“Restrictions and rules can be seen as limitations, but they greatly improve traders' discipline”

Many traders will always complain about the strict FTMO Challenge requirements. On the other hand, those who have already completed the FTMO Challenge appreciate that the loss limits have taught them to stick to a trading plan and a strategy, which has led to more consistent results. And our new FTMO Traders have had a similar experience.

Trader Alfred: "A stoploss keeps the emotions under control."

How did you manage your emotions when you were in a losing trade?

A stoploss keeps the emotions under control. Once the trade is officially a loss (+/- 1% of account) it is important to remind yourself everything is executed according to the trading plan.

Do you have a trading plan in place, and do you follow it strictly?

Trading consistently without a trading plan is practically impossible, so yes, a plan is in place! Over the years there have been plenty of occasions when I violated my own plan. Reasons for that always go back to psychology. Greed, FOMO, impatience, revenge, etc. etc. the list goes on and on. FTMO helped me to make that last step with strict drawdown limits.

How does your risk management plan look like?

0.83% risk per trade. Max 2 losing trades a day, max 4 losing trades first week, 3 second week. When 7 losing trades below initial capital no trading for a week. Next trading weeks cannot exceed 3 losing trades. This provides a time span of at least 5 weeks before hitting the 10% max loss limit and avoids emotional trading.

What do you think is the most important characteristic/attribute to become a profitable trader?

Stick to your plan. Simple but crazy effective.

How did loss limits affect your trading style?

Previously I didn't spread out losing trades to an extend of 5 weeks before hitting the max loss limit. 10% loss limit is now also incorporated into my Futures and Options trading.

What is the number one advice you would give to a new trader?

Start with a simple trading plan including min R:R ratios, max risk, setups/strategy, markets, etc. Stick to it and only make hard changes if certain aspects are proven wrong.

