“My risk management is strict”

Proper risk management supported by good backtesting can save a trader many sleepless nights. When a trader has his potential losses under control and avoids gambling and chasing returns at all costs, it helps him both on the account and in terms of psychology because he is more at ease and does not make mistakes. Today even our new FTMO Traders know this.

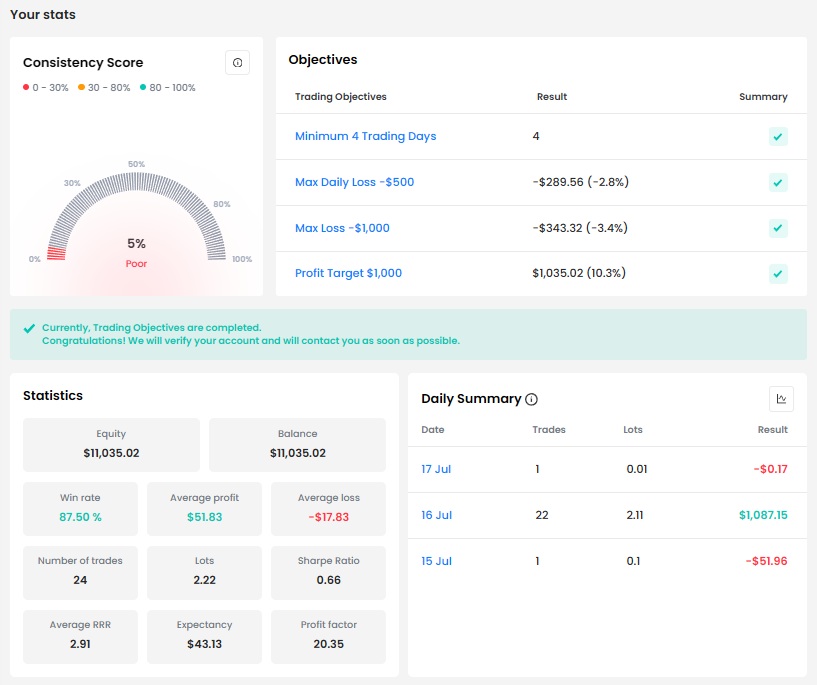

Trader Leónid: “Treat trading like a real business.”

What was easier than expected during the FTMO Challenge or Verification?

Identifying high-probability setups was easier than expected because I focused only on clean technical structures and avoided overtrading.

Do you have a trading plan in place, and do you follow it strictly?

Yes, I follow a clear swing trading plan. Every trade is pre-planned with defined entry, Stop Loss, and target levels. I review my trades daily and conduct a deep, detailed review once a week to improve consistency.

What does your risk management plan look like?

My risk management is strict: I never exceed 1% risk per trade idea. I often take partial profits around 1:1 or 2:1, but I aim for the highest RRR the market allows. I don’t fight the market – sometimes I let trades run, sometimes I exit earlier – but the risk stays consistent.

Where have you learnt about FTMO?

I first heard about FTMO in 2021 through a YouTube video. I don’t even remember whose channel it was, but that’s where the whole journey started for me.

Describe your best trade.

My best trade was on EURUSD. I spotted a liquidity grab and a market structure shift on the 4H chart. I entered after confirmation, took partial profits at 2:1 and 4:1, and let the rest run as long as the market narrative stayed valid. It was a great feeling because I managed to ride almost the entire trend – the RRR was very high, and it felt amazing to see the plan play out.

One piece of advice for people starting the FTMO Challenge now.

Treat trading like a real business. Keep the risk per trade small and consistent, follow your plan, and document everything – not only on a computer but also by hand in a journal. Organized trading and proper records will help you stay disciplined. Patience and consistency always beat luck.

