“One of the toughest obstacles on my trading journey is dealing with emotions”

Whether we want to or not, we will never completely remove emotions from trading. For some traders, it is more difficult to digest a series of losing trades. The key to success is avoiding panic, having confidence in your strategy, and realizing that no one's approach will generate 100% profitable trades. In short, every losing trade should be taken as an experience from which we can learn.

Trader Alexandre: “I have accepted the fact that each trade carries some sort of emotion with it.”

What was the hardest obstacle on your trading journey?

To be able to maintain my discipline through the rough trading conditions. Looks silly on paper but that was really challenging since in periods of drawdowns the pressure is significantly harder. It took some strict mathematical and mechanical rules to protect my psychology.

How did you manage your emotions when you were in a losing trade?

It started by increasing awareness of how I was feeling before, during and after a trade by tracking my feelings for each trade and setup on an Excel sheet, each 2 to 4 weeks on weekends I went back to my sheet and learned more about myself and where and when I was feeling more emotional than normal so I could track the roots of the issue. I have accepted the fact that each trade carries some sort of emotion with it even if it's low since money is linked to our survival, but making sure to fix mistakes that won't heighten the emotions more than they need to be is key to protect my mind from potential heightened emotions that can lead to costly trades.

What was easier than expected during the FTMO Challenge or Verification?