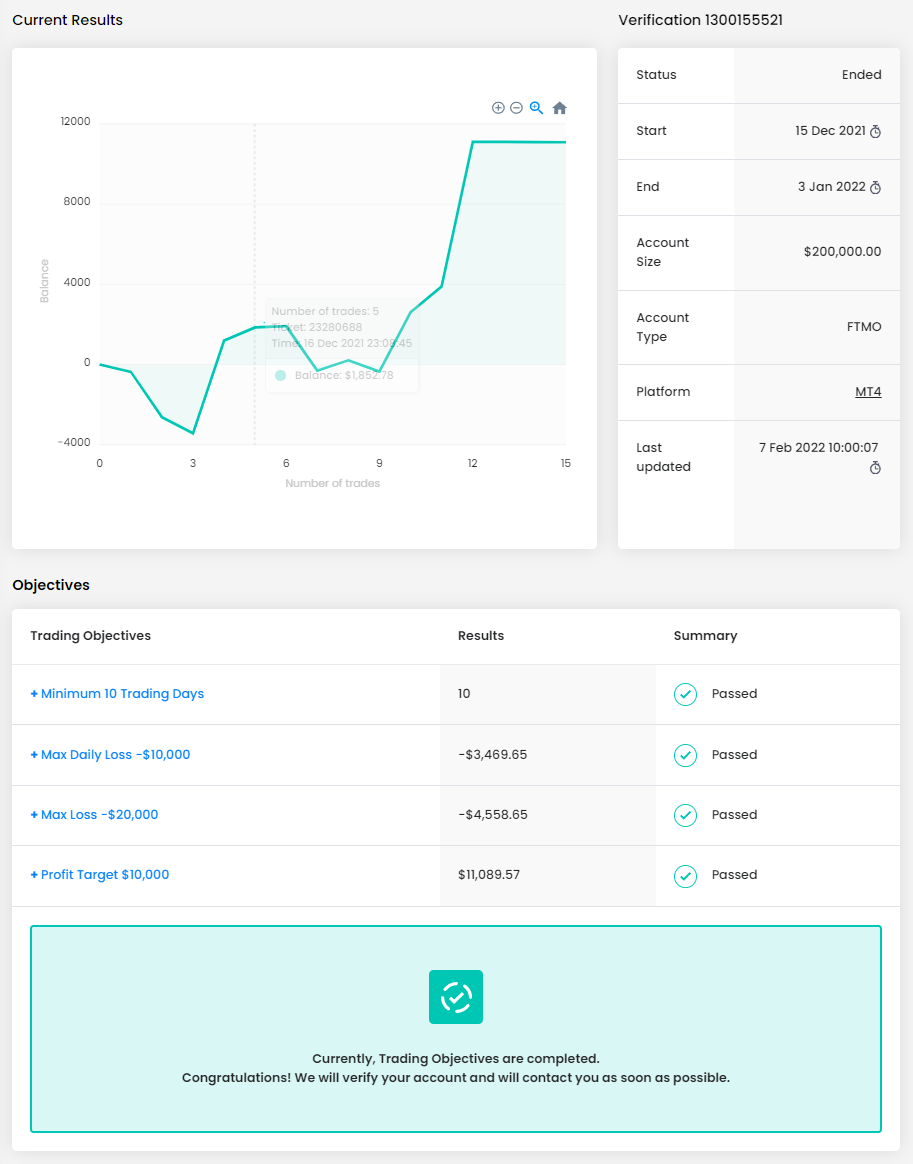

Trader Georgios-Christos: "Losing trades are just part of trading."

How did you manage your emotions when you were in a losing trade?

Losing trades are just part of trading, there was no need to worry because I know that if I follow my rules, my strategy will play out eventually and I will end up with profit.

What do you think is the most important characteristic/attribute to become a profitable trader?

I managed to become profitable only when I started to trade my plan every day and be strict about following my rules.

What was the most difficult for you during your FTMO Challenge or Verification and how did you overcome it?

I was 5.5% in drawdown on verification at the beginning, because my emotions were taking over but I realized that I had so much time in my hands to bring the account back and so I did finish the 2nd stage with just 3 great trades.

How would you rate your experience with FTMO?

FTMO is the best company in the game, never had any issue, these guys are so professional.

What inspires you to pursue trading?

Freedom of working for myself at such a young age, from where I want and when I want.

What is the number one advice you would give to a new trader?

Develop or find a trading strategy that you know it works through backtesting and follow it as best as you can.

