The timing of trade entry can make a big difference

In the next part of our series on successful FTMO Traders, we'll take a look at a trader who made the vast majority of his profits on positions he opened within one specific time frame. Is the time of market entry really that important?

Although forex and CFDs are traded virtually around the clock during the business day, traders are usually advised to enter positions at times when liquidity is at its highest in the markets. This is usually when the markets in London and New York are open and traders can take advantage of low spreads and expect the most significant price movements.

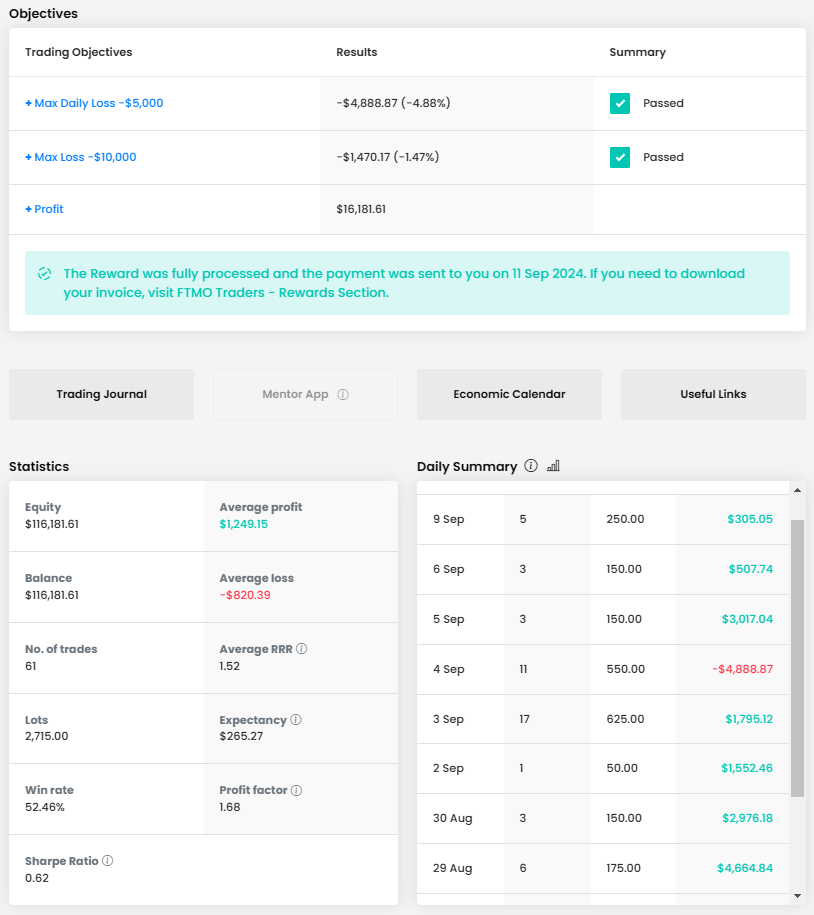

However, the trader we'll look at today made the most money at a time when trading gold is generally not recommended. But his results show that it may not actually be such a bad idea. A look at the growth of his balance curve proves part of this, even if it's not an ideal case. The trader was not spared a losing streak, but in the end, even with the help of good consistency in daily results, he made a very impressive return.

He was a bit lucky, because on the penultimate trading day he was very close to the Maximum Daily Loss limit. To risk losing an account when the trader has already made almost $45,000 is certainly unnecessary and we cannot commend such an approach. The trader opened lots of unnecessary positions that day, which only deepened his loss. He could have quit trading much earlier that day and saved money and nerves. The trader did not have a problem with the maximum loss limit and his total return was a whopping $53,836.32.

During the ten trading days, the trader executed 64 trades with a total size of 423 lots. This means an average of 6 to 7 trades per day, and also 6.6 lots per trade. The trader actually opened trades of 6 or 7 lots and did not open multiple positions, which is perfectly fine for an FTMO Account size of $200,000. The success rate of the trades was less than 30%, but with an average RRR of 4.92, even with such a success rate, an attractive return can be achieved.

