Those who can adapt to market events have already won half the battle

In the next part of our series on successful FTMO Traders, today we will look at a trader who has used his trading style to adapt to changing market conditions. Thanks to his patient and patient approach, he made some very nice money.

There are traders who can adapt quickly to market events and make the most of it, but there are also those who can struggle to do so, which then costs them unnecessary money. When a trader trades longer-term swings, a change in the short-term trend can cause him short-term losses, but if he can adapt to the change in the markets, he can still profit from it. It is similar for intraday traders and scalpers, who have to be prepared for changes in trends much more often. For the more skilled ones, this means more trading opportunities but at the same time you have to get the trend change right, so to speak, and be patient so that you don't make unnecessary losses.

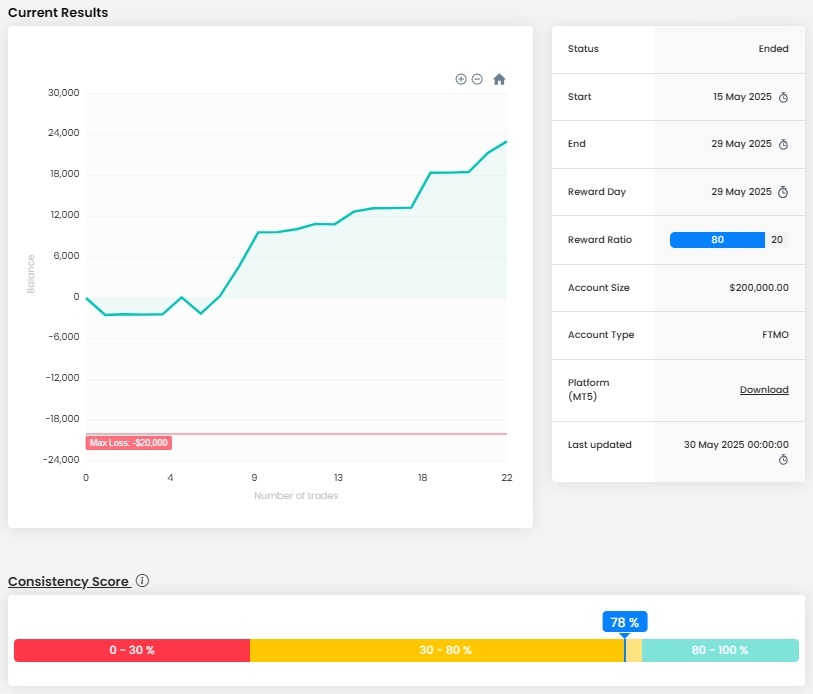

Fortunately, our trader managed to do that and thanks to that he recorded a very nice result for the trading period. Although there are a few drawdowns on the balance curve, overall the trader stayed in the green numbers throughout the trading period. The patient approach then proves the high consistency score.

The total profit of $22,513 is great for an account size of $100,000, especially considering that the trader only needed nine trading days to make it. Moreover, the trader had no problems with loss limits, with a Maximum Loss of only $99.5 being a very good result. This is also underlined by the fact that the trader ended all trading days in the green numbers, which is not seen that often.

