“Success in trading is a journey of self-mastery”

Traders are usually aware that without basic knowledge of how financial markets work, they will not succeed in Forex in the long run. However, continuous education and learning new things during the trading career is already underestimated by some, and this is especially true for those who have been in the markets for a long time. Fortunately, this is not the case with our new FTMO Traders Seme, Ryan, Elyangel, and Eliyahu.

Trader Seme: “The key to long-term success is to keep learning and stay informed about the Forex market.”

What does your risk management plan look like?

I have to always remember that Forex trading involves inherent risks, and not having a solid risk management plan can completely hurt my trading future. However, a well-thought-out and disciplined approach to risk management can help me as I navigate the challenges and improve my chances of long-term success in Forex trading. I have several key things in place to assist me in this regard. Capital preservation: the primary goal of me applying proper risk management is to protect my trading capital. I am sure to --- never risk more than I know I can afford to lose. Position Sizing: I go into each trade with a pre-determined size of each position based on my risk tolerance and the stop-loss level. I do this to avoid over-leveraging, as it can lead to significant losses. Risk-Reward Ratio: maintain a favorable risk-reward ratio. Aim for a minimum of 1:2 or higher to ensure that my potential gains outweigh my potential losses. Consistency: stick to my risk management plan consistently. Avoid deviating from it due to emotions or impulsive decisions. Emotional Control: keeping my emotions in check. Fear and greed can lead to poor decision-making. I vow to trust my strategy and follow my plan. I round these off with many other factors, but these are my most key measures.

What do you think is the key for long-term success in trading?

I think the key to long-term success is to keep learning and stay informed about the Forex market. Knowledge is a powerful tool in managing risk effectively. I will never cease to be a student of the Forex market. I must apply myself and obtain knowledge every day in order to adapt to the changing market.

How did loss limits affect your trading style?

I appreciated the Maximum Loss limits because it helped me to be more risk-averse. I was less likely to take high-risk trades or use excessive leverage because I was constantly aware of the loss limits for the day. Although I consider myself an aggressive trader, this somewhat made my trading style more conservative.

What was the hardest obstacle on your trading journey?

