“My Stop Loss is my peace zone”

The ability to tolerate losses is one of the most important skills any forex trader can have. A trader who cannot accept that some trades will occasionally end in a loss—predefined by a clearly set Stop Loss—cannot be successful in the long term. Our new FTMO Traders understand this well.

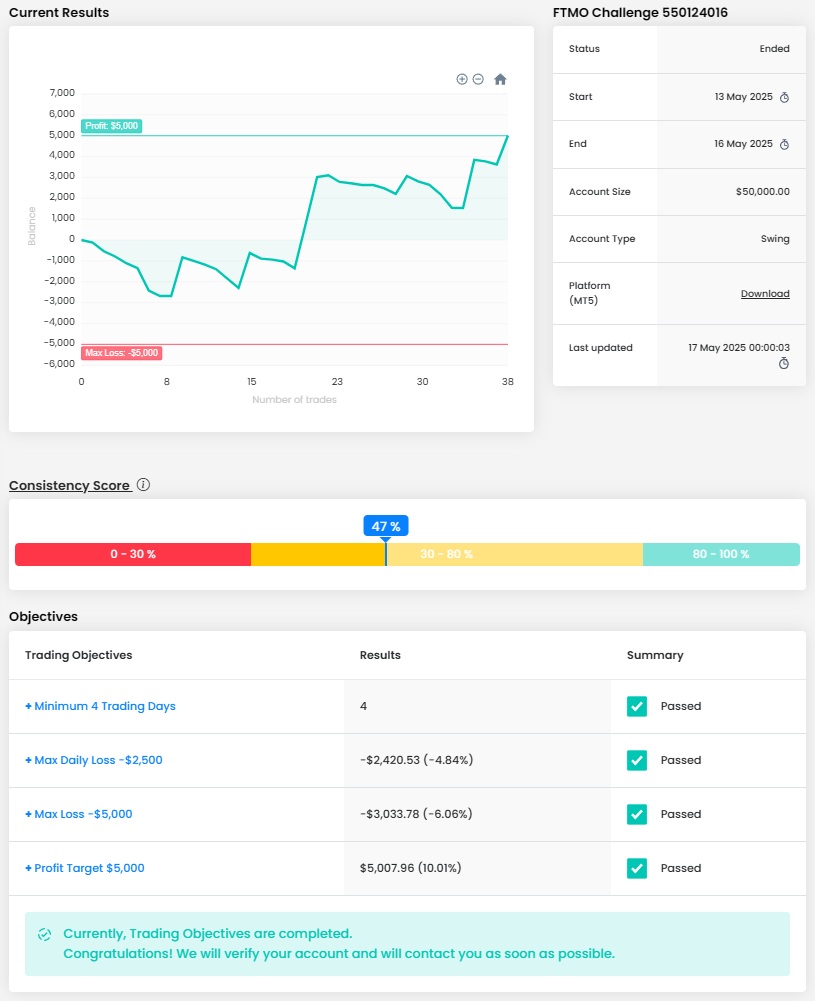

Trader Lee: “I reminded myself that losses are part of trading.”

What do you think is the key for long term success in trading?

The key to long-term success in trading is risk management, continuous learning, and adaptability. Keeping minimal drawdowns, evolving with market conditions, and refining strategies based on data and experience ensure sustainability in trading.

What inspires you to pursue trading?

Discipline and patience are the most important attributes. A profitable trader follows his strategy consistently, avoids impulsive decisions, and manages risk effectively. Emotional resilience is also key to handling both winning and losing streaks without deviating from the plan.

What does your risk management plan look like?

I focused on sticking to my trading plan and predefined risk management rules. I reminded myself that losses are part of trading and maintain a disciplined mindset. Taking a break, analysing the trade objectively, and avoiding revenge trading helped me stay in control emotionally.

How would you rate your experience with FTMO?

I would rate my experience with FTMO as excellent. The structured evaluation process and clear risk management guidelines have significantly improved my trading discipline and strategy execution

How did you manage your emotions when you were in a losing trade?

During losing trades, I focused on maintaining composure by sticking to my trading plan and risk management strategy. I reminded myself that losses are part of the trading journey and took time to reflect on what could be improved, using each loss as a learning opportunity.