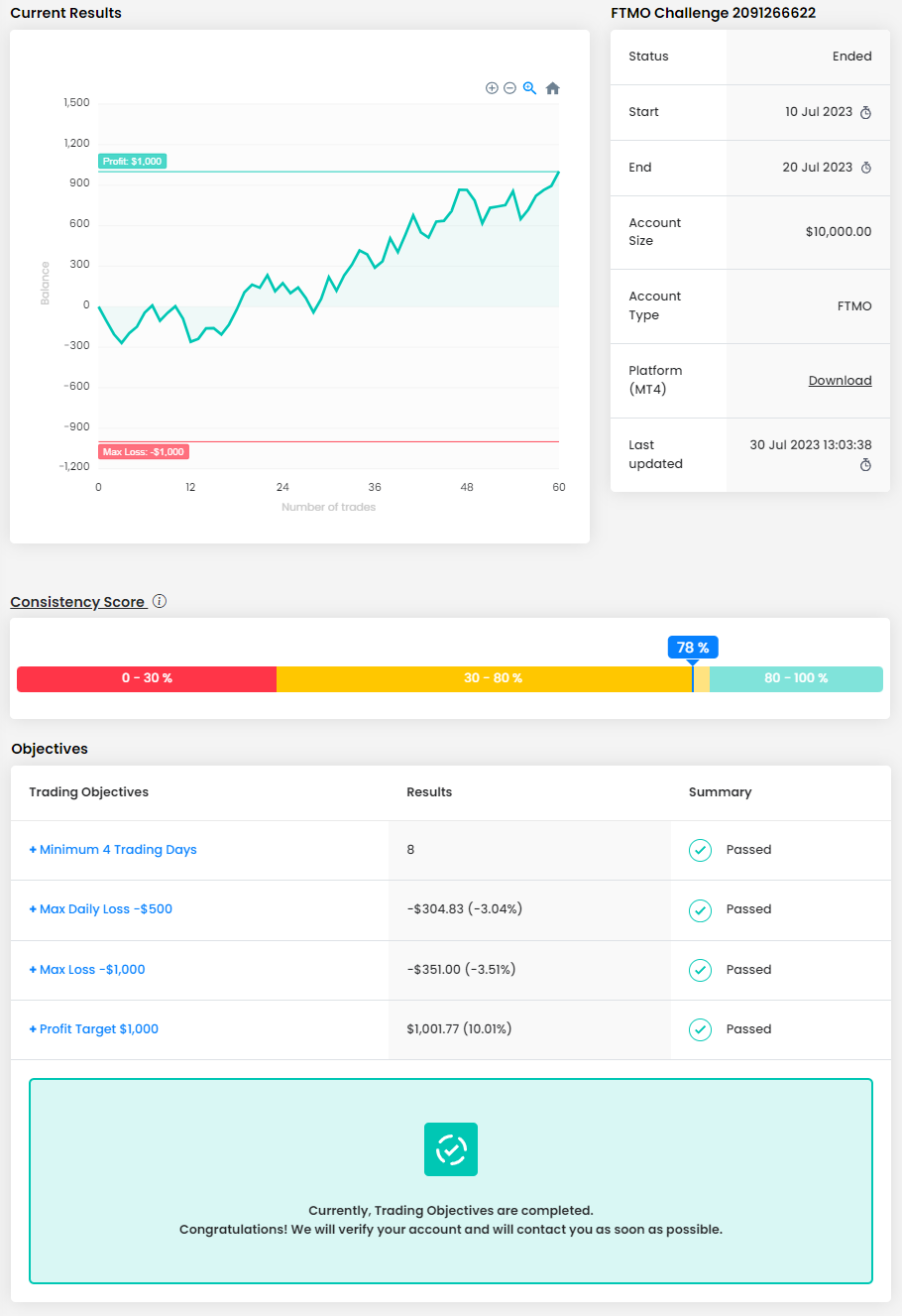

Thankfully, FTMO's support and technicality, tighter spreads, and commissions than my typical brokers and the stats kept me held accountable to stick to what works best as numbers will easily project what works and doesn't with a significant trade sample size.

How would you rate your experience with FTMO?

Very professional, every time I had an issue it was solved very fast.

What do you think is the most important characteristic/attribute to become a profitable trader?

Knowing how to spot a system that works or doesn't (via rigorous backtesting), knowing what makes a balanced success rate with RRR that won't risk blowing the account or dragging it down to huge drawdowns (even if it does have an edge and is profitable long term, we're all humans on short term and most can't handle the pressures of drawdowns of misbalanced RRR's in profitable strategies). And of course, practicing the strategy itself so the trader's mind and discipline gets accustomed to the backtested strategy applied.

One piece of advice for people starting an FTMO Challenge now.

Thankfully FTMO removed the time limits and there's no need to rush trades. If you practiced your working strategy the account is basically yours once you buy the Challenge, just a matter of time and waiting for the market to give you the setups where your edge exists.

Trader Yusuf Al Rasyid: “I rarely look at charts, so I am not addicted”

How would you rate your experience with FTMO?

9/10. I really like the FTMO Challenge, and I am extremely happy to be part of the FTMO Trader community. FTMO has taught me discipline and adherence to the rules set by the company (aka FTMO). Without these two factors, I wouldn't have become a profitable trader.

How did you manage your emotions when you were in a losing trade?

Because I understand the probability of my method, I don't panic about the losses I experience. I believe that, in the long run, my method will be profitable for me. The losses I incur are just considered as losing trades or "losing opportunities," as there is no trading strategy that guarantees 100% profit. Additionally, I rarely look at charts, so I am not addicted, and my psychology remains unaffected. The infrequency of checking charts makes me calmer and better able to manage my emotions. No FOMO, no panic, and no addiction.

What was easier than expected during the FTMO Challenge or Verification?

