The market is constantly delivering new opportunities

Patience - one of the essential qualities that a successful trader must either have or learn over time. It is the lack of patience that forces us to rush into wasteful trades that often lead to unnecessary losses. The fact that there are always plenty of opportunities in the market worth waiting for is being realized also by our traders who have managed to pass the Evaluation Process. Meet our new FTMO Traders Tom, Chelsea, Nicolas, and Adrián.

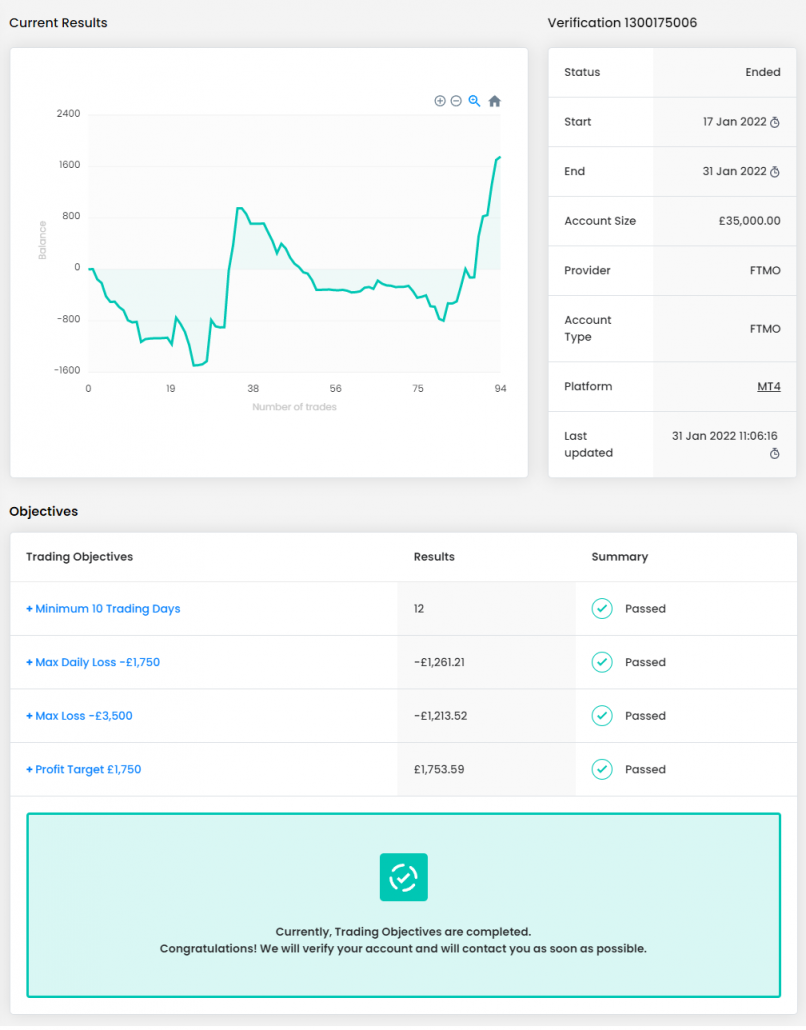

Trader Tom: “Have patience, patience, and more patience.”

Where have you learnt about FTMO?

Fellow traders within a trading community.

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

The most challenging aspect I found was the time limit of 30 days in the initial challenge. To begin with I knew my strategy would give me a high probability of passing the challenge in a little number of trades yet, knowing this time deadline was there added some pressure for me to trade. Initially on both the challenge and the verification I took trades that didn't meet all my trading criteria due to this. I adapted my trading strategy to a lower timeframe to present me with more trading opportunities, so I was able to hit the target within the 30 days. Then it was just applying patience and knowledge from the vast amount of back testing I have done on my strategy to know a trade was just around the corner.

What does your risk management plan look like?

The risk management of my strategy is very solid when paired with the RR I aim for. So even on a string of losses I knew I just had to remain patient and trade my plan and the profits would soon outweigh the losses. One thing trading has taught me is the market is constantly delivering trades to traders, the one you may have missed will never be the last so don't rush it and don't force it.

What was easier than expected during FTMO Challenge or Verification?

Realizing the profit targets once I applied strict management to my trade selection and execution. I think it's fair to say I even cut my trades early as they reached the targets, and this is encouraging as it shows a greater profit potential if and when the trades are given more room to play out.

Do you have a trading plan in place, and do you follow it strictly?

I do have a trading plan. It's a very profitable strategy which I have back tested a lot to give me an edge on exactly how and when to trade it. I have put a lot of work into the strategy to make it as straight forward to trade as possible with the view to remove as much 'objective' decision making, especially when it comes to the point of entering and exiting my trades.

What is the number one piece of advice you would give to a new trader?

