“My best trades were the ones I didn't take”

A large number of trades rarely leads to consistent returns. The ability to not enter a trade when a trader feels he has not executed a trade in a long time is often the very fine line that separates the long-term profitable traders from the rest. And our new traders Felix, Joseph, Mariusz and Matija could belong to the first group.

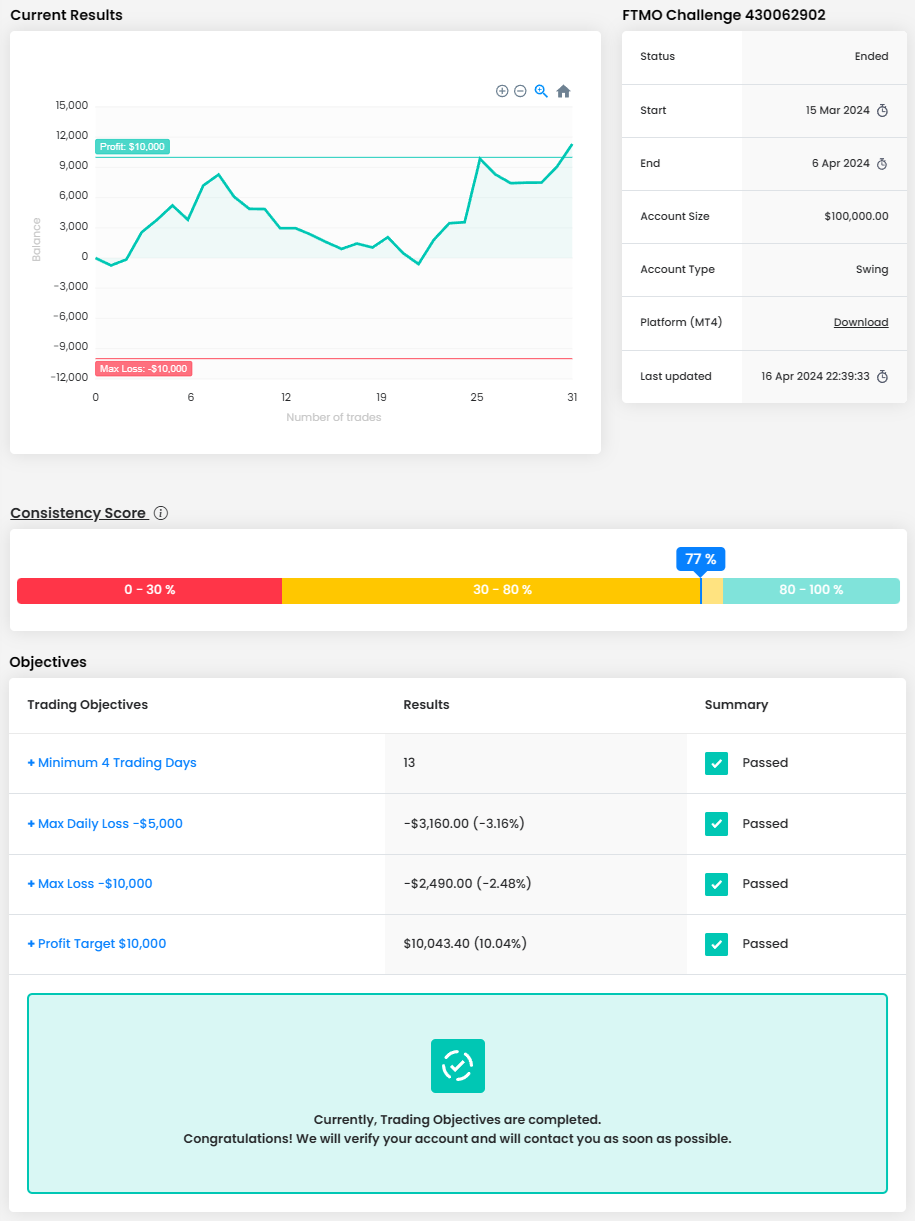

Trader Felix Jr Genio: “Extra patience is absolutely essential.”

