“Max limits are really great tools”

Many traders say that our loss limits are too strict for them. However, when they realize that it is in their best interest not to risk too much per trade, they realize that these limits were behind their success and helped them to get their FTMO Account. What do our new traders Peter, Majid, Sara, and Kachi think about it?

Trader Peter: “Don’t get overexcited when you start and don’t take huge trades at the beginning. Be calm and take your time.”

How did loss limits affect your trading style?

Max limits are really great tools because they make you stop trading when your day goes badly. I mean you know your limits and you can’t overtrade otherwise you are out. So, it gives you that time to calm down your emotions and gives you another chance, another day to make better decisions with a cooler head.

Has your psychology ever affected your trading plan?

Definitely, it’s the core of everything. I can have 10 great days but if I fail the 11th and wipe out all my profit then it’s for nothing. This happened to me many times and I know you should never get overconfident about your results even though you feel like you are the king of the world at that moment.

What inspires you to pursue trading?

Vision of financial freedom,a better understanding of how financial world works, being able to manage my time my own way and not be dependent on a 9-5 job.

What was more difficult than expected during your FTMO Challenge or Verification?

Trying it 3 times and failing and at the end of the 4th time it went well. Definitely, you are sometimes overexcited about taking the Challenge and seeing that you can become a pro. So, you take a huge trade in the early stage and if it goes bad it frustrates you and can stick with you. This happened to me and that’s why I failed 3 times.

How did you eliminate the factor of luck in your trading?

By carefully watching my trading habits and sticking with the good ones. I mean, when you trade you need to know when not to trade, when you are in control of the position, the most important thing is to get those great entries when you are instantly in the profit and you need to watch pattern, price levels, price actions, choose the right asset (choosing stronger currencies against weaker ones).

One piece of advice for people starting the Challenge now.

Don’t get overexcited when you start and don’t take huge trades at the beginning. Be calm and take your time.

