Overtrading will not give you good returns

In the next part of the series on successful FTMO Traders, we will look at a trader who diversified his trades between gold and US indices and discovered quite early that overtrading would not help him to make long-term profits.

Overtrading is a problem for many traders who feel that the more trades they execute, the better their results will be. In reality, it ends up being quite the opposite because in most cases, traders start making mistakes after a series of losses and lose even more in an attempt to get back in to profit.

The biggest problem with overtrading, however, is that it can happen to any trader, as it can be caused by virtually anything. Therefore, it is very important for a trader to become aware of this problem as soon as possible and try to stick to their strategy and trading plan.

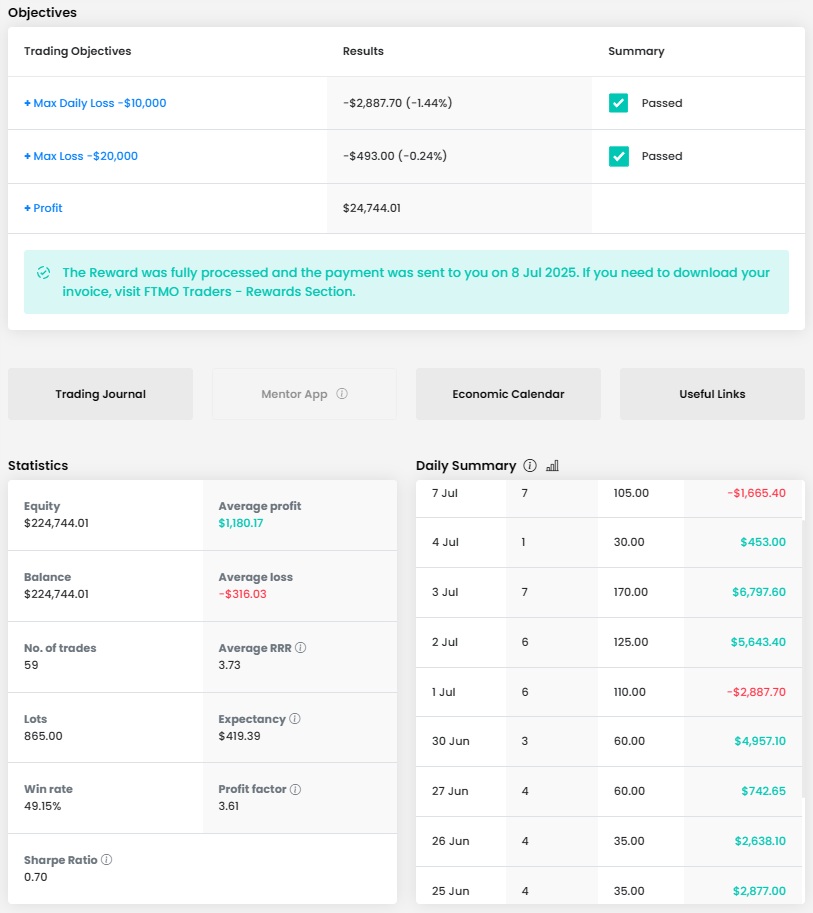

A similar problem occurred with our trader who executed the most trades on the first day of the trading period, but it only led to this day being one of his most losing days. This can be seen in his balance curve, which starts in the red numbers.

Fortunately, the trader probably understood soon enough that opening a large number of positions at any price is probably not the right approach on an FTMO Account and with the reduction of the number of positions, better results followed. There were losing periods after that, but that is part of trading forex and CFD instruments, so it is not unusual. The key is, to learn from such periods and avoid them in the future.

A total profit of $16,121 is very good for an account size of $100,000. As can be seen, the trader had no problem with the overall loss. However, towards the end of the period, the trader had to be careful about the Maximum Daily Loss as a few days before his reward day, several positions ended up in the red and his daily loss was over 4%.

The trader executed 41 trades over two weeks with a total volume of 424.5 lots, which is just over 10 lots per trade. This is not a problem for the size of the account, nor is it a problem in terms of the number of trades. He rarely opened multiple positions, so all is well in that regard. Likewise, we praise the RRR value of 3.25, so the trader could be successful even though more than half of the trades ended in losses.