Have patience, patience, and more patience. Many strategies out there will make money in the financial markets, the main reason they don't is because people 'tweak' them, change them, don't give them enough time and ultimately trade with zero patience, trying to force the markets. As Warren Buffet once said, "the markets are a means for transferring wealth from the inpatient to the patient". This is so true.

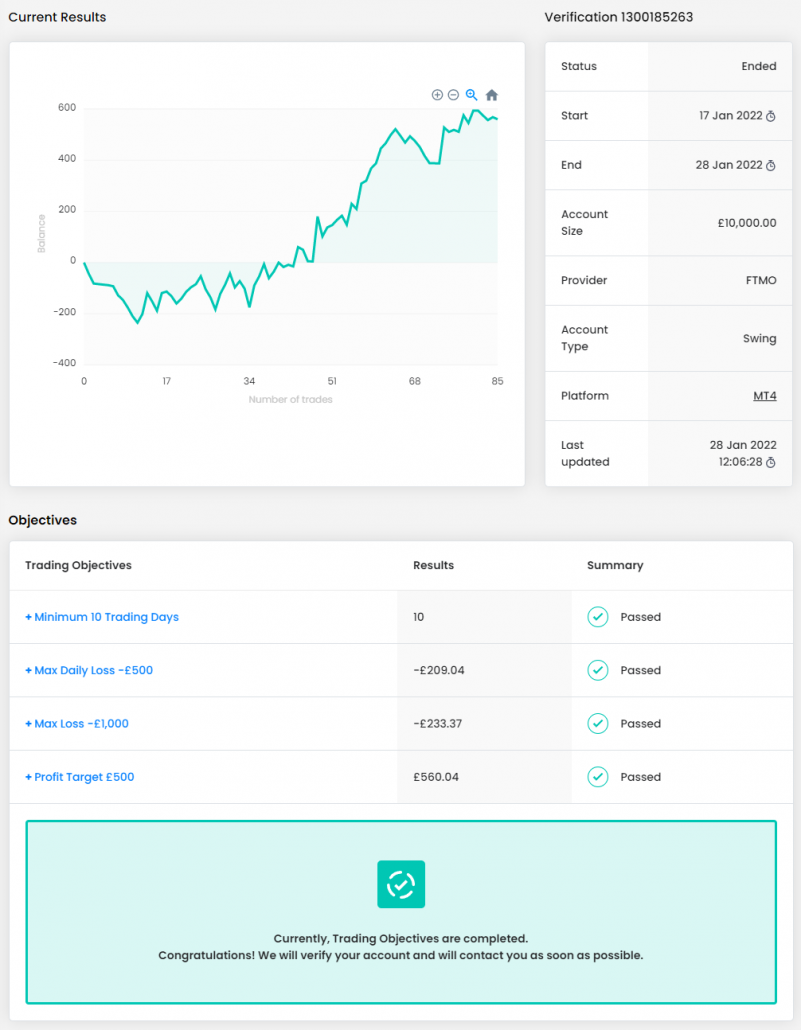

Trader Chelsea: “As long as you have a good risk management and mindset in place, you’ll be fine.”

How did loss limits affect your trading style?

I think it’s really easy to get caught up sometimes, especially with someone that’s being monitored it’s easy to let pressure get to you, but the maximum loss limits really pushed me to stick to my risk management and to switch off on days when I needed to. They helped me keep any slight glimpses of greed away!

How did you eliminate the factor of luck in your trading?

I ensured I stuck to a strict risk management plan and monitored my performance regularly. I also made sure my analysis was thorough and any trades that weren’t perfect I didn’t place.

What was more difficult than expected during your FTMO Challenge or Verification?

It was difficult to not want to gain back the losses by placing unnecessary trades. It’s easy to look at a loss and panic in situations like this but I think as long as you have a good risk management and mindset in place, you’ll be fine.

What does your risk management plan look like?

My risk management plan is to risk 0.5% per trade unless I’m on a dead certain trade then I would risk 1%. I also try to stick to a maximum of 5 trades at once and an absolute max of 10 trades per day to keep risk to a minimum.

What was easier than expected during FTMO Challenge or Verification?

The process in itself was generally a lot easier than I expected. The tools that FTMO supplied such as the account matrix and the analysis tools all helped me keep on track of what I was doing alongside my own trading journal. Easy, seamless process.

One piece of advice for people starting FTMO Challenge now.

GO FOR IT. Definitely do the free trial first to gain an insight of what’s in store and if you pass then go for it. If you’re thinking about it then you’re already ready. Stay consistent, don’t let pressure get to you and good luck!

