“The loss limits taught me to be more disciplined”

The loss limits that our traders must follow can be a source of frustration and embarrassment for some. In reality, however, they are one of the tools we use to teach traders the disciplined approach that is essential for long-term success. Those who understand this early on are the ones who can go on to become FTMO Traders.

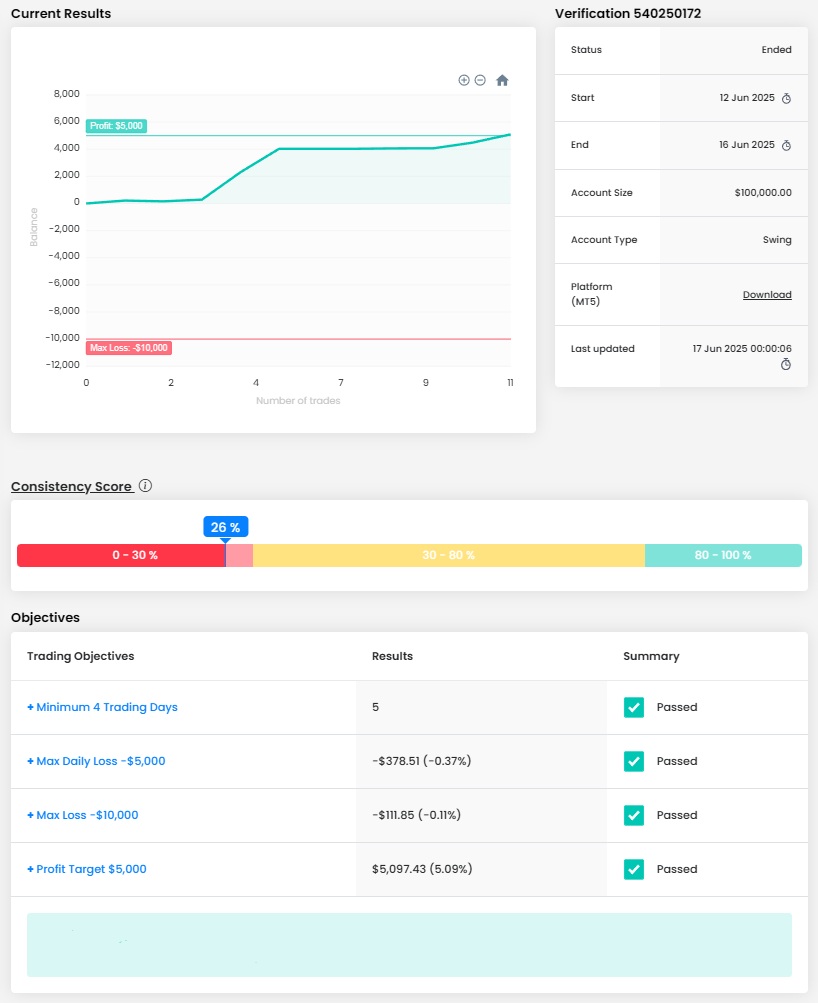

Trader Waleed Zeyad Ragheb: “Passing the FTMO Challenge and Verification gave me the confidence and structure I needed.”

What does your risk management plan look like?

I follow a strict risk management plan. I risk a fixed 0.5% to 1% per trade, depending on the market conditions. I always set a Stop Loss before entering any trade, and I avoid overtrading. My focus is on consistency and protecting the capital, rather than chasing profits.

How does passing the FTMO Challenge and Verification change your life?

Passing the FTMO Challenge and Verification gave me the confidence and structure I needed. It opened the door to trade larger capital with lower emotional pressure, and it gave me a real sense of achievement and purpose in my trading journey.

What was the hardest obstacle on your trading journey?

The hardest obstacle was emotional discipline — learning to control fear and greed. It took time and experience to master my mindset and stick to my plan even during losing streaks or market volatility.

What was easier than expected during the FTMO Challenge or Verification?

Surprisingly, following the rules was easier than I expected. Once I had a clear plan and stayed focused on execution rather than outcome, it became a smooth process. The structure of the evaluation actually helped me stay disciplined.

Do you plan to take another FTMO Challenge to manage even bigger capital?

Yes, I absolutely plan to take another FTMO Challenge. Growing my capital and scaling my trading career step by step is part of my long-term vision. I’m focused on consistency, and managing a larger account will help me reach higher financial goals.

What is the number one advice you would give to a new trader?

