New FTMO Traders answer our questions

Welcome to the new interview with our latest FTMO Traders who passed the entire evaluation process to get our initial balance. They share useful tips and tricks that helped them in their trading and much more!

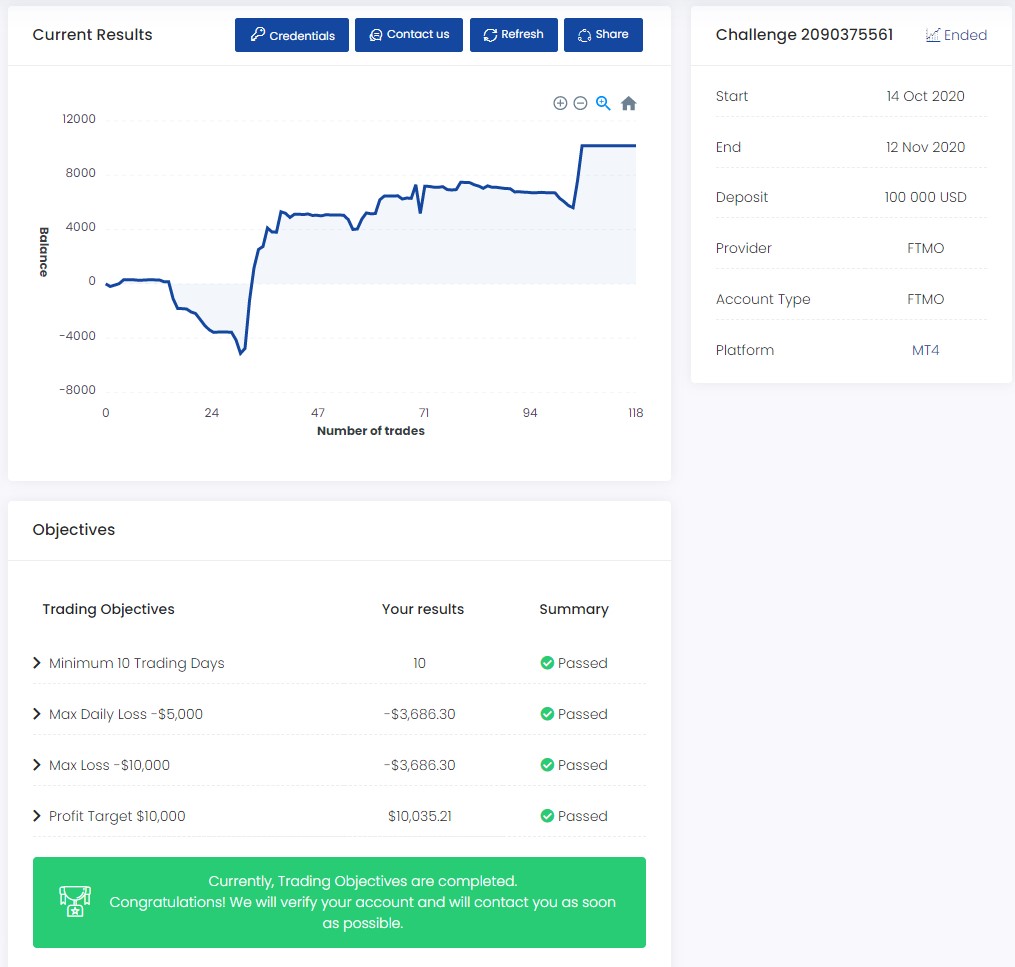

Trader David - Max loss limits made me a lot of a better trader

How did you eliminate the factor of luck in your trading?

Simple, Risk management, and Psychology.

In my psychology, I think in terms of probabilities how Mark Douglas teaches in his book Trading in the Zone.

It's important to also note you're never promised the next trade but you are promised how much your willing to lose every time.

With the mindset out of the way, the main key that makes me confident is my Risk Management.

If you know you have a 0% risk of ruin you trade more and more confidently.

To get that 0% risk of ruin you need to implement fail-proof risk management that will allow a lot of consecutive losses (8) if you had the worst-case scenario and hit a bad patch of trades.

I like to use the 2-1-1/2 rule

What do you think is the key for long-term success in trading?

Definitely looking at the long term picture. It's an oxymoron that people want to make fast profits quickly, yet the quickest profits you can ever make happen down the road when you compound your account. Compounding = Time x Consistency. So it's about the long-term consistency that will compound big gains, not the next trade.

How did Maximum loss limits affect your trading style?

Made me a lot of a better trader, before if I was a little more flexible that will not pass with FTMO so I had to really force myself in the nitty-gritty and have all my ducks lined up in a row.

