“To grow and develop, you must be willing to learn from the past mistakes”

Nobody is perfect and even the best of us make mistakes sometimes, which is also true in trading. However, the ability to learn from your mistakes is often the key trait that separates the winners and losers. Our traders Lebohang, Luke, Lan and Lawrence know this very well and that is why they can trade on their own FTMO Accounts today.

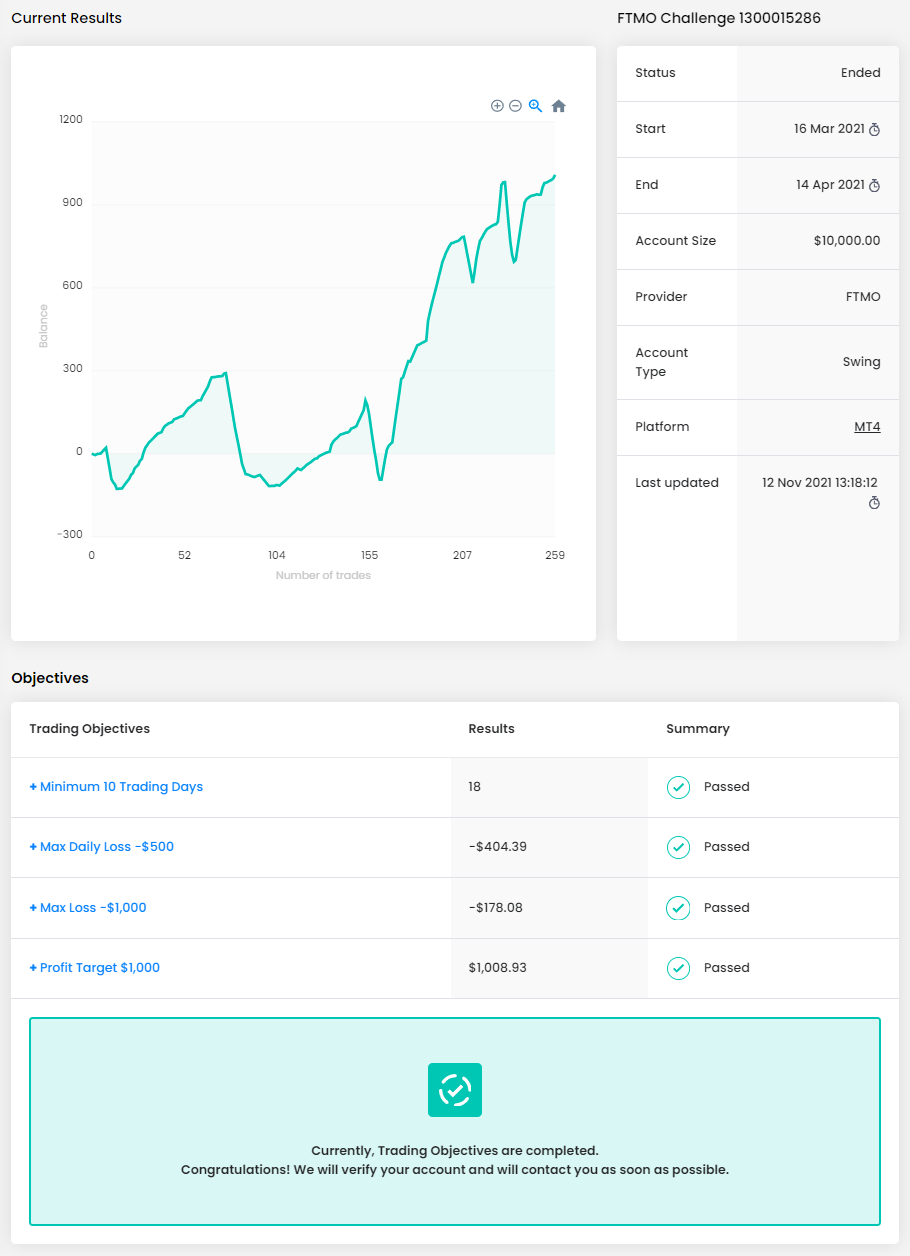

Trader Lebohang: Forex is not a 100% sure shot practice.

How did you eliminate the factor of luck in your trading?

I have predefined set of rules that governs my decisions to execute trades. This I achieve through quantifying quantities of demand and supply at price levels. I am capable of identifying reliable price turning points. As another means of proof checking high probabilities on the trades I open, I use harmonic patterns, which indeed also add value to my trade performance.

How did you manage your emotions when you were in a losing trade?