Focus on risk management and emotional discipline from day one. It’s not about how much you can make in one trade — it’s about how long you can stay in the game. Consistency, patience, and sticking to a plan are the real keys to success.

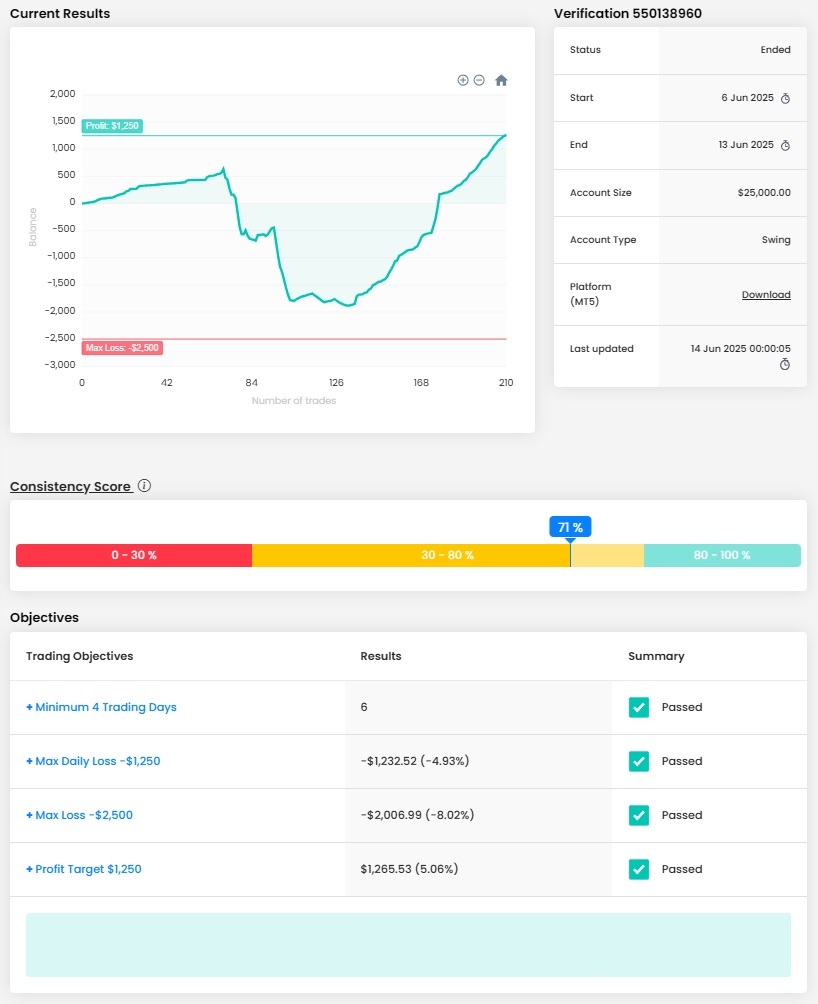

Tradder Rabiatou: “Managing psychology is just as important as having a solid strategy in trading.”

Do you plan to take another FTMO Challenge to manage even bigger capital?

Yes, it’s definitely something I’m considering. Now that I’ve successfully passed both phases, my main focus is to manage the current account with consistency and discipline. However, in the near future, I plan to take another FTMO Challenge to increase the capital I manage.

Where have you learnt about FTMO?

I heard about FTMO through social media, especially on YouTube and Instagram, where many traders share their experiences and results with the company. That sparked my interest, so I decided to do more research on my own. After that, I decided to give it a try, and I’ve now successfully passed both phases of the challenge.

Has your psychology ever affected your trading plan?

Yes, my psychology has affected my trading plan at times. In the beginning, I sometimes let emotions like fear or greed influence my decisions — for example, closing trades too early out of fear or overtrading after a few wins. However, with experience and discipline, I’ve learned to stick more closely to my plan and trust the process. Managing psychology is just as important as having a solid strategy in trading.

How did you eliminate the factor of luck in your trading?

I eliminated the factor of luck in my trading by focusing on consistency, backtesting, and strict risk management. I rely on a well-defined trading plan with clear entry and exit rules that I’ve tested over time. Every trade is based on data and probability, not emotion or impulse. By sticking to my strategy and managing risk properly, I no longer depend on luck — I depend on discipline and statistics.

How did loss limits affect your trading style?

The loss limits taught me to be more disciplined and selective with my trades. Knowing that I have a limit forces me to avoid overtrading and emotional decisions. It made me focus more on quality setups and proper risk management. Instead of trying to win every trade, I now focus on protecting my capital and staying consistent, which has improved my overall performance.

