“The beauty and demise of trading is that there is no one way to do it”

The nice thing about trading Forex is that there is no one right approach to making money here. But at the same time, it can be a bit confusing for many traders because they are not sure if their approach is the right way to succeed. Our new traders Takudzwa, Rugved, Lyndon and Abbie seem to have found the right approach after all.

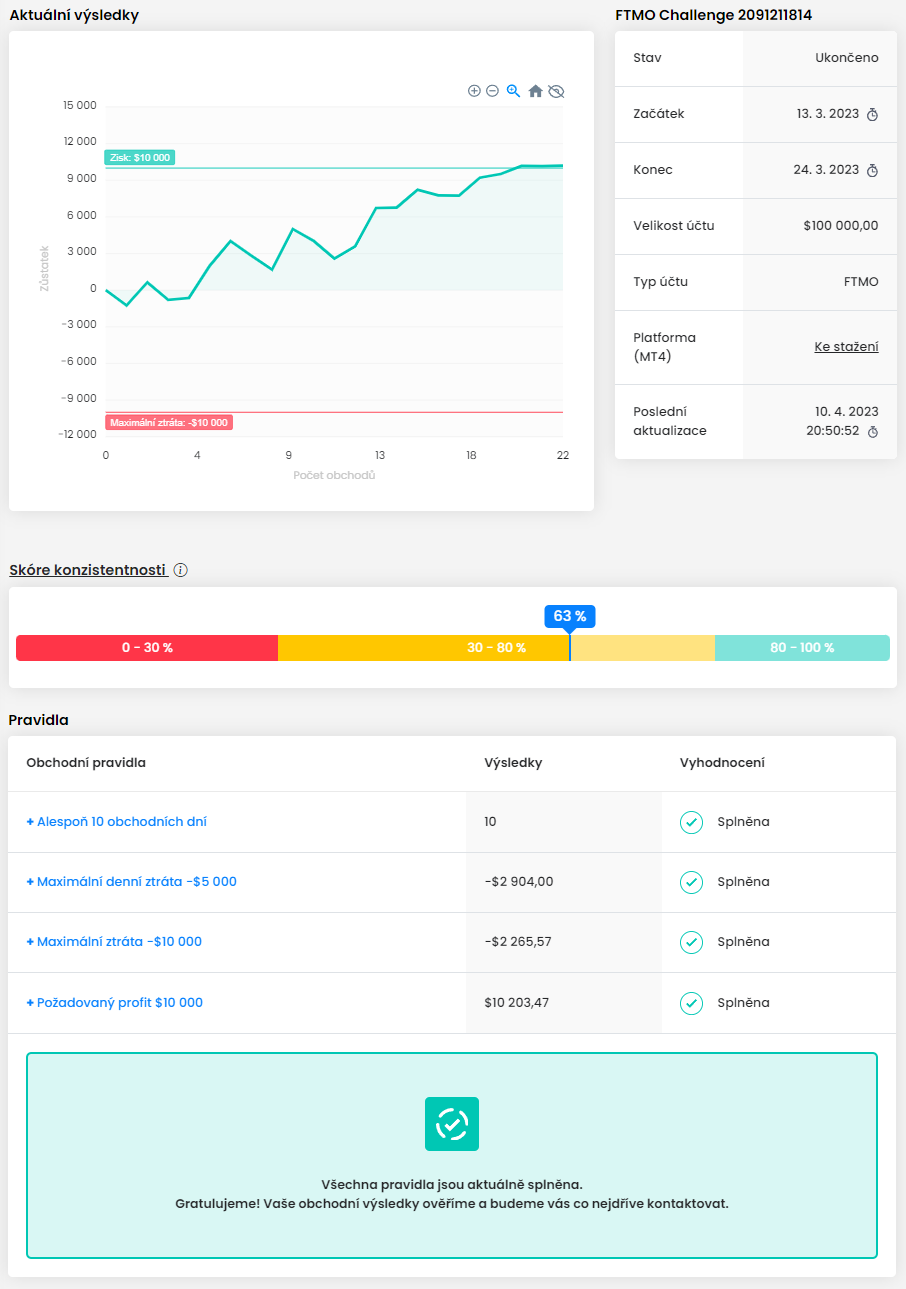

Trader Takudzwa: Success in trading is not just about hitting profit targets, but about having a disciplined and sustainable approach to trading.

