Editorial note: All responses are 100% organic and received from our new FTMO Traders during the contract signing process. All responders agreed to have their feedback published and all their answers are not being edited by FTMO, hence they can include grammatical mistakes or typos.

“Never ever give up, success is not a straight line”

Everyone knows that the road to long-term success is not always easy. In trading, it is even more complicated as markets often seem to be against us. That’s why risk management and money management are two of the most critical factors needed for long-term consistency and success.

Trader Oluwatobi: "Don't use signals. Hone your skills. It's worth it in the long run."

What was easier than expected during the FTMO Challenge or Verification?

The profit target for the verification stage.

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

Disciplining myself to stick to 0.25% to 1% exposure. I needed to deny myself of some opportunities to imbibe the culture of discipline. The solution was accountability and I have a trading mentor who goes through all my trades every day. The fact that I needed to defend my trades made me very accountable. And it is someone I respect so much who has handled huge accounts in the past. We also planned every week, what and how to trade. If we were looking for a "BUY" I would never take any sell opportunities that day or trade any pair, I did not plan to trade initially.

How did you manage your emotions when you were in a losing trade?

This borders much on psychology, science, and emotions. Psychology/Emotions - as always, I train my mind to accept the worst that could happen, and then I find it easy to overcome. More so, I manage and cut my losses and let it go. Conclusively, every good trader must be a professional loss manager - Michael J. Huddleston Science (empirical approach) - Using a RRR (risk to reward ratio) allows one to set the max loss per trade, you would then have nothing to fear. You know for a fact, if your RRR is 1:3, meaning out of 10 trades, you can lose 7 trades. You only need less than 3 trades to break-even. And except one is reckless, you should NOT lose 7 trades out of 10. Also, if you factor your daily floating drawdown of 5% and your maximum risk on all open positions is 1%, you know for a fact that you can never break the drawdown rule. So, a little math helps alleviate fear of loss. I am not perfect and may get emotional at times but these helped me a lot. Even on trades without SL> I was on the charts monitoring them.

Describe your best trade.

My best trade was not the one with the highest profit but the one that played out according to my pre-market session analysis and trade planning. I was able to accurately predict price action based on institutional market structure, several times back-to-back. It boosts my confidence and experience of the market.

What was more difficult than expected during your FTMO Challenge or Verification?

Hmm! Nothing really. As an index futures trader that came from a prop firm with 3% ($3,000) daily drawdown, this already favoured my trading approach to be able to find FTMO easier. So, my risk management and trading psychology was already configured to ace FTMO. And I think getting a positive RRR was a major challenge for me, and I never really knew how to calculate it. Even though I had a reasonably quite high win rate of 80% to 97% on several accounts.

What is the number one advice you would give to a new trader?

Be confident in your setups. Trust your setups!!! Forget trading biases proliferated online. This is assuming you already have what works well for you. Don't use signals. Hone your skills. It's worth it in the long run. Focus and have a plan. I have a solid roadmap to a $2m funded account and how to sustain in the long run. Don't go searching for any holy grail. Focus on a strategy that works for you.