One piece of advice for people starting the FTMO Challenge now.

Stay disciplined and follow your trading plan religiously. Consistency is the key to passing the challenge, so avoid impulsive trades and always keep risk management as your top priority.

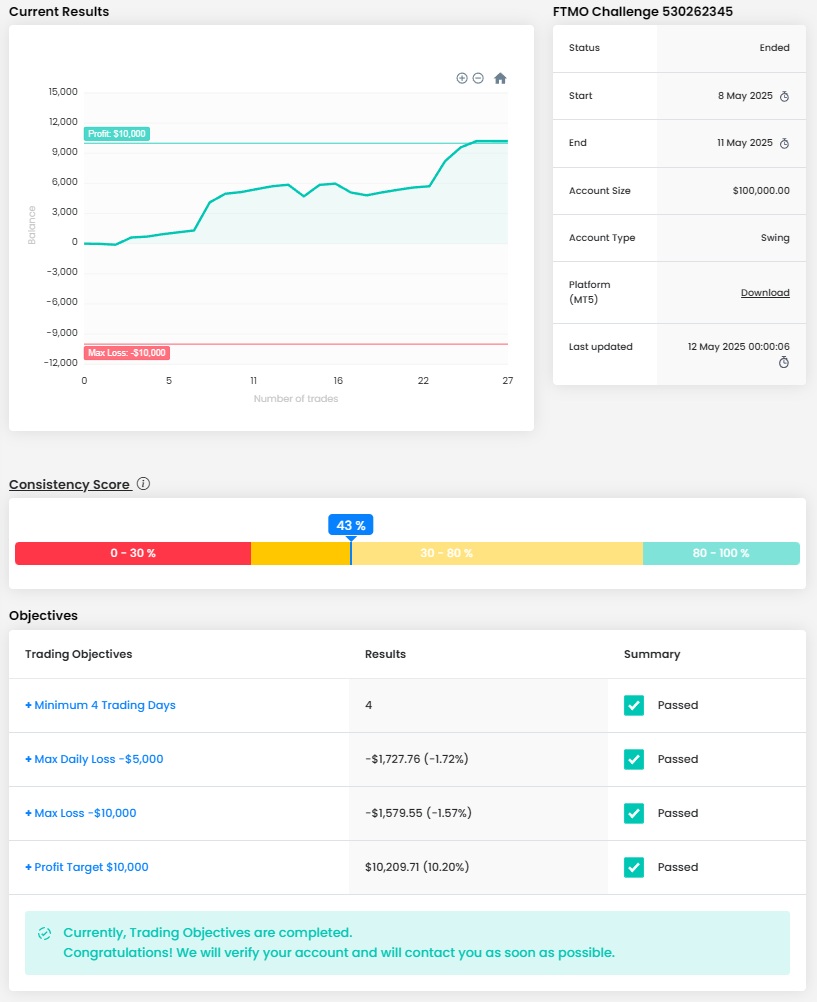

Trader Tan Jun Wei: “Even losing trade is a good trade.”

What inspires you to pursue trading?

At first it was the thought of financial freedom and being able to purchase something without having the stress over it. But slowly, I realized that trading is very tough and the ideology of it is beyond what I initially thought was. I lost money and was humbled. Yet I did not give up because I see a potential in this career. Hence, I kept trying.

How did you manage your emotions when you were in a losing trade?

Even losing trade is a good trade. I will tell myself that all trades that I took were valid and even if it ended in a loss, it’s still a good loss. Hence, my emotions would not be affected much.

How did you eliminate the factor of luck in your trading?

Trading is more than just luck. It’s about analysis, entering at the right time and conserving your capital when needed. I believe in strategic execution and do not require luck in trading. It’s skills that I need.

Describe your best trade.

My best trade was a swing trade of XAUUSD (GOLD), over 700 pips. It was a trade I held for 2-3 days, and the volume was insane. This trade made me realize that I should believe in my own analysis and shall not be emotionally affected by the result of the trade.

What do you think is the most important characteristic/attribute to becoming a profitable trader?