How has passing the FTMO Challenge and Verification changed your life?

Passing the FTMO Challenge and Verification has been a life-changing experience for me! It has boosted my confidence in my trading ability and shown me that I can achieve anything I set my mind to with discipline, hard work, and dedication. Knowing that I have a solid source of income has brought me a sense of security that I have never felt before in my career, and I am excited to see what the future holds for me as a professional trader. This is only the beginning, and I am ready to progress with a sense of fearlessness. If I can do it, so can you! Believe in yourself, stay disciplined, and the sky's the limit!

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

The FTMO Challenge and Verification was a challenging but rewarding experience for me as a trader. The most difficult part was to fully trust my trading plan and to stick to it, especially when market conditions were tough. However, I overcame this challenge by focusing on actioning my plan and evaluating myself based on how well I followed it, instead of just meeting the Trading Objectives. This experience taught me that success in trading is not just about hitting profit targets, but about having a disciplined and sustainable approach to trading. By remaining focused and disciplined, I was able to achieve my goals and become a more confident trader. If you're going through the FTMO Challenge and Verification, remember that discipline and trusting your plan are the key to success. Trust your plan, stick to it, and evaluate yourself based on how well you follow it.

Do you plan to take another FTMO Challenge to manage an even bigger capital?

This is one of my long-term goals, but for now I want to gain more experience as a disciplined and sustainable funded trader before I progress onto another FTMO Challenge.

How did you manage your emotions when you were in a losing trade?

Managing emotions during losing trades was crucial for me to do well in the Challenge. To manage my emotions, I stayed away from impulsively checking my trades and reminded myself to trust the plan. I had predefined stop-loss levels that helped me limit losses and avoid taking on too much risk. By also accepting losses as an inevitable part of the journey, I could stay disciplined and trust the process even during a series of losing trades.

Describe your best trade.

My best trade was on the USD/JPY pair where I made a 2% return. This involved completing a thorough analysis, sticking to my plan, and executing my plan with full confidence. I was able to avoid emotional interference and to make irrational decisions. This helped me to maximize my profits and avoid the temptation to make impulsive decisions or exit the trade too early. This trade reinforced the importance of staying disciplined and focused on the plan and avoiding impulsive decisions or emotional trading.

What would you like to say to other traders that are attempting the FTMO Challenge?

As a trader who recently passed the FTMO Challenge, my advice to other traders attempting the Challenge is to trust your plan, stick to it, and evaluate yourself based on how well you follow it. Don't give up, as it may take time for everything to click. Also, try a few Free Trials first before attempting the Challenge. Keep a positive attitude and stay motivated, and you will succeed!