What inspires you to pursue trading?

My wife and 4 children are my inspiration in making Forex trading my career. I wanted so much to give them the financial freedom that I have been dreaming of ever since.

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

The most difficult part in my FTMO Challenge and Verification is "waiting for the perfect setup" before entering a specific trade. Extra patience is absolutely essential. Entering a trade not in a precise moment will make me suffer unnecessary drawdown, or worse, my Stop Loss will be hit, it being very tight so as not to violate the daily allowable loss because I am trading 10 lots per trade.

What was more difficult than expected during your FTMO Challenge or Verification?

The more difficult part is having a strategy in place, knowing that I have to wait for the perfect setup before entering my trade, and yet I am so eager to enter a trade. I really must conquer myself in order to be successful in this career, and I just recently did. Thanks to FTMO.

How did you eliminate the factor of luck in your trading?

I eliminated the factor of luck in my trading by coming up with a trading strategy and by employing strict discipline by being extra patient in waiting for the perfect setup before executing my trade.

Where have you learnt about FTMO?

I learnt about FTMO from the internet. I keep browsing the net to find a proprietary company to address my problem of lack of capitalization. And boom!!! I found FTMO to be the best out of those that I've seen during my search.

What would you like to say to other traders that are attempting the FTMO Challenge?

For those traders out there, who really wanted to try the FTMO Challenge, please do it now. Come up with your trading strategy and be patient enough to wait for the precise moment and perfect setup before executing your trade.