I simply managed emotions by ensuring that I stick to the rules that I have defined for my trading recipe or plan. I also ensured that by trading during high volatility session. Last, I avoided to manage multiple pairs or running trades, rather I would trade one pair, but open multiple trades for one sure shot trade. Again, I seldom run trades for lengthy periods. This helps me to have a very minimal loses whenever I may come across it.

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

I felt too pressured when wanting to reach the set profit target in a record time.

What does your risk management plan look like?

Most importantly, three most significant practices that are building blocks to my risk management are, I use proper protective stop loss, proper position size and keep losses very small. In my experience, Forex is not a 100% sure shot practice from which I know for certainty that the next opened trade is a win! But in my practice, I deploy 1:3 risk to reward ratio in positions I open. This helps me to ensure that even if I lose four consecutive trades, if I win one, it covers all losses, with a positive profit.

What was more difficult than expected during your FTMO Challenge or Verification?

The most difficult practice was this of working on targeted profit value. Regardless how of how much equity I had and how little the expected profit I had to put was, it was very challenging to me. The thing was, being in that situation somehow disoriented my trading psychology, this hardship was worse especially in the first challenge. In the second challenge, I had to review my performance, and had to just calm, and restored my normal performance. In the first challenge again, I did not understand this part of minimum daily loss, which nearly made me fail the challenge, but consistent live chats I had with support made me aware and I changed my approach instantly.

What is the number one piece of advice you would give to a new trader?

Most importantly, for a new trader that is good in trading, I just have a strongest believe the big challenge to them at times is not understanding the expectations of FTMO. For instance, this actually happened to me, when I had a different view on what it is meant by a minimum daily loss. This nearly made me loose the challenge, but for the fact that I kept having several live chats with support, I was luckily saved from fail as for most rules, I misinterpreted them, but they saved me!!! The new traders must ensure that, they have live chats with the support, for those rules that determine their success in the challenges. My experience, one day I made a minimum daily loss of $465 approximately, and this huge loss, I was not aware that, if it hits $500.1 for instance, I lost the challenge.