The discipline to be humble and learn. When I started my trading career, I was arrogant and unwilling to accept losses. I would take revenge on trade and chase back the losses that I made. This is psychologically affecting me and would affect my analysis on my trades. So, having the ability to accept loss is an attribute to becoming a profitable trader because you learn when you lose.

What is the number one advice you would give to a new trader?

Never go to a market looking for wins. Go to the market and look for precise opportunities.

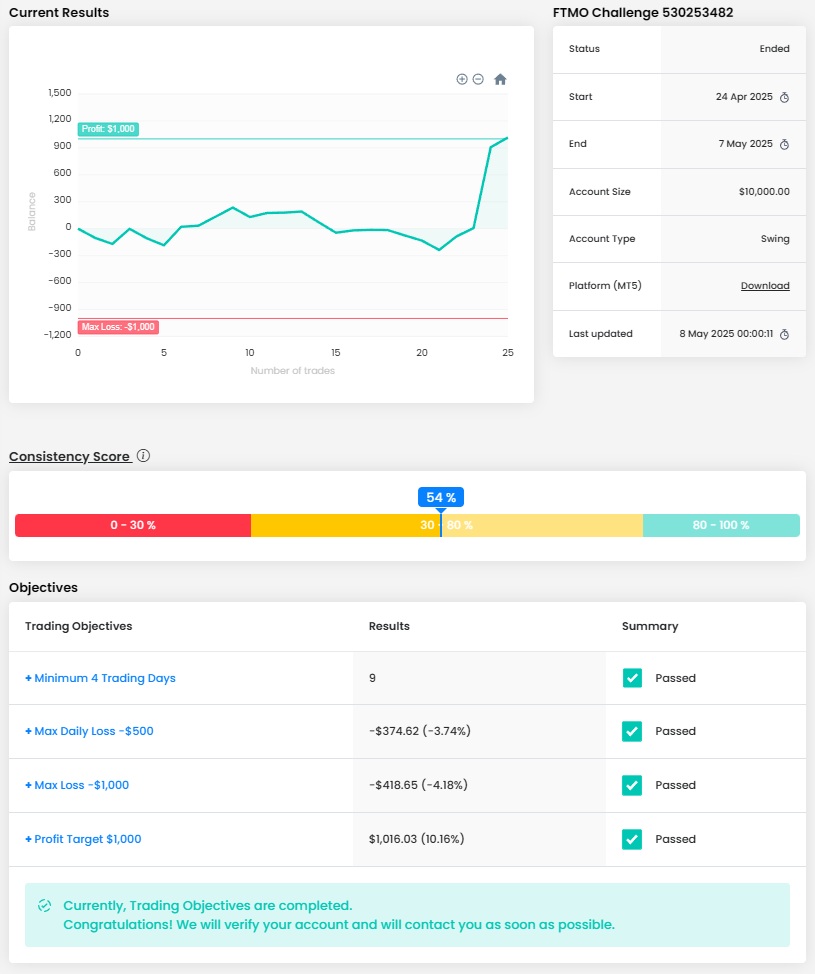

Trader Alang Yunior: “When I execute a trade, I accept what I risk.”

How did you manage your emotions when you were in a losing trade?

My stop loss is my peace zone. When I execute a trade, I accept what I risk emotionally speaking. I've lost so many times that I don't even feel them anymore, and I focus on the lessons.

How does passing the FTMO Challenge and Verification changed your life?

After passing the test, my decision-making, both in charts and in my personal life, has improved dramatically. My management and analysis have evolved. I feel like a different person, closer to my best version.

What do you think is the key for long term success in trading?

Consistency, discipline, learning to lose, and learning to win the lessons of losses, putting faith in change as a person towards constant improvement.

Where have you learnt about FTMO?

In 2022, I learned about the company, researching which was the most efficient and legitimate company on the market, and I discovered that FTMO has been around since 2014, and that gave me more confidence in investing my money in FTMO.

Do you have a trading plan in place, and do you follow it strictly?

Yes, I have a very clear plan of what to do when executing, and of managing my account both financially and emotionally, it is that plan that has helped me achieve the goal.

