“Risk management should always be a priority to preserve capital”

Proper risk management can be a big challenge for some traders. This is especially true for those traders who have experience trading on a small account and may initially struggle to manage such large sums after moving to a larger account with FTMO. Our trading rules are designed to help them do this, as proven by our new FTMO Traders Hesam, Muhammad, Karen and Timea.

Trader Hesam: “Loss limits enforced discipline and risk management in my trading style.”

Do you have a trading plan in place, and do you follow it strictly?

Yes, I have my trading plan and style.

What do you think is the key for long term success in trading?

The key to long-term success in trading is a combination of discipline, continuous learning, adaptability, and emotional resilience. It's essential to develop a robust trading strategy based on sound principles and to stick to it through both favorable and challenging market conditions. Risk management should always be a priority to preserve capital. Additionally, staying informed about market dynamics, being open to evolving strategies, and mastering emotional control are crucial for sustained success over time.

What do you think is the most important characteristic/attribute to become a profitable trader?

Discipline.

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

The most challenging aspect of my FTMO Challenge or Verification was managing emotions during periods of drawdown. To overcome it, I focused on sticking to my trading plan, maintaining discipline, and regularly reviewing my trades to learn and adapt. Additionally, I practiced mindfulness techniques to stay calm and composed during stressful moments.

How did loss limits affect your trading style?

Maximum loss limits enforced discipline and risk management in my trading style. They compelled me to be more selective with trades, avoid overexposure, and prioritize high-probability setups. Adhering to these limits encouraged me to stay within my risk tolerance and prevent catastrophic losses, ultimately shaping a more conservative and prudent approach to trading.

What would you like to say to other traders that are attempting the FTMO Challenge?

Stay focused, stick to your trading plan, and manage your risk diligently. Embrace the learning process, stay resilient through challenges, and remember that consistency is key. Trust in your strategy, but also be adaptable and willing to learn from both successes and setbacks. Stay disciplined, stay patient, and believe in your ability to succeed. Best of luck on your journey!

Trader Muhammad Waqas: “I've experienced the downside of not sticking to my trading plan.”

Do you have a trading plan in place, and do you follow it strictly?

I do have a trading plan that I've developed over time. While I strive to follow it as closely as possible, there are instances when market conditions or new information prompt adjustments. Yeah, I've experienced the downside of not sticking to my trading plan. Sometimes emotions or impulsive decisions can lead me astray, resulting in losses. I'm working on improving my discipline and staying true to my plan, even when things get hectic in the market.

Describe your best trade.

