Success in Trading: No Need to Rush

As part of our series on successful FTMO Traders, today we will look at a trader who did not try to make a lot of money at any cost right at the beginning of the trading period. This is something that few long-term successful traders can do.

We constantly remind our clients that trading is not a quick way to big money. It's not a sprint, but a long-distance race in which patience and the ability to follow the rules under all conditions play a big role. Unfortunately, many traders ignore this basic rule and rather bet on a quick profit in a short period of time so that they can show off their success on social media or to their friends and relatives.

Fortunately, our trader today probably didn't have such thoughts in that trading period and went about it much more conservatively and patiently. Although he did not do well on the first day and saw his first trades close in losses, he did not give up and patiently waited for better trading opportunities.

Eventually, after closing a few trades with small profits, he managed to get into the green and gradually increased his profits with a few minor fluctuations. The high consistency score is then already proof that a consistent approach combined with patience simply pays off.

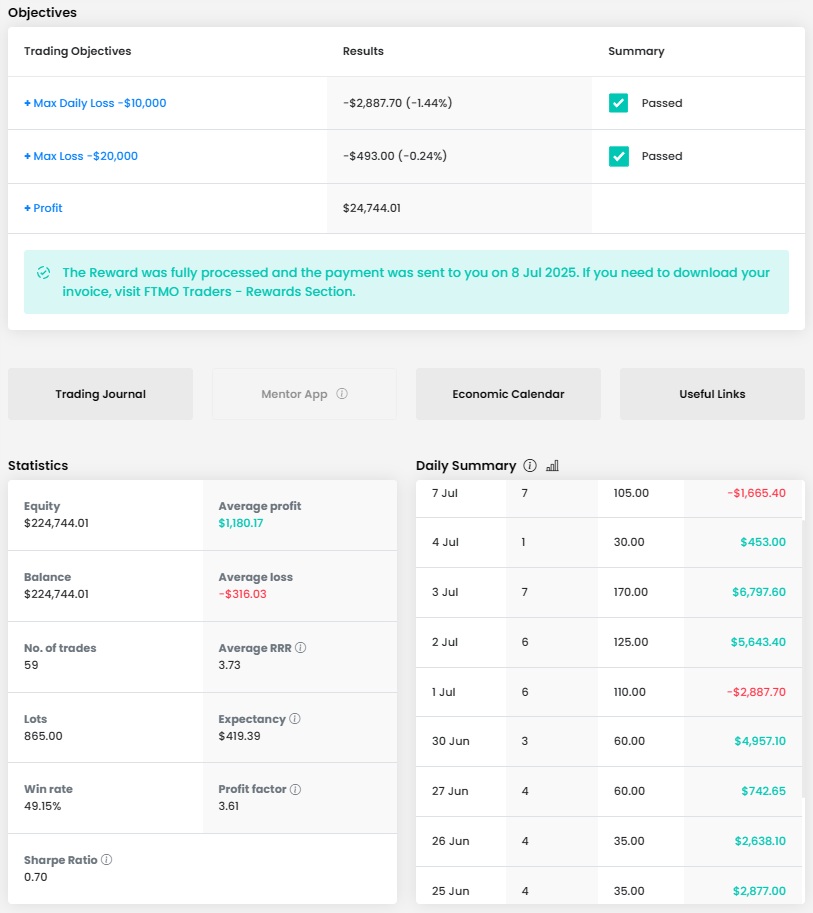

The total profit of $24,186.61 is great for an account of $100,000 and it is clear that the trader had no problem with loss limits due to his approach. The average RRR of around 1 is quite low, but this was compensated by a very high win rate (80.77%).

The trader opened 78 positions with a total size of 57.7 lots, which is just over 0.7 lots per position. This is evidence of a conservative approach, but the trader often opened multiple positions within a single trade, so it cannot be said that he was overly conservative.

Looking at the trader's journal, we can see that we have a slightly different case here than in previous cases. In fact, up to a third of the trades were held by our trader for more than one day, with some of the most successful trades being held for up to three weeks. So this is a swing trader for whom patience is really important when entering a trade, but also when exiting a trade.

