New week, new FTMO Traders

Every Wednesday, we bring you new interviews with FTMO Traders. Read their stories and inspire yourself by learning from their experiences.

Trader Mohammed shares valuable information

Describe your best trade.

My best trade so far has been EJ long. We had a nice push down and then formed a very clean desc nature (or channel), broke out and I entered on the break. I managed this trade by trailing my SL behind the most recent lows and got taken out after 5 days for 11.87%. It was an amazing trade for me and this was the trade that passed me the Challenge!

What was more difficult than expected during your Challenge or Verification?

It was a bit more difficult for me to stick to my plan as I felt more pressure to hit the 10% profit target within the 30 days and as soon as I had placed my 1st trade, I could already feel the clock ticking down in my head (this wasn't helping at all). I knew that I would feel more pressure and emotions than I usually felt with trading on my own account but I didn't expect these emotions to be magnified as much as they were during my Challenge. For the Cerification, there wasn't anything that I thought turned out more difficult than I had expected.

What was the hardest obstacle on your trading journey?

The toughest part of my trading journey so far was staying resilient when the self-doubt started to creep into my mind. At times I'd question whether trading would work out for me over the last 2 years and even if I was profitable, where would I get capital from to be able to make a living and potentially even a killing from trading. So these questions would pop up from time to time and I'd tell myself that anybody would be willing to give you money if you could show consistent returns so that's what I worked on and kept on striving at.

How does your risk management plan look like?

I risk 1% per trade per pair. I trade 3 pairs so I'd have a 3% risk on the table max at any 1 time.

How does passing the Challenge and Verification changed your life?

Well, now I've got capital that will allow me to make a very nice living off of trading and will also allow me to work on other projects that may interest me in the future. It's now providing me with the opportunity to go and obtain my own financial freedom for me and my family.

What would you like to say to other traders that are attempting the Challenge?

I'd advise them on keeping an emotional journal and write in there all the things that have happened on each day, how this has made them feel and add any trades they've taken that day including how they were feeling at the time of the trade too. Also, stick to your trading plan, you've backtested this thoroughly and so you should have absolute confidence in executing your plan. These were the 2 things that worked really well for me.

Trader Steve gives great tips for new traders

What do you think is the most important characteristic/attribute to become a profitable trader?

I believe the most important characteristic is money management. To be a profitable trader over the long term, it is important to have strict money management

How would you rate your experience with FTMO?

I'm really happy to have participated in the FTMO experience. This allowed me to evolve and learn very quickly by correcting several of my mistakes such as money management and my decision-making while not taking my emotions into account.

How did you manage your emotions when you were in a losing trade?

I take the time to check several things in order to validate my position again. Like technical analysis, fundamental analysis and looking on the internet for other people's opinions on a currency pair in order to make a decision whether to continue with my position or not. I believe that having multiple confirmations is very important in enhancing the likelihood of having a winning position.

What was easier than expected during the Challenge or Verification?

The easiest way is not to reach the maximum daily loss and the maximum loss because if you have strict money management and you position your stop loss on each trade, you will never be able to violate the rules for permitted losses.

What inspires you to pursue trading?

When trading is your passion, you will definitely want to keep trading. My goal is to be able to live from trading with FTMO and to have the 3 certificates

What would you like to say to other traders that are attempting the Challenge?

I started trading and wanted to learn when I was 18. In the beginning, I was a bit like everyone else, no experience and the ultimate desire to make a lot of money.

Unfortunately, I quickly realized that trading can negatively change your life if you have no experience. When I was 19, I made the mistake of borrowing from the bank and using my credit card to the max by trading which in the end made me lose a lot of money because I don't know really about the trading and the money management.

For several years I was close to falling because all I earned with my salary, 95% left to repay my debts.

Despite this, I have always continued to want to learn more and more in trading especially since it is a passion for me.

Correct my mistakes, and save as much as I can to start trading again. It was then after a few years of training that I got to know FTMO. For me, FTMO is the opportunity to be able to live from my passion. Even if I failed the exams 3 times before, I always started over because I told myself that one day, by correcting and learning from my mistakes, that I will pass the FTMO exam and that's it. Never give up on your dreams, after the rain comes the good weather.