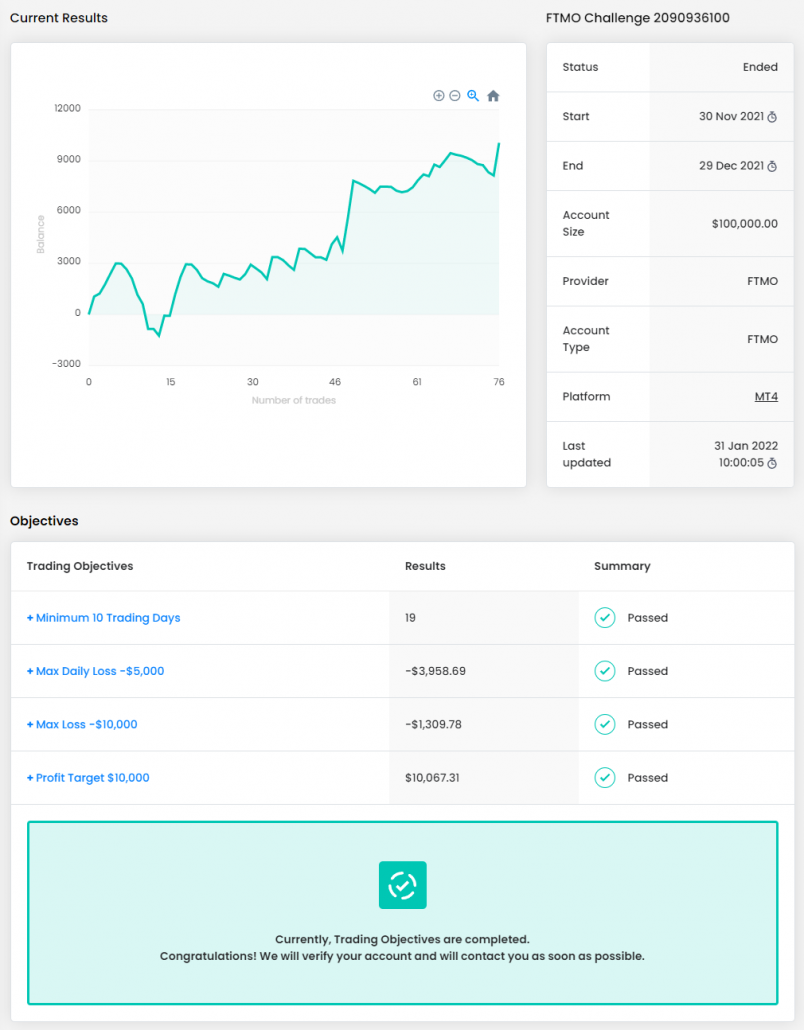

Trader Nicolas: “Really the most difficult part is patience.”

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

Really the most difficult part is patience. Understanding that I might have the skill, but do I have the patience to keep a clear mind and focused and not get greedy.

How did you manage your emotions when you were in a losing trade?

Honestly just understanding that risk to reward is everything. I had some days where I had multiple losses, then 1 trade made it all up plus some. So just understanding that I just need to keep trading (not overtrade) but if I had a loss, I needed to put that in my journal and understand why I made that loss and slightly tweak my trading plan so that I can try not to keep making that same mistake.

What was more difficult than expected during your FTMO Challenge or Verification?

Honestly this is like my 5th time trying this challenge. The first times I just wasn’t ready, I tried to rush the process instead of maybe trying demo again to make sure my plan was good. Then I took a break from trying and tried completing the demo with the same requirements. After I did that, I knew it was just a matter of time. Honestly just the patience and discipline I had to build.

Has your psychology ever affected your trading plan?

It has but one thing I try to never let it affect is my risk to reward and understanding those losses are nothing. They are just lessons that I needed to learn in order to be where I am today.

How has passing FTMO Challenge and Verification changed your life?

Well, it hasn’t changed too much yet because I need to make some money on it, but it has definitely brought up my confidence. I dropped out of college midway through without ever making a cent with forex because I knew this is what I wanted to do. Everyone criticized me and only a couple supported me, but I watched a video Cue Banks put out and he said, “don’t try to explain it to people because they don’t understand the possibilities”. I’ve realized people don’t really care about your dreams, they only support when they see progress.

What would you like to say to other traders that are attempting to pass FTMO Challenge?

I would say to them stick with it. The first time I tried the challenge I told myself, “if I don’t get it this time, then I’m trying again. If I don’t get it the second time, I’m trying again” and I kept going for about 5 minutes just saying that. Nothing is getting in my way, I am going to get this account and it is just a matter of time no matter how many tries.

The biggest advice I would give is don’t tell small minded people your goals and dreams especially if you are just getting started. I wonder how many more great people there would be in the world if they didn’t listen to their family members who told them what to do. Don’t have hate towards them just understand who you listen to is who you become. If you’re listening to your father who has done well in life but nowhere near where you want to be but you listen to him for everything, why do you think you will surpass him? I didn’t listen to my “rich uncle” who might have a couple million telling me to go back to school and all this. I listened to the billionaires on YouTube telling me you don’t need college, you need a plan, you need patience, you need passion, and you need persistence.