How does your risk management plan look like?

2% / 1% / .5% Rule: You can risk 2% until you lose, then you drop to 1% risk until you made back at least (1/2) of your 2% loss. If you made (1/2) of your loss back you can go back to 2%. If you lost again at 1% you drop down to .5% and stay at .5% until you make back your loss. This way it dramatically reduces your drawdown curve and is one of my secret strategies. With FTMO I use more like 1% / .50% / .25% because of the max daily limits rules

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

MY psychology for sure. Just getting familiar with bigger numbers, I had to take a day off and rewrite my trading plan to the T. To include all the FTMO rules and have 0% risk of ruin by following my Plan / Risk management to the T

One piece of advice for people starting the FTMO Challenge now.

Risk management is really the secret sauce. Do enough trials where you know you can't lose because you risking so little. You can always size up and use your normal risk when you get funded and have some cushion in your account.

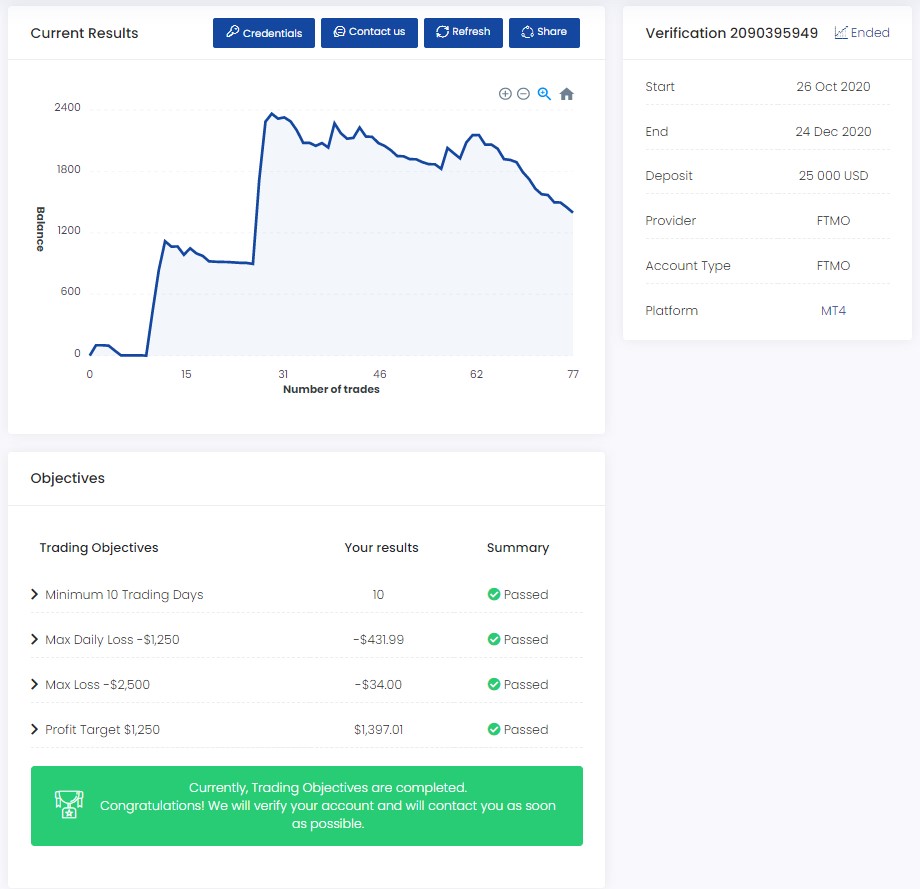

Trader Ahmad - the word 'luck' does not exist in my trading principles

What was the hardest obstacle on your trading journey?

I believe trading is 80% psychology & 20% skills.

Hence, the hardest obstacle that I have to constantly work on myself throughout my trading journey is my psychology.

I believe I have the knowledge & skills to trade but alongside my psychology, it will always be a work in progress. Therefore, trading has become more like a lifestyle to me than just a hobby. And now I am on my way to become a full-time trader.

Do you plan to take another FTMO Challenge to manage even bigger capital?

Yes definitely! I love challenges & of course with bigger capital comes with bigger responsibility. It allows me to evolve exponentially in all aspects. I'm grateful that I've been awarded this opportunity to be able to trade on behalf of FTMO alongside other traders and of course for great profit sharing too. I'm really looking forward to grow with FTMO.

How did you eliminate the factor of luck in your trading?

I have my 10 trading principles written down in front of me.

It's just my way of nurturing that discipline within me and so as to remind me every time before I start the day to trade.