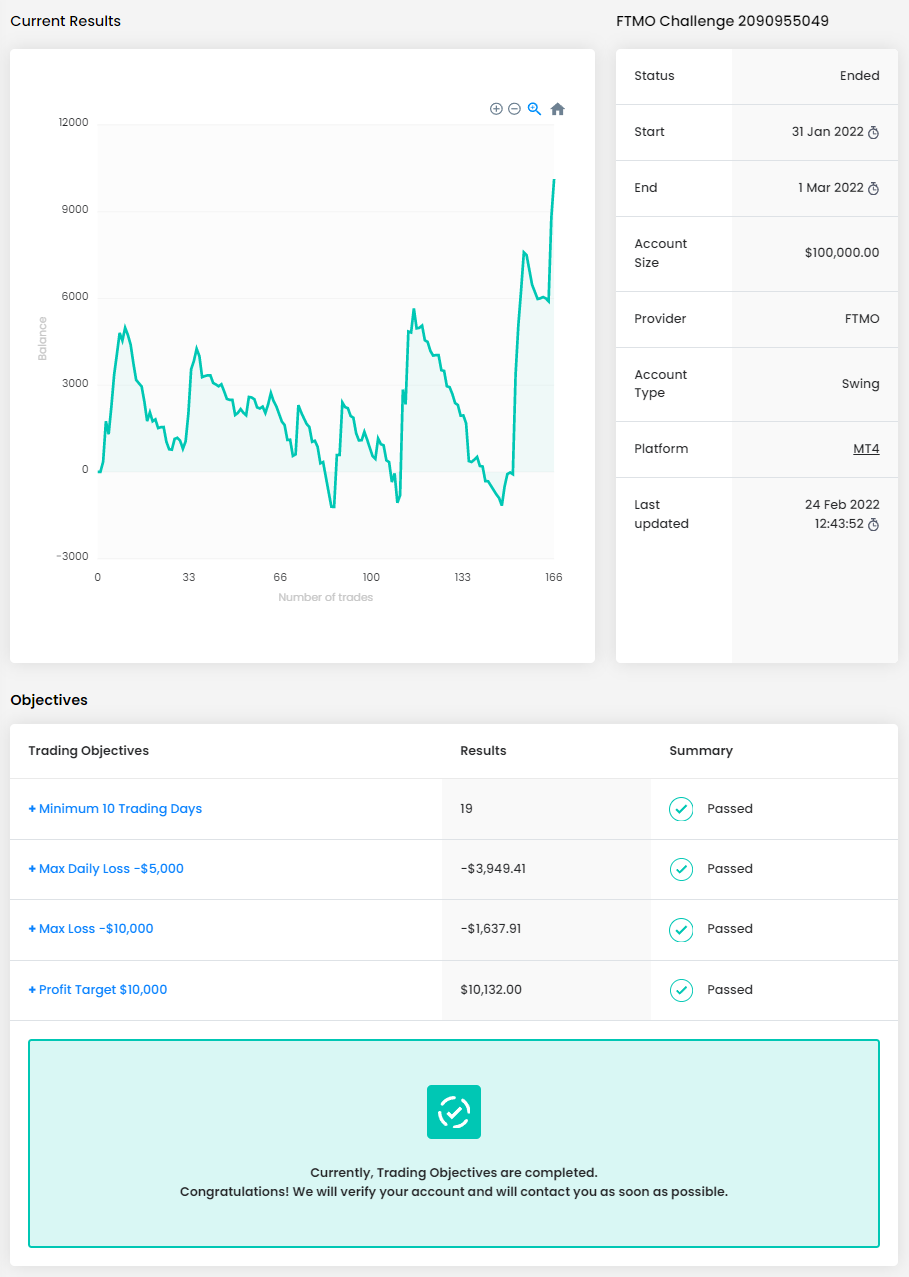

Trader Luke: To grow and develop, you must be willing to learn from past mistakes.

What inspires you to pursue trading?

Trading allows me to become the best version of myself. In order to grow and develop, you must be willing to learn from past mistakes and I apply that to both my trading and my personal life. I’m excited to have financial freedom for myself and my family so we can focus our energy on things we are passionate about.

What was the hardest obstacle on your trading journey?

I found the process of applying a winning strategy the hardest part of my trading journey. The strategies I learnt were full of discretion and didn’t have clear entries or position management rules. Once I found a more systematic approach and heavily backtested it, I found I was able to apply my edge consistently with almost no discretion.

How would you rate your experience with FTMO?

FTMO is an amazing platform for profitable traders to raise funds. The 10% drawdown and 5% daily loss limits allow you to have flexibility to apply a winning strategy. The process is quick and straight forward with useful trading tools that help track your objectives. The support team were always quick to respond if I had any questions.

How did you manage your emotions when you were in a losing trade?

I fully accept the risk when placing a trade and understand that losers are part of the game. I get frustrated if I have placed an invalid trade and this happened during the challenge when I was trying to force the market into submission - not a great thing to do! I decided to step away from the charts for a few days to hit the reset button.

What do you think is the key to long-term success in trading?

For me, the key to long term success in trading is to approach it with scale in mind. It doesn’t matter if you manage a $100 account or $1,000,000 account. You want to be able to apply an edge and manage risk. To do this you need a winning strategy, a winning mindset and great risk management.

One piece of advice for people starting their FTMO Challenge now.

Have a well backtested strategy combined with robust risk management. Always focus on your winners.