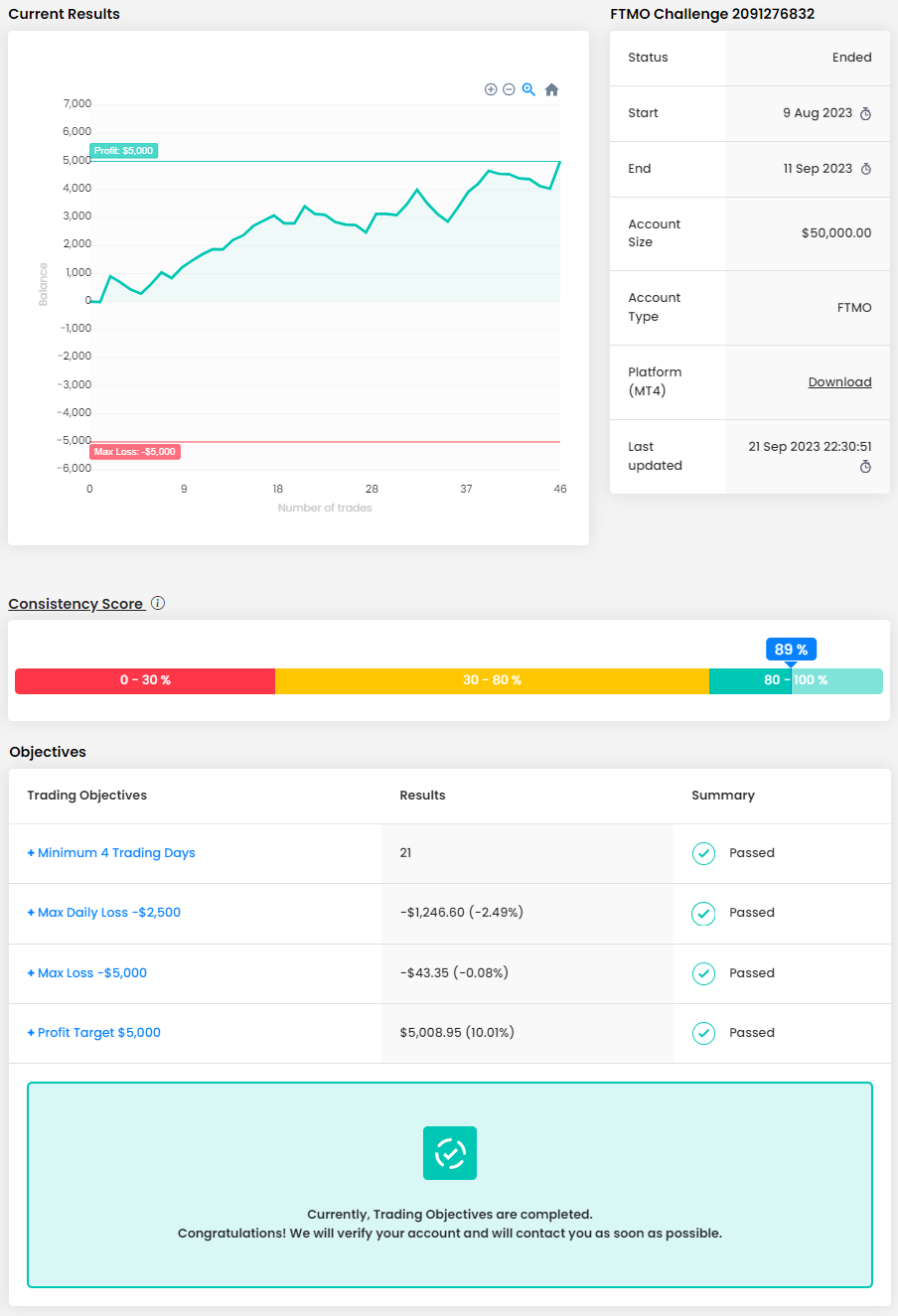

Trader Majid: “The most important thing is to be patient.”

How did you manage your emotions when you were in a losing trade?

I managed my emotions through trust and effort put in. For example, I have dedicated so much time and effort into building my strategies and backtesting them that I have built up a large portfolio of how the strategy works in each currency, this has helped me to trust the process and have an idea of what’s going to happen. Also, effort, I have dedicated a lot of time and effort into trading, and it took me a while to get to this level, so I have been able to hone my emotional control skills during a loss.

Do you have a trading plan in place, and do you follow it strictly?

Yes of course, I follow my trading plan very very strictly and would not get into a trade if my requirements for a trade are not met, even if it’s the smallest thing I would still not enter the trade. I am extremely strict with it, thus why I have a high W/L percentage.

What was easier than expected during the FTMO Challenge or Verification?

I’d say the Profit Target for Verification was quite easy, after completing the Challenge, it gives you a boost of confidence which you can use towards completing the Verification.

What was the hardest obstacle on your trading journey?

The hardest obstacle was not being able to hold trades over the weekend and I’d say loss limits. My personal loss limits are higher than the ones given by FTMO, but It didn’t take as much from me when getting used to the FTMO ones.

How did loss limits affect your trading style?

At first, it was quite hard but then it got really easy as I realized the benefits of having Maximum Loss limits. It helps you to recoup and think about what to do next, go back to your trading plan, and stops you from making any emotional trades.

What is the number one piece of advice you would give to a new trader?

The most important thing is to be patient and dedicate time to building 2 things, your strategy and emotional control. It takes years to master trading, not overnight.

Trader Sara: “Maximum loss limits have encouraged me to be more disciplined”

How did loss limits affect your trading style?

Maximum Loss limits have encouraged me to be more disciplined and cautious in my trading approach. They have helped me avoid taking excessive risks and making impulsive decisions, which ultimately has improved my overall trading performance.

Do you have a trading plan in place, and do you follow it strictly?

Yes, I have a well-defined trading plan in place, and I make a conscious effort to follow it strictly. Adhering to my trading plan helps me maintain consistency and manage risk effectively in my trading activities.

What was easier than expected during the FTMO Challenge or Verification?

One aspect that was easier than expected during the FTMO Challenge or Verification was the ability to maintain emotional discipline. While I anticipated it to be challenging, I found that by sticking to my trading plan and risk management strategies, I was able to keep my emotions in check more effectively than I initially thought.

Where have you learned about FTMO?

I learned about FTMO through online trading communities, forums, and social media platforms. Many traders shared their experiences and insights about FTMO, which helped me gain knowledge about the company and its programs. Additionally, I also conducted research on their official website to gather more information and understand the details of their trading Challenges and funding programs.

Has your psychology ever affected your trading plan?

Yes, there have been instances where my psychology has affected my trading plan. Emotions like fear, greed, or impatience can lead to deviations from my planned trading strategy. It's crucial to recognize and address these emotional influences to ensure that I stick to my trading plan and make decisions based on a rational analysis of the market rather than being swayed by emotions. Developing emotional discipline is an ongoing process in trading.

One piece of advice for people starting their FTMO Challenge now.

My advice for people starting their FTMO Challenge now is to prioritize risk management above all else. Focus on preserving your trading capital by adhering to strict risk limits and maintaining discipline in your trading decisions. Patience and consistency are key. Additionally, thoroughly understand and practice your chosen trading strategy before and during the Challenge to increase your chances of success. Good luck!