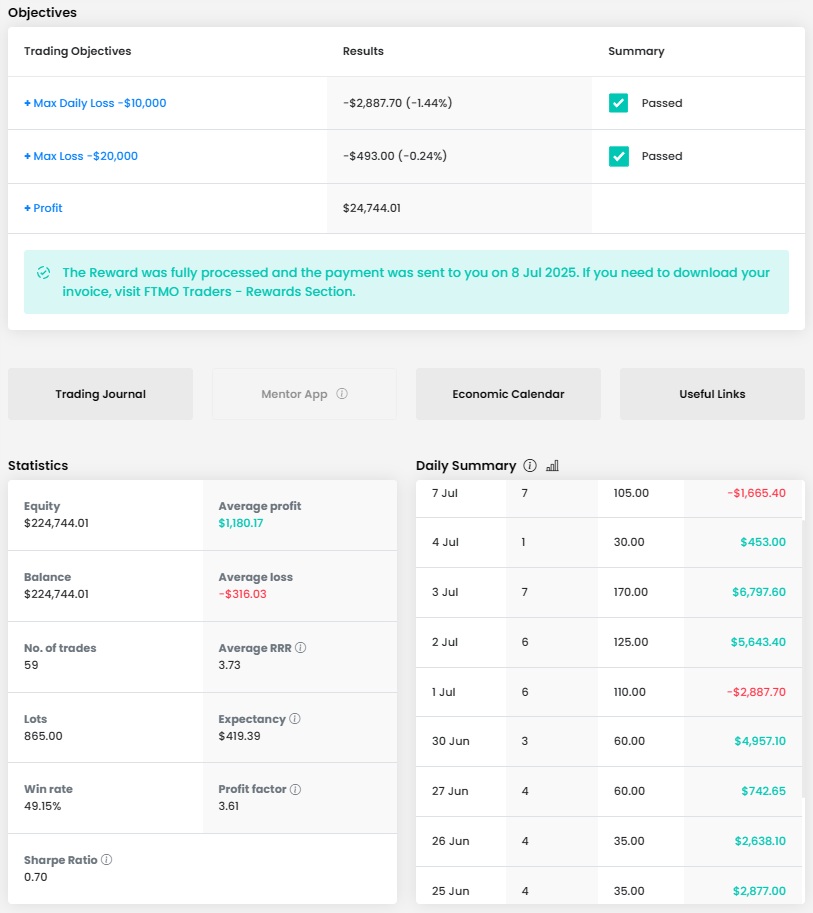

The trader executed 38 trades in the trading period with a total volume of 95.85 lots, which makes an average of around 2.5 lots. This is not a problem at all for gold and the given account size, and since the trader did not open multiple positions in his trading style, it is perfectly fine. It only remains to add that the trader traded with a success rate of almost 40%, which is not that surprising for his style, but the average RRR of 3.76 made up for it perfectly.

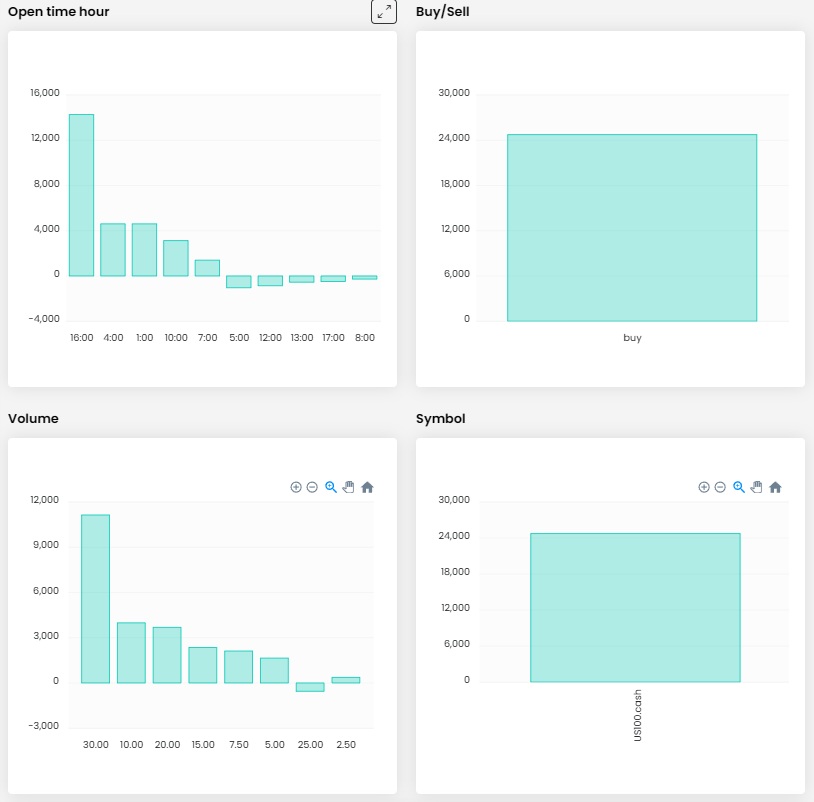

Looking at the journal, we see that here we have again an intraday trader and scalper who holds his trades for a very short period of time. Sometimes it is even only a few tens of seconds, and his longest trade (which was also the most profitable) lasted almost three hours. So it is logical that the trader did not keep positions open overnight and thus did not lose money due to negative swaps.

We can also see in the journal that the trader did not set Stop Losses and Take Profits for all his positions, which we certainly do not approve of. On the other hand, we must commend the trader for keeping his losses at a reasonable level despite the absence of Stop Losses and Take Profits. Thus, in only two cases the loss slightly exceeded 1% of the account and the average loss was less than 0.7%, so here too it is fine.

The trader is from Europe, which corresponds to the times he opened his trades. The fact that his biggest losses occurred at times when the European stock markets open might suggest that he should probably wait to trade until after the volatility subsides when the markets open.

Since the trader traded exclusively the most popular instrument, which is gold (XAUUSD), it is not surprising that he made much more on long positions than on shorts. What is rather interesting is the fact that gold was in a multi-day consolidation phase at the time the trader traded, so one would expect that short and long positions could have made him the same money.

We will also review the most profitable trades made by this trader. The first noteworthy trade was a short position taken as gold began a multi-day downward trend. On the minute chart, we can observe that the trader entered the position following a rejection from a resistance level established earlier that day. Although the trader initially attempted to capitalise on the move prematurely—resulting in a few losses—he eventually demonstrated patience and executed the trade successfully, securing an impressive profit of over $5,000.

The second trade followed a similar pattern, but this time, the trader entered before waiting for a clear bounce from the support level, which had previously acted as resistance and coincided with the psychologically significant $3,100 mark. As with the earlier trade, impatience initially led to a few minor losses. However, the trader persisted and ultimately secured a profit of over $5,200 on what became his longest-held trade.

Note: Since we cannot clearly define the exact trader's strategy from the chart, this is only the private opinion of the author of this article. FTMO Traders are free to choose their strategy and as long as they do not explicitly violate our Terms and Conditions and follow our risk management rules, the choice of strategy and execution of individual trades is up to them.

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?