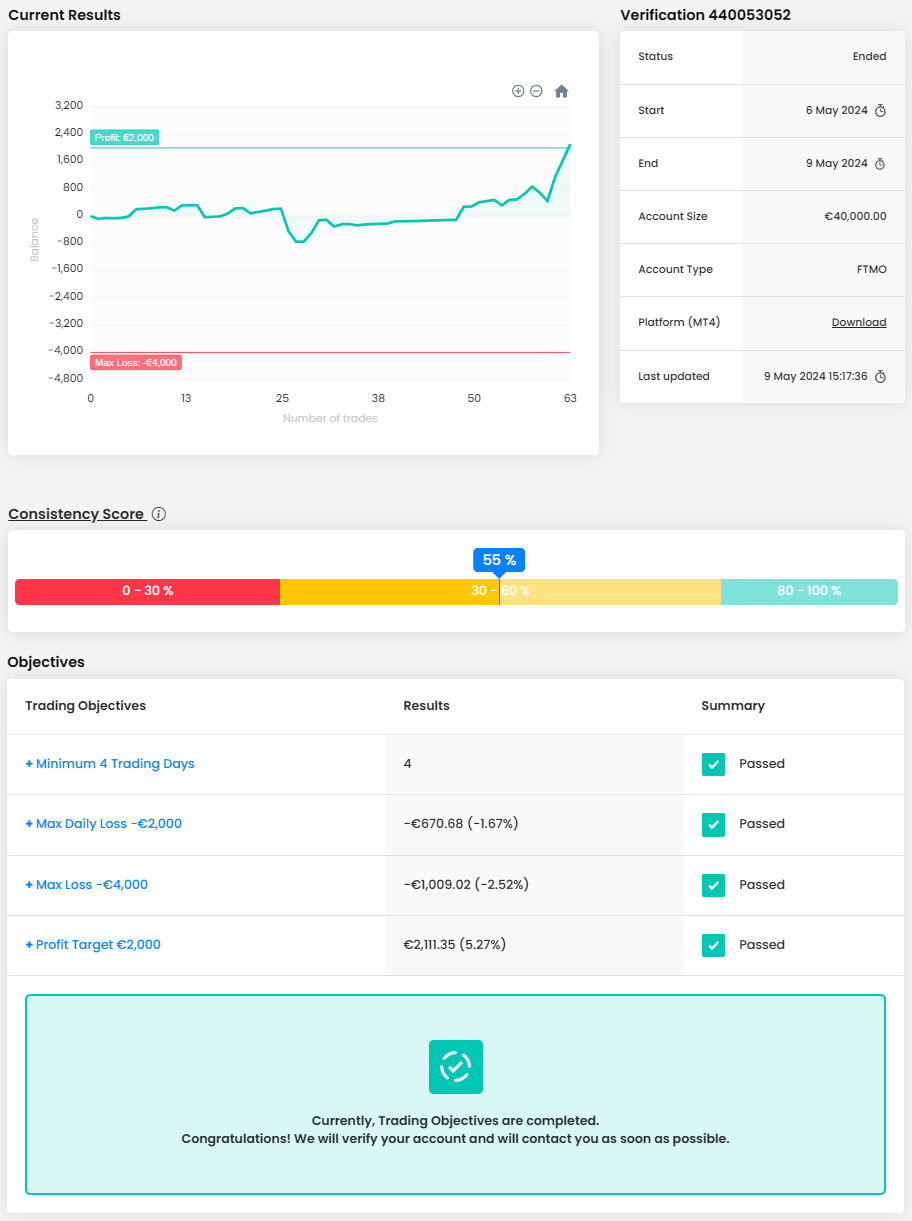

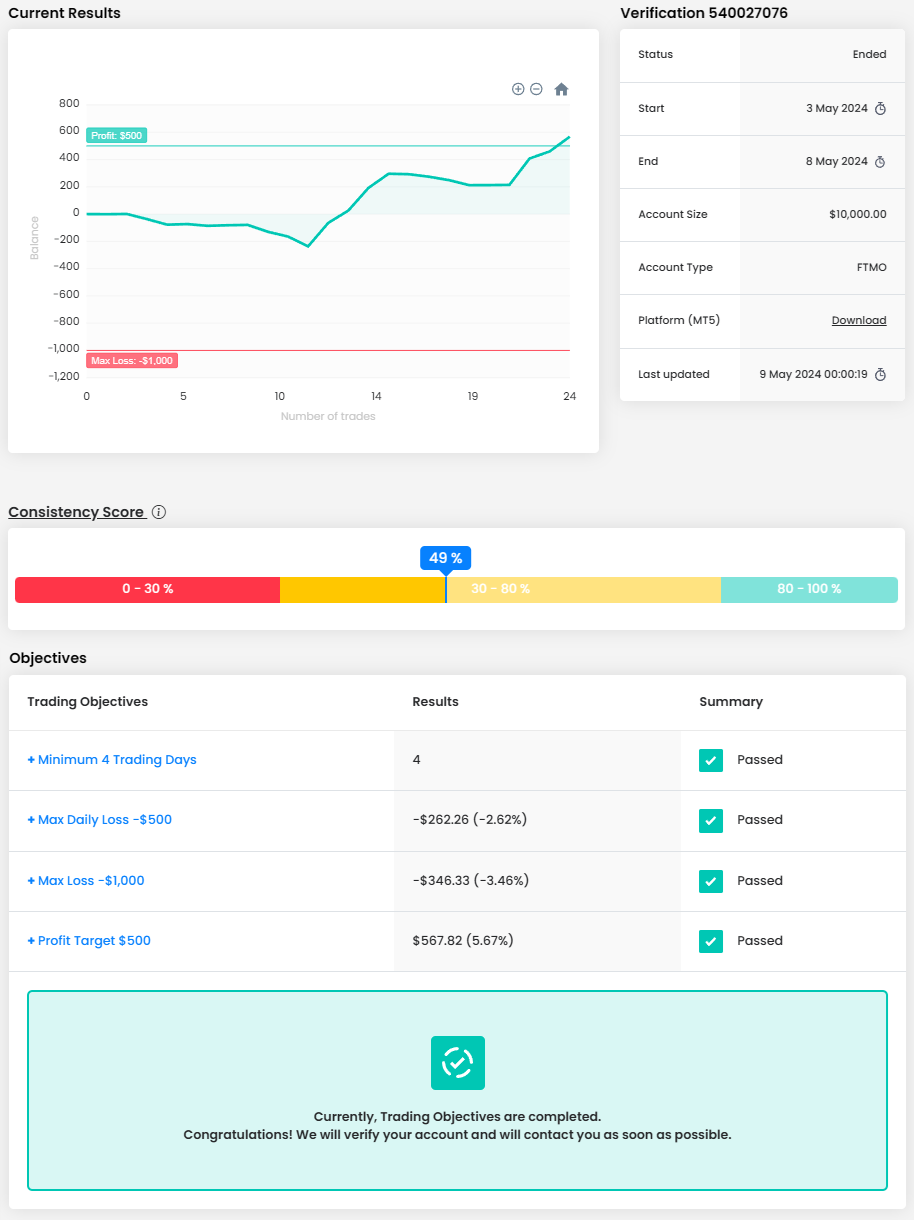

My best trade was on the XAUUSD pair. Which led me to pass my Verification phase.

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

One of the most difficult aspects of my FTMO Challenge/Verification was maintaining emotional discipline during periods of market volatility. There were moments when sudden price swings tempted me to deviate from my trading plan or exit prematurely out of fear. To overcome this challenge, I focused on sticking to my predefined risk management rules and reminding myself of the importance of staying calm and composed.

How would you rate your experience with FTMO?

My experience with FTMO is excellent.

Where have you learnt about FTMO?

From some family member.

What would you like to say to other traders that are attempting the FTMO Challenge?

Stay focused on your trading plan and risk management strategy—it's the key to success in navigating the markets. Remember that challenges and setbacks are inevitable, but they also present opportunities for growth and learning. Don't be discouraged by temporary setbacks; instead, use them as valuable lessons to refine your approach and improve your skills. Stay disciplined, stay resilient, and most importantly, believe in yourself and your abilities.

Trader Karen Gilbuena: “There will always be the next trade with better conditions and opportunities.”