The journal again shows that he is a classic intraday trader and "occasional" scalper who usually holds trades for less than an hour. However, the most profitable trades lasted several hours and in two cases the trader held the position overnight (and interestingly, in these cases holding the position for a longer period of time did not pay off much). We appreciate that the trader did not forget to set both Stop Loss and Take Profit for all his positions. As mentioned, the trader only opened positions of 6 or 7 lots and traded one of the most popular instruments among FTMO Traders, which is gold.

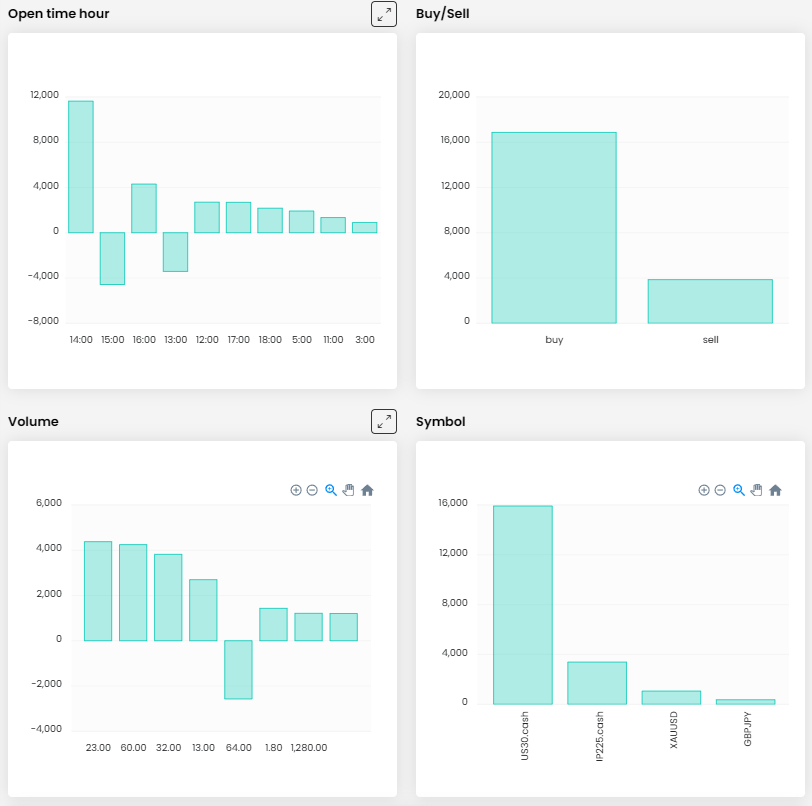

The trader traded at a time when gold was in a strong uptrend following a correction from the July highs. Not surprisingly, he took the vast majority of his profits on long positions and short positions ended in a slight loss.

The interesting thing is the aforementioned time he opened his trades. Clearly, the trader was most successful in the trades he opened around 3 a.m. CET, which is certainly not a time when traders are advised to open positions in gold.

On the other hand, this is a time when exchanges are open in China or Hong Kong, where gold trading volumes are at a relatively high level (but still relatively low compared to London or New York). In addition, traders do not have to deal with the announcement of major macro data relating to, for example, the US dollar, which can shake the gold price significantly. Gold trading at these hours exhibits less liquidity and volatility, but can also be less stressful.

The five most profitable trades were opened by the trader at the aforementioned time of around 3 a.m. CET, and on these five trades alone he managed to realize a profit of nearly $69,000. Of course, the question arises why he didn't trade only at this time, but we won't really speculate on that.

In the image below we can see the most profitable trade on which the trader made over $18,500. In doing so, he took advantage of price's bounce off local support after a significant move to the downside and took advantage of the change and strength in the short-term trend that followed that bounce.

The interesting thing is that the trader opened the trade in the same direction a few minutes earlier and closed it at the SL, which was practically the same as the low on that candle. We could blame him for impatience, because he did not wait for the mentioned bounce from the support, set the wrong SL and unnecessarily recorded a loss. On the other hand, we have to appreciate that he trusted his approach and did not get discouraged by an unlucky trade, which many traders would attribute to price manipulation and make excuses for " Stop Loss hunting".

Note: Since we cannot clearly define the exact trader's strategy from the chart, this is only the private opinion of the author of this article. FTMO Traders are free to choose their strategy and as long as they do not explicitly violate our Terms and Conditions and follow our risk management rules, the choice of strategy and execution of individual trades is up to them.

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?