New year, new FTMO Traders

2021 is here and we wish it brings new hopes to many people globally. This is the first edition of FTMO Traders who battled in the evaluation process last year and started 2021 with their fresh FTMO Accounts. Be inspired by their stories and experiences.

Trader Ziaul - "Luck is not a trading strategy. someone can win some trade with luck. but this is not a proper approach for a trading career."

What do you think is the key for long term success in trading?

Personally, I follow some key rules for trading

- proper trading strategy

- proper risk management

- nothing emotional

- follow all trading objective strictly 5. trade in your way

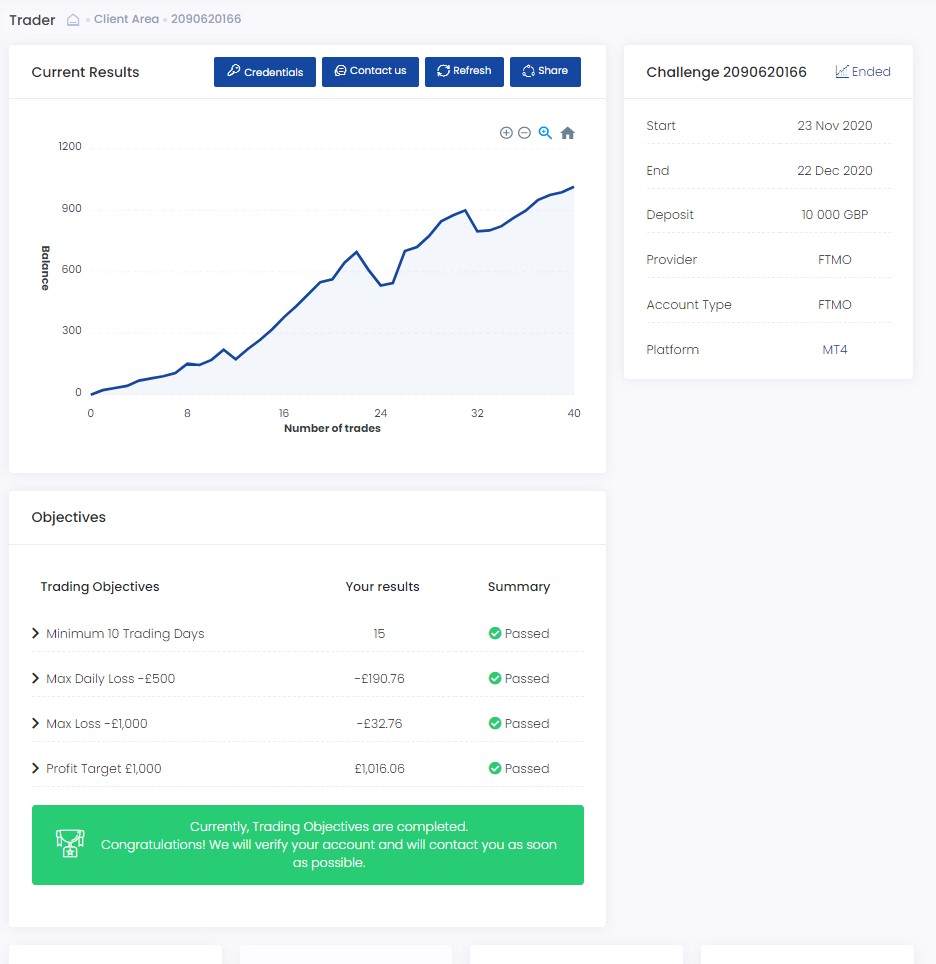

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

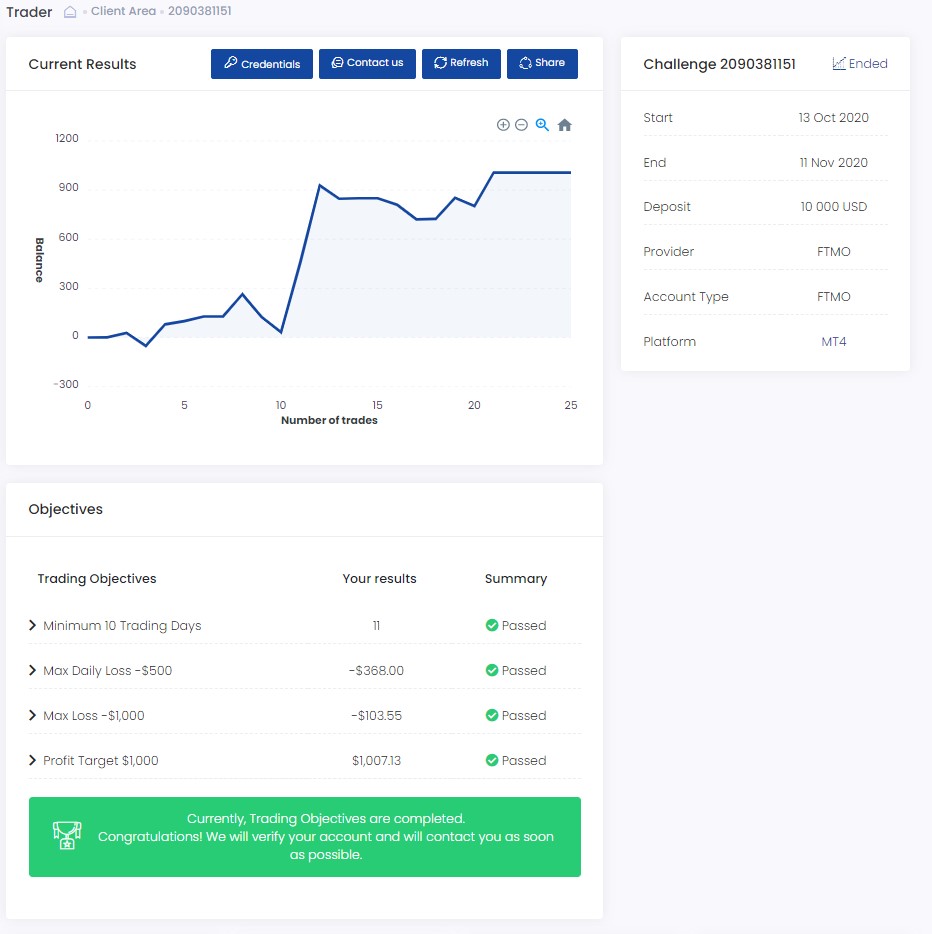

I faced a very bad week in FTMO Challenge Step 2. but I know my strategy and I had a plan to recover that. I always try to follow FTMO objectives which make me a better trader I think. Following all objectives was very difficult BUT if anyone can follow all objectives properly he/she will be a better trader for the future.

How did Maximum loss limits affect your trading style?

Maximum loss limits did not affect me cuz I placed all trades with proper lot size which I can effort. I think max daily loss/max loss limit teach me something really different which I did not get before FTMO. thanks for that.

What was the hardest obstacle on your trading journey?

Follow max daily loss limit. cuz I had a bad week, where I nearly close to a max daily loss. but if anyone does not do overtrade or big lot size, it will be ok for them.

How did you eliminate the factor of luck in your trading?

Luck is not a trading strategy. someone can win some trade with luck. but this is not a proper approach for a trading career. so from my beginning, I did not depend on my luck.

What is the number one advice you would give to a new trader?

1. need to know about trading properly by yourself 2. follow your strategy 3. do not get excited or emotional 4. trade in your zone 5. always try to know something new 6. understand the market properly 7. do not follow what others people are doing, always follow the market in your way 8. think for a long time

Trader Ayman - "The jump in skill and mindset between evaluation and verification was incredible and I now feel like I am in control of my trading."

Where have you learnt about FTMO?

A mentor of mine had been through the process and recommended it.

Do you have a trading plan in place, and do you follow it strictly?

Yes, I do. My plan is based on something called smart money concepts; Low risk-High reward trading. A deep understanding of Wyckoff's theory, structure, and supply/demand enabled me to develop a plan that can consistently deliver It required extremely strict risk management and a lot of patience.

Has your psychology ever affected your trading plan?