One piece of advice for people starting the FTMO Challenge now.

One piece of advice for people starting the challenge now is: Focus on risk management and stay disciplined. Don’t try to rush the process or chase profits. Stick to your trading plan, respect the daily and overall loss limits, and treat the Challenge like a real funded account from day one. Consistency and patience are more important than trying to impress with big wins.

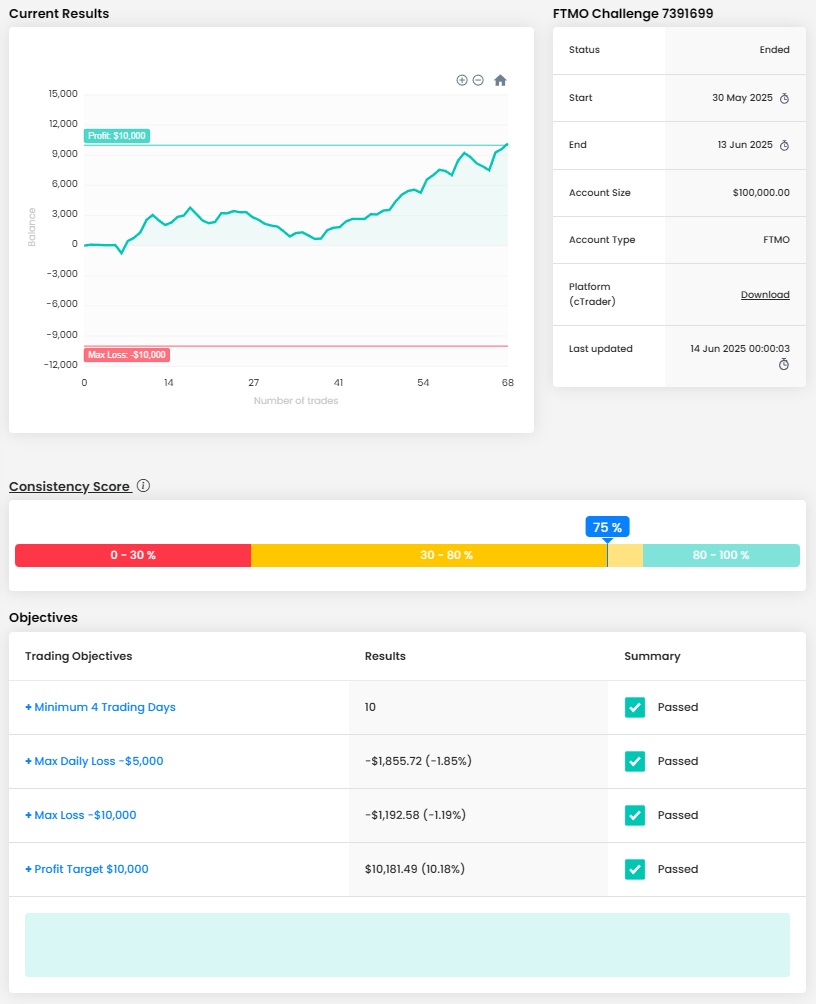

Trader Fabrizio: “It's not gonna be easy, the path is HELL.”

Describe your best trade.

My best trade was probably done the Monday, the 16th of June. After having a small loss on the NASDAQ, I opened a long position on the Dow, that rallied 300 points, and I added to my winning position 5 times, held on to it, and made a total profit of 4%. This trade was proof of what I tried to achieve during these last times, discipline and discomfort while the big unrealized profit grows even more by adding to the position.

What inspires you to pursue trading?

There's only one individual that did the work for me, and his name is Tom Hougaard. Excellent trader.

How did loss limits affect your trading style?

I simply could not bet bigger from the beginning, but it was fine, it's not something that I minded a lot.

What do you think is the most important characteristic/attribute to becoming a profitable trader?

Adding to winning positions, being slow at taking profit and QUICK at cutting losses, and A LOT of consistency.

Has your psychology ever affected your trading plan?

Yes, but only on the good side of things. I believe that psychology is my strength.

One piece of advice for people starting the FTMO Challenge now.