Unfortunately, we cannot commend the trader for his approach to money management, as he ignored the Stop Loss settings in most of his trades. Especially if the trader does not monitor the platform throughout the duration of the trade and holds positions overnight, this approach can be very risky. The trader was lucky in this case, which was probably supported by the fact that, given the relatively small positions, the trades had sufficient margin for sudden moves in the wrong direction. Nevertheless, we cannot recommend this method, both for short-term and long-term traders.

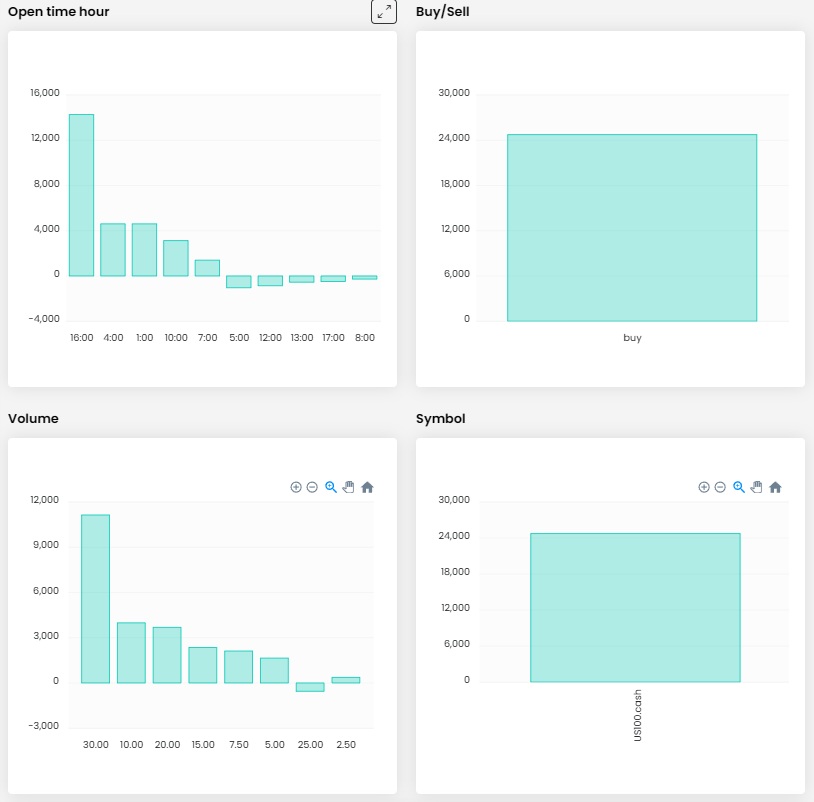

The trader did not prefer any specific time to open his positions, and although it does not seem like it at first glance, he did not prefer the direction of his trades either. The fact that his sell positions ended up in the negative overall is more a matter of coincidence, as his three most losing positions were downside speculations.

He diversified his trades between four instruments, two of which were currency pairs (EURUSD, GBPUSD) and then the very popular gold (XAUUSD) and the recently much talked about bitcoin (BTCUSD). However, EURUSD and gold led in both number of trades and success rate.)

We will also look at some of the successful trader's trades. The first example is a trade on the EURUSD pair that the trader made at the end of February. When he entered, he was probably counting on a continuation of the uptrend that had been evident on the pair since the beginning of February. Although the trade did not develop very positively, the trader was patient and ended up with a very good profit thanks to the significant move. The trader split this trade into three positions and closed the first two after nine days and nine hours with a profit of over $5,200. He then held the third position for another twelve days and closed it with a profit of $2,042.50.

In the second trade we will look at, the trader speculated on the rise in the price of gold, which has been in a strong uptrend since the middle of last December. The trader executed his trade immediately after the price bounced off support, and the two positions into which he split the trade were then held for 10 and eleven days. Since the price had been moving in the right direction since the trade was opened, the trader could only wait for it to break the psychological level of $3,000 per troy ounce. It finally did, and the trader realised a profit of $4,980 on two positions.

Note: Since we cannot clearly define the exact trader's strategy from the chart, this is only the private opinion of the author of this article. FTMO Traders are free to choose their strategy and as long as they do not explicitly violate our Terms and Conditions and follow our risk management rules, the choice of strategy and execution of individual trades is up to them.

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?