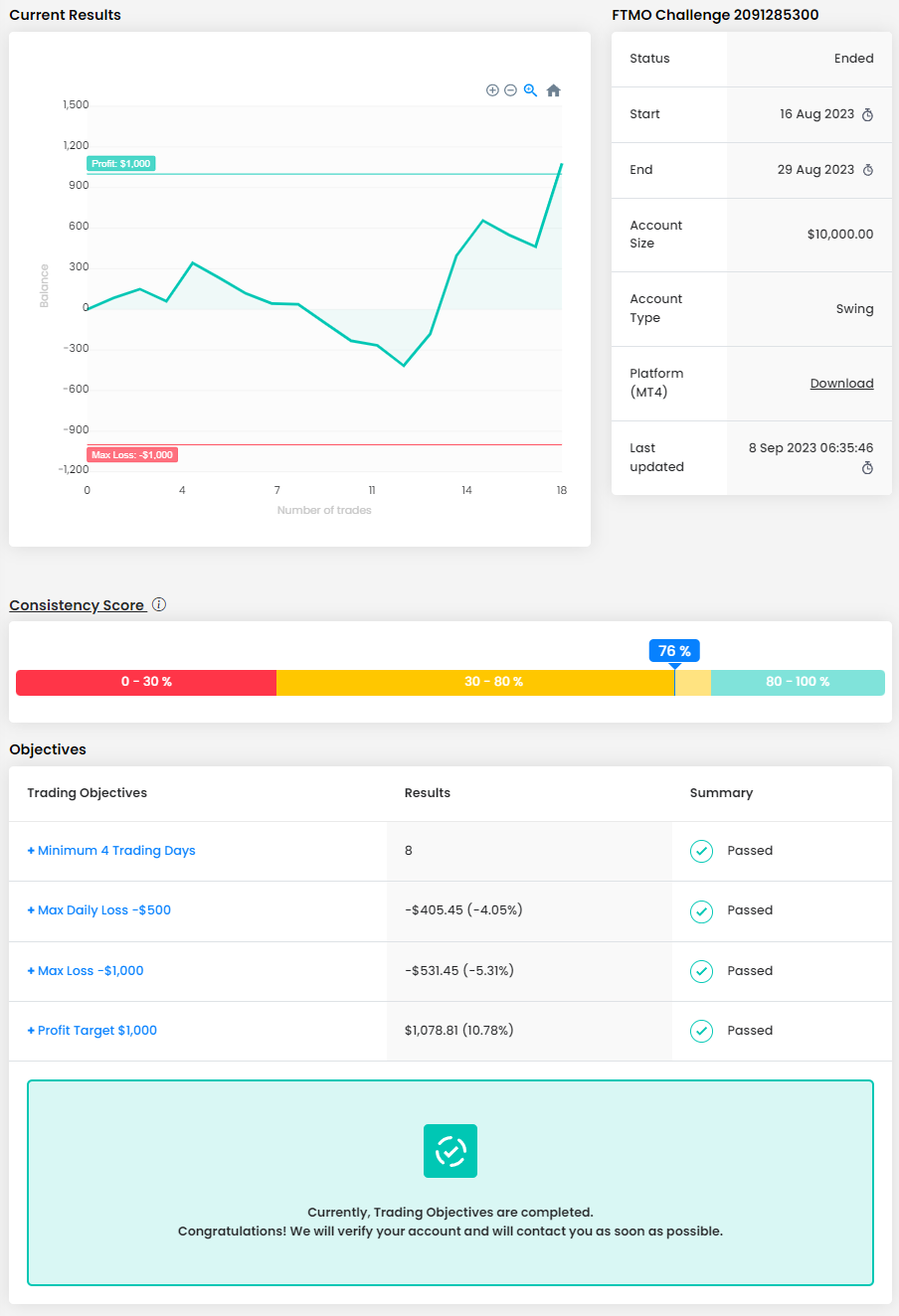

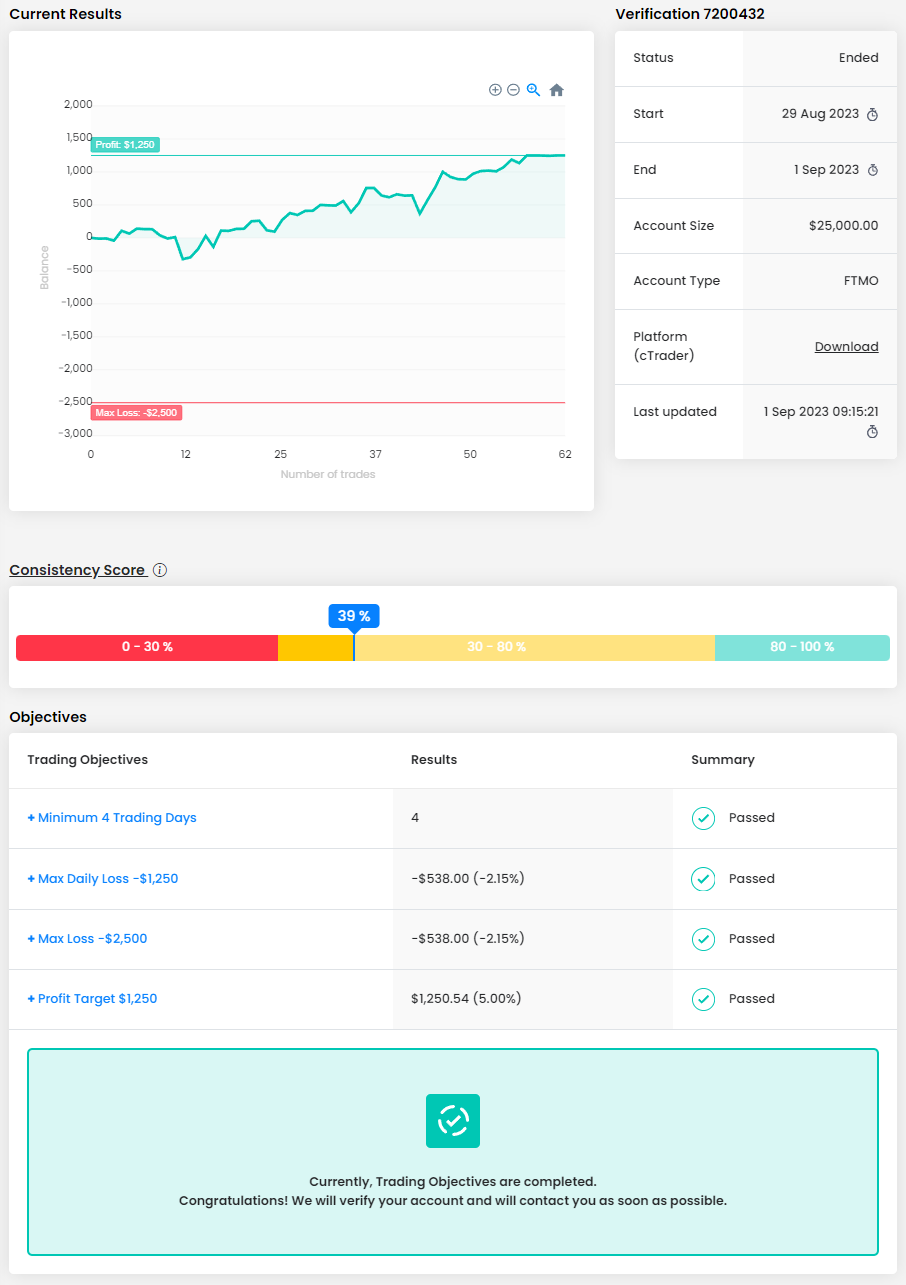

The hardest obstacle in my trading journey was simply wanting to reach the fully funded point. I wanted to be able to hold onto my earnings and going through the process of the Challenge and Verification was necessary, however tough because I am the type of person who likes to jump fully into things.

Has your psychology ever affected your trading plan?

I have had to keep my emotions in check. I came into the process knowing that fear and greed can lead to poor decision-making. To combat this human error, I made sure to trust my strategy and follow my plan at all times.

One piece of advice for people starting an FTMO Challenge now.

My advice to those starting the Challenge now is to focus on the objectives at hand. You can make tons of money once you are funded. For now, use proper measures, keep your psychology in check, and manage your risks well. Take your time and focus like heck! You got this!

Trader Ryan: “Take time to learn and improve on it through study and practice.”

Has your psychology ever affected your trading plan?

Yes, all the time (but I am a psychology major so perhaps it's more salient for me to see how it might affect me as I trade). The key is to manage it through knowing yourself, creating systems to adjust, having self-discipline, and learning new things.

What was the hardest obstacle on your trading journey?

The hardest obstacle has been trying to be a generalist in terms of the market conditions for trading. Rather than cherry-pick my best setup, I have tried to force myself to be a generalist first and then choose my specialty setups. I figure this will make me a more consistently profitable trader, being able to detect and navigate other market conditions that are what I might be better specialized for.

Do you plan to take another FTMO Challenge to manage even bigger capital?

Yes. I will continue Challenges until I have reached the 400k limit.

What was more difficult than expected during your FTMO Challenge or Verification?

Specifically, not increasing my risk with each new trade. It's tempting to want to increase it if you succeed and it's tempting to want to "revenge trade" if you fail. It was key for me to reign that temptation in.

What do you think is the key to long-term success in trading?

First, keeping risk at around 1%-4% for all trades. Second, waiting for only the best trades. Third, being wary of wide trends and ranges, disguised as more solid trends.

What is the number one piece of advice you would give to a new trader?

