To achieve Prime status you need patience and consistency

In the next part of our series on successful FTMO Traders, we will take a look at the account of a trader who got into our Premium Programme thanks to his skill. How does one of our best traders trade?

Our Premium Programme is definitely an attraction for all FTMO Traders as it offers them exceptional opportunities and better Rewards. At the same time, it is true that getting into it is not easy, because we only want to have the best traders in it who prove to us that they are capable of delivering consistent results over the long term. In today's article, We'll take a look at the FTMO Account of one of our traders who has managed to work his way up to the first level of our Premium Programme so far.

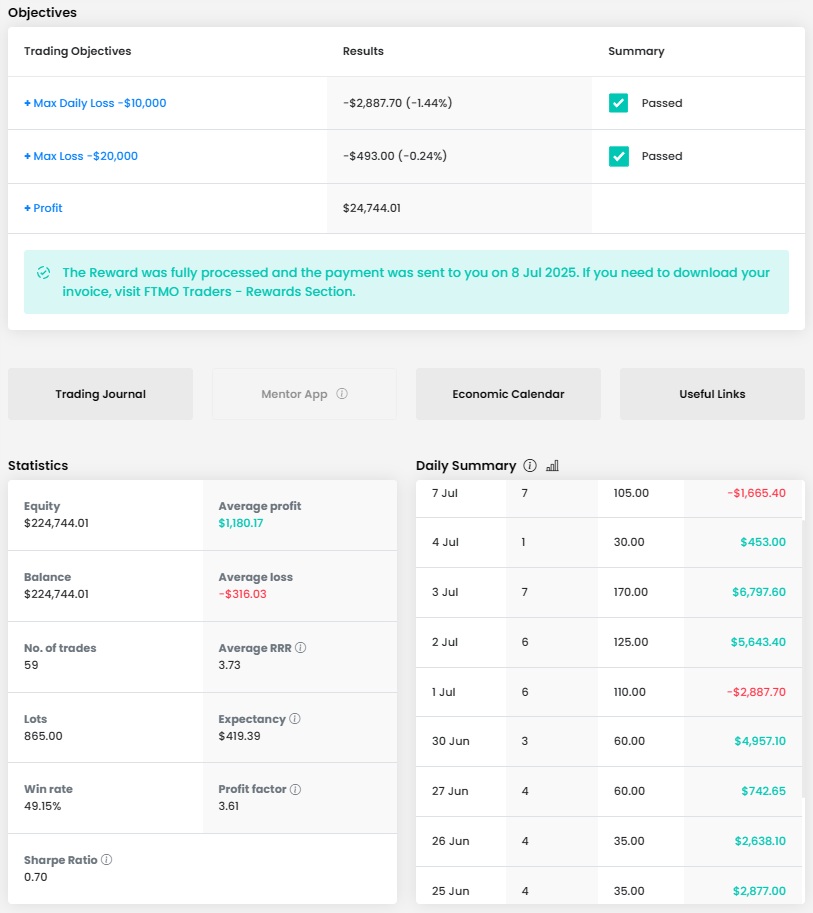

So it is clear that this is a trader who has no problem with making good profits or being consistent, which is of course evident in the first picture. Although the beginning of the trading period was not very successful for the trader and after the first two trades he was in a loss of over $6,500, it took him a few good trades to get into the green numbers.

And although he did not avoid losses completely, which is quite normal in forex and CFD trading, he stayed in the green numbers until the end of the trading period. The great consistency score is then just proof that a consistent approach with well set up risk management and money management is a very good prerequisite for a trader to achieve very good results in the long term.

The total profit of $24,111 is very good for an account size of $250,000. The statistics show that the trader had no problem with loss limits. A Maximum Loss of over $8,000 may seem like a lot, but given the account size, it is far away from the 10% limit. Similarly, the Maximum Daily Loss, which is just over 2% in percentage terms, is perfectly fine, so there is nothing to complain about here.

The trader opened 31 positions with a total volume of 67.85 lots over 15 trading days. This is two positions per day with an average size of 2.1 lots, but in reality the trader opened positions with a size of 2.86 to 5.36 lots, plus a few smaller positions.

The average RRR was 3.69, which is a value that not every trader can maintain in the long term. However, with a win rate of 35.48%, it is impossible to do without such a high RRR and a trader in such a case must be very resilient psychologically. Our trader obviously has no problem with this, so we can only congratulate him.