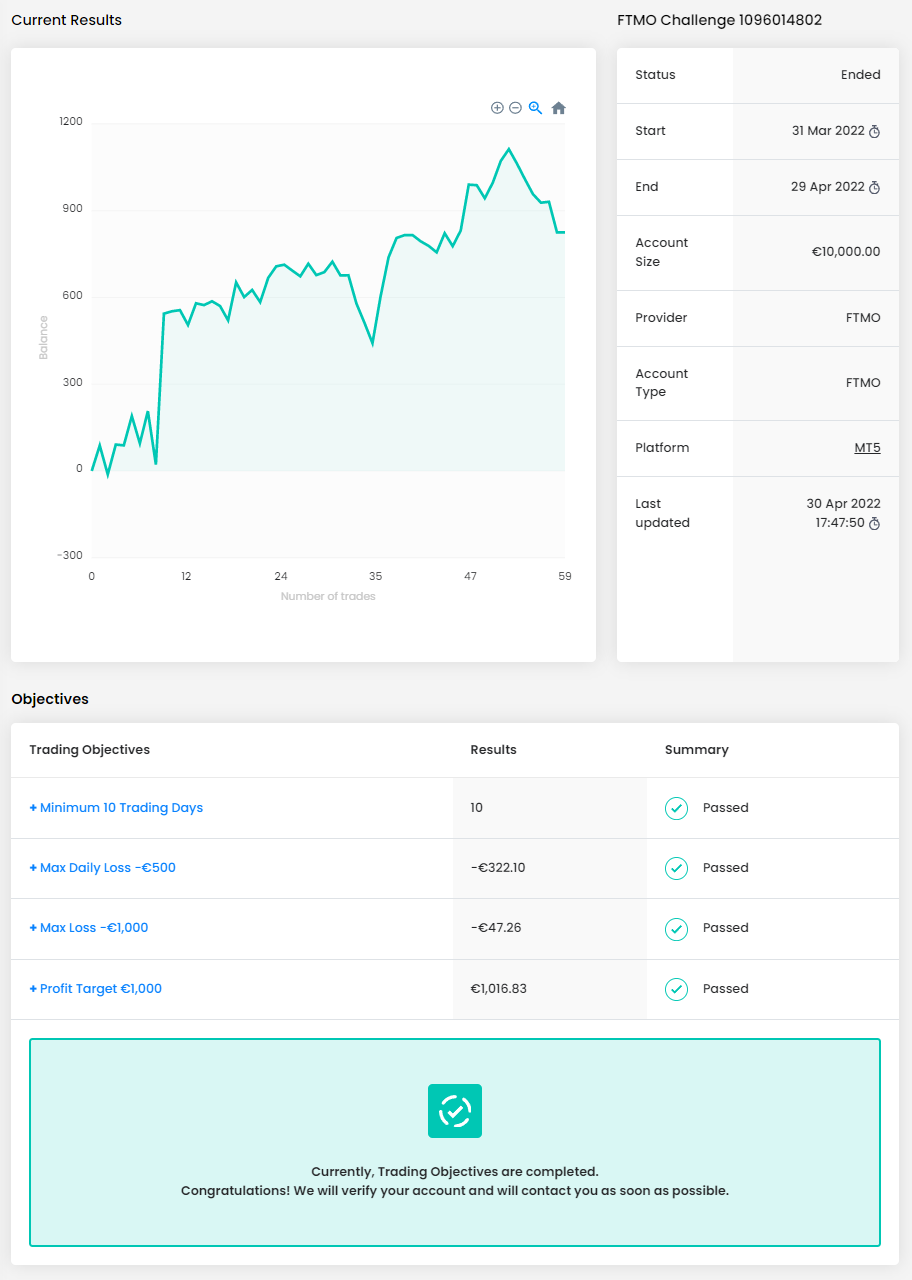

Trader Lan: I have acknowledged my mistakes and corrected them.

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

The most difficult thing was to not over trade, especially in Verification stage where I have completed my 5% profit goal in two days and didn't want to skip trading days and insert just 0.01 lot positions and not to use my strategy. At the end it was a bit rough because I didn't trade at specifically hours I usually trade because I was in Austria for another business. But at the end I have acknowledged my mistakes and corrected them.

What does your risk management plan look like?

My risk management is usually to risk 1-3% via whole day. Which means that I usually open a trade with 0.5 lots which on 20 pips SL is €100 -> 1%.

How has passing FTMO Challenge and Verification changed your life?

It changed it in a way that now I achieved what I have always dreamt of, and I have proven myself to me and me only, that I can achieve everything I want, and I dedicate my time and energy to.

What was more difficult than expected during your FTMO Challenge or Verification?

Overtrading and waiting for my minimum of 10 trading days to finish.

How did you manage your emotions when you were in a losing trade?

I have set my mind in a righty way that you can't win every trade. If I have traded as my strategy needs me to trade her, I wasn't banging my head on the door because I knew it wasn't a good day for me and it wasn't my fault. But if I traded different that my strategy wants me to, I was a little bummed out and angry at myself to not sticking to something that works.

What is the number one piece of advice you would give to a new trader?

Find a strategy that works for you and your style of trading. Don't overtrade and don't try trading more than few pairs because it’s not worth it. Specialize in one pair, index, metal etc. and perfect that.