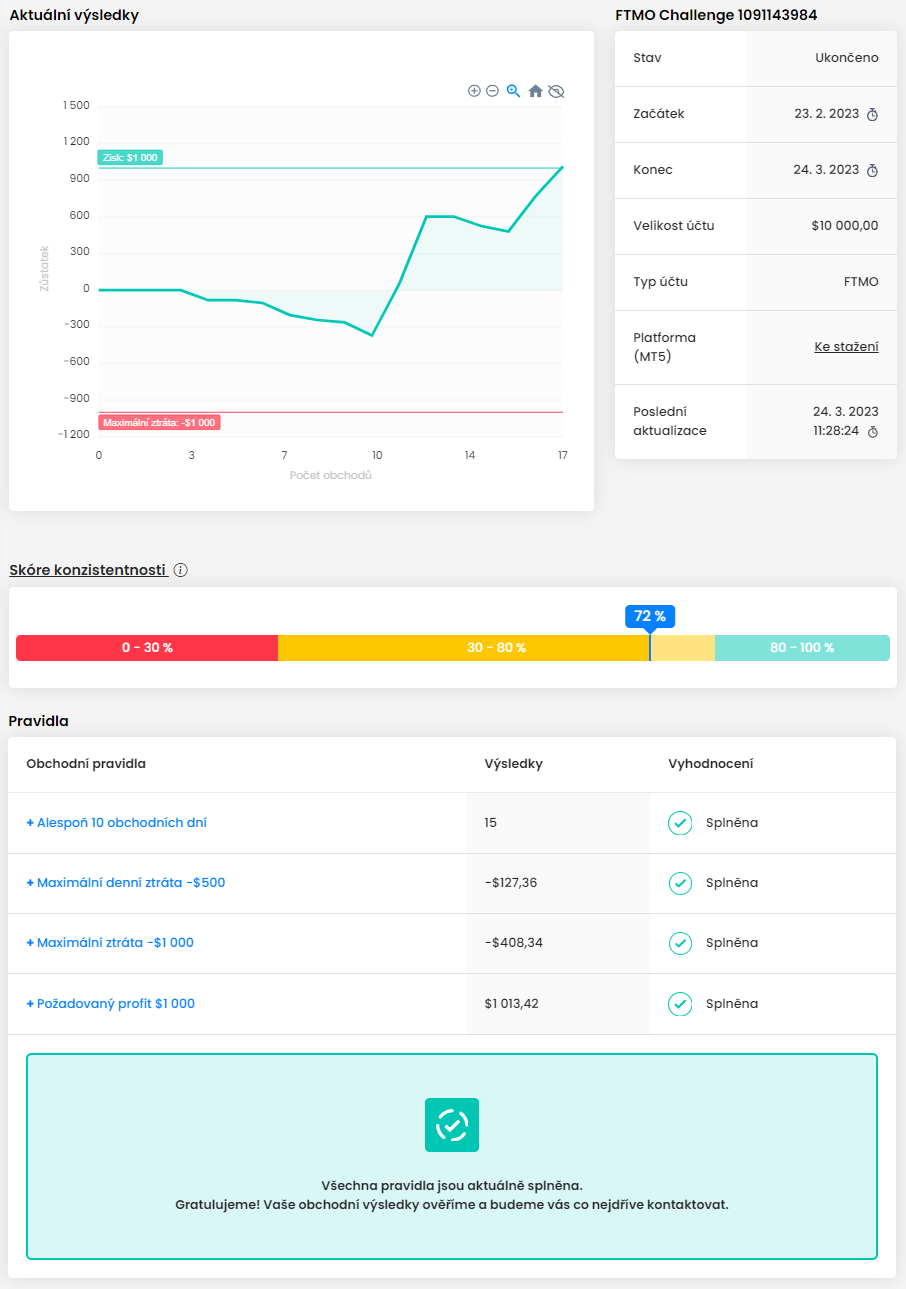

Trader Rugved: I am now at a stage where I can shut off my emotions by simply focusing on my plan.

Where have you learnt about FTMO?

By word of mouth. From my friends who are traders.

What does your risk management plan look like?

I risk 0.5% - 1% on a trade depending on the setup. I always use a stop loss. My minimum risk to reward ratio on each trade is at least 1:3, this requires me to have a win-rate of only 30%.

Has your psychology ever affected your trading plan?

It has in the past. But over the last few months, I have learnt to put my emotions aside using 1 tactic. That is my focusing on my plan and focusing on my process. I used to be too focused on making money, this led to complacency with following my plan. Furthermore, this led to more losses. However, I am now at a stage where I can shut off my emotions by simply focusing on my plan. This has been very helpful to me. It has taken stress away as I am no longer thinking about making money. Additionally, it has given me good results like passing the FTMO Challenge and Verification.

What do you think is the most important characteristic/attribute to become a profitable trader?

Having a trader's mindset, hands down. Technical analysis is a great tool, but if you cannot handle the environment of trading mentally, you can never be successful in this game.

What was the hardest obstacle on your trading journey?

Getting the right mindset. I always saw trading as a way to change my life, and I still do. However, in the past I would let that cloud my judgement and I would let it deteriorate my plan, just in hopes of making some money.

What would you like to say to other traders that are attempting the FTMO Challenge?

Believe in yourself. The beauty and demise of trading is that there is no one way to do it. This can be detrimental because the number of options you have, the number of strategies you can use and the number of trades you can take are so high that it can mess you up mentally. However, the beauty is that if you can manage to cut out the noise, you can find a way to trade that is uniquely your own. Remember why you started, remember those thoughts you've had, remember the people who have doubted you. You can do this. YOU WILL DO THIS.