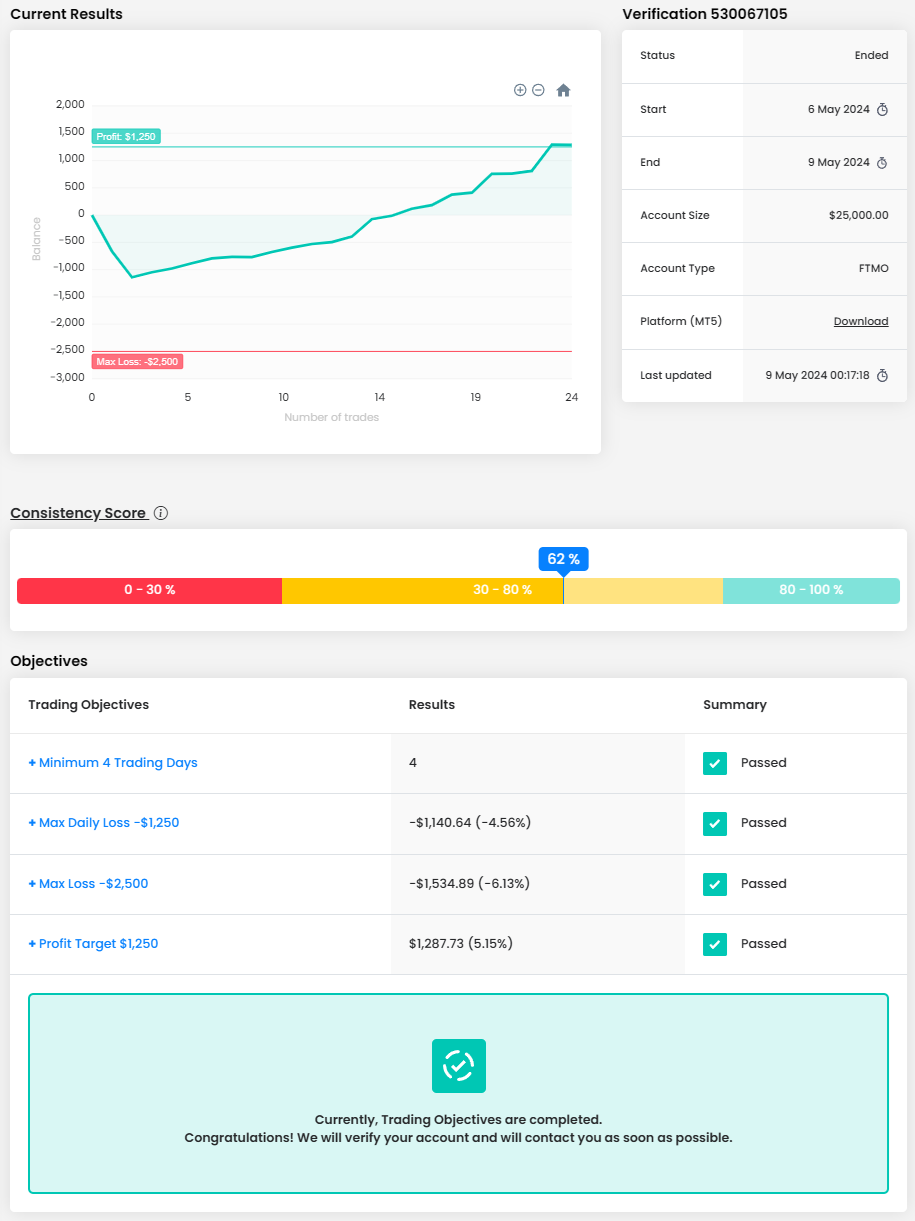

I love analysis and have always wanted to trade for a few years now. I did start a small account at some point, but eventually figured out that a bigger capital is needed to kickstart it. My ultimate goal is to be able to trade full-time and consistently be profitable.

Do you plan to take another FTMO Challenge to manage even bigger capital?

Yes, absolutely.

How did you manage your emotions when you were in a losing trade?

If you ask me 5 years ago, I would keep trading with the goal of trying to make up the loss. But now, after getting more understanding on money management and my own risk tolerance, I was able to set targets and a trading plan. Understanding the importance of sticking to my trading plan and keeping my risk small is a very important lesson in the past 5 years. There will always be the next trade with better conditions and opportunities. There are still days that the market is totally unpredictable, so if I do have a losing trade and I am close to my allowable loss limit, I take a step back. I think it is the best thing that I have added to my trading rules. This helps me evaluate my emotional and mental status to avoid revenge trading or being too emotionally attached to a trade.

Describe your best trade.

There are a few, but I am most fascinated about getting my trade entries on point. Since I prefer XAUUSD as a trading instrument, I love to trade with the trend, but there is always that challenge of identifying the best entry point so that even if it is just 10 pips, you can still turn that trade profitable. At this point, for me, each trade that I manage to close in profit are the best trades. Getting 2% profit on a trade is just a bonus. For now, my focus is the trading process of making profitable trades.

What was more difficult than expected during your FTMO Challenge or Verification?

I think figuring out the lot sizes since it is a bigger capital than I am used to. But overall, the process was straight forward, and I did enjoy both phases of the FTMO Challenge.

What would you like to say to other traders that are attempting the FTMO Challenge?

Trust yourself and follow your trading rules. As long as you are patient and disciplined enough, not just during the FTMO Challenge, but in every trade that you make, regardless of if it is a demo or a live account, that mentally will gear you up to success.

Trader Timea Jana: “Even small losses are wins, BE are wins, small wins are wins and big wins are wins.”

How did you manage your emotions when you were in a losing trade?

Since I had a proper risk management, it never affected me much emotionally. I knew that I could take a loss without risk of losing the FTMO Account. I also kept in mind that even small losses are wins, BE are wins, small wins are wins and big wins are wins. I knew that as long as I followed my trading plan and had a good risk management, I would be good to continue.