I'd also love to share with you guys:

- Do not chase the market

- Patience pays

- Execute based on plan & rules

- Let the market come to you

- Patterns work but not you

- Be emotionless, be hopeless

- Set profit targets: Daily > Monthly > Yearly

- Journal your trades & revise

- Keep it simple

- Be strict!

Follow all the above to become successful. So, I believe the word 'luck' does not exist in my trading principles. And I'm very grateful it pans out that way too :)

What do you think is the key for long term success in trading?

On top of my trading principles, I also do have a simple set of day trade & intraday trading plans layout.

So every time I'm about to place a trade, I ensure I check all boxes are tick first. So in essence, I believe the key for long term success in trading is to be able to consistently focus and follow your trading plans, trust your system after you back-tests it again and again. And most importantly to detach yourself from the market.

Focus. Consistency. Profits. Repeat. And I believe that is where I am now in growing myself to become a more profitable trader.

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

I wouldn't say it is the most difficult because learning to get better at it with time. It's the time period window to achieve a certain amount, I think.

Probably because I'm not used to set a target in a period of time so the pressure I must say it is both exciting and fun too.

Also the fact that my trades are for medium to short term but with your challenges have pushed me harder to a limit that I will learn to ensure myself to become an intraday profitable trader much sooner. So with your Challenge & Verification stages, I believe I have improved well in terms of achieving the target in a shorter time period because now I have a target.

A lot more of improvements to come, I believe I'm a fast learner too. I didn't do well in my first trial

One piece of advice for people starting the FTMO Challenge now.

3 simple lines, I hope this will help 1. Focus on your trading system 2. Consistency = Discipline 3. Profits are your priority!

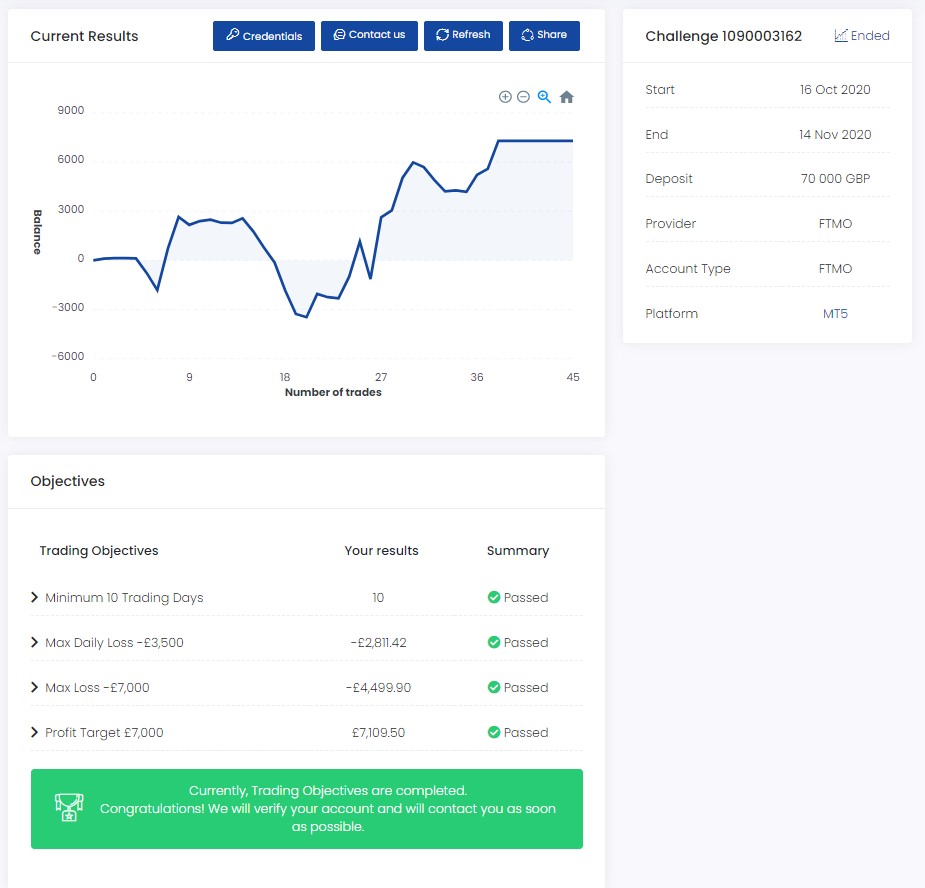

Trader Patrik - don't ever see mistakes or failure as a bad thing, channel it into positivity

How did you manage your emotions when you were in a losing trade?