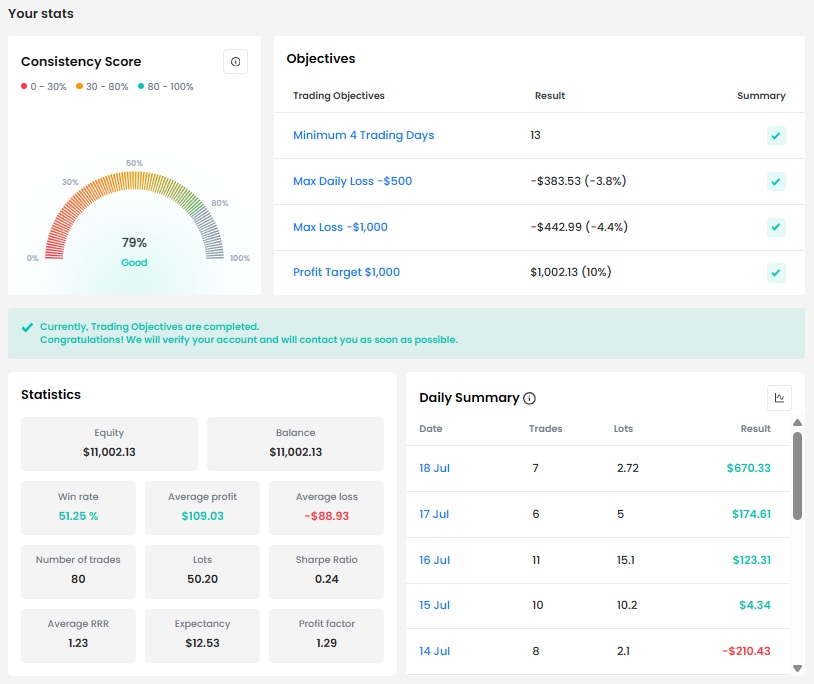

Trader Beka: “My best trade wasn't my most profitable, but the one where I followed my plan perfectly.”

How did you manage your emotions when you were in a losing trade?

I treat losing trades as a necessary part of the business. My focus is always on my trading plan and risk management. I remind myself that a single trade doesn't define my success, sticking to my strategy does.

Describe your best trade.

My best trade wasn't my most profitable, but the one where I followed my plan perfectly. I identified a setup, patiently waited for my entry, set my risk, and then let it play out without interference. The feeling of seeing analysis confirmed through disciplined execution was the real reward.

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

The most difficult part was managing my psychology during a period of drawdown. I overcame it by stepping back, reviewing my trading journal to confirm my strategy was sound, and reaffirming my trust in my risk parameters. It was a test of discipline.

What was easier than expected during the FTMO Challenge or Verification?

Adhering to the loss limits was easier than I anticipated. My personal trading strategy already had strict risk management at its core, so following the FTMO rules felt like a natural extension of how I already trade.

What would you like to say to other traders that are attempting the FTMO Challenge?

Trust your preparation and your strategy. Don't focus on the profit target; focus on executing your plan perfectly with solid risk management on every single trade. The profits will follow if your process is sound.

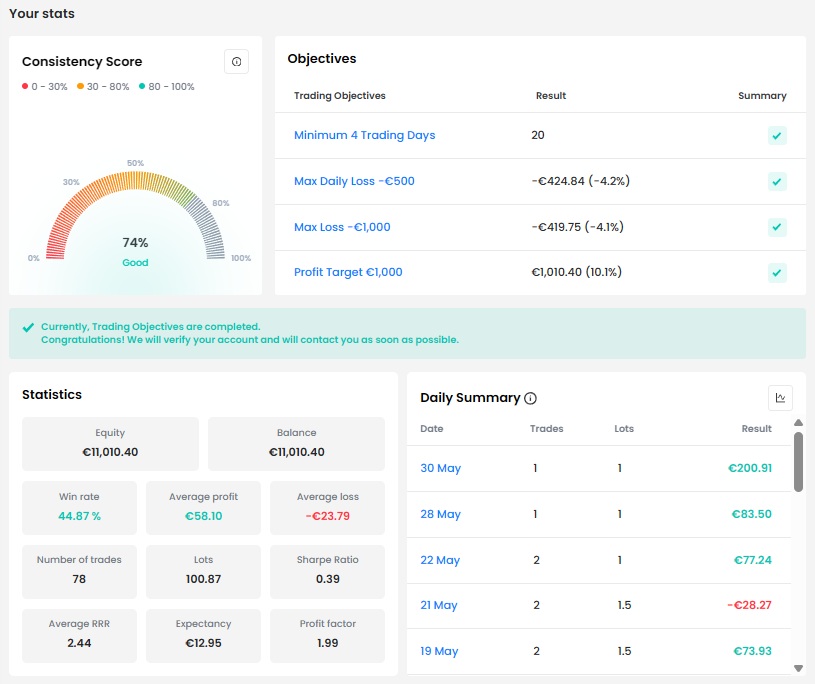

Trader Antonis: “I accept the risk before entering the trade, so I know what to expect.”