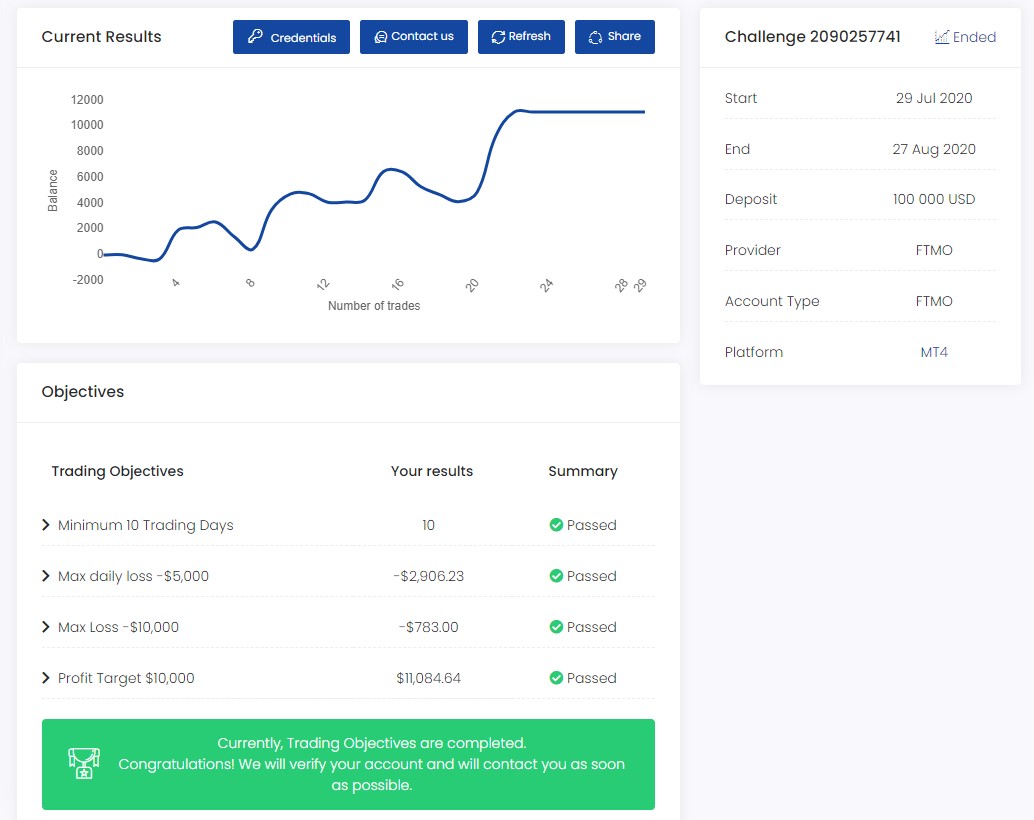

Trader Rohan on how FTMO rules helped his performance

How did Maximum loss limits affect your trading style?

I found that having the maximum loss limits impacted my trading style in the beginning. I never had set loss targets before. But having these loss limits, improved my trading MASSIVELY because I felt that I don't over trade as much now, since we all know it is one of the worst things a trader can do. Plus, now I am more accepting of my losses and I chose to fight another day if things are not going as per my plan.

What do you think is the key for long term success in trading?

Two things - patience and avoid revenge trading. I am a strong believer in not trading when the market does not offer any trading opportunities, as per my strategy. Also, if you lose a trade or two, it is okay. Have faith in your strategy and live to fight another day.

Describe your best trade.

My best trade was going long on GBPUSD. Followed basic trading concepts of price action and bought when the price started bouncing off the previous support level. Little did I know that it was the start of a massive uptrend and I just trailed my SL to a 7:1 RR trade, until the SL was hit.

What was more difficult than expected during your Challenge or Verification?

Waiting for the right setups if the market is not favourable for your trading style.

How did you eliminate the factor of luck in your trading?

I cannot stress this enough but believe in your system/strategy and wait for the right setups. I try not to be greedy.

What would you like to say to other traders that are attempting the Challenge?

Definitely, practise on the Free Trial provided by FTMO. Maybe even try it twice just to be sure of your trading style, before you start the Challenge.

