“Managing emotions during drawdowns was more challenging than anticipated”

Traders who can't handle their emotions can have it quite difficult in trading. Emotions can ruin a good trade and can make a successful trader a losing trader. Managing emotions, on the other hand, can make the average trader a successful trader who can handle even the most difficult situations. Here's what our new FTMO Traders Max, Bunchhay, Gabriel and Bao Tam think of it.

Trader Max Johan Leo: “Adhering to my trading plan was easier than expected.”

What do you think is the most important characteristic/attribute to become a profitable trader?

The most important characteristic for becoming a profitable trader is discipline. Successful traders adhere to their trading strategies, manage risk effectively, and stay emotionally detached from market fluctuations. Without discipline, it's easy to make impulsive decisions that can lead to losses.

What does your risk management plan look like?

My apologies for the oversight. Here's a more realistic risk management plan:

- **Position Sizing**: I allocate a specific percentage of my trading capital to each trade, typically limiting it to 1-2% to ensure I can withstand potential losses.

- **Stop Loss Orders**: I always set stop loss orders at strategic levels based on technical analysis or volatility, aiming to limit losses to a predetermined amount if the trade goes against me.

- **Diversification**: I diversify my trading portfolio across different assets, sectors, and strategies to spread risk and reduce exposure to any single market event.

- **Risk/Reward Ratio**: Before entering a trade, I assess the potential risk against the potential reward, aiming for a minimum risk/reward ratio of 1:2 to ensure my wins outweigh my losses over time.

- **Continuous Assessment**: I regularly monitor my trades and adjust my risk exposure based on evolving market conditions, news events, and technical indicators to mitigate potential losses.

- **Capital Preservation**: I prioritize capital preservation over chasing high returns, focusing on consistent, long-term profitability rather than risking large portions of my capital on high-risk trades.

- **Emotional Discipline**: I maintain emotional discipline by sticking to my trading plan, avoiding impulsive decisions driven by fear or greed, and accepting losses as a natural part of trading.

How did loss limits affect your trading style?