What do you think is the key for long term success in trading?

Trading psychology. Being able to control your emotions and stay disciplined is the most important part of trading. You can have the best strategy, but without the right mindset, it’s very hard to be consistent in the long run.

Do you have a trading plan in place, and do you follow it strictly?

Yes, I do. I always try to position myself in the market after price takes out a liquidity area. I’ve been using the same strategy for two years now and I try to follow my rules consistently. Having a clear plan helps me stay focused and avoid emotional decisions.

Has your psychology ever affected your trading plan?

Yes, many times. In the past, I’ve struggled a lot because of bad psychology. I used to overtrade or break my rules when I was emotional. Lately, I’ve been more focused and disciplined. I try to stick to my plan, follow my rules, and accept the risk so I can avoid overtrading and mistakes caused by emotions.

How would you rate your experience with FTMO?

So far, my experience with FTMO has been very positive. I didn’t have any issues like slippage or anything like that. Everything has worked smoothly.

How did you manage your emotions when you were in a losing trade?

I try to stay calm and stick to my plan. I accept the risk before entering the trade, so I know what to expect. I usually risk around 0.5% per trade, which I’ve found to be a comfortable risk percentage for me. Keeping the risk small helps me avoid stress and keep my emotions in control.

What is the number one advice you would give to a new trader?

Stick to your plan. Try to avoid emotions as much as possible. That’s the key to being a successful trader. If your strategy is profitable based on backtesting, then trust it and stay consistent. In the long run, you will see results.

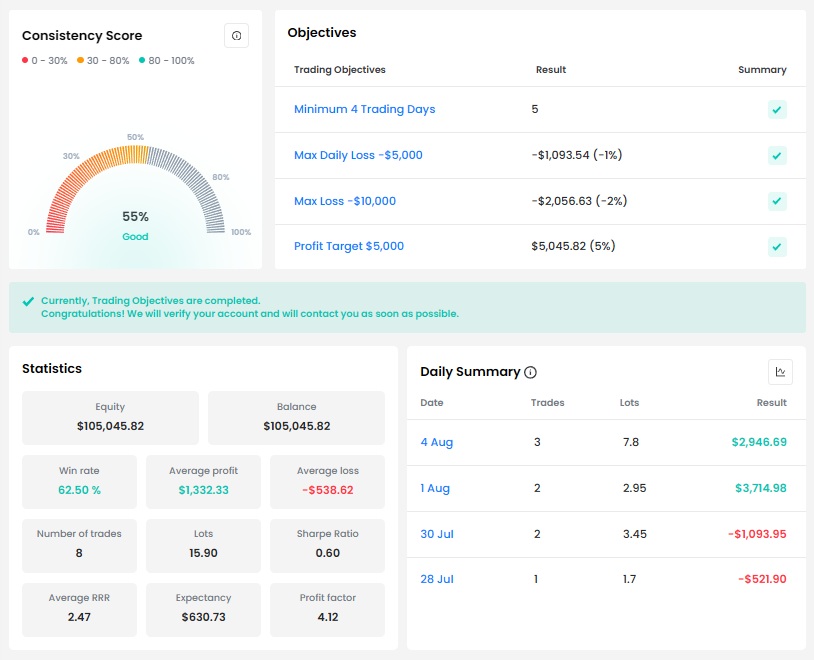

Trader Malgorzata Anna: “Don't get carried away by your emotions.”

What was easier than expected during the FTMO Challenge or Verification?

Sticking to the rules to pass the Challenge and Verification.

Has your psychology ever affected your trading plan?

No. During the last 2 years I have worked a lot on my psychology in trading. As a result, I'm currently trading without emotion, and I don't make up for losses by force.

Describe your best trade.

My best trade was realized in a couple of hours despite the fact that I am a swing trader. Immediately after opening the position the trend reversed and went straight into profit just as I predicted, zero market hesitation.

What do you think is the most important characteristic/attribute to become a profitable trader?

Sticking to one strategy, good risk management, and not getting out of a trade too early when it's gently in the profit - this will ensure adequate risk to reward.

Where have you learnt about FTMO?

From other traders I've met over the years.

One piece of advice for people starting the FTMO Challenge now.

Stick to your strategy and risk management principles. Don't get carried away by your emotions before and during the transaction, only this will give you success and a positive reward to risk.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.