Yes, it was definitely affected. FTMO was a whole different level from trading live or demo. The social pressure of your peers and family who are doubting you as well as the money on the line creates a different environment. My own Dad even said I would never make £100 from trading. Lol. It's important to regulate fear and greed and remember that the markets are not going to go your way just because you want them to. If you are aware of the psychological challenge when you go in, then you've cleared the first hurdle

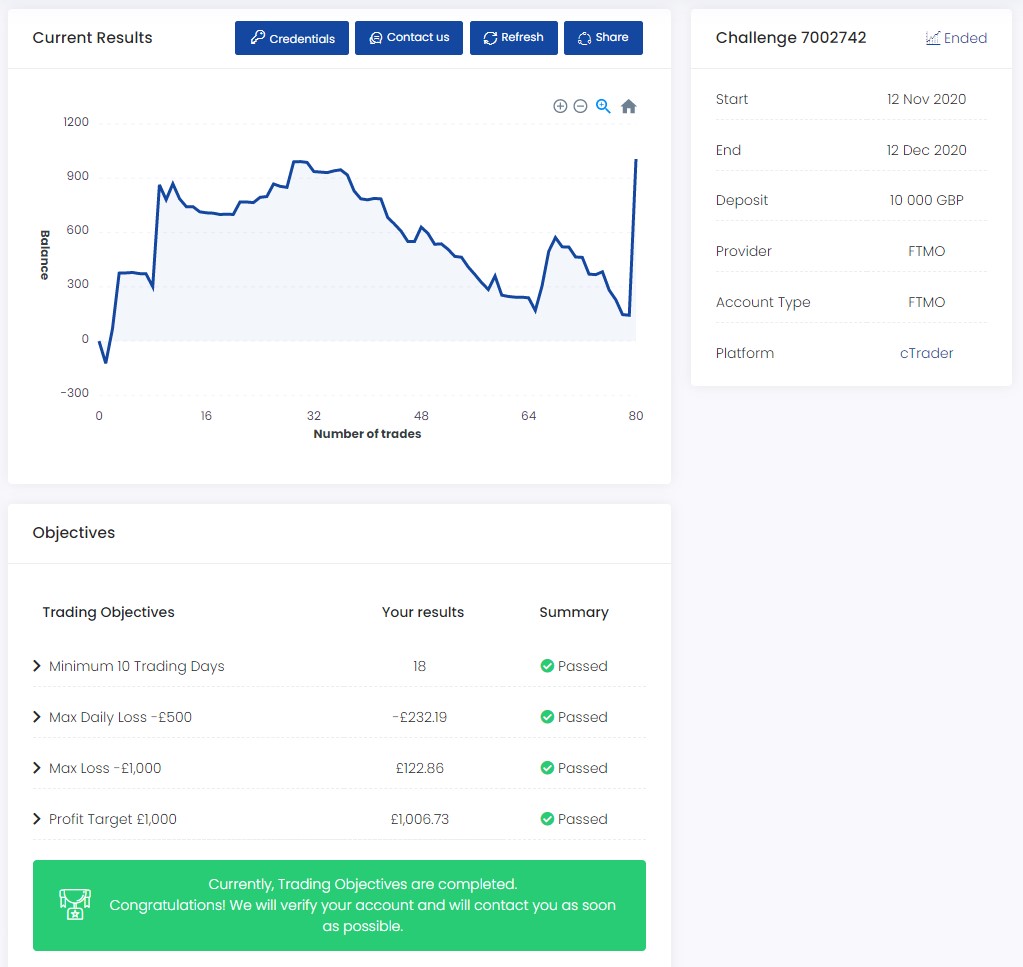

What was the hardest obstacle on your trading journey?

