“Sometimes taking a break can be beneficial”

Trading can be mentally demanding, and continuous exposure to the markets can lead to fatigue and stress. Taking breaks is a proactive approach to maintaining a healthy and sustainable trading career. And what do our new FTMO Traders Nicholas, Guadalupe, Cody and Kamoy have to say about it?

Trader Nicholas: “You have to become good at losing to be successful.”

Do you plan to take another FTMO Challenge to manage even bigger capital?

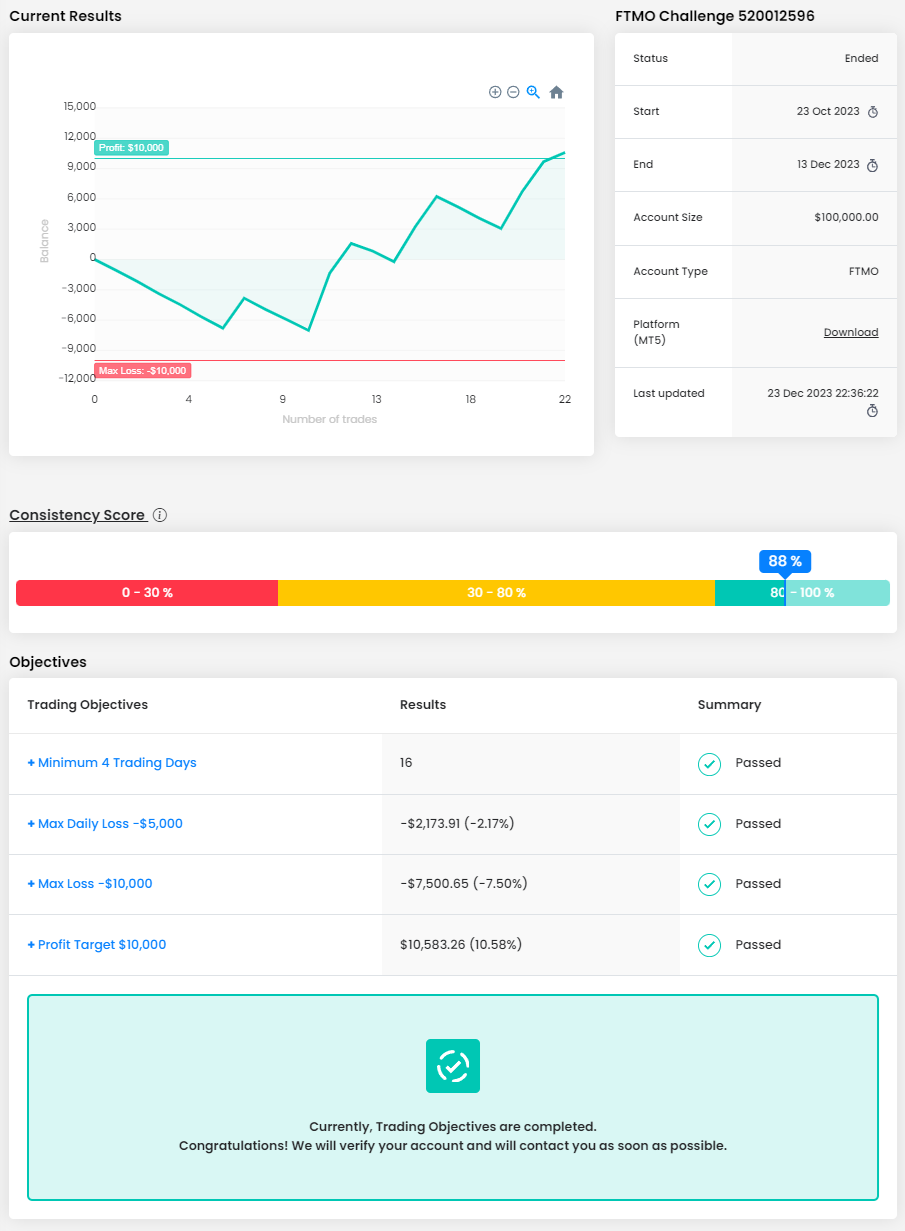

Yes. I passed 2 100k Challenges and I have another 100k Challenge close to passing the Verification stage and I just started another 100k Challenge.

What do you think is the most important characteristic/attribute to become a profitable trader?

I’d say at a base level you have to have passion and love for the game along with drive, discipline, and focus. But sometimes taking a break can be beneficial. You just have to listen to yourself. I took a year and a half break from trading after 4 years of working hard at it and it was actually super helpful, and it allowed me to come back to it with a new set of eyes and I started seeing things in a new way. Not saying you have to take that long of a break but that helped me a lot.

How did you manage your emotions when you were in a losing trade?

Nobody likes losing but you have to become good at losing to be successful. Once I realized that a losing trade was just falling on the wrong side of probability relative to me (assuming you didn’t make any technical or psychological mistakes) then it didn’t bother me anymore because I trust my edge. But sometimes I would get a little worried when I’m on a big losing streak. To put my mind at ease I’d check my trades and if the answer was yes, I would take those trades again even though they lost then I know I’m doing everything right and it’s just probability playing out (in this case a bunch of losers in a row).

