Successful pyramiding can lead to extraordinary returns

In the next part of our series on successful FTMO Traders, we will look at a trader who successfully used the method of increasing positions in a profitable trade—and his return was indeed above average.

Increasing positions in a trade that is already profitable and moving in the expected direction—also known as pyramiding—is a strategy that allows a trader to boost the profit potential of a position without unnecessarily increasing risk.

At first glance, this may seem like a simple task, but only a few traders manage to apply this method of adding to their positions successfully. Most traders tend to close their positions—or at least a portion of them—once they reach a certain profit. In the worst-case scenario, they add to losing positions, hoping the market will eventually reverse and yield even more profit than they would have gained at the original entry point. However, this approach unnecessarily increases the risk of the trade, in addition to any potential return, and we strongly advise against it for most traders.

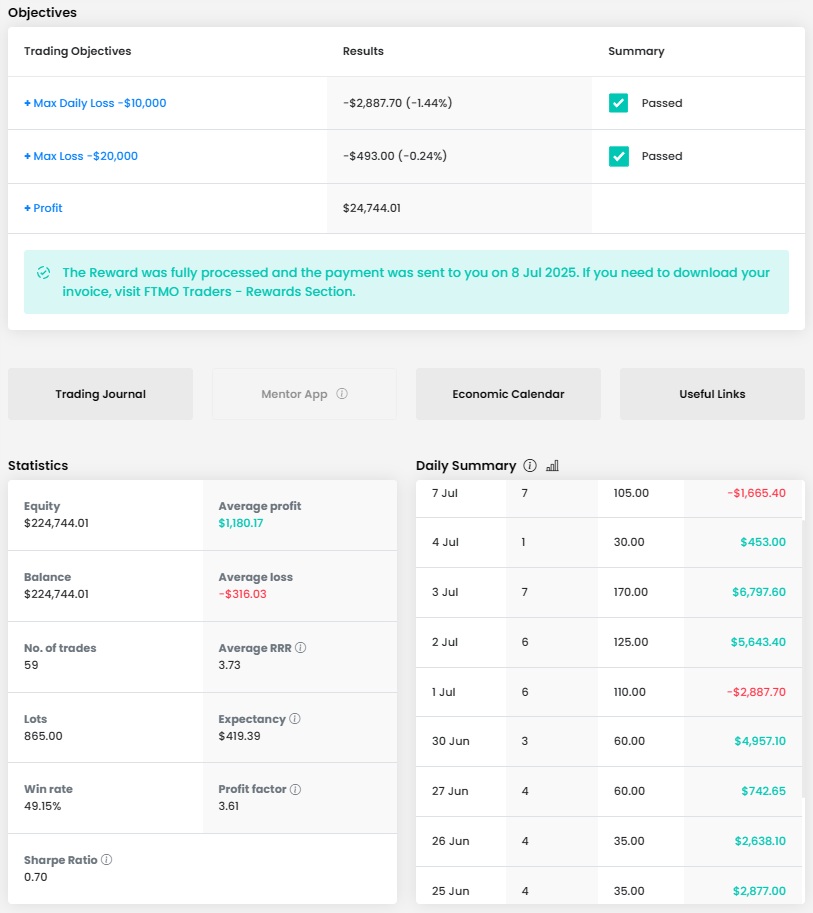

As we mentioned, our trader managed pyramiding at the highest level during the trading period, and his equity curve reflects that. Despite a few drawdowns, he remained in positive territory from the beginning. Fortunately, the periods of growth were longer and steeper, so the end result certainly made the trader happy. We, in turn, were pleased with his high consistency score.

Another positive is the fact that the trader didn’t “go crazy” at the end of the trading period by risking more and more money in pursuit of even greater profits—so things turned out very well.

A profit of over $50,000 in two weeks is an excellent result. With an account size of $200,000, that’s a return of over 25%, which is far from an everyday occurrence. Perhaps the only blemish on this performance was a period in the middle of the trading phase when the trader executed several poor trades in a single day, and his loss nearly reached the Maximum Daily Loss limit. Fortunately, he recovered by opening a few smaller positions later that day, which likely helped him regain composure before continuing his profitable run.

Looking at the trader’s statistics, we can see that his average risk-reward ratio (RRR) was 1.46, which is a solid result. A win rate of 69.23% is also very strong; with an RRR around 1.5, it’s practically a formula for success. Over the course of nine trading days, the trader opened 78 positions with a total volume of 61 lots. That’s less than one lot per position, which—on a $200,000 account—signals a relatively conservative approach (and we certainly commend that).