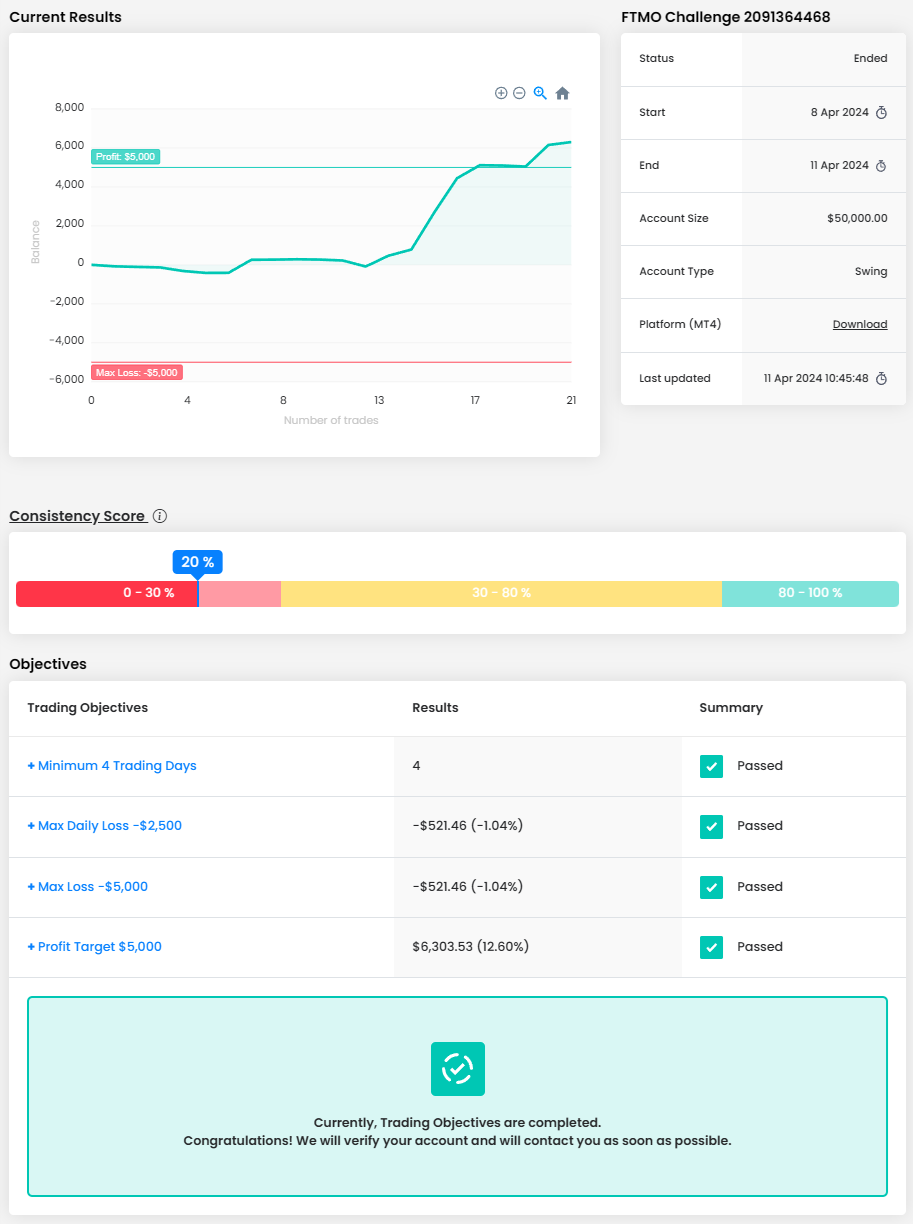

Trader Joseph: “Not trading is also a trade.”

What was more difficult than expected during your FTMO Challenge or Verification?

Patience. I'm now thankful for my past failures, because of them, I now know the cost of impatience in the market.

Describe your best trade.

My best trades were the ones I didn't take, even though very tempting, because the candle formations in MTFs (top down and vice versa analysis) didn't satisfy my set-up requirements. Not trading is also a trade, for capital preservation.

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

Nothing really because I kept to my rules. Wait for the right session. Trade the right pair relative to session, calculate lot size to pip ratio based on market structure and not money. Add on positions in high probability set-ups. Exit at market structure, not money based on money amount.

How would you rate your experience with FTMO?

Very grateful I'm able to trade and make life changing money, and still only risk 1% because of the equity made possible by FTMO. Replies have been quick, professional, and friendly.

What do you think is the key for long term success in trading?

Risk management. Also letting winners run and cutting losses quickly.

What would you like to say to other traders that are attempting the FTMO Challenge?

Make sure to do the background work needed to be able to be a successful trader. This isn't an overnight success, it is a life decision.