Experience cannot be taught, it can however be acquired through building solid foundations, so what you'll find is that once these key foundations are built and practiced, a losing trade will no longer have a negative impact on your psychological state because you yourself are sticking to your trading plan which consists of accurate risk management. So whenever I enter a new trade, I am more than comfortable with the well-calculated risk that is at stake. For me, this is a 1% risk per trade.

How does your risk management plan look like?

I keep a close eye out for high impact news to avoid any sudden moves that can possibly get me taken out of a trade prematurely. I stick to high-quality setups that line up accordingly with many other confluences and keep my risk in percentages the same per trade.

Has your psychology ever affected your trading plan?

It used to, but with experience, you learn to control your emotions. Psychology is a strong sector and after all, we are all humans so it can try and get the better of us, however, if we keep a positive outlook, trust the process, and stay strong... everything will turn out alright.

What inspires you to pursue trading?

The burning passion and love that I hold within for the craft, the freedom it unlocks, and the lifestyle it provides. Wealth isn't just constructed of money, it's a multitude of different sectors, and I know that trading gives me the ability to work on all of them.

How does passing the FTMO Challenge and Verification changed your life?

For sure, I've always had a real passion for trading even during the thought early stages but now I can take my full-time trading to the next level with some crazy capital, it is for certain life-changing! And I've met some incredible friends for life along this journey.

One piece of advice for people starting the FTMO Challenge now.

Take your time, stay positive, and don't ever see mistakes or failure as a bad thing, channel it into positivity because they are after all a lesson in disguise.

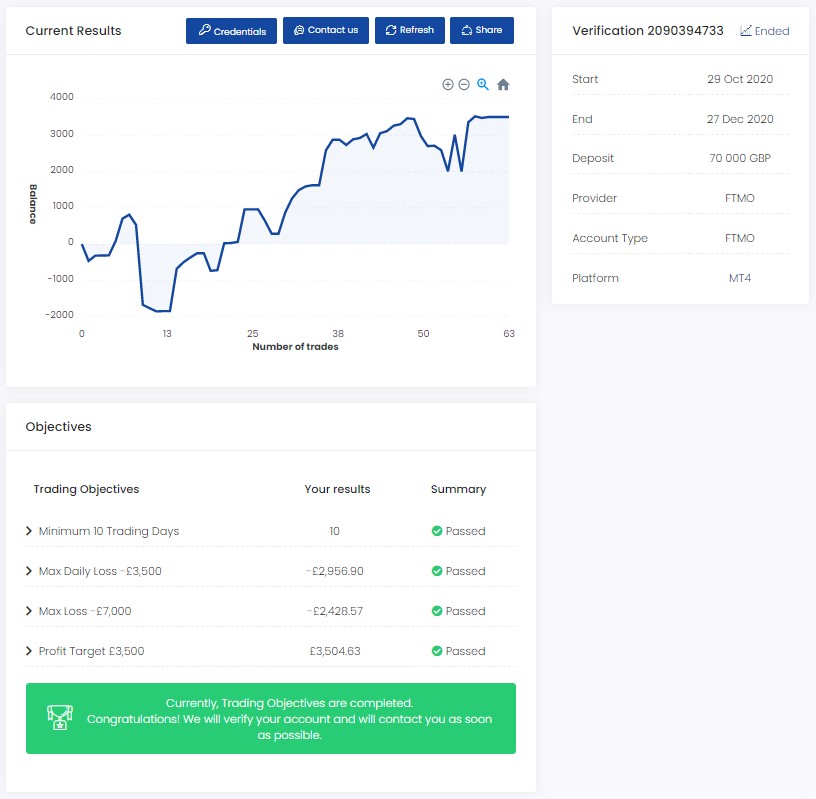

Trader Herby - use the Free Trial and practice

How did you eliminate the factor of luck in your trading?

Consistency

What was the hardest obstacle on your trading journey?

The hardest obstacle on my trading journey was the psychology aspect related to risk management. my analysis was always good but my risk management wasn't and so I had to work on that and I continue to work on that.

What do you think is the key to long-term success in trading?

Staying positive, being realistic with goals, risk management and knowing when to quit while you're ahead.

How did you manage your emotions when you were in a losing trade?

When in a losing trade, If I'm emotions are starting to become affected, I figure it's just best to leave the trade and wait a few hours/days. Sometimes I would put a stop loss too, this helps takes me out of trades that may have had a poor entry with minimal loss.

