Sometimes less is more

We have written several times about the fact that overtrading, or opening a large number of positions right after each other, does not make much sense in trading. In today's part of the series on successful traders, we'll look at a trader who also found overtrading unprofitable and fortunately realized it soon enough.

Overtrading, when a trader opens one position after another thinking that "now it will definitely work out", ends in most cases with big and unnecessary losses. One loss follows another, and the trader can soon get into a vicious circle, from which, in the worst case, he can only get out if he breaks the maximum loss rules and loses his account.

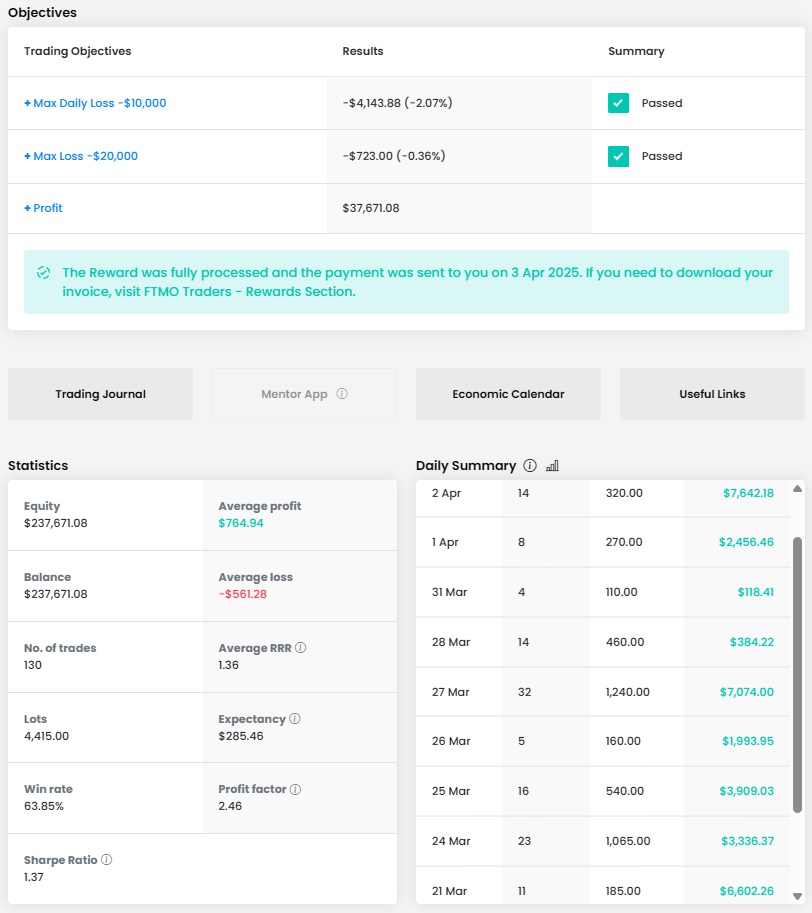

Fortunately, this black scenario did not come true in the case of our trader. However, looking at the balance curve, we can see that he was unable to avoid periods when he tried to trade too actively and this had a negative impact on his results. Thanks to the successful start of the trading period, the trader did not get into the red numbers during the trading period. Thanks to a good consistency score, he was eventually able to cope with two periods of fairly significant drawdowns. In the end, when he realized that fewer trades might be a better way to a good result, he managed to achieve a very good return.

It amounted to more than $20,000, which is a little over ten percent of the $200,000 account size, so the trader could certainly be satisfied with his result. The trader didn't have too many problems with the loss limits, but the daily loss of over 4% on the second drawdown was probably a very sufficient warning that overtrading probably won't get him anywhere.

The trader executed 30 trades during the trading period for a total volume of 166.1 lots, which is about 5.5 lots per trade. With an account size of $200,000, this is fine on the XAUUSD instrument as long as the trader sets Stop Losses at reasonable levels. The average RRR of 3.22 is very good and with a trade win rate of 36.67%, it is practically a must for a good result.

Again, we have an intraday trader who does not hold positions open overnight, so he pays no swap fees. You could even say that he is closer to scalping because he only ever holds his positions for more than a few hours. Again, we have to commend the fact that the trader sets both Stop Loss and Take Profit in all cases. Since he trades on a fairly volatile instrument and sets Stop Losses and Take Profits quite tightly due to the size of the position, setting a Stop Loss is even more of a necessity. We must also commend the fact that the maximum loss was around one percent.