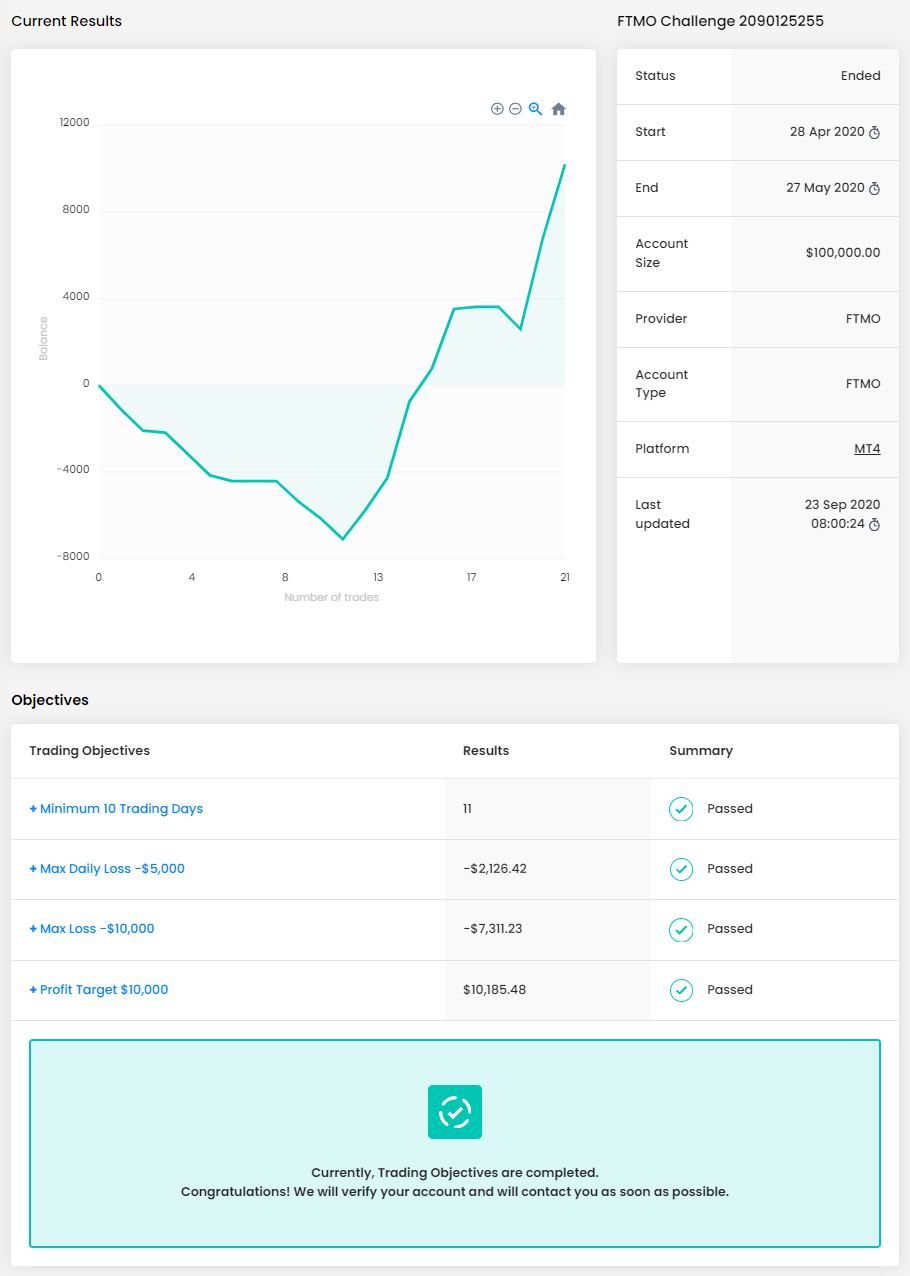

Trader Lawrence: The only thing under your control is your risk.

What does your risk management plan look like?

Risk management is my trading plan, after being in market for a while I have learnt, the only thing under your control is your risk. I risk between 0.25 to 2.50 % and no more whatsoever. 99 percent of my trades are placed within 0.25 to 1% risk of capital. If I am above 10% profit for that month and an excellent setup come along with technical and fundamentals aligned, I will place a 1% trade and scale it to 2.5% risk max, but I must say these are rare. I would like to point out, 2.5% risk trades are swing trades and my stops are wide, I don’t place a day trade with high risk as a small slippage can make thing really bad really quick.

Do you plan to take another FTMO Challenge to manage even bigger capital?

Yes, I am aiming for max allocation. I have come to realize bigger capital gives you the flexibly and patience to wait for the right trade. Only a few trades with minimum risk can give you handsome returns.

How would you rate your experience with FTMO?

My experience has been awesome. US500 had a spike in my evaluation trading, and it gave me 400K profit, however I want to say I place a lotto trade, this was a data error, I notified them, and they investigated and corrected the error. I have been treated fairly and professionally by FTMO.

Do you have a trading plan in place, and do you follow it strictly?

Yes, I have a trading plan, and that is all I follow day after day, having a trading plan is like having a process in place, when you have a process, you can minimize losses and things become effortless.

How did you manage your emotions when you were in a losing trade?

This is something I learnt with a lot of struggles; Risk management keeps emotion under control. One trick I use even today is once I click on the trade, I verify the execution and I am off my desk, take a walk, have a tea, do something that is not trading. Slowly you will stop messing with your trades, your psychology becomes stronger.

What would you like to say to other traders that are attempting their FTMO Challenge?

Don’t look at this as a challenge and deviate from your trading plan, I have seen a lot of people on internet sharing crazy risk management tactics to clear the challenge. You only need 4 trades with 2.5RRR 3 trades with 3.5RRR 2 trades with 5.0RRR and only risking 1000 or 1 % of equity.

[/av_textblock]

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.