Trader Lyndon: By far the hardest thing to overcome for me was discipline.

What was the hardest obstacle on your trading journey?

By far the hardest thing to overcome for me was discipline. I've had four or five successful strategies in the last 5 years but have not been able to find consistency with any of them until now. I think the key is to pick something you know works, don't overtrade it and be patient. The last 5 years for me could easily have been condensed into 1 if I'd have understood the importance of discipline and consistency.

What does your risk management plan look like?

I risk 1% per trade and rely on a risk reward ratio between 1:1 and 1:6.5 (market conditions vary) to ensure over the course of multiple trades I have a positive balance.

What inspires you to pursue trading?

Two things; financial freedom and to be in charge of my own life. I have to say I've also come to love the challenges the markets throw up.

How has passing the FTMO Challenge and Verification changed your life?

I've given up everything to get to this point. Going forward I aim to work with FTMO to make consistent gains in the market and kick-start my future as a full-time investor. I'm finally able to be proud of what I've accomplished, and I look forward to the future.

Has your psychology ever affected your trading plan?

Too many times over the last five years. The key to success is trusting the weeks/months you've spent backtesting and formulating a trading plan. This allows you to trade robotically and if you aren't profitable at this point, you know there's an issue with the plan, not yourself.

What would you like to say to other traders that are attempting the FTMO Challenge?

You probably aren't ready until you've passed a trial Challenge executing the same trading plan and risk management system as you would in the real Challenge. Chase percentage gain, not monetary value.

Trader Abbie: Patience was a factor that I found to be difficult.

How did the Maximum Loss limits affect your trading style?

Risk management and Psychology are the key to becoming a good trader. The Maximum Loss limits did not affect my trading style as much as I was only risking 0.5% - 1% of my account during the FTMO Challenge. In order to achieve long-term consistency, it is vital that good parameters and rules are set in place, so they can be followed. The Maximum Loss limits help to avoid revenge trading and over-trading on your account.

Do you have a trading plan in place, and do you follow it strictly?

A trading plan is essential so yes, I do. I only take a maximum of 1-3 trades a day, the risk parameters can range from 0.5%-2% depending on the capital buffer present and the trade set-up. I only trade during the London or New York sessions.

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

Patience was a factor that I found to be difficult as I took more trades than I expected in a day. Hence, whilst evaluating my statistics, I would like to patiently wait for setups to reach my price before I execute a trade, this will help improve my overall equity curve and thus my performance. In my Verification phase, my psychology lacked considerably, however, it just took 1-3 good trades to make up for all my losses. This is the power of risk management. I am consistently working on improving these issues so I can level up! Trading in the zone by Mark Douglas is a book that I actively read in order to combat these issues, I believe this book honestly is the holy grail to improving your psychology.

Has your psychology ever affected your trading plan?

During the FTMO Challenge, I would say dealing with psychology was a major part of my journey as learning to cope with wins and losses can be difficult. After a nice 1:3RRR trade, I could see through the Account MetriX, that my performance dipped due to overconfidence. In order to combat psychological struggles, I adjusted my rules, whereby I did not trade after a winning trade or I stopped trading after a losing trade.

How did you eliminate the factor of luck in your trading?

I can have a set of winning trades, day in and day out, which some may call lucky. However, those trade set-ups have simply presented themselves to me and I have flawlessly executed them. I have a solid trading plan that allows me to have a set of losing streaks but still come out profitable in the end. Knowing this allows me to stick to my trading plan and not revenge/over-trade. Luck can negatively impact your trading psychology (if you let it) when you have a series of wins, however, I always stick to my plan, only take a few trades a day and keep the same lot sizes so that this factor does not affect me.

One piece of advice for people starting the FTMO Challenge now.

'Shoot for the Moon. Even if you miss, you'll land among the stars.' My number one advice would be to create a robust trading plan and to be strict with it! Treat this like a business and have healthy risk parameters set in place. As soon as you think you are encountering bad psychology, turn your laptop off and walk away from the screens. Believe in your dreams.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.