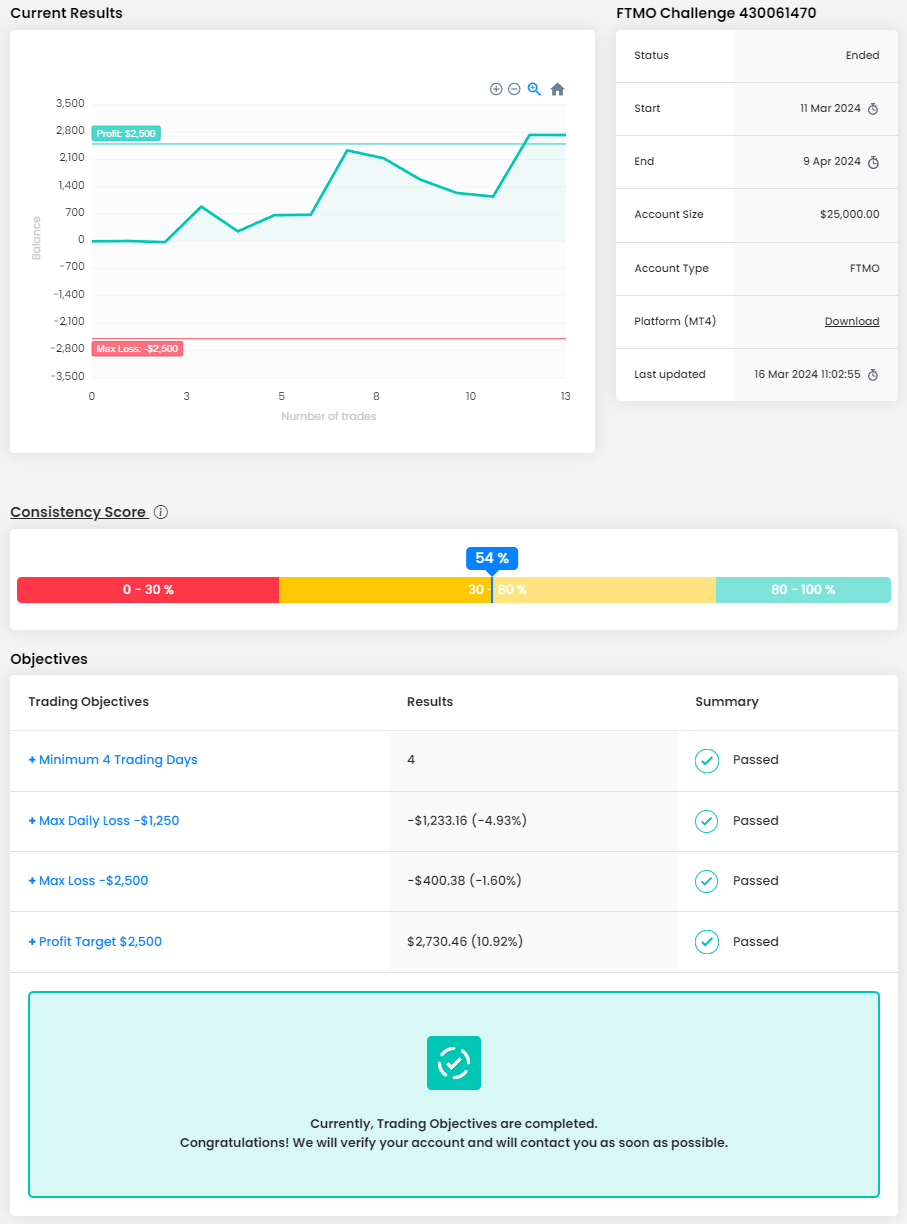

Implementing a $1250 daily stop loss has significantly influenced my trading style. It forces me to be more selective with my trades, focusing on higher-probability setups and managing risk more diligently. Knowing that I have a cap on potential losses for the day encourages disciplined decision-making and helps prevent emotional reactions to market fluctuations. It also prompts me to reassess my risk exposure throughout the trading day and adjust position sizes accordingly to stay within the prescribed limit. Overall, having a maximum loss limit in place has instilled greater discipline and risk awareness in my trading approach, ultimately contributing to more consistent performance over time.

What was more difficult than expected during your FTMO Challenge or Verification?

Managing emotions during drawdowns was more challenging than anticipated. Staying disciplined and confident in my strategy proved tougher amidst consecutive losses, highlighting the importance of emotional control in trading.

What was easier than expected during the FTMO Challenge or Verification?

Adhering to my trading plan was easier than expected. Having a clear strategy and risk management plan helped maintain discipline, resulting in smoother execution of trades.

What would you like to say to other traders that are attempting the FTMO Challenge?

Remember, the challenge is a journey of growth and development. Embrace the process, stay committed, and keep striving for excellence. Good luck!

Trader Bunchhay: “I eliminate luck away from my trading by thinking of probability.”

How has passing the FTMO Challenge and Verification changed your life?

FTMO trader has always been a dream for me. Being in a developing country, my chance of getting ahead is slim. However, with FTMO in mind, I believe that this will be a game changing opportunity for me, as well as my family. I am looking forward to building a long-lasting relationship with FTMO.

What does your risk management plan look like?