Do you have a trading plan in place, and do you follow it strictly?

Yes. I have a small playbook of memorized rules I made for myself, and I follow it strictly 99% of the time. If I make a mistake, then I forgive myself and add a solution to the playbook and now if I make that same mistake again it’s unacceptable. Good to read the playbook everyday if you don’t have it memorized.

What was more difficult than expected during your FTMO Challenge or Verification?

I’d say the hardest part was not having the previous gains from the last stage to give you a buffer. After the first stage, the account gets reset back to baseline so I would get a little stressed if I entered a small losing streak right away. But I didn’t let that affect my trading. I still remained consistent. You cannot trade with a fear of loss.

What would you like to say to other traders who are attempting an FTMO Challenge?

Make sure you have proven data on spreadsheets that prove you have an edge in what you’re going to do. Have a plan and a playbook. Don’t go in blind and hope to get lucky. The first thing is to build that data and spreadsheet (I used a year's worth of data) and the next is to tweak variables like entries and exits to your liking and create a losing streak chart to make sure you don’t drawdown more than 10% too often. Once you have all that then working on your trading psychology is last so you can effectively take your paper trade results into a market where you have skin in the game.

Trader Guadalupe: “The easiest part was managing my risk because that was something that I could control.”

Do you plan to take another FTMO Challenge to manage even bigger capital?

Yes, I plan to max allocate.

What do you think is the key to long-term success in trading?

The key to long term success is being disciplined enough to know when to walk away from a trading day. I started finding success when I started to learn how to preserve my capital as opposed to making more capital.

What was more difficult than expected during your FTMO Challenge or Verification?

I found passing the Verification more difficult because I was almost done which made me get into my head too much about my next trades.

What was easier than expected during the FTMO Challenge or Verification?

The easiest part was managing my risk because that was something that I could control.

Where have you learnt about FTMO?

I learned about FTMO through my trading mentor.

What is the number one piece of advice you would give to a new trader?

The number one piece of advice I would give to a new trader is to apply what you’re learning as soon as you learn it. A lot of people want to learn as much as they can before they enter the markets but physically entering the markets is going to help you have a better understanding of how the markets work, even if you’re not sure what you’re doing.

Trader Cody: “You will fail many times before you succeed.”

How did you manage your emotions when you were in a losing trade?

I have watched endless trading psychology videos from no-nonsense forex and maverick trading to dial in my emotions. I feel good that I am in a place financially and mentally where I don't rely on trading for sole income, so my emotions never run too high or too low anymore. I have a system I follow religiously so if my algorithm tells me to exit a trade, I exit.

What do you think is the most important characteristic/attribute to become a profitable trader?

Consistency and psychology. Not letting fear or greed take over too much in either direction.

What inspires you to pursue trading?

Freedom. You can do it anywhere on the planet where you have internet. It challenges me daily.

Where have you learnt about FTMO?

Discord.

What do you think is the key to long-term success in trading?

Managing risk.

What would you like to say to other traders who are attempting an FTMO Challenge?

Be patient and don't quit. Trading is HARD. It takes time to master a system that works for you and your trading style and managing your emotions takes time also. You will fail many times before you succeed. Backtest and paper test religiously at first. Do it every day. Listen to multiple traders on what works for them and find something that works in your lifestyle. Most importantly, enjoy the process. The early days of learning and finding your own system are the most enjoyable. Good luck to everyone trying to make it in a profession where most won't.

Trader Kamoy “Developing a plan and sticking to it can help mitigate emotional reactions to market fluctuations.”

How did you manage your emotions when you were in a losing trade?

I don’t trade with emotions, I use strategies, risk management, and discipline to navigate the emotional challenges of trading. Developing a plan and sticking to it can help mitigate emotional reactions to market fluctuations.

What does your risk management plan look like?

My risk management in forex trading are Stop Loss Order, Risk- Reward Ratio, Risk per Trade, all these fundamental components help my risk management plan works.

What do you think is the key to long-term success in trading?

A key long-term success in trading is implementing a robust risk management strategy. It is crucial for long-term success in trading.

What was the hardest obstacle on your trading journey?

One of the toughest obstacles was trading through managing emotions, emotions like fear, greed and impatience can lead to impulsive decisions, and also deviating from the trading plan and incurring unnecessary losses.

How did loss limits affect your trading style?

In the early years of my trading, it affected me drastically but over the years I learnt that having predefined limits helps to avoid catastrophic losses and emotional decision-making.

What would you like to say to other traders who are attempting an FTMO Challenge?

Success in the FTMO Challenges requires adhering to specified trading rules, managing risk effectively, and demonstrating consistent profitability. It’s a rigorous evaluation, and those who succeed often exhibit both technical and disciplined risk management.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.