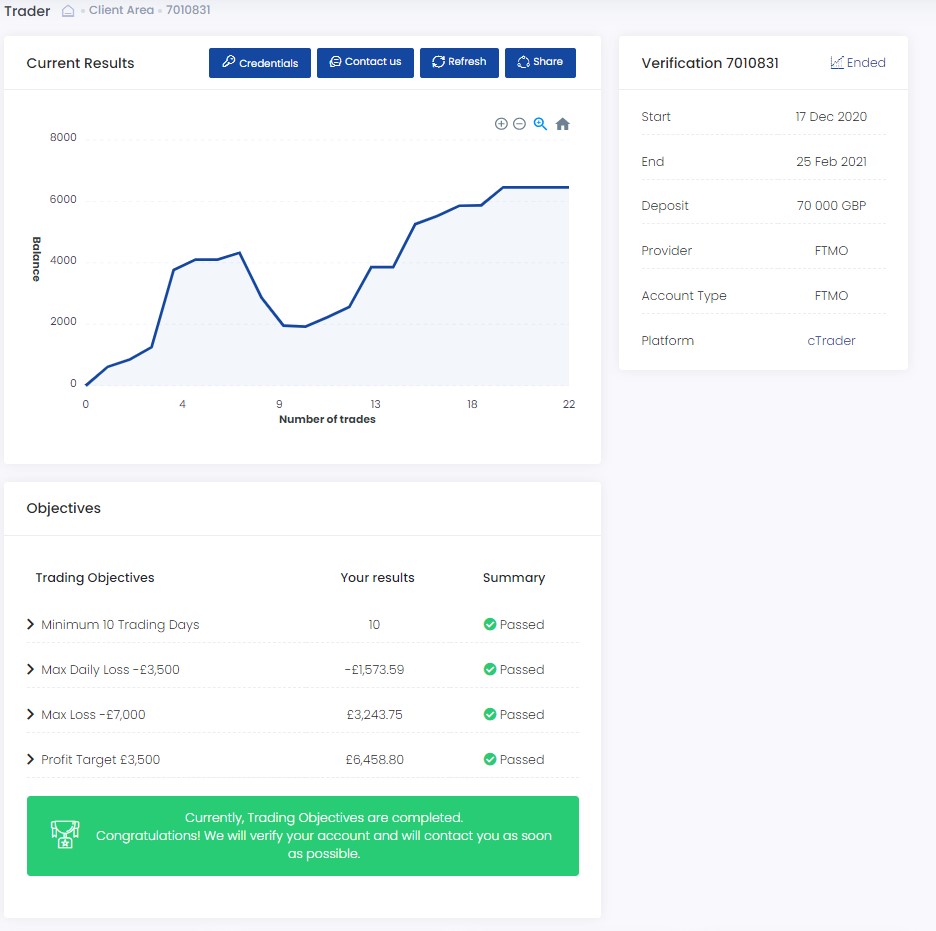

Probably mid evaluation, I went from 9.92% to 1.7%. I was so annoyed, and while I maintained risk management my entry criteria were probably loosened as I was desperate to finish. However, at this point, I went into overdrive, spent days and nights backtesting, and refined and improved my plan. within a few days, it was done.

How would you rate your experience with FTMO?

An incredible learning experience. the jump in skill and mindset between evaluation and verification was incredible and I now feel like I am in control of my trading. FTMO themselves were pretty helpful, good customer service, and decent enough spreads. I'd advise avoiding crypto for now though.

One piece of advice for people starting the FTMO Challenge now.

Make sure your plan works and you know it can do 10%. At this point, just trade your plan as normal. Keep a cool head. Adjust your risk if necessary to fit the drawdown criteria but enjoy the process and go in willing to learn! I had only been trading this strategy for a few weeks before I took my FTMO but I was confident in my abilities and therefore I was able to see it through, despite my lack of experience.

Trader Sven - "The key for long term success is to always monitor your winning strategies for changes in performance."

What was the hardest obstacle on your trading journey?

The hardest obstacle for me was finding a strategy that I could follow confidently even through bad days.. I often found myself abandoning strategies before they had a chance to shine.

Do you have a trading plan in place, and do you follow it strictly?

Yes, and I log all of my trades in an excel sheet and reflect daily on the results to see if I followed the plan properly. I've found that following a trading plan in a flippant manner not only causes you to lose money but more importantly you won't even know if the plan is any good or not!

Describe your best trade.

I don't have a single best trade, as my trading plan is quite boring.. it's always a great feeling to win all of my trades for the day, however.

How did Maximum loss limits affect your trading style?

I adopted a mentality that a maximum loss limit essentially cuts your effective capital by that amount; a 10% drawdown limit on a $100,000 account should have a trading risk equal to that of a $10,000 account with no drawdown limit. That changes my mentality sufficiently to calculate a safe level of risk in my trading.

What do you think is the key for long term success in trading?

The key to long-term success is to always monitor your winning strategies for changes in performance. You must also continually learn and apply new strategies to add robustness to your trading in case of changing market conditions.

What would you like to say to other traders that are attempting the FTMO Challenge?

Risk management is key. You can always retry the challenge for free if you do not hit the profit target, but it's game over if you have a string of bad trades that are too large of a lot size for your trading plan. Calculate the risk first, then place the trade. Make sure that you have insulated yourself properly from a bad trading day or week because they will happen at some point.

Trader Nicolas - "The market does not respond to the emotions you are feeling that day whether they be positive or negative so it is critical to try your best to just remove emotions completely and be robot-like."

Do you have a trading plan in place, and do you follow it strictly?

