TOP FTMO Trader Ugnius: "You have to wait for a good trade"

In the third part of our series on successful FTMO Traders who have made impressive profits or are able to achieve consistent results, we have a look at trader Ugnius from Lithuania.

Ugnius started investing when cryptocurrencies were at their peak, which for him, like many other traders, was an expensive training in risk management and discipline. Of course, dreams of a new Ferrari were nothing, but thanks to a friend, he eventually got into trading. To his own surprise, by copying other traders, he did well in the beginning and made good money, but eventually lost it again.

Fortunately, this lesson forced him to start educating himself in trading and realise that copying other traders' approach is not the path that leads to success. Thanks to his job, he had enough time to learn, which he devoted himself to intensively for quite a long time.

The basis of success is patience

Further mistakes and failed attempts at the FTMO Challenge taught him that the key to success is discipline and patience, that you can't do the FTMO Challenge in one trade. Overall, however, it eventually took him about 10 years before he decided that, despite his good position at work, he wanted to take up trading full-time (but only after he had already earned enough from trading to support himself and pay all his bills for a longer period of time).

Technicals and fundamentals

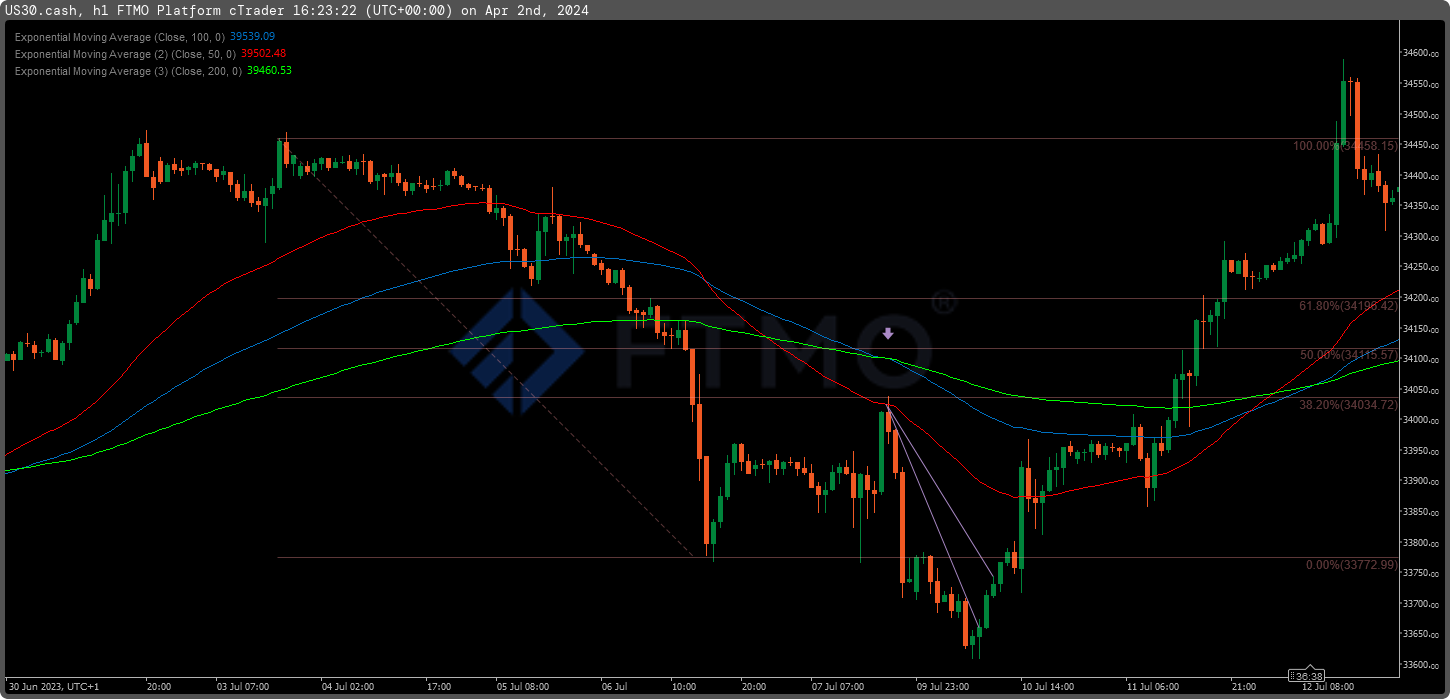

Ugnius trades intraday and exclusively with the DJIA stock index (US30.cash), which suits his style best. He uses moving averages as well as trend lines and Fibonacci levels in his approach. In addition, he tracks the most important macro data, such as inflation trends, and also emphasizes statements by central bankers.

Thus, when he decides to enter a position, but the market is expecting an important statement or macroeconomic report, he prefers to wait to see what impact it will have on the price. If there is a significant move of a few dozen points, he prefers not to enter the trade as it is not beneficial for him in terms of the size of the Stop Loss level.

He focuses primarily on the one-hour chart when deciding to enter a trade, where he believes the Fibonacci lines work well, but he also looks at the daily chart to determine the market direction. However, the hourly chart is also important because he is not willing to hold his positions for too long and so this timeframe is the most advantageous for his intraday style (although he sometimes holds trades overnight).

An important aspect is the aforementioned patience, thanks to which he managed to stay away from the loss limits on his successful FTMO Accounts, on which he earned over $100,000. As he pointed out in the interview, "you have to wait for a good trade."

He risks no more than one percent per trade, keeps his RRR around 1.5 and executes an average of one to two trades per day. As can be seen in the figure below, he is taking advantage of a confluence of multiple factors, in this case a bounce off the Fibonacci level of 38.2% and also the 50-day EMA.

The hardest part is silencing the voices in your head

In terms of psychology, Ugnius says the most important and most difficult thing is to silence the voices in one's own head (which he calls the "operator") that forces one to make wrong decisions. This happens especially when a person is not in a good mental health or is too "wired". In short, a balanced state of mind and a patient approach is essential.

It is also important, according to him, that the trader is able to realise a profit at a predetermined level and, above all, not to dwell on the fact that if he had stayed in the market, he could have made much more money if the move had continued. In short, a profit is a profit, and it is not so important how big it is. To sum it up, profits do not make a trader poor.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.