Although the trader is quite active in managing his trades (he moves the SL quite early after reaching a certain profit), trading without SL in such a busy market might not be profitable. We can criticize the aforementioned tendency to open multiple positions in a row in an attempt to make a profit at any cost. This showed up very nicely in the journal as a series of five losing trades in a row that were executed within two hours.

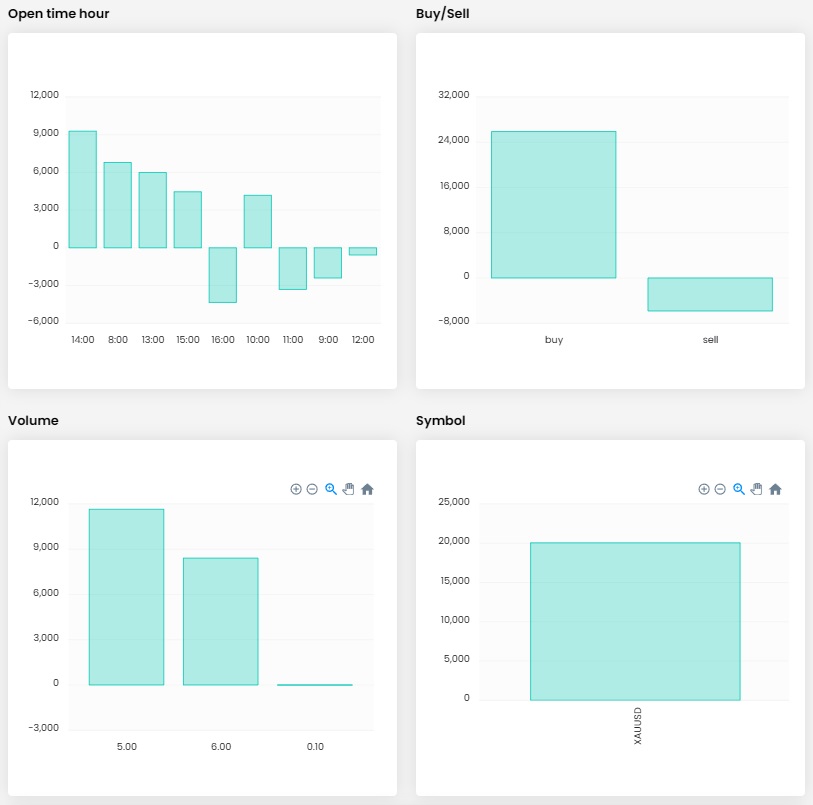

The trader traded only one instrument, which was Gold (XAUUSD), a very popular instrument among traders. He mostly opened positions of 5 or 6 lots, which probably suits his style. His opening hours were spread over a long period of time, but he was most successful in the afternoon, before the US markets opened. Given that Gold is in a long-term uptrend, it's not such a surprise that the trader performed much better on long positions.

Again, we will also look at some trader trades. In the first case, the trader waited for the local resistance to break and entered a long position. Considering his other trades, we can assume that the SL was set somewhere below the marked resistance level, but the price continued in the direction the trader wanted, so he eventually moved the SL into profit.

The trade eventually ended with an exit on the shifted SL, which is a bit of a pity given the subsequent price movement. On the other hand, the profit on the trade is more than triple the SL, so overall it is a very successful trade with a profit of over $6,800.

The trader took a similar approach in the second example. The entry was after the local resistance was confirmed to be broken and prices continued to rise.

The difference from the first sample trade is that the trade ended with a Take Profit. Here too, at first glance, it may seem that the trader could have achieved a better return, but given that this is a TP, where the RRR is somewhere between 2.5 and 3.5, criticism would probably be pointless. Less is sometimes more.

Note: Since we cannot clearly define the exact trader's strategy from the chart, this is only the private opinion of the author of this article. FTMO Traders are free to choose their strategy and as long as they do not explicitly violate our Terms and Conditions and follow our risk management rules, the choice of strategy and execution of individual trades is up to them.

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?