Yes, I have created a strict trading plan in order to achieve my goal of stress-free trading. I trade the NY session Monday-Friday from 7 am-12 pm and only placing trades usually no earlier than 8 am.

It took me a long time to develop a trading plan that I could stick to consistently and have success with. I do not deviate from this plan ever but am always trying new things and backtesting to see if there is anything to improve which there always is. I try not to set a certain dollar amount goal because I do not want to limit myself to making a certain amount. I want to maximize my capabilities without factoring in greed as much as possible.

How did you eliminate the factor of luck in your trading?

Along with what I said above in regards to my trading plan, I eliminate luck as best I can by using good risk management. At the end of the day, it is somewhat lucky that you are making money because I've learned anything can happen. It's just a matter of managing your risk and realizing you can't win every single trade so it is very important to not overleverage your account so when you do get that red trade, it is a small loss of maybe 1-3%, depending on my risk appetite is in correlation to account size. I learned as well that you are not going to get rich off of one trade so there is no reason to risk a large percentage of your account.

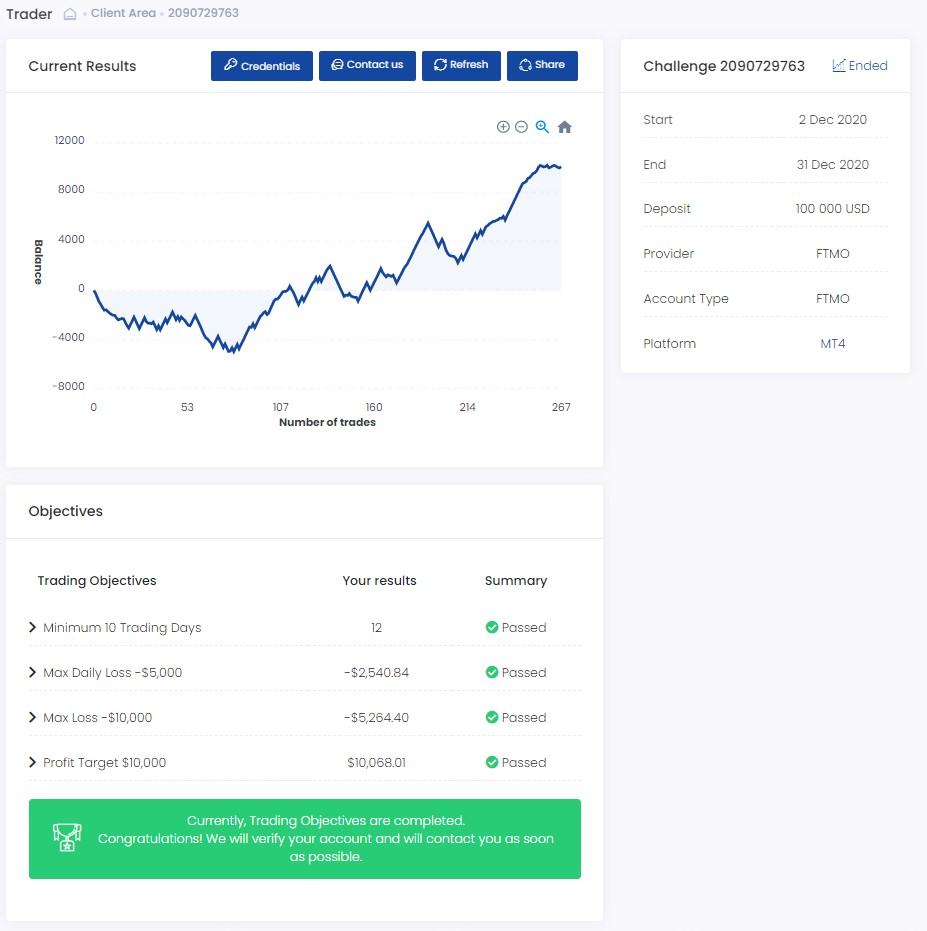

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

I think the most difficult part of the challenge was when I was $50 away from completing the challenge and I took a $200 loss. I was pretty bummed because I was so close but I ended up finishing the challenge a couple of days after that. I think the most important part was that first trade and really trying to start the account off in the blue to give you that courage for the rest of the challenge. I feel the verification is not too hard because you already have so much confidence from completing the challenge.

How did you manage your emotions when you were in a losing trade?

I just kept my cool because I use the proper risk management and I know I just need at least about a 50% win rate to be profitable. I'm not worried about losing trade because I know I will make it back.

