Talking with new FTMO Traders

We bring you another part of our series where we talk with freshly funded FTMO Traders. Be inspired by their stories and find out what helped them to get funded by us!

Great insights from trader Bruce

What was the hardest obstacle on your trading journey?

If I had to sum up my two issues with respect to trading, they are risk management and riding winners out, not bailing too early. Once I managed that things started to improve. I doubt I will ever stop improving but I think that's an aspect I enjoy, the strive to attain the unattainable, a perfect methodology.

Do you plan to take another FTMO Challenge to manage even bigger capital?

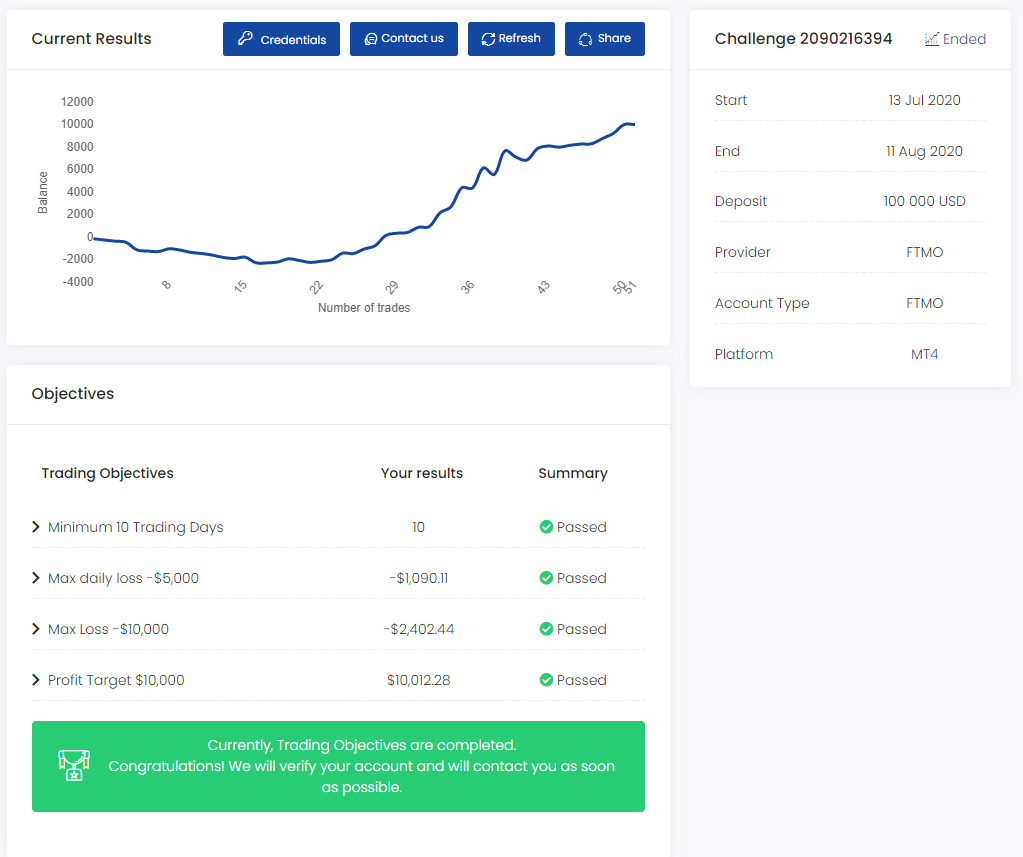

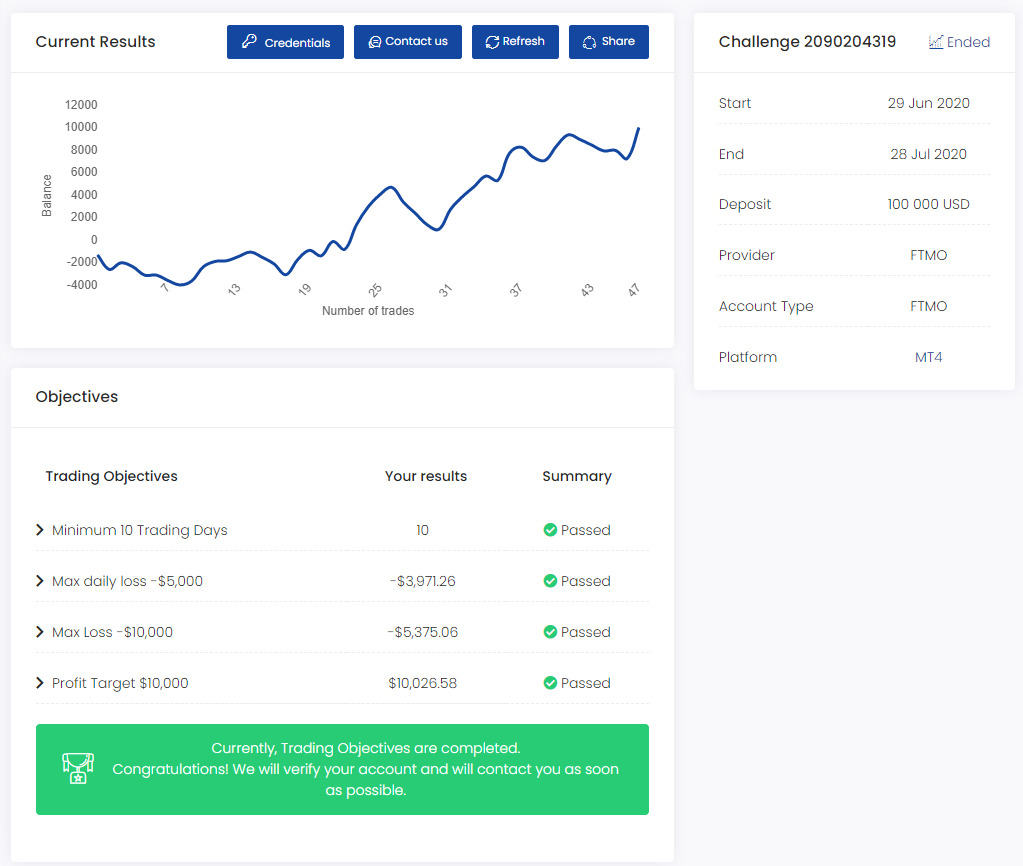

