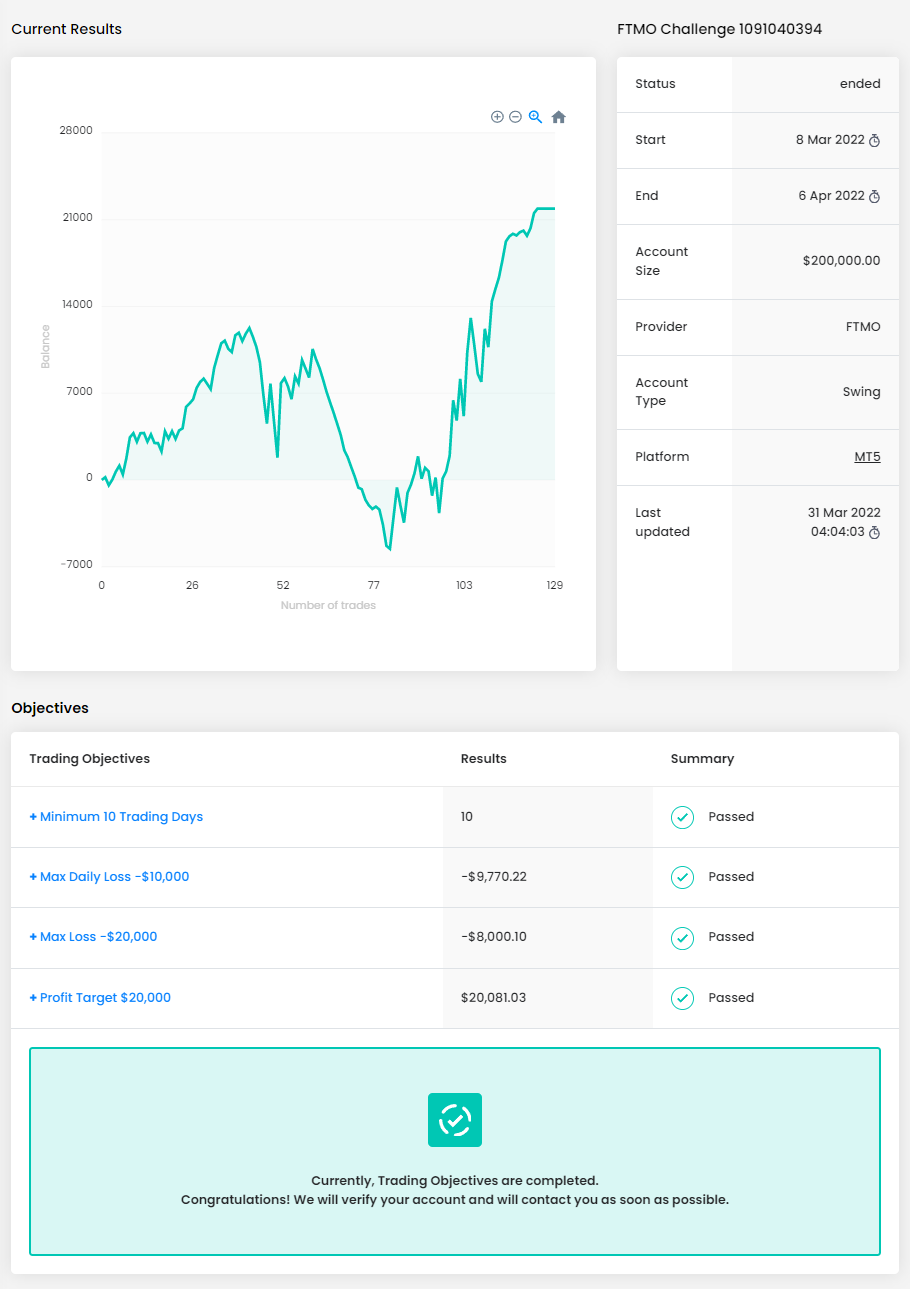

Trader Bernel: “Through experience, I believe that psychology is more than 90%.”

Has your psychology ever affected your trading plan?

Yes, my psychology is affecting my trading plan in the past. Solid trading psychology is what makes me successful in passing the challenge and verification. I can say that this is a work in progress as sometimes still affecting my trading plan.

Do you have a trading plan in place, and do you follow it strictly?

Yes, I have trading plan in place. Still working on my consistency in order to follow it 100%.

Do you plan to take another FTMO Challenge to manage an even bigger account?

Yes, I am. I will purchase the 2nd 200K account challenge on my first payout in order to get the max allocation this month.

Describe your best trade.

My best trade is when I am able to wait patiently at the reversal price and ride it nicely.

How has passing FTMO Challenge and Verification changed your life?

This will totally change my life as this is the turning point if I will continue sailing or retire for good. I am really looking forward to retiring from sailing this year.

What would you like to say to other traders that are attempting to pass FTMO Challenge?

My first advice to other traders is to accept that forex trading is another profession. We need both the theoretical and practical competencies to be a PRO in forex trading. If they will just take their time to acquire skills and experiences in trading, eventually they will become profitable in trading. Heavily invest in their training and education to be successful in forex trading. Good thing is that they can now access many information/webinars/YouTube presentations online for free. Just need to refine it and develop their own trading strategy. Most importantly is to develop a solid trading psychology. I learned in the past that successful trading formula is 70% psychology, 20% money management and 10% strategy. But through experience, I believe that psychology is more than 90%. What I mean with solid trading psychology is that a trader should be able to isolate his thoughts and focus only trading during the trading hours. For example, a medical doctor during surgical operation, he/she is not thinking of other things during this period but only about the operation. Same with trading, one trader should be able to think only his trading plan, strategy, set up, etc. during the trading hours. This is not easy, but it is doable. Good luck in passing the challenge and verification!

Trader Claire: “I don’t think that luck can be eliminated.”

Do you have a trading plan in place, and do you follow it strictly?

I try to stick to my trading plan as much as possible. Whilst discipline is essential, I also think that it is important to have a little flexibility and discretion when trading.

What does your risk management plan look like?

I typically risk around 1% of my account balance on any one trade and I always use a stop loss. I only trade once or twice per day to avoid overtrading. I don’t trade if there is a major economic news event. I will not trade if I am feeling unwell or emotional. I never drink and trade!

Do you plan to take another FTMO Challenge to manage an even bigger account?

Absolutely. The only way is up!

Describe your best trade.

My best trade was on XAUUSD. On this occasion, I was able to actively manage the trade over the course of several hours. Sometimes, my work commitments do not allow for this, so I usually must accept a low risk to reward ratio and must always set a take profit. However, on this occasion I was available to manage the trade and I trailed my stop loss for a fantastic result.

How did you eliminate the factor of luck in your trading?

I don’t think that luck can be eliminated. You can only be honest with yourself and acknowledge good/bad luck as it happens. In my opinion, a good trading plan should put a trader in the best position to take advantage of luck, by minimizing losses and maximizing gains.

One piece of advice for people starting FTMO Challenge now.

Use the free trial. I attempted the free trial a few times and it gave me some interesting insights. I also felt more confident attempting the full FTMO challenge in the knowledge that I could pass.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.