What do you think is the key for long term success in trading?

I think there are a lot of factors that play into your success in forex. The main things I would have to say are risk management, no greed, and realizing these markets do not care about your bills or anything of that sort. The market does not respond to the emotions you are feeling that day whether they be positive or negative so it is critical to try your best to just remove emotions completely and be robot-like.

One piece of advice for people starting the FTMO Challenge now.

The only piece of advice I have for people starting the challenge is don't give up. If you fail the first time try again, and again, and again until you get what you came for because it will all be worth it and the knowledge you will receive from failing or winning will make you a great trader.

Trader Mohammad - "Apply the right strategy and right rules and anybody can achieve it."

Has your psychology ever affected your trading plan?

Yes, constantly it is a battle especially as I am not a pure price action trader and do consider fundamentals.

However, I have a rigid trading plan and execute it if it meets my rules and set up. Impatience has also been an issue whereby I lost out on 100s of pips simply by not trusting myself and exiting too early -however it’s been a massive lesson learned during this challenge and the improvement made as a result of being PATIENT AND TRUSTING MY STRATEGY-

What was easier than expected during the FTMO Challenge or Verification?

I think I was lucky as there was so much volatility during the last few months and that can either fluster you or bring out the best from you and I feel that I thrived with the volatility as it also provided so many opportunities and fitted my strategy quite well. My confidence grew during these times and I stopped getting worried about what the markets would be like and instead get excited about the opportunities that I would get to apply my strategy...positive outlook improved so much and also spent less time wondering what if I did this or did not do this, I was able to get over bad decisions quickly but by learning from them such as revenge trading etc...

How would you rate your experience with FTMO?

Fantastic experience, there is nothing I could whinge about, everything worked as expected even though sometimes the usual connection issue but which is out of your hand. Whenever I emailed support I always got a prompt reply with positive support...so far my experience has been brilliant.

Do you plan to take another FTMO Challenge to manage even bigger capital?

Yes, my plan is to start trading for a couple of weeks on my 1st funded account and then in feb to take another challenge and if successful to take a 3rd challenge and hopefully have them by the end of the first quarter of 2021....I’ll be going for capital growth mainly and keeping much of my profit within the funded account as well as any scaling that I will get subject to the performance of course. The refund that I will get for this completed challenge will pay for the next challenge and so on.

Where have you learnt about FTMO?

A fantastic company giving the likes of me a fantastic opportunity to trade with clout in the financial markets. There are hidden talents out there that only need that chance that platform to show what they can do. I’ve been fascinated by the markets since I was 16 and remember well when George Soros broke the Bank of England and that has been what kick-started my interest. I have had numerous shots at trading using a personal account but not the leverage or capital to make it successful. Partly because I never took it that’s serious with a professional mind to it and did not even have a trading plan or strategy. FTMO gives the environment and rules that allow for safe and proper capital management. Apply the right strategy and right rules and anybody can achieve it.

What is the number one advice you would give to a new trader?

Please please keep it simple 1. Have a trading plan as simple as it gets and make sure you’ve applied it and tweaked it and it works in the sense it does generate profits. Set rules for entry and exit. 2. Risk management-key part of trading. Trading is not just about making money but also managing Croatian to avoid erosion. Use stop loss properly as a newbie. 3. Execute the trading plan and apply the rules irrespective of your own mindset. If your strategy works then trust it and stick by your own devised rules. Do not let your mindset influence your decisions, your strategy should do that. You will experience fear of missing out or fear of losing, panic and lack of patience but try to distract yourself rather than looking at your charts all for the time-as long your SL and TP is set. 4. Record your trades and the emotions behind it-I’ve not done it enough myself but I reflect a lot about my trading journey where I went wrong or missed out and immediately change my practice on the next opportunity. 5. Review those trades that went well and stick with what worked and take out those bits that did not go well. Most of the time it will be the mindset and psychology that would be at fault. Get rid of any ego type thoughts or materialistic thoughts-it creates a risky mindset and tries to rush you through your journey. 6. Most importantly to it mindset, you have to believe in yourself your strategy and your desire to make it. Always try to see the bigger picture of you achieving and making it as a trader. But don’t equate success to lots of money-take a step at a time and grow yourself grow your confidence in the trading business and gradually everything will fall into place- your sole aim should be a consistent and profitable future and the rest will follow.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.