On the other hand, the trader sometimes opened multiple positions, so opening larger ones might have been unnecessarily challenging for him from a psychological standpoint. As mentioned earlier, the trader was active for only nine trading days—which is quite a short period to generate such a profit. Four of those trading days ended in the red, but thanks to a solid risk-reward ratio and a high success rate, he still ended up making what can only be described as an impressive return.

A glance at his trading journal reveals that he doesn’t strictly follow any of the most common trading styles. In some cases, he held trades for more than two days; in others, he closed positions after just a few minutes—and often didn’t even keep them open for an hour. The good news is that he placed stop losses on all of his trades, which is something we can only praise. And since he avoided opening overly large positions, it’s no surprise he kept his losses under control—none of his trades resulted in a loss greater than 1% of the account.

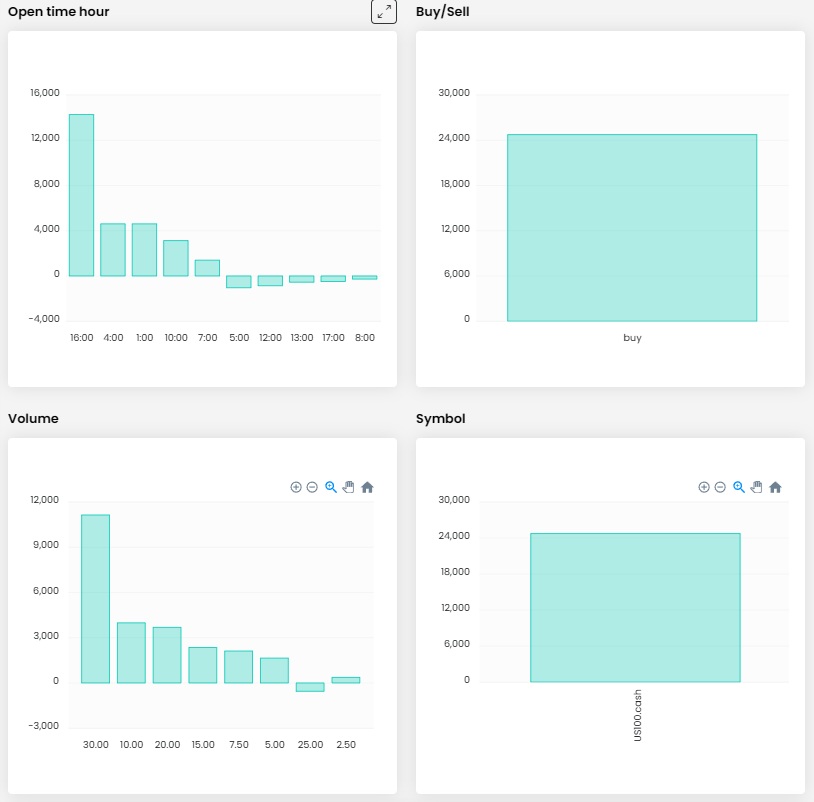

The trader often opened his trades during the night in European time (or platform time), which is likely due to his place of residence. He most frequently traded gold, which has long been the most popular instrument among FTMO Traders.

An interesting statistic is the success rate of his buy and sell trades. Although he opened significantly more long positions (buy), his profit from short positions (sell) was up to $7,000 higher than from long positions.

As always, we will also look at a few of the trader’s successful trades to show how he was able to effectively add to his positions when in profit. In the first case, the trader was speculating on a continuation of the uptrend in gold, which began after the price dropped to the $3,200 per troy ounce level. When the price continued to rise after a second minor swing and broke above short-term resistance, the trader opened additional positions, which he closed during the following consolidation.

When the price continued to rise, he opened additional positions, keeping the first one open and closing it last. In total, after closing all of these positions, he made a solid $22,200. After opening the second position, he didn’t need to increase his risk at all, as the profit from the first trade could cover a large portion of any potential losses from the other positions.

The second case is an even better example of how the strategy works when all positions are kept open until the end. The only minor criticism is that the trader opened the first position on Friday night, meaning he held it over the weekend—an action that always carries the added risk of a gap and potentially larger-than-expected losses. In this case, the trader was fortunate: a price gap did occur, but in the right direction.

The trader opened two more positions early Monday morning (platform time), and after a brief consolidation, the price made a more significant move in the right direction. He was therefore able to close all his positions before noon European time. He opened one more position shortly afterward but closed it after a few minutes—likely the right decision. The total profit from the four open positions was $16,300, which is once again a great result.

Note: Since we cannot clearly define the exact trader's strategy from the chart, this is only the private opinion of the author of this article. FTMO Traders are free to choose their strategy and as long as they do not explicitly violate our Terms and Conditions and follow our risk management rules, the choice of strategy and execution of individual trades is up to them.

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?