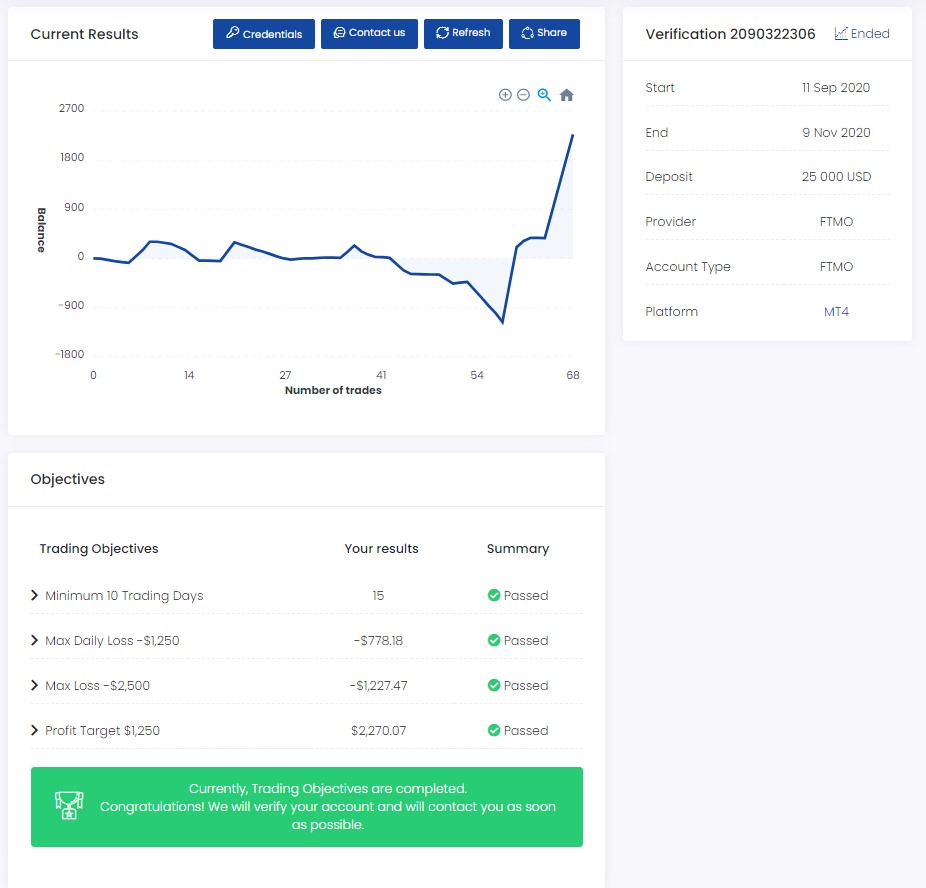

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

The most challenging part of the process was 5% and 10% restrictions. Though I believe that is what helps with me becoming a better trader because it forced me to actually wait for better trades and analyze the charts a different way for better entries.

One piece of advice for people starting the Challenge now.

Use the free trial and practice before actually paying to start the challenge. Make sure you have actually can trade and know at least the basics.

Trader Jordan - do not become too attached to a certain outcome

Do you have a trading plan in place, and do you follow it strictly?

Yes, I have a trading plan in place and I follow it very strictly.

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

The most difficult obstacle during my challenge/verification was staying focused and consistent while dealing with many changes. Since I started my FTMO journey I have had to adapt to many transitions, all while prioritizing my trading.

How did you manage your emotions when you were in a losing trade?

When trading, my go to strategy when it comes to managing emotions is to never be too attached to a certain outcome. Before I enter a trade I completely assume the risk, and become comfortable with either outcome. Everything is calculated and accounted for, which helps me stay grounded during the ups and downs of a trade.

Has your psychology ever affected your trading plan?

Yes, my psychology was probably the biggest downfall in my trading plan until recently.

There were times in the past where I had it all figured out, until I actually got into a trade and it didn't go perfectly.

This led to me closing too early, or causing myself unnecessary stress. Many times the trade ended up going in my favor and would have payed off if I would have detached my emotions and stuck to my trading plan. Sometimes my psychology even had me doubting trade set-ups that would have ended in a win.

What was the hardest obstacle on your trading journey?

The hardest obstacle in my trading journey has definitely been learning to keep my emotions and psychology under control. Trading is not the easiest skill in the world to learn, but it is not rocket science either. For traders, especially newer ones, it is very easy to let your mind and emotions get the best of you while watching your money fluctuate up and down. This proved to be my biggest obstacle during my trading journey, and one that I worked hard to overcome.

What would you like to say to other traders that are attempting the FTMO Challenge?

To any other traders that are attempting this challenge, I would like to say that the most important thing that you can do for yourself is to create a plan and stick to it diligently. You have your work cut out for you, and all you need is a plan in motion to succeed. Stick to what you know, and pick the challenge apart piece by piece. Do not become too attached to a certain outcome, assume the risk and live with it, and do not become a victim of fear of greed. Happy trading.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.