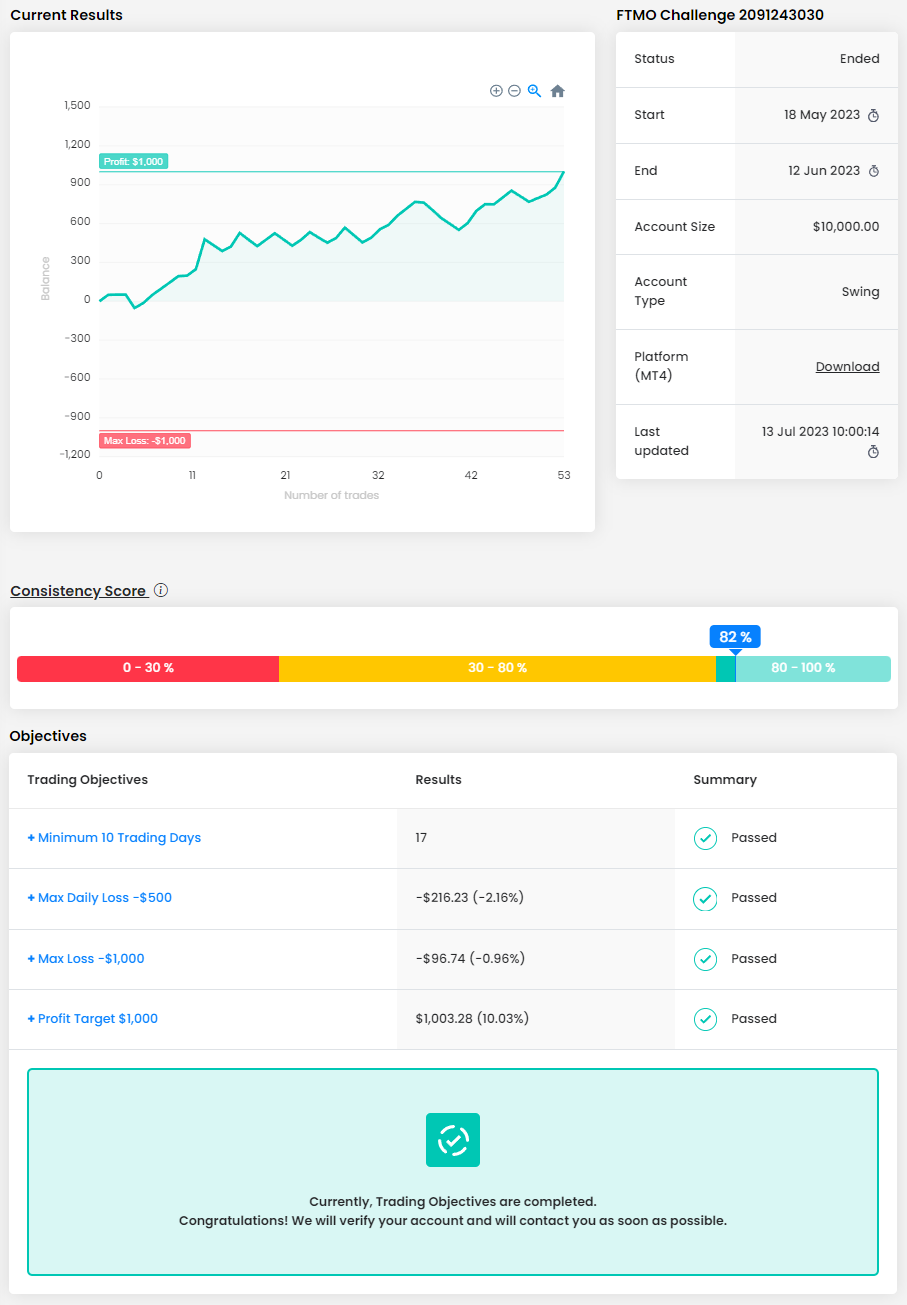

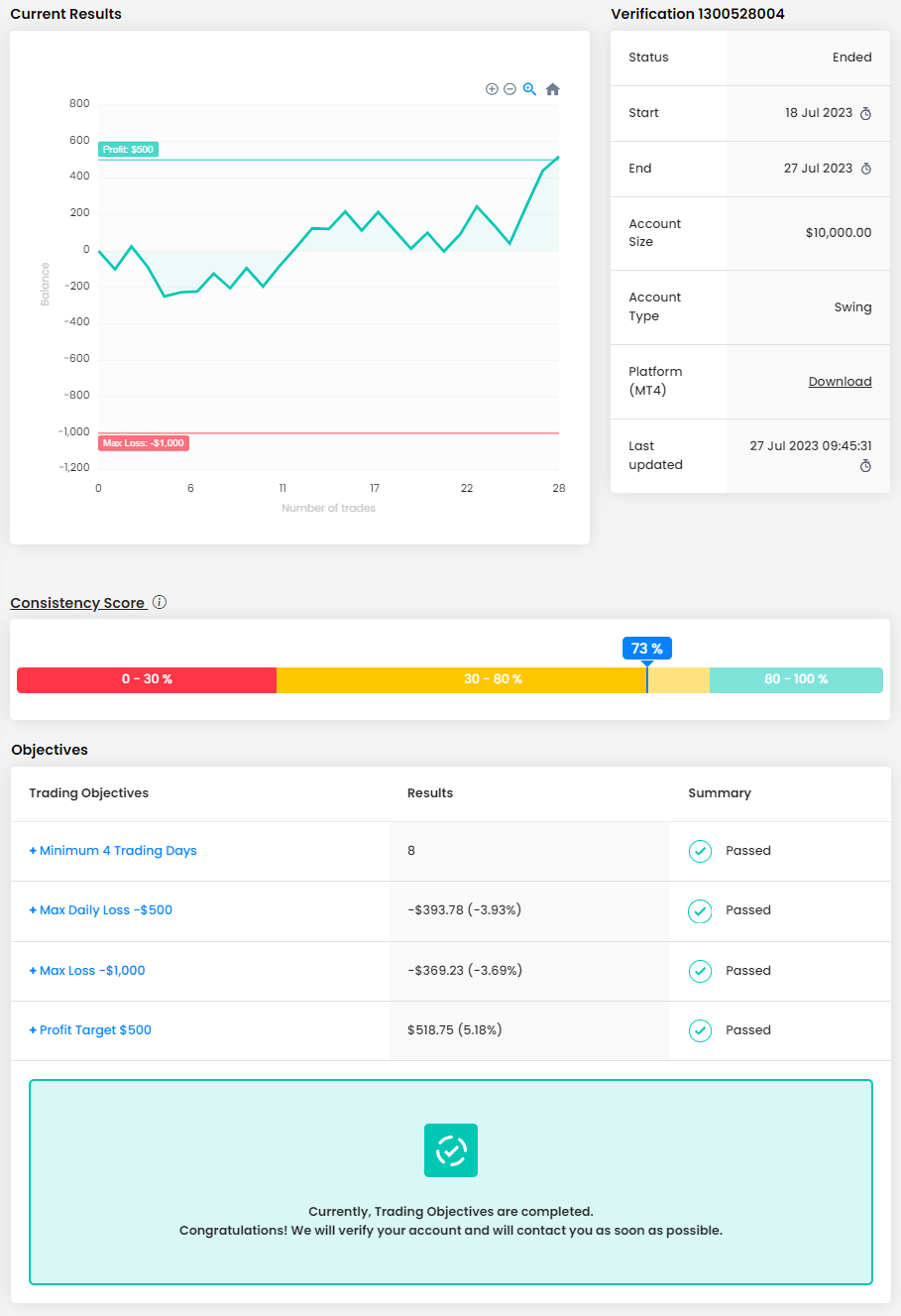

I thought the FTMO Challenge with a 10% Profit Target in 30 days was very difficult to achieve. But unexpectedly, I managed to complete the rules. I didn't expect that I could accomplish them. I simply went through the trading process, and suddenly I finished the Challenge. I was surprised! As for the Verification stage, I found it easier than the FTMO Challenge, so I was able to complete it with ease.

Do you have a trading plan in place, and do you follow it strictly?

I only have two methods. One method I use when the market is ranging, and the other method I use when the market is trending. My methods are very rigid. I have already backtested the methods I use. During a ranging market, I only use support and resistance. I place sell limit orders at resistance and buy limit orders at support. When the market is trending, I only use the "secondary movement" and place limit orders at Fibonacci extension levels around the 0.5 and 0.618 ratios. Pretty simple, right? I strictly stick to these two methods and do not mix them with other methods like SMC, chart patterns, etc.

How did Maximum Loss limits affect your trading style?