The journal clearly indicates that this is an intraday trader who does not hold positions overnight, thereby avoiding swap fees. It also reveals several very small positions opened during the day, held for only a few seconds. To be frank, it is unclear what the trader aimed to achieve with these; perhaps they were reducing position sizes following two losing trades or experimenting with a different approach. However, as this behaviour occurred only once, it likely does not warrant further discussion. We must commend the use of Stop Loss orders for all significant positions (excluding the aforementioned very small trades).

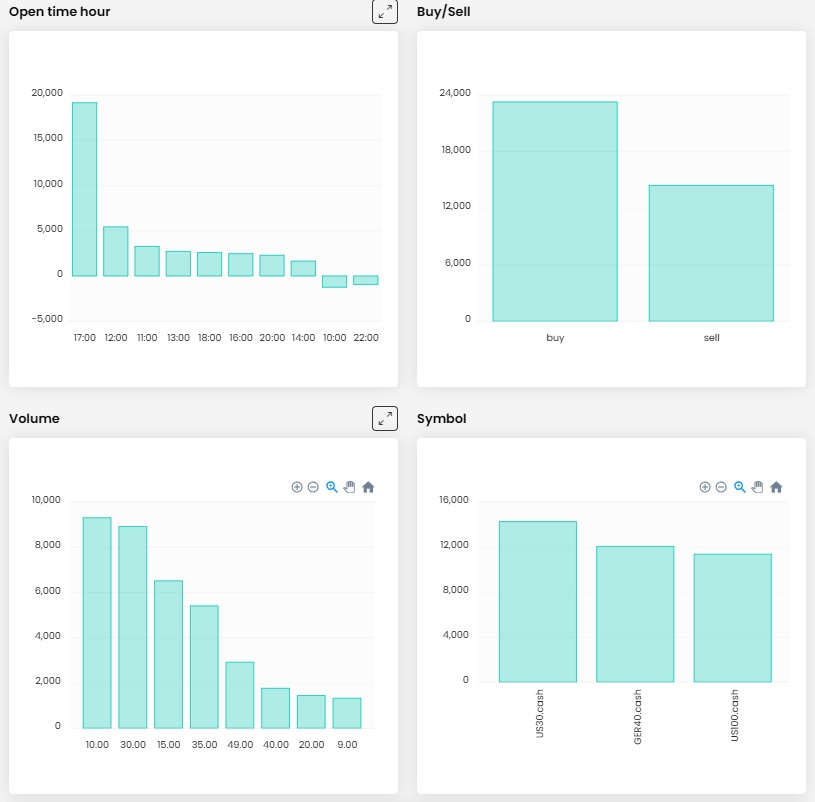

The trader did not focus on just one opening time for his positions, so he opened positions at the time when the opportunity arose. The interesting thing is the disparity between the success rate of buy and sell positions. Mostly, given the current strong uptrend in gold, this is not surprising. The trader opened only three short positions and all ended in losses, so he has no problem speculating on the downside, but the current situation in gold simply does not favour these positions.

The trader focused on only one instrument, which is gold (XAUUSD), which is one of the most popular instruments among traders, which is even more true today, with its strong growth and regular surpassing of historical highs. Most of the positions that the trader opened were 2.86 lots, which is a fairly conservative approach given the size, which we can only commend.

We'll also look at a few profitable trades. In the first example, the trader opened a position after the price bounced off a local support. At first glance, it may seem that the trader opened the position late, but the bounce from the support occurred during the night hours of European time, when the trader does not trade. A well-set SL kept him from closing the position at a loss when the price was in a range and the close occurred on a TP that was set at an RRR of 3:1. Although the price continued to rise after a minor swing, the profit of nearly $3,900 is great, so criticism would be unnecessary.

The second trade is a typical short-term speculation after important macro data has been published. In this case, it was the US labour market reports, specifically NFP, which did not look good for the dollar, as well as the Consumer Sentiment Index from the University of Michigan. After the volatility caused by NFP subsided, the trader opened a long position.

A few dozen minutes later, he realised a profit of over $7,000, just before the price reversed and saw a fairly significant swing to the downside. The result is very nice, but such speculative trades are not recommended for inexperienced traders, as luck plays a big role here.

Note: Since we cannot clearly define the exact trader's strategy from the chart, this is only the private opinion of the author of this article. FTMO Traders are free to choose their strategy and as long as they do not explicitly violate our Terms and Conditions and follow our risk management rules, the choice of strategy and execution of individual trades is up to them.

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?