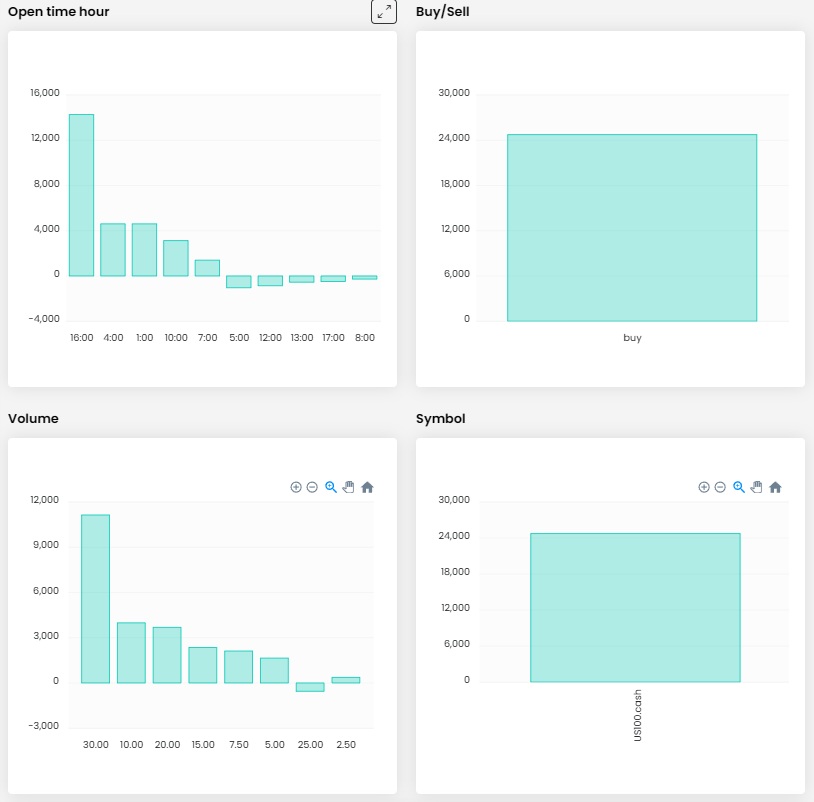

Looking at the trader's journal, we see that the trader had a stop loss set for all positions, which we clearly commend. He is an intraday trader, so he holds positions for a few hours at most, but his specificity is that he sometimes opened positions before midnight and closed them early in the morning, so despite the short duration of the trade he paid a little unnecessary swap.

His longest trade then lasted over two days, but this is due to the trader holding the trade over the weekend. As you can see, it was his largest losing trade, and he can still talk about luck, as a very significant gap formed on gold over the weekend against the trader's direction. Thus, the luck of the drawback for the trader was that he had set a fairly wide SL, which was filled shortly after the market opened, but the loss was no more than the trader had originally planned.

The trader split his trades between three instruments, including gold (XAUUSD) as the most popular instrument among FTMO Traders, and the two most traded index instruments tracking the DJIA (US30.cash) and the Nasdaq 100 (US100.cash). Although both gold and the US stock indices have been hovering near their all-time highs recently (and perhaps because of this), the trader has been able to profit on both long and short positions.

Let's have a look at a few more trades the trader made on XAUUSD. In the first trade, the trader speculated on a drop in the price of gold, which saw a drop of $250 after breaking its all-time high at the end of October. The trader opened the trade in line with the downtrend after the price saw an upward swing.

The trader moved his SL during the trade, but left the TP at the original level, i.e. at the previous local low. In hindsight, it may seem that the trader could have held the trade for a longer period of time, but in this case we can only give credit to the fact that the trader stuck to his plan and strategy and the TP was set reasonably. A profit of over $6,000 is then only proof of the trader's correct decision.

We will then use the next example to show the aforementioned trade that the trader held over the weekend and almost lost more on it than he would have liked. Weekend gaps can wreak havoc on a trader's account in forex and especially in commodities, and in this case the trader could talk about luck.

The trader actually opened a short position on Friday night and it looked like his SL withstood the swing upwards and the price would continue to fall further. However, gold opened $64 higher on Monday morning and shortly after the open the trade was closed at a loss. If the gap had been a little larger, the trader's loss could have been much higher and there would have been nothing he could have done about it. It is therefore necessary to approach such trades with great caution and prefer to avoid them.

Fortunately, the trader recovered from the loss and opened another long position during the day, which then ended with a profit. However, we can criticize the trader a bit here as well, because he did not hold the trade until his Take Profit and unnecessarily closed it earlier, with a lower profit.

Note: Since we cannot clearly define the exact trader's strategy from the chart, this is only the private opinion of the author of this article. FTMO Traders are free to choose their strategy and as long as they do not explicitly violate our Terms and Conditions and follow our risk management rules, the choice of strategy and execution of individual trades is up to them.

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?