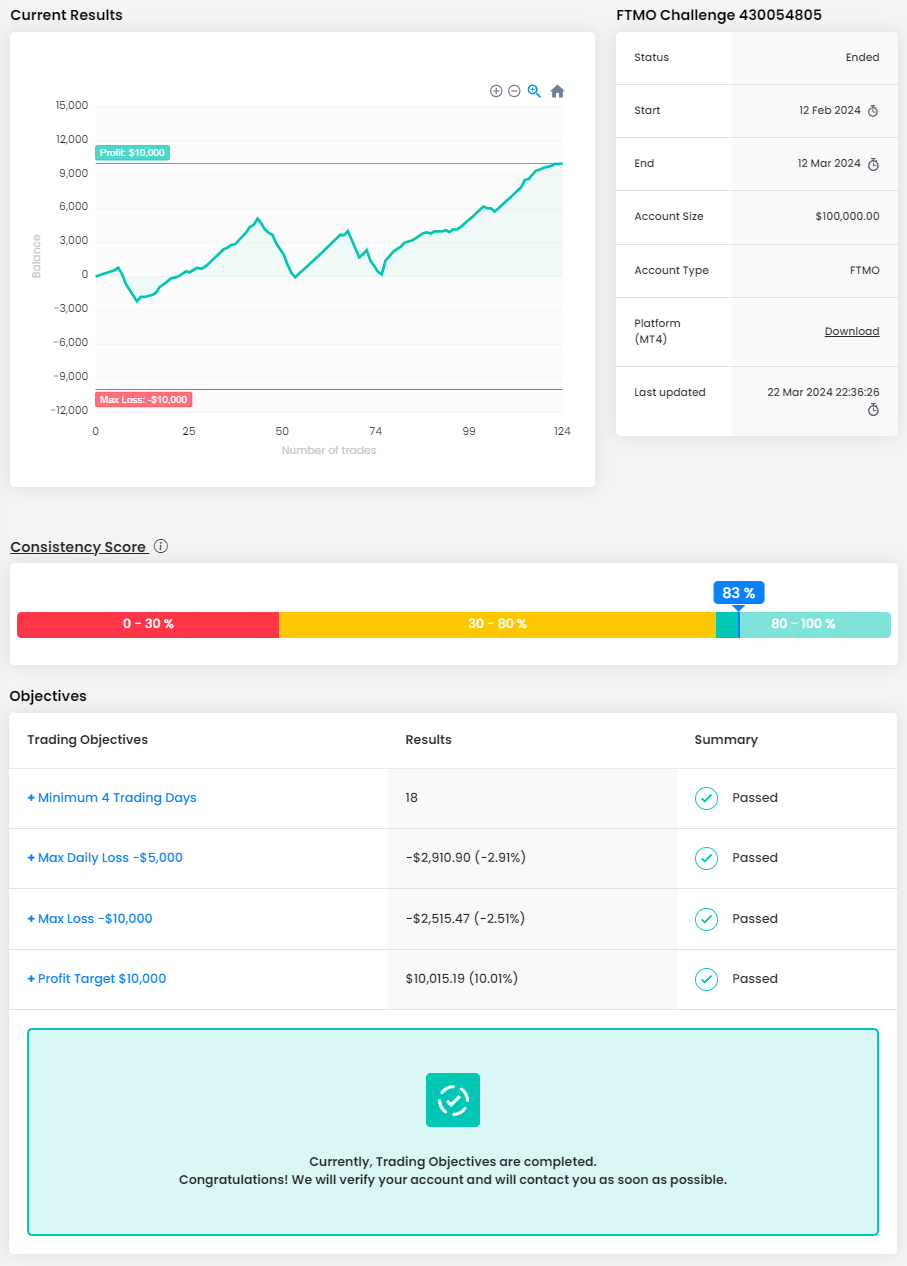

Though my RR is not really great compared to those in the industry. However, accompanied with an over 80%-win rate, I do believe that my strategy will work well. I plan to go as safe as possible, anything from 1% to 2% is a Max risk exposer for me.

How did you eliminate the factor of luck in your trading?

I eliminate luck away from my trading by thinking of probability. Luck has always roamed around me for so long, which results in a failed many Challenges as well as real account. However, having learned the hard way, I do believe by thinking about the possibility of winning and losing, will make my mind feel at ease. By that, luck will no longer be in my mind since I know that, that exact one position that I open will result in this amount of loss or that amount of gain.

What was easier than expected during the FTMO Challenge or Verification?

Spread, swap, execute speed, more importantly FTMO's dashboard. Now I do believe that FTMO is made by trader for trader, everything is just so smooth and easy to use.

How would you rate your experience with FTMO?

100/100 cannot stress enough that FTMO is my only choice for so so long.

One piece of advice for people starting the FTMO Challenge now.

Stay decline, lost trade mean to be recovered with another good setup. Never chase trade. Good luck!

Trader Gabriel Imre Guy: “I do not believe in mechanical planning as a strategy meaning.”

Do you have a trading plan in place, and do you follow it strictly?

I do not believe in mechanical planning as a strategy meaning. It's more about understanding EACH movement and to be able to trade them. I am using some concepts yes, but globally it’s about my own understanding of the current situation with macroeconomics and technical analysis.

What does your risk management plan look like?

For 5 stars trades, I usually risk between 1 and 2% MAXIMUM. If I made big profit for the day, I could use those profit as “leverage" to risk a little bit more. But it’s only in specific scenarios, with, again, 5 stars set up.

What was the most difficult during your FTMO Challenge or Verification, and how did you overcome it?

Nothing was difficult, I am already a confirmed trader.

How did you eliminate the factor of luck in your trading?

With long-term trading and good risk management. The factor of luck is called in reality "variance", it’s not luck, its variance and we all have to adapt to this factor.

How did loss limits affect your trading style?

Positively, if I am trigger one day for any reason and I make a mistake and lose too much in one day, I will be forced to stop to trade to not blow up my account.

One piece of advice for people starting the FTMO Challenge now.

Start with paper trading for months until you are really profitable. Work on the hardest part, which is the psychological part, no emotions in trading. The technical part is not EASY, but it’s not difficult, it’s just time, determination, and passion, you have to stay for hundreds, thousands of hours in front of the graph of a specific asset to maybe understand it and master it one day.

Trader Bao Tam: “Everything FTMO does now is fine.”

How has passing the FTMO Challenge and Verification changed your life?

Completing FTMO's challenging tests has helped me gain more confidence in my best friend's knowledge and skills.

Has your psychology ever affected your trading plan?

I think psychology determines 70% of a trader's success.

What was easier than expected during the FTMO Challenge or Verification?

I think all is well. Everything FTMO does now is fine.

What was the most difficult during your FTMO Challenge or Verification, and how did you overcome it?

I think the difficult thing in the FTMO Challenge process is round 1. If it is easy to pass, it will help traders have more confidence in their plans and skills, making it easier to pass round 2 (Verification).

What does your risk management plan look like?

My risk management plan is that when I first open a position, I will choose an open position so that the stop loss only accounts for a maximum of 5% of the account. With good positions at reversal points, I can confidently increase the loss to more than 5-10%, because at that time I will have more confidence in my decision to enter the order. And the expected profit taking level when entering an order will reach 10% or more of the account and gradually raise Stop Loss to entry.

One piece of advice for people starting the FTMO Challenge now.

I just want to advise new traders starting their FTMO Challenge that they should put risk management first before opening a trading position. This will help them manage their accounts more easily and not violate FTMO's Maximum Loss rules. And when they lose 2-3 orders in a row, they should stop, rest, and review their trading plan for the next waves.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.