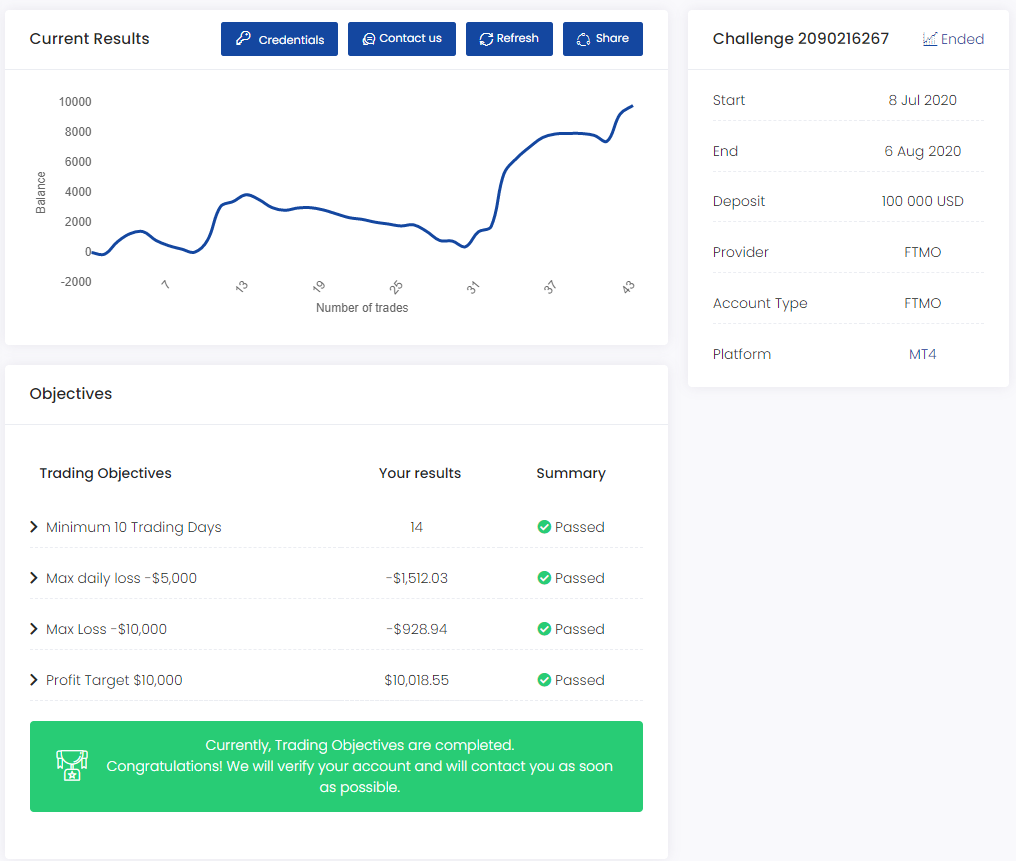

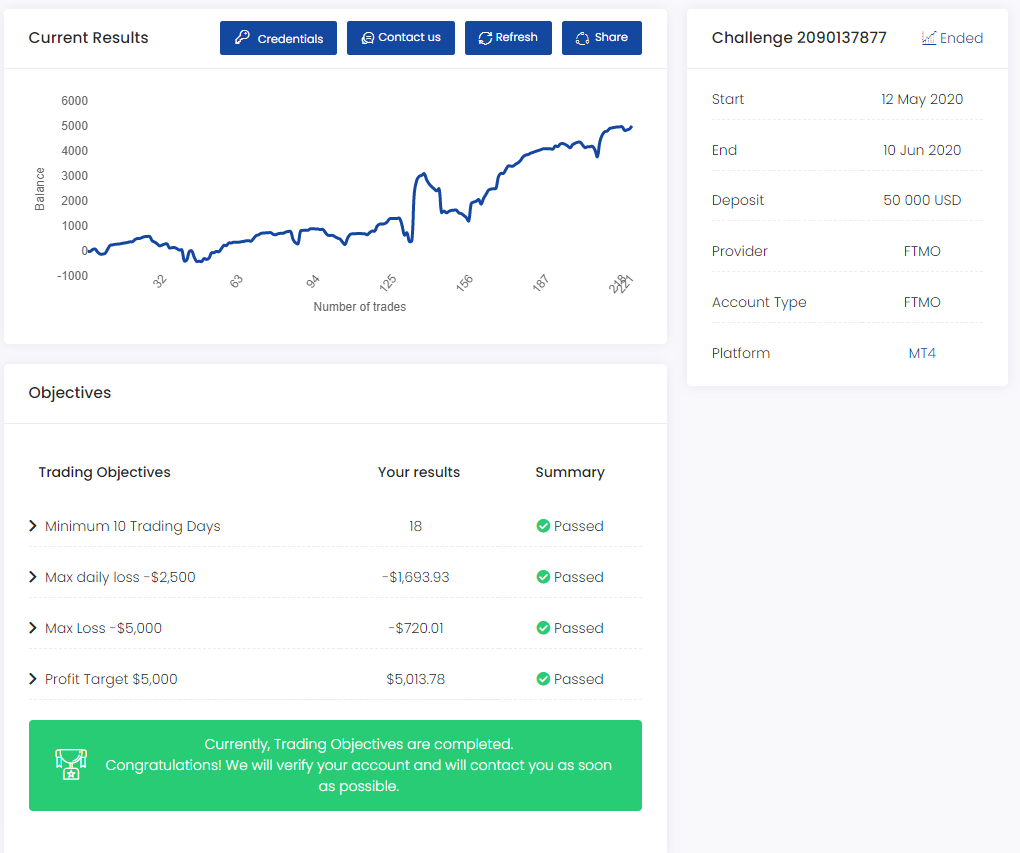

Without a doubt. I am what is these days called a "senior citizen" and I cannot think of something more intellectually stimulating and rewarding for those so-called fall years. I have traded futures, options, and the stock market but the world of Forex is a different beast. Obviously, technology has changed so much and made it accessible to all of us. I still recall phoning in orders to the open outcry pits in Chicago. I hope to max out on three $100k accounts.

Where have you learnt about FTMO?

FTMO is exceptionally well marketed on the internet and I went through all several prop firms offering similar opportunities but once they are broken down, I believe your product stands out. In this day and age with so many scams and "fake" deals, FTMO has a very solid reputation.

What was the most difficult during your Challenge or Verification and how did you overcome it?

I think the "market type" makes a difference specifically in the Challenge. With the increased volatility and currency pairs have a bigger ADR than a few months back, prior to Covid its easier to catch a wave and ride it. In reality, I had to develop a different system for ranging markets prior to Covid. So the 10% in 30 days is easier in the current market type than quiet ones. I intended being very cautious in the verification phase, but it just worked well and I succeeded early.

How does your risk management plan look like?