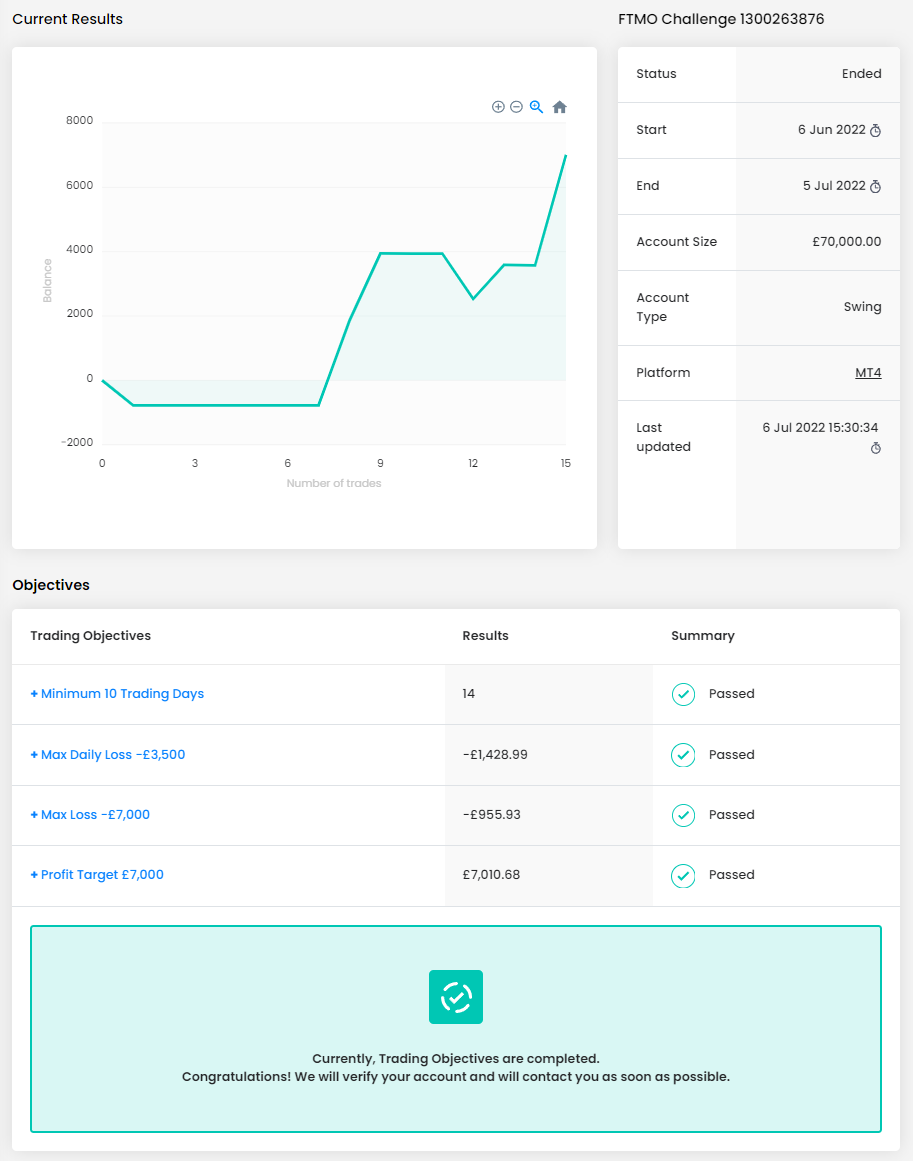

Trader Salvatore: "10% is an absurd amount of money in only 20 trading days... but not impossible."

Has your psychology ever affected your trading plan?

Absolutely. I already learnt the lesson not long ago after passing my first verification. I was dealing with multiple stress factors and trading at the same time.... HUGE MISTAKE.

How would you rate your experience with FTMO?

I'd say largely formative. Restrictions and rules can be seen as limitations, in my opinion they drastically improve discipline in traders.

Describe your best trade.

It wasn't just a trade but an idea that made me place multiple trades focusing on the USD. It happened during the March FOMC meeting. I was heavily short USD on multiple crosses which realized 12% profit and closing the first step of the challenge. Funny thing is with that challenge I was down 9% and managed to gain 19 % in a few days.

What was more difficult than expected during your FTMO Challenge or Verification?

Catching the best idea at the best time/price possible. 10% is an absurd amount of money in only 20 trading days... but not impossible.

How did passing the FTMO Challenge and Verification change your life?

It's the second time I pass a verification (I lost my first funded account unfortunately ) but still, it gives me hope and satisfaction. I really want to trade professionally for as long as possible.

What is the number one advice you would give to a new trader?

Keep studying, reading, listening... never lose touch with the market narrative/global macro.