It's not gonna be easy, the path is HELL. But someday you'll get there, JUST BE CONSISTENT

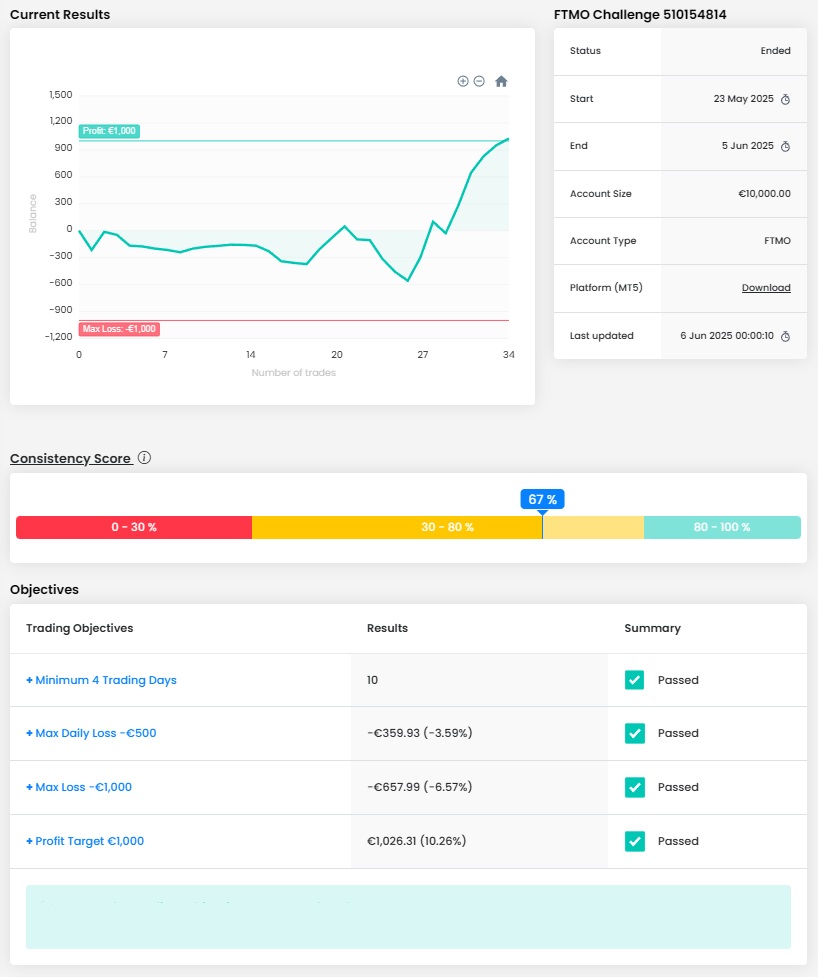

Trader Emerson Emanuel: “The most difficult part was managing the pressure of the daily loss limit”

How would you rate your experience with FTMO?

I would rate my experience with FTMO as very positive. The entire process—from registration to completing the FTMO Challenge and Verification—was smooth and professional.

What was more difficult than expected during your FTMO Challenge or Verification?

The most challenging aspect was managing the psychological pressure, especially when close to hitting daily loss limits or trying to recover from a losing streak. Staying calm and sticking to my trading plan without forcing trades was harder than I anticipated, especially under time constraints.

What was easier than expected during the FTMO Challenge or Verification?

What I found easier than expected was following my technical strategy. Once I stayed disciplined, my setup worked as planned. I was also positively surprised by the responsiveness of FTMO’s support team and how user-friendly the dashboard and metrics tracking were.

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

The most difficult part was managing the pressure of the daily loss limit, especially on days when trades didn’t go as planned. Knowing that one bad day could end the Challenge added extra stress, which at times tempted me to deviate from my strategy. I overcame this by reducing my lot size slightly, which gave me more breathing room and helped me focus on executing my plan rather than worrying about the loss limits. I also made it a rule to step away from the screen after a losing streak to reset mentally and avoid emotional decisions.

What was the hardest obstacle on your trading journey?

The hardest obstacle on my trading journey has been mastering emotional discipline. Early on, I struggled with overtrading after losses, chasing the market, or exiting trades too early out of fear. Learning to stay patient, trust my strategy, and focus on long-term consistency instead of short-term outcomes took time and effort. Developing a mindset that treats trading as a probability game rather than taking individual wins or losses personally has been the biggest challenge—but also the most valuable lesson.

One piece of advice for people starting the FTMO Challenge now.

Treat the FTMO Challenge exactly like a live funded account from day one. Focus on protecting your capital first—don’t rush to hit targets. Stick to your plan, respect your risk limits on every trade, and don’t let emotions push you into overtrading or revenge trading. Consistency and discipline matter far more than trying to pass as quickly as possible.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.