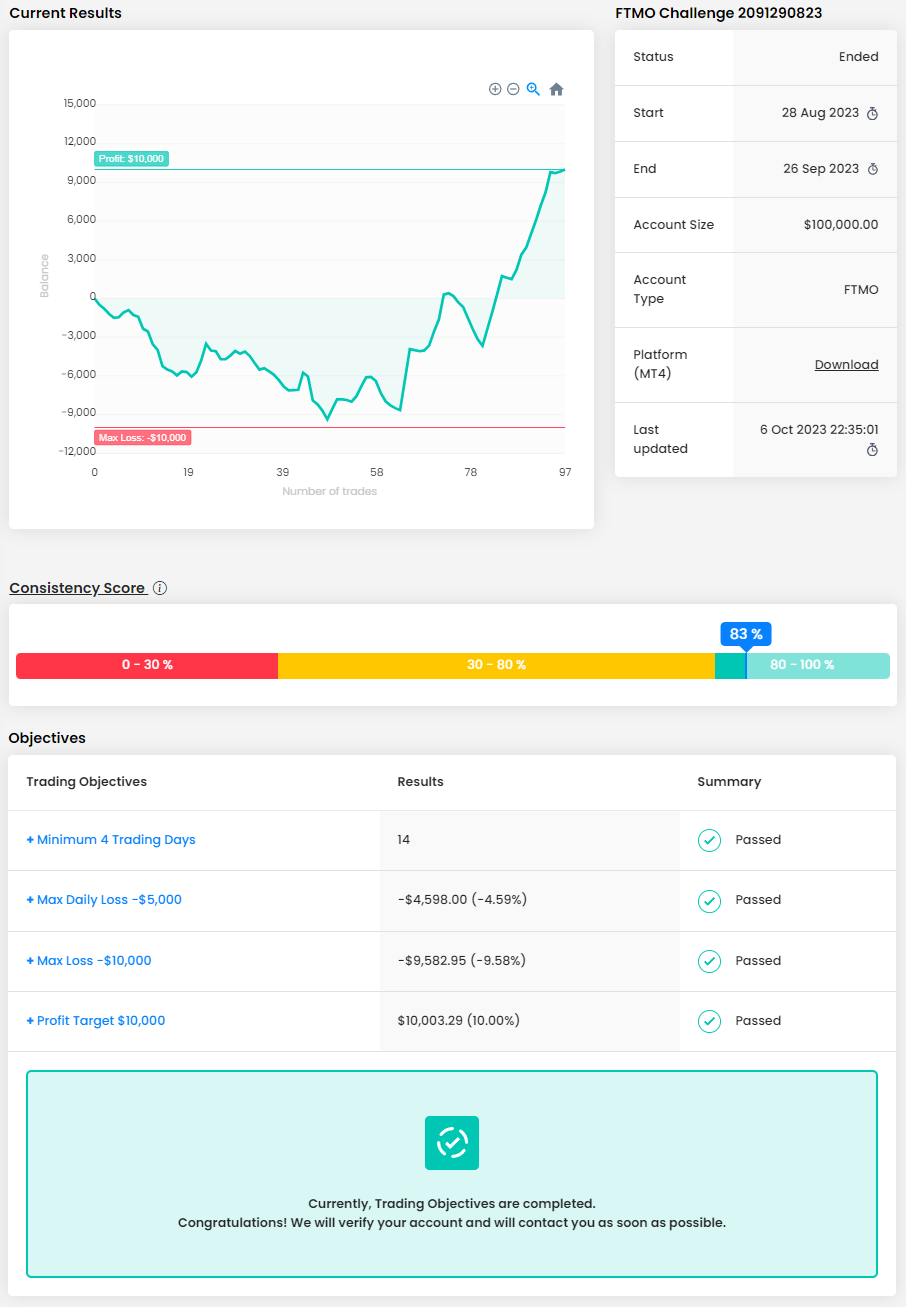

Trader Kachi: “Never forget the value of the money you're trading, regardless of account size.”

What was more difficult than expected during your FTMO Challenge or Verification?

The Verification. It was a mental game. I personally grew a little bit impatient and just wanted to pass and that made the losses hurt more because it felt like they were just prolonging the inevitable.

What does your risk management plan look like?

I risk about 0.5% per trade on the account. That would be $250 of the $50,000 account, I stop trading after 2 full R losses in the day. For each trade where I do risk 0.5%, I will still have a “cut early” plan and that is usually between 40-60% of my SL on that trade. I use value areas (in relation to previous days) and points of control as cut-off points.

Has your psychology ever affected your trading plan?

Yes, usually when it comes to profit-taking. I catch myself cashing out early sometimes when I have set a TP instead of watching the price interact with that level and see if further continuation happens. I like the idea of taking my crumbs from the market consistently to build a loaf rather than taking the whole loaf up front. Sometimes I will but I have found (especially in shorts) that reversals can be quick, and you can end up with less than you originally thought.

What was the hardest obstacle on your trading journey?

Integrating auction ranges with efficient timing. Knowing the best point to enter a trade with tight stop losses, especially if I'm managing on the 5M chart. I have a lot less room to manage and have to be a lot more sure of my choices compared to a 30M managed chart.

How did you eliminate the factor of luck in your trading?

Following my 10 daily rules. Only entering once at least 2/7 "other" conditions were hit on my trading plan, however, all 3 of the "non-negotiable" ones always had to be met. Clear MSB, at least 2 stops to take before the target, all clear stops taken/DEMAND(SUPPLY) hit.

What is the number one piece of advice you would give to a new trader?

Never forget the value of the money you're trading, regardless of account size. Treat yourself every now and then just to remind yourself how serious the stakes are and can be.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.