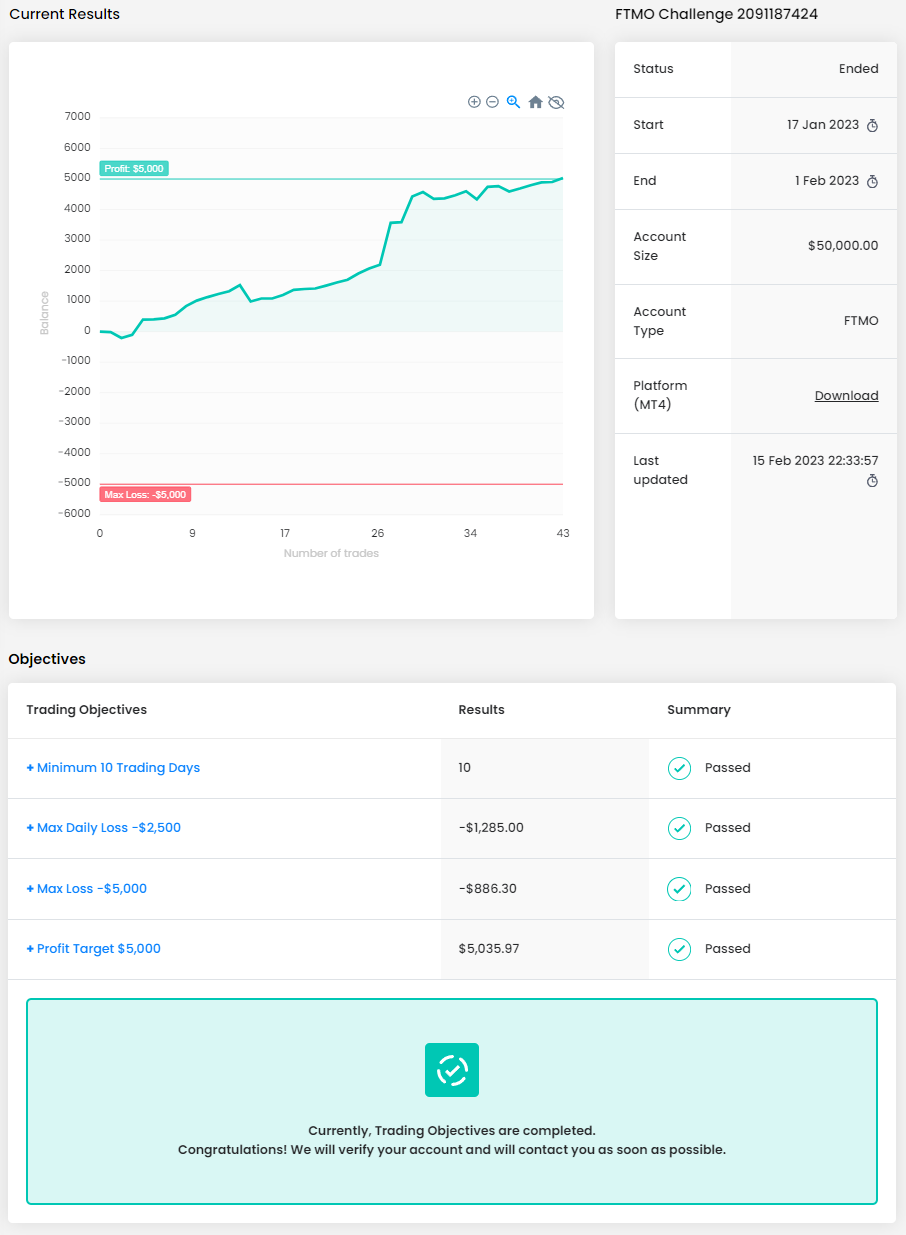

Trader Nima: "I always rather have small losses than lose it all."

Describe your best trade.

My best trades are usually the ones that I have full confidence in the direction of that trade based on my own factors, especially when the trend line is in my favour. I love trading when the volatility is high in the market as the majority of my trades take place during those times.

How did loss limits affect your trading style?

Maximum loss is a great tool that helps me realize how much I am able to trade in a particular setup and not go over that limit. I always make sure to keep those limits in my mind and follow them. It stopped me from big losses. I always rather have small losses than lose it all.

How has passing the FTMO Challenge and Verification changed your life?

I have to say I still have a lot to achieve, and this makes me get one step closer to my goals. I can say FTMO is a great opportunity to prove to yourself what you are capable of and to show that you are on the right track.

What does your risk management plan look like?

My risk management usually varies and is mostly based on what symbol I am trading, time of trading and volatility.

How did you manage your emotions when you were in a losing trade?

As we all know the psychological part of trading is the most important factor of any trade. I always try to set some rules for myself during a losing trade. Firstly, I keep my patience during the trade and remind myself that this is not my last trade and there can be another future trade with profits. Secondly, I do my best not to change my stop loss on trade as this can in some situations make that trade your last trade.

One piece of advice for people starting the FTMO Challenge now.

Never ever give up, success is not a straight line. Always keep educating yourself and learn from your mistakes so that they can become your strength for the next trade.