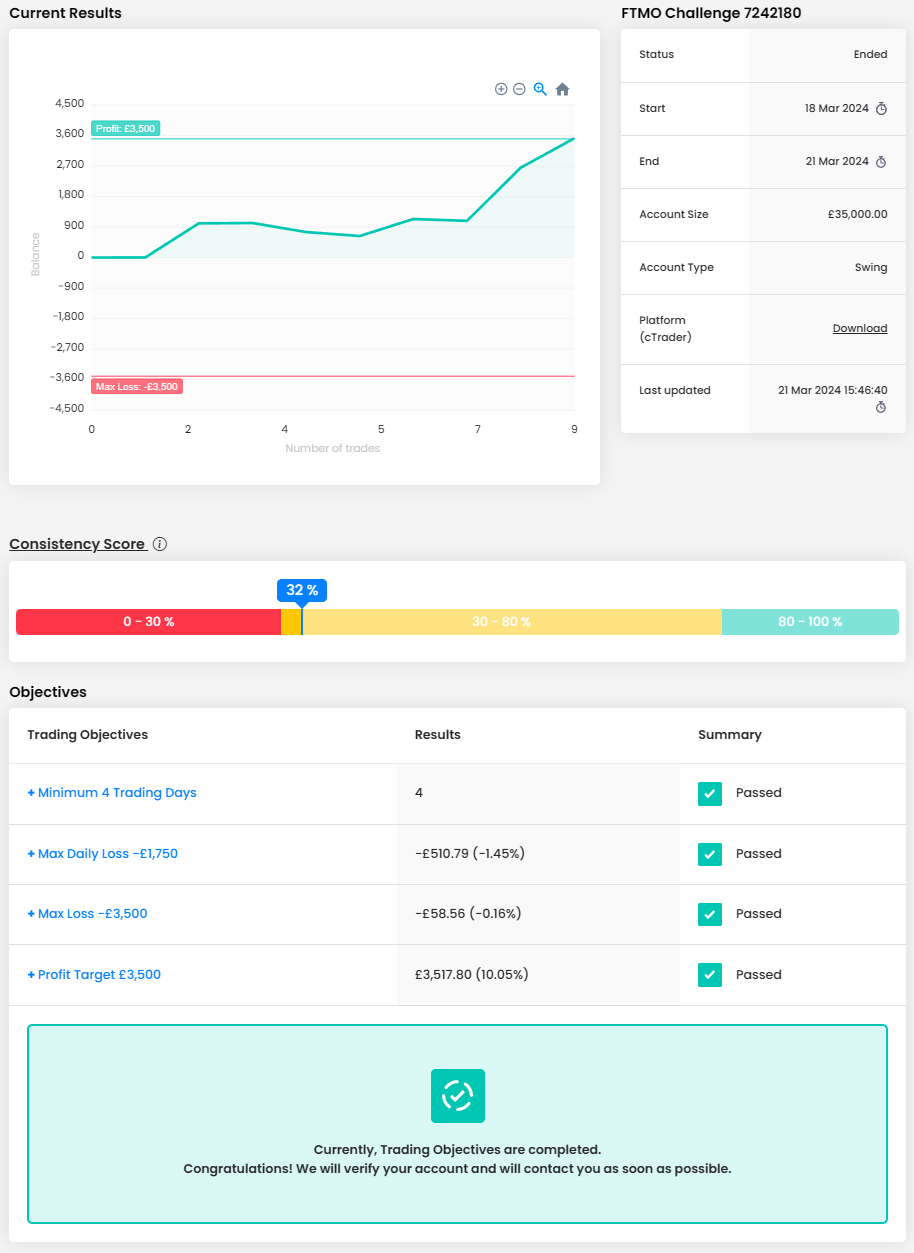

Trader Mariusz Sebastian: “Impatience is really dangerous.”

Describe your best trade.

There were a couple of great trades in my so-called "career" - so far over 20RR in several hours using pyramid.

What was the hardest obstacle on your trading journey?

To let things go, without me involved. Setups, profits, trading days. I don't need everything NOW - impatience is really dangerous.

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

Drawdown period. When I see that my account is under initial balance, emotions slowly try to take over. It is critical to shake it off, slow down, review trades to see what was actually wrong. Too many trash positions? Over-leverage? Maybe something else. Whatever it is, you should slow down, and counter-act to whatever is dragging you down.

Do you have a trading plan in place, and do you follow it strictly?

I will do my very best to follow my plan 100%. There are days however, when the guard is lowering a little, and that is why journaling is very important!

How has passing the FTMO Challenge and Verification changed your life?

Can't answer just yet. I passed before and lost accounts - I need this one to be different. It has to work out, so I am rather focused on good performance. Of course, big money can change a lot, make it better, I hope this will be my case too.

What would you like to say to other traders that are attempting the FTMO Challenge?

Never give up, but do not be stupid either. If you make a mistake 1000 times and do nothing to understand and fix it, then be prepared to face the same mistake in an endless loop.