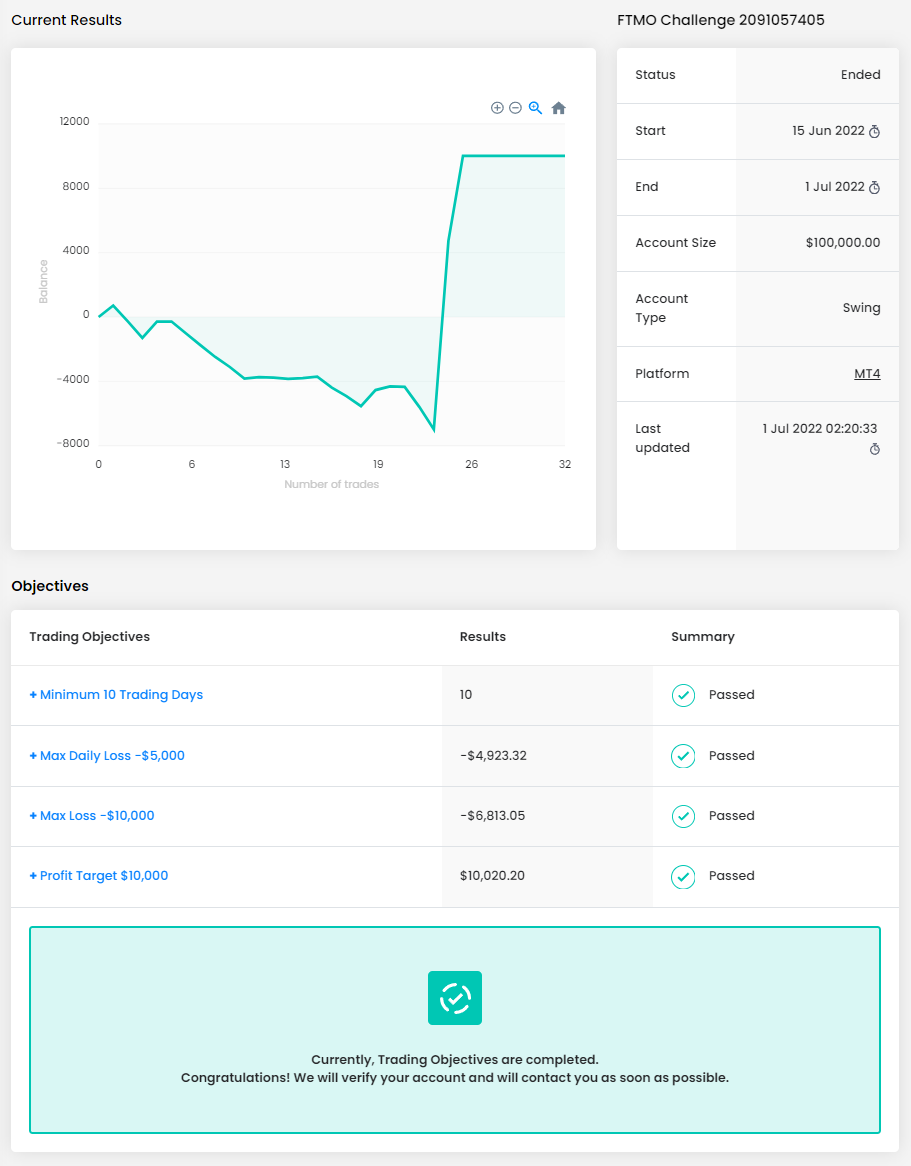

Trader Christopher: "Be patient for confirmations for entries and don’t revenge trade if you suffer a loss."

Do you have a trading plan in place, and do you follow it strictly?

Yes, I do have a trading plan that I strictly follow.

How did you manage your emotions when you were in a losing trade?

I report my losses in my personal trading journey and seek my mistakes. Rather if it was me lacking patience for my confirmations, wrong reads, or news, I own up to my loss and view them as lessons.

What was the most difficult for you during your FTMO Challenge or Verification and how did you overcome it?

The most difficult part of both, Challenge and Verification, was missing opportunities. I found myself relaxing and telling myself “You got time, there will always be more opportunities, and slow and steady.”

What was more difficult than expected during your FTMO Challenge or Verification?

The most difficult part about the FTMO Challenge and Verification was seeing your progressions throughout these stages and not wanted to mess up and potentially lose money.

How did loss limits affect your trading style?

The maximum loss limits helped me with risk management, stop losses, and how many trades I could take.

One piece of advice for people starting the FTMO Challenge now.

Psychology is Key! Be patient for confirmations for entries and don’t revenge trade if you suffer a loss.

Trader Aidan: "Risk management is the number one priority."

How does your risk management plan look like?

Risk management is the number one priority. With capital preservation first in mind, consistent returns from high RR setups are a natural by-product.

How did you manage your emotions when you were in a losing trade?

I simply walk away from my desk and do something different. I cap myself at two (2) losses max per day so that I don't end up revenge trading.

Describe your best trade.

My best trade was on EURUSD where I managed to catch the top of a daily leg to the downside and was able to scale multiple positions on the way down for a total return of 100% in 3 days.

What do you think is the key for long-term success in trading?

Discipline within your trading plan.

What was more difficult than expected during your FTMO Challenge or Verification?

Having a time restriction of 30 days to achieve 10%. Most people don't make 10% in a whole year in other markets like equities.

What would you like to say to other traders that are attempting the FTMO Challenge?

Create a plan and stick to it. Don't feel like you have to rush it in your first week. Relax, and let the high probability setups come to you.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.