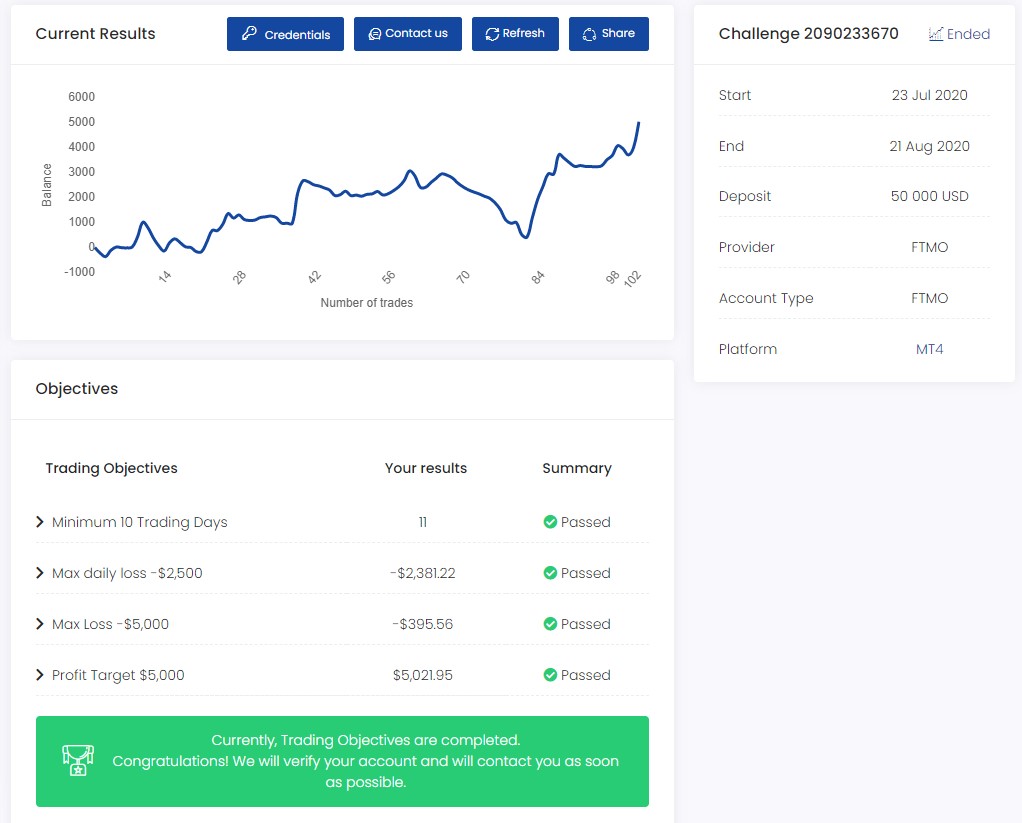

How did trader Dmytro deal with overtrading and revenge trading?

Do you plan to take another FTMO Challenge to manage even bigger capital?

Yes, however, I want to first utilize the account I have to withdraw profits from the market.

How would you rate your experience with FTMO?

Great!! Amazing!! I Especially love the customer support, they always come thru.

How did you eliminate the factor of luck in your trading?

Trade according to your strategy. Although not going to lie I did get lucky at times. However, if a trade does go against me I do have an exit strategy.

Describe your best trade.

EUR/AUD price dipped into a daily level that I was monitoring in the Asian session, I loaded up on Longs before London Session and waited patiently for the price to continue its bullish run from that level.

What was the most difficult during your Challenge or Verification and how did you overcome it?

Over-Trading, Jumping back into trades after loss, Revenge Trading. One Big Position Ruined 2 weeks of hard work. I overcame this by learning to discipline myself how to walk away from the chart, usually having a personal journal/notebook where you can write your thoughts or ideas helps a lot.

What would you like to say to other traders that are attempting the Challenge?

Don't Marry The Trade! Take what the market is giving you. If you're up to $300 in the Asian Session take it off the table. There will be new opportunities in the London Session. If you're up $700 in the London Session take it off the table. There will be new opportunities in the NY Session. If you're up to $450 in the NY Session take it off the table, there will be new opportunities next day. If you think about it now you're up to $1,450 just because you decided to take profits off the table.

Trading Jonathan about his trading journey

Do you have a trading plan in place, and do you follow it strictly?

Yes very much so. I have developed my style & trading plan over the last 3 years through lots of trial & error. I have found which currency pairs & markets work best for me & I now focus solely on the combinations of £, $, € & ¥ as well as the S&P 500. These 7 markets give me a consistent level of trading opportunities & so I can wait for the very best setups whilst also being fairly active.

What inspires you to pursue trading?

I have always had a passion for numbers & mathematics since I was young & the Challenge of trading & becoming a successful trader always I’m fascinated me.

Has your psychology ever affected your trading plan?

Without a doubt yes. One of the hardest things to get right I think is your mindset. Emotions play such a big part & so once you have mastered your mindset & developed a level headed professional approach then you are halfway there!

What do you think is the key for long term success in trading?

Discipline & patience. Once you have developed your own style & have a profitable strategy in place, your only job is to execute well & let your edge play out. Every time you get into a trade too early, too late, mid-size a position or take profits too early then you are reducing your edge.

How did you manage your emotions when you were in a losing trade?

I think it’s important to leave emotion at the door. As I always think about trades as a percentage of my overall bank rather than a dollar amount it is far easier to stick to your risk management plan as overtime when the dollar amounts grow, the percentage is still just 1% for example & so it is more comfortable & relaxed way to keep your level head & emotions in check.

What would you like to say to other traders that are attempting the Challenge?

Make sure you are ready! Don’t jump into the Challenge on a whim hoping to have a good month or so & pass the Challenge. Unless you have a proven edge & strategy that you know works for you long term you are likely to be unsuccessful. There is no rush & as the saying goes “the market will always move money from the impatient trader to the patient trader every time”

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.