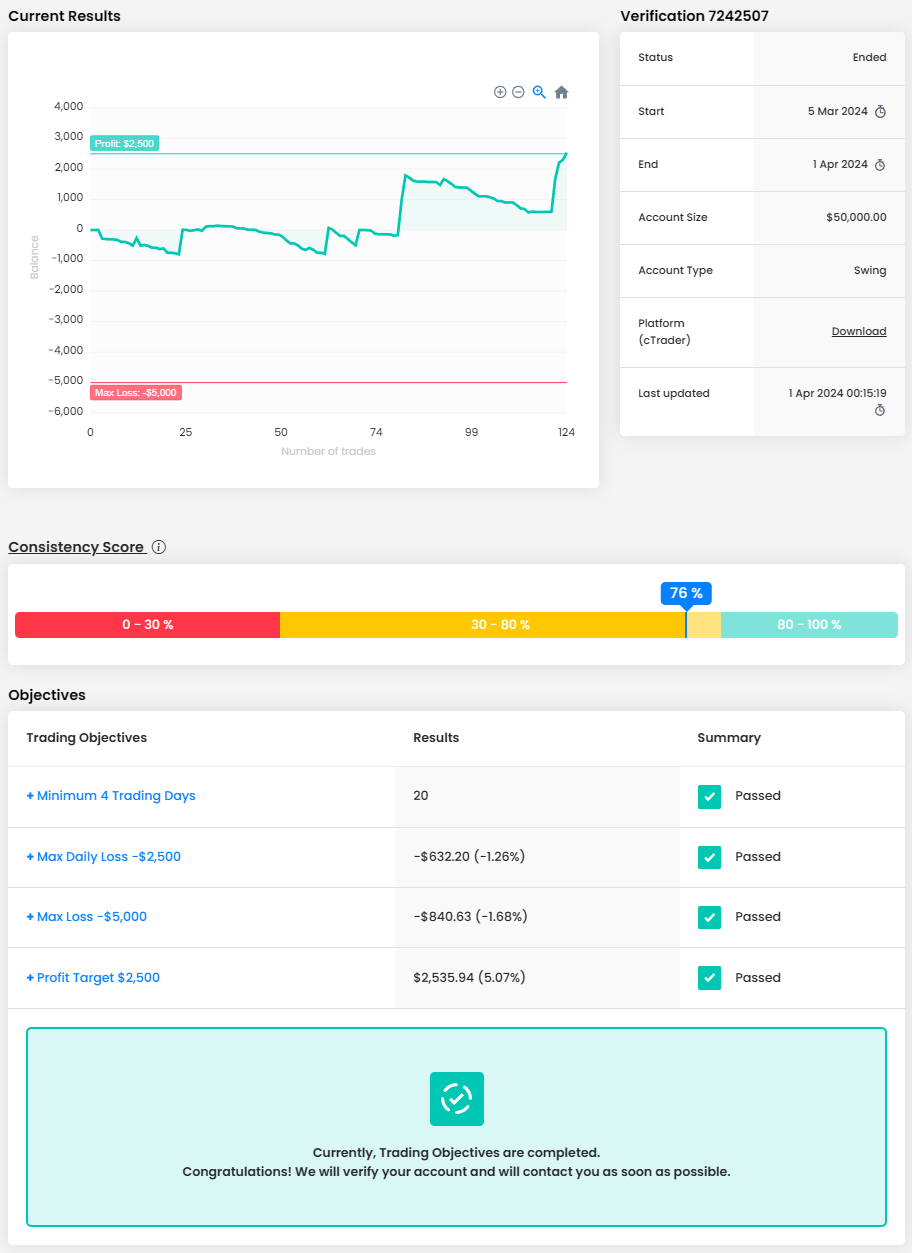

Trader Matija: “I just simply let the losing trade to be a loser.”

Where have you learnt about FTMO?

From my friend.

What do you think is the key for long term success in trading?

Consistency and understanding your system and edge about the market. Also knowing when to trade and when to stay away.

How did you eliminate the factor of luck in your trading?

Simply by understanding my edge and rules.

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

I already had a profitable system, but generally was closing trades too early that caused me to lose money. Now I do understand my edge and I will follow my system and rules regardless of how I "feel" about the market. I was also not fully understanding what kind of market conditions I want to stay away from and on what kind of market conditions I want to take my risk on.

How did you manage your emotions when you were in a losing trade?

I just simply let the losing trade to be a loser because losses are unavoidable part of the game. If trade is placed by my rules and in the right context, there is nothing to worry about if any given trade is loser, winner, or what outcome may be.

What would you like to say to other traders that are attempting the FTMO Challenge?

Just follow your rules, understand your system, and don't let emotions dictate your trading decisions.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.