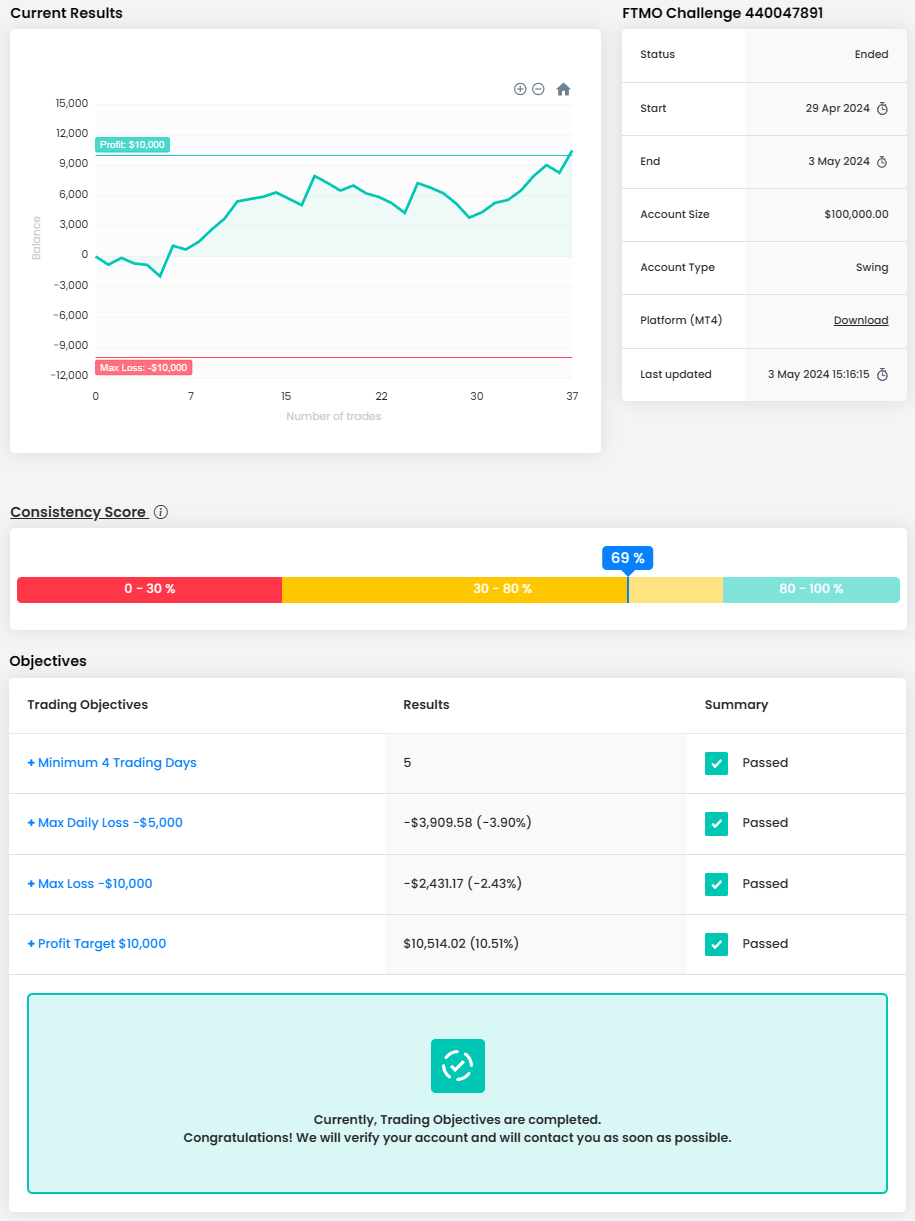

Do you plan to take another FTMO Challenge to manage even bigger capital?

Yes, I plan on taking more and bigger FTMO Challenges in a couple of months to grow my capital.

What do you think is the most important characteristic/attribute to become a profitable trader?

I believe in order to become a profitable trader it is extremely important to be persistent, patient but most of all disciplined. It is important to be disciplined to follow your trading plan and not break your own rules.

Do you have a trading plan in place, and do you follow it strictly?

I do have a trading plan and follow it strictly. I do however update it every now and then when I notice improvements that can be made. It is important that you have a realistic trading plan that you can follow.

What do you think is the key for long term success in trading?

The key to long-term success in trading is consistency. No matter how many times you fail or take a loss, you need to keep on going. Remember that every failure is one step closer to success.

What would you like to say to other traders that are attempting the FTMO Challenge?

Don’t rush the process. These challenges have unlimited days to pass, so there’s no need to rush it. It is better you take your time and notice the days you feel that you aren’t in the right mindset to trade.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.