If you can create a system or a way so that each time you push that button to enter or increase a position, you have a "winning traders’ equation", then you will be successful as math (probability) is on your side. Having a winning traders' equation means that your risk to reward ratio, your max risk per trade, and your win percentage all add up to ensure your success. Create systems that work for you and your personality in order to do that. It could mean programming your system, doing a mindfulness exercise mid-trading, journaling, etc. Every day whether win or loss will show you what you need to learn and improve on. Take time to learn and improve on it through study and practice. Above all, if you really love trading, make sure your systems towards success, your trading style, and your lifestyle make you happy as you work hard towards your future success.

Trader Elyangel: “The chart’s not always going to paint the perfect picture on a silver platter for you.”

What inspires you to pursue trading?

Success in trading is a journey of self-mastery, I fell in love with the process of working hard, learning, and improving. That’s what life is all about, and trading mirrors life.

Do you have a trading plan in place, and do you follow it strictly?

Yes! I have a few signals that are an absolute MUST like an MACD cross-over and a break of structure, and a few factors of confluence that help add confidence to my trades like volume and Fibonacci levels but can vary from time to time in how they look. The chart’s not always going to paint the perfect picture on a silver platter for you. Rigorous backtesting and experience have helped me figure out what feels like a good trade to me. Generally, I’m only going for continuation trades when the momentum is high.

What was the hardest obstacle on your trading journey?

Becoming profitable is one thing, STAYING profitable is a whole other challenge. Like I said earlier, this is a journey of self-mastery. Staying levelheaded through life’s obstacles is essential. You can’t let the ups and downs of life negatively affect your charts. For example, if you’re stressed out and pressed for time in your day-to-day life for some reason, those problems can show up in your trading.

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

Instilling the discipline of not overtrading and not risking more than 1% loss a day. It came down to how serious I was about becoming a trader. Through backtesting and looking at my stats, it became clear that most of the time there’s no benefit in chasing a loss on the same day. It just messes up your win ratio. Even with compounding a win, you need to be very careful.

Where have you learned about FTMO?

They really want to see you win! Actually, using FTMO resources to my advantage definitely helped, I started reading articles, videos, studying my MetriX, and using their Equity Simulator app based on my MetriX stats, which is a huge reality check! Not to mention now it’s unlimited time and only 4 trading days, they clearly want people to win.

What would you like to say to other traders who are attempting the Challenge?

Be patient! There is NO such thing as fast money, but you’d be surprised how fast it comes when you take things slow.

Trader Eliyahu: “Once you have a strategy that is proven to be profitable, think about how much you would like to earn per month from the market.”

What was the hardest obstacle on your trading journey?

The main difficulty is in adapting the trading method to your drawdown rules. I was used to trading on a private account where I would allow myself to be in high leverage without fear, and suddenly I had to realize that I had to reduce leverage in order to succeed.

How did you manage your emotions when you were in a losing trade?

Trying to set a stop on each transaction. In those where I have not set a stop in the system, I often get carried away emotionally and sometimes come close to Maximum Daily Loss.

How would you rate your experience with FTMO?

My experience with FTMO is very good overall, but very shaky in terms of understanding the game. Getting a "Nostro" account is good news for every trader, something that didn't exist when I started 15 years ago, and now it opens almost unlimited possibilities to succeed and change life thanks to the field of forex trading and indices.

How did loss limits affect your trading style?

It made me realize that I must trade with lower leverage, and also at the same time because I can trade with a large fund, still make significant money.

Do you plan to take another FTMO Challenge to manage even bigger capital?

Sure, planning to purchase another 200K account with profits and reach a total of 400K trading accounts.

What is the number one piece of advice you would give to a new trader?

Once you have a strategy that is proven to be profitable, think about how much you would like to earn per month from the market. Divide it into 10 days. Explanation: "There are 22 trading days in a month. About 2 will not be traded for all kinds of reasons. About 5 days will end in a loss that will wipe out a profit of about 5 earned days. That leaves us with 10 profitable trading days." This is the realistic calculation I like to plan according to. Now that you know how much you need to make per trading day, think about what size trades you need to open to reach that daily profit, depending of course on your strategy to suit your and FTMO's risk management.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.