What would you like to say to other traders that are attempting the FTMO Challenge?

I would tell them to never give up, be consistent, and focus their minds on improving themselves, since trading is just like your personal life.

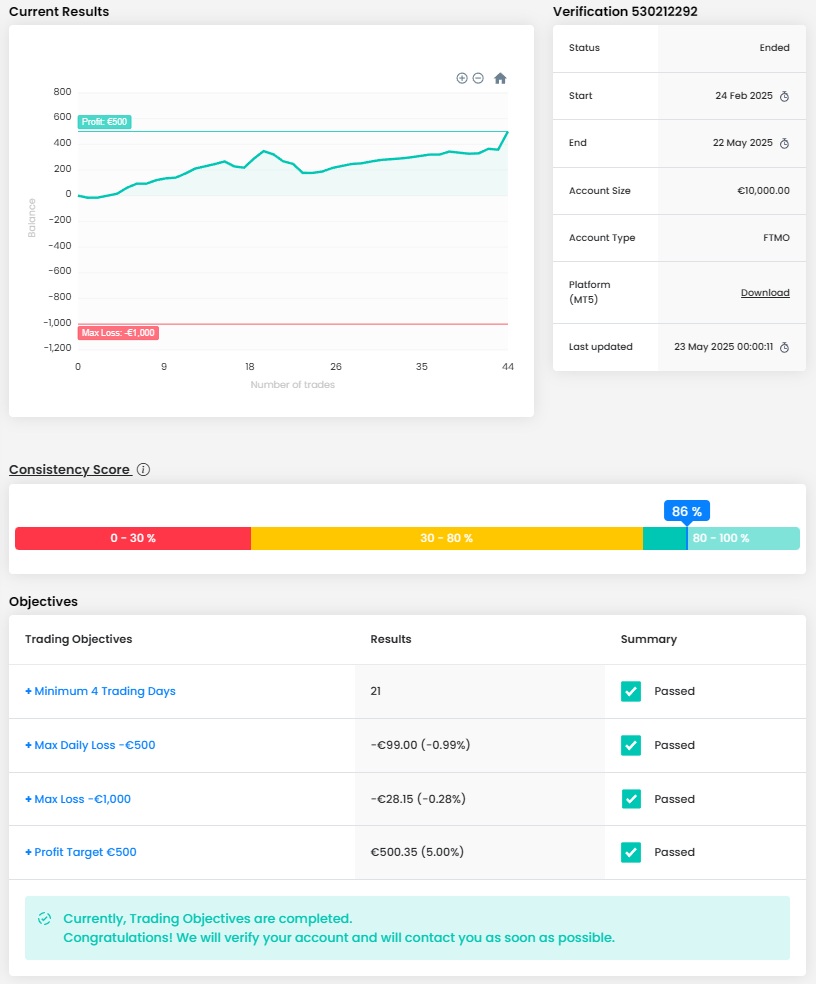

Trader Jaydi: “See the bigger picture, do not try to rush anything.”

Describe your best trade.

I made a lot of trades that I enjoyed taking but I think the most exciting trade for me was my last trade to pass the complete challenge.

How does passing the FTMO Challenge and Verification change your life?

Nothing has changed yet because I now go for payouts and bigger capital accounts, but it is definitely a milestone for me. I have been in the market for many years with a lot of ups and downs, but I found my way.

How did you eliminate the factor of luck in your trading?

Try to pass a challenge with a lot of time horizons and I did not want to pass it quickly because then it’s not consistent. So, it’s no luck anymore every trade that I now take is with calculation and a deeper understanding.

Has your psychology ever affected your trading plan?

Yes, I think every trader first needs to find himself with his own thoughts before he can find his way in the markets. Every trade is based on what you are thinking.

How did you manage your emotions when you were in a losing trade?

Before I entered a trade, I already considered that a possible outcome is a loss. So, when it happened, I knew it was ok. Stick to myself and next trade no hard feelings.

What would you like to say to other traders that are attempting the Challenge?

See the bigger picture, do not try to rush anything now that you don’t have to pass it in 60 days. Trade calmly and learn from every trade. Also, when you make a good trade analyze it over and over.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.