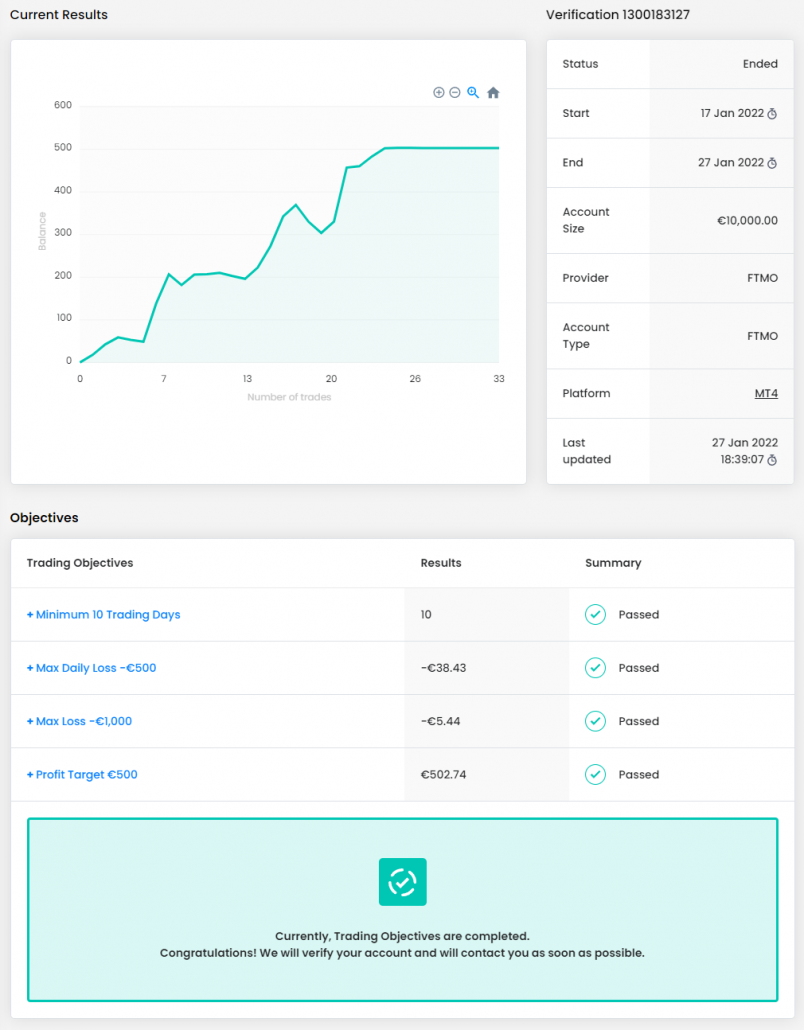

Trader Adrián: “Risk management is your best friend, your emotions are your worst enemies.”

How would you rate your experience with FTMO?

The FTMO evaluation process was a really good challenge for my knowledge and trading skills. I really enjoyed it, after a 6% drawdown (from which I learned a lot) I realized what I need to change in my trading style to make the challenge. Without this evaluation process I would probably never realize these small, but very needed things. I'm ready for another 2 challenge accounts with more confidence and skill.

How did loss limits affect your trading style?

I needed to specify my risk management in my trading plan before I started the evaluation process to prevent breaches of the drawdown rules. Because of this risk management the maximum loss limits didn't affect my trading style because I adapted my trading plan to the FTMO rules.

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

Like I said I had a 6% drawdown in the challenge phase after which I was confused a little bit. it was necessary to make some changes in my trading plan and calm down my emotions, but if the risk management wasn't right, I would be probably out because of the drawdown rules. After that, I made it from -6% to +4%, so if you have proper risk management and your psychology is okay, everything is possible.

What inspires you to pursue trading?

Freedom...

How did you eliminate the factor of luck in your trading?

I consistently followed my trading plan, never entered any trade if it doesn’t fit my plan even if I would be right at the end, I just don't care. If it doesn’t fit my plan, I wouldn't take it. Simple.

What would you like to say to other traders that are attempting to pass FTMO Challenge?

Risk management is your best friend, your emotions are your worst enemies. You need to strictly follow your risk management because that's what matters. Losses can occur anytime, but you need to know that you can recover from any drawdown with a good risk management and trading plan. You need to maximize your focus and minimize your emotions. Good risk management helps with emotions too, it makes it easier, you need to realize before every trade you enter how much percent you can lose in that trade, and you need to be okay with it. And if the trade hits your SL, because it happens even to the best ones in this industry, you need to analyze the mistakes you made and follow through. If you became really consistent with you risk management by backtesting it, it'll be much easier.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.