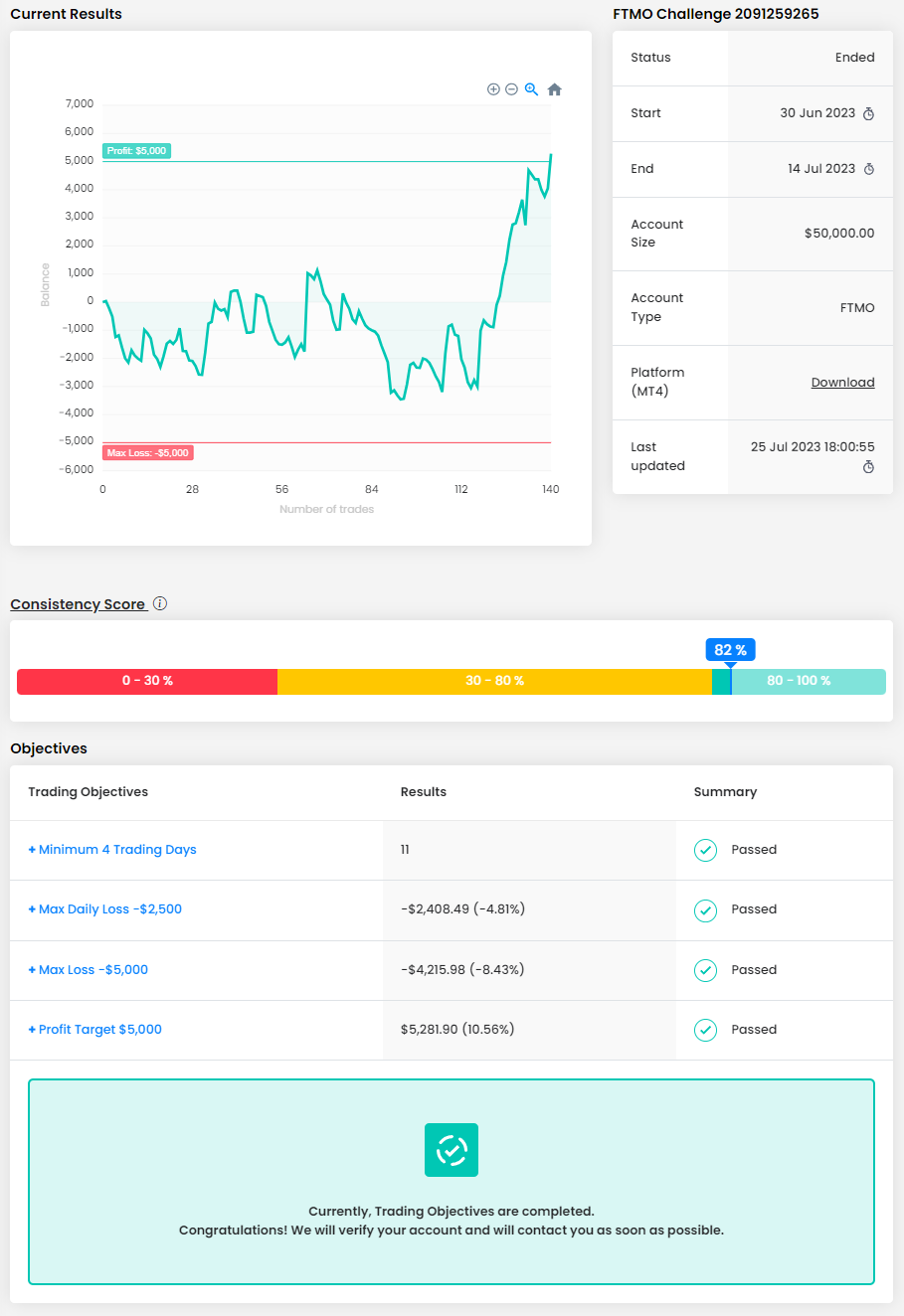

The risk per trade I use is 1%. If my trading capital is $10,000, I'm willing to lose only $100 on each Stop Loss. When I reach the Take Profit (TP) level, I'll also gain around $100 or more. You can see the risk-reward ratio in my account analysis. However, when a major trend has arrived, sometimes I don't use Take Profit and let the profit run. This is because I believe that when a market trend arrives, we can achieve significant profits. Even though I don't set a Take Profit during a major market trend, I still use a trailing stop (SL+) to limit risks.