After blowing more accounts than I care to discuss, I have reduced portfolio risk to a maximum of 3% and typically take on an individual pair at 0.25%. I have tight stops so I am either moving with the flow or stopped out. The risk-reward I aim for is always more than 3:1 but if you look at my journal it averages out at less than that. That's partly because I often close out early for "red news" events which are I have found too much of a gamble.

What is the number one advice you would give to a new trader?

Position size is talked about all the time along with R:R but living it as opposed to talking it are two different things. I journal all trades with comments and my biggest flaw is FOMO but I am getting there. If traders got those two items right, I believe far more would succeed.

Trader Ryan shares his journey

What do you think is the most important characteristic/attribute to become a profitable trader?

Psychology. Without the proper mindset, you can consider yourself gambling with anxiety.

Describe your best trade.

My best trade was a trade I had been waiting on for a couple of days. I was very patient with it. Once I received confirmation, I enter without any hesitation and held until my TP. I was even able to get a second entry on a retracement.

What was more difficult than expected during your Challenge or Verification?

Managing my emotions. I was in a rush to pass that I did not take into consideration risk management the first time around.

How does your risk management plan look like?

I usually look for 1:3-1:5 RR. It gives me the best opportunity to be a profitable trader.

What inspires you to pursue trading?

I enjoy the freedom that the trader lifestyle gives me

One piece of advice for people starting the Challenge now.

BE PATIENT!!! you have more than enough time to complete the challenge. Take your time and do no over leverage.

Trader Terrill from the United States

How did you eliminate the factor of luck in your trading?

I eliminated the factor of luck in my trading by finding a system that worked for me and through a lot of backtesting on the charts. I understand how my trading style works and the probabilities in the long run.

What was the most difficult during your Challenge or Verification and how did you overcome it?

The most difficult thing was adjusting to the big numbers. Most traders come from trading small accounts so seeing $100,000 and seeing the profits and some times drawdown can make you a little nervous, but it took me a few days to adjust and I was fine.

How does passing the Challenge and Verification changed your life?

Passing the challenge and verification changed my life by giving me an opportunity to take care of my family through what I love which is trading.

What do you think is the most important characteristic/attribute to become a profitable trader?

I think for me the most important characteristic/attribute to become a profitable trader is perseverance. You will go through a lot of ups and downs in trading and you have to keep going and try your best to get better every day. Trading is a marathon.

What inspires you to pursue trading?

The things that inspire me to pursue trading is my family, time freedom, waking up every morning and doing what I love, and financial freedom.

What would you like to say to other traders that are attempting the Challenge?

I would like to say take your time. Don't be in a rush to get it done fast. Make sure your strategy is profitable before you attempt the challenge and believe in yourself. You are better than you think.

Trader Reiss gives valuable advice for new FTMO Traders

What do you think is the most important characteristic/attribute to become a profitable trader?

Patience. The ability to be patient before, during and after a trade is one of the most important attributes for me. I know many traders can relate after a losing trade you will want to get straight back in and make back what you lost which can sometimes do more harm than good. Stick to your plan and wait for the next set up.

How does passing the Challenge and Verification changed your life?

Being given the opportunity to trade with more capital will help me achieve my overall goal of becoming a full-time day trader quicker than it would have taken if I just relied on building my personal account and savings. Once I hit monetary targets I have set for myself I'll be able to cut down on work hours and invest more time into trading and other ventures.

Do you have a trading plan in place, and do you follow it strictly?

Yes, I believe having a trading plan is a must if you want to become profitable and wouldn't recommend trading without one. I follow mine as strict as I can, it's based around time and price action. so for example, I'd only trade during the London and New York sessions looking for specific things in price to occur before taking a trade.

Has your psychology ever affected your trading plan?

It has in the past but eventually, you learn to control it the best you can which will come with experience with your trading plan and having trust in it.

How did Maximum loss limits affect your trading style?

The maximum loss limits didn't affect my trading style in a negative way at all, I have strict rules of only risking 1% per trade and a 3% max risk exposure at one time so i was never worried about hitting any of the limits. Knowing these limits are there does help me stay consistent with my own rules so I'm happy they're in place.

What would you like to say to other traders that are attempting the Challenge?

Make sure you already have a profitable strategy that you're confident with before taking the challenge. Take advantage of the free trial and make sure you understand the rules. Remember to be patient and try not to rush any of the stages. If you take this advice on board you'll have a good chance of passing. Good Luck!

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.