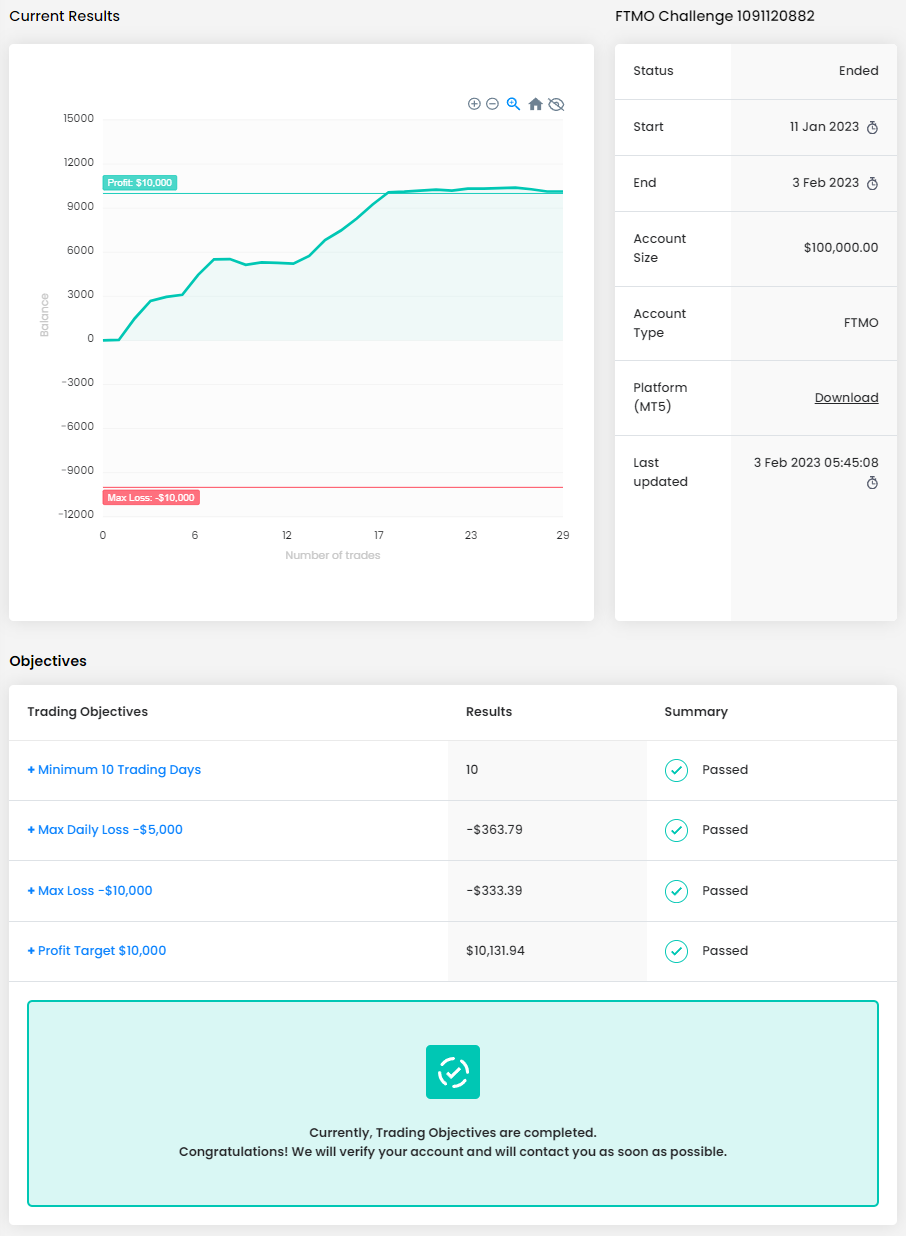

Trader Brandon: "Practice. Practice. Practice."

Describe your best trade.

My best trade was during the Verification when I traded TSLA on 2/8/2023. There was a small gap down at the open, and I was already anticipating a reversal based on my HTF analysis. Once the price delivered a swing low and broke the structure of that swing to the upside, I got long and earned 2R on that trade. Just beautiful price action.

What was more difficult than expected during your FTMO Challenge or Verification?

I think the hardest part about the FTMO Challenge is the time. Even though I believe traders who have a system with edge should have no problem completing the FTMO Challenge within the time constraints, mentally the time limit can influence bad trading decisions. Enough bad decisions can make the time limit a real issue.

What do you think is the key for long term success in trading?

Having an edge based system that includes no more than 2 or 3 key setups that show up frequently enough for the trader to easily be able to practice patience in those setups appearing. Also, knowing exactly where you're going to get in and out of every trade. Risking the same amount on every trade based on the initial funded amount, and consistently allowing your targets (Stop Loss and Take Profit) to hit. Your Take Profit should always be at least twice the size of your Stop Loss. Doing this day in and day out will build consistency.

Has your psychology ever affected your trading plan?

Of course! That's why I think it's important to have predetermined setups, predetermined risk, and predetermined rules for handling every scenario that can present itself when trading.

What do you think is the most important characteristic/attribute to become a profitable trader?

Resilience.

What is the number one advice you would give to a new trader?

Practice. Practice. Practice. You must practice your process in real time simulated markets.

Trader Samuel: "I would like to say it's a marathon not a sprint."

Do you plan to take another FTMO Challenge to manage even more capital?

Yes, I do, so that I can focus on risk management but make a better return.

What was easier than expected during the FTMO Challenge or Verification?

I thought initially when I heard about FTMO it was going to solve all my problems, but I realized even though it was a demo account it was still very challenging psychologically. But when I cut down the number of pairs I was focusing on and started to focus on one pair and control the risk I became more successful.

Has your psychology ever affected your trading plan?

In the past I was letting my losses run so I could fish with a win. But I've come a long way and have realized that doesn't work. Read a lot of trading books like "Trading in the Zone" and it has helped me become a sounder trader. Overall, I am confident and grateful for the opportunity I've been presented with so I will not take it for granted at all. I'm here to stay a long time so I can build a better relationship with FTMO overall.

What was more difficult than expected during your FTMO Challenge or Verification?

I think the idea of being funded was a big deal and I worked desperately to control that outcome. But overall, I realized the opportunity it presents which means I can be happy with 3% a month.

Describe your best trade.

My best trade is one I have analysed thoroughly. One that I expected to reach a certain zone before I entered. And one that overall gives me a better reward than risk. So, I feel like I've been confident with EURUSD.

What would you like to say to other traders that are attempting the FTMO Challenge?

I would like to say it's a marathon not a sprint. I hope they can take me as a lesson and learn from me. And just tell them to manage their risk and over a long period of time the odds will be in their favour.

__________

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.