What would you like to say to other traders that are attempting an FTMO Challenge?

Understand the probability of the trading method you use, apply it rigorously, strictly, and rigidly, and never underestimate the risks.

Trader Muhammad: “Emotions like fear, greed, and impatience can greatly influence decision-making.”

Describe your best trade.

One of my most successful trades as a forex trader was when I identified a strong upward trend in the EUR/USD currency pair. After conducting thorough research and analyzing various economic indicators, central bank policies, and technical chart patterns, I decided to enter a long position at the perfect moment. As the bullish momentum continued to strengthen, I carefully managed my trade, regularly adjusting my Take Profit levels to capitalize on the rising price. To protect my capital from potential market reversals, I also implemented a tight Stop Loss. Throughout the trade, I remained disciplined and avoided the temptation to exit prematurely, allowing the trade to unfold according to my analysis. As the EUR/USD pair approached a significant resistance level, I made a well-timed exit, securing substantial profits from the trade. The success of this trade emphasized the importance of thorough research, technical analysis, and effective risk management in forex trading. It was an incredibly rewarding experience that boosted my confidence and honed my trading skills in the forex market.

How has passing the FTMO Challenge and Verification changed your life?

As a forex trader, passing the FTMO Challenge and Verification has been a life-changing experience. Firstly, it has boosted my confidence and validated my trading skills. Successfully completing these challenges demonstrates that my trading strategy is effective and that I can consistently manage risk and adhere to the rules.

What was the hardest obstacle on your trading journey?

One of the toughest obstacles on my trading journey is dealing with emotions. Emotions like fear, greed, and impatience can greatly influence decision-making and lead to impulsive actions that might result in losses. Managing these emotional biases and staying disciplined in following a well-defined trading plan can be a real challenge.

Has your psychology ever affected your trading plan?

I can say that yes, my psychology has, at times, affected my trading plan. Emotions can play a significant role in trading decisions, and if not managed properly, they can lead to deviations from the original plan. Fear and greed are two common emotions that can impact my trading.

How did you eliminate the factor of luck in your trading?

I eliminated the factor of luck in my trading through a combination of careful planning, disciplined execution, and risk management.

What is the number one piece of advice you would give to a new trader?

The number one piece of advice I would give to a new trader is to focus on education and continuous learning. Acquiring a solid understanding of the forex market, trading principles, and various trading strategies is paramount to success.

Trader Matthew: “The risk of losing an account or Challenge isn’t worth the greed/ego that has taken over.”

What do you think is the key for long-term success in trading?

Risk management, accepting risks, and understanding that the market is a place full of opportunities and not an entity that is there to take your money.

How did Maximum Loss limits affect your trading style?

It actually helped because it refrained me from over-trading. I’m not going to lie and say I haven’t gone over those, but once I knew I was getting close I would refrain from trading because the risk of losing an account or Challenge isn’t worth the greed/ego that has taken over.

Do you have a trading plan in place, and do you follow it strictly?

Yes. This helps balance your emotions and to trade with an edge.

What was the hardest obstacle on your trading journey?

Discovering my edge. There are so many strategies out there and so many courses, but people don’t realize that trading is discretionary. You need to tweak those strategies to fit YOUR style, or else you will be unable to replicate the results that others are doing. So, after trial and error, I finally came up with my own edge and then the next hardest part was psychology.

How did you manage your emotions when you were in a losing trade?

Accepting risk and understanding that the markets are unpredictable and fluid in nature. As long as I have followed my rules and pressed “execute” then I did all I can do, and if I lose it’s just a short-term loss.

One piece of advice for people starting the FTMO Challenge now.

Start off small. If you find success in demo/paper trade but don’t have the capital to trade real money, then work a job that can fund your Challenges. But start at 10k and prove to yourself you can pass that before moving on to the higher payout accounts.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.