How to eliminate the factor of luck in trading?

There is a certain degree of randomness in the financial markets. Not only because of the unexpected global events that can cause price spikes but also we as retail traders are usually the last ones who get the information. Although we like to think the market moved because of our great technical strategy which is, of course, better than everyone's else, this is very rarely true. In this article, we will take a look at how you can deal with this randomness and luck in trading.

How to eliminate the factor of luck in trading?

Every week on Wednesday, you can find new interviews with our new FTMO Traders on our Blog.

The question of "How to eliminate the factor of luck in trading?" is one of those we ask them frequently.

The answers they give are very similar to what we cover in this article. There are 3 major aspects you can tackle to eliminate luck in your trading.

Proper risk management

Risk management is the most important thing in trading.

Even though you can have a trading strategy that turns out profitable over the next 10, 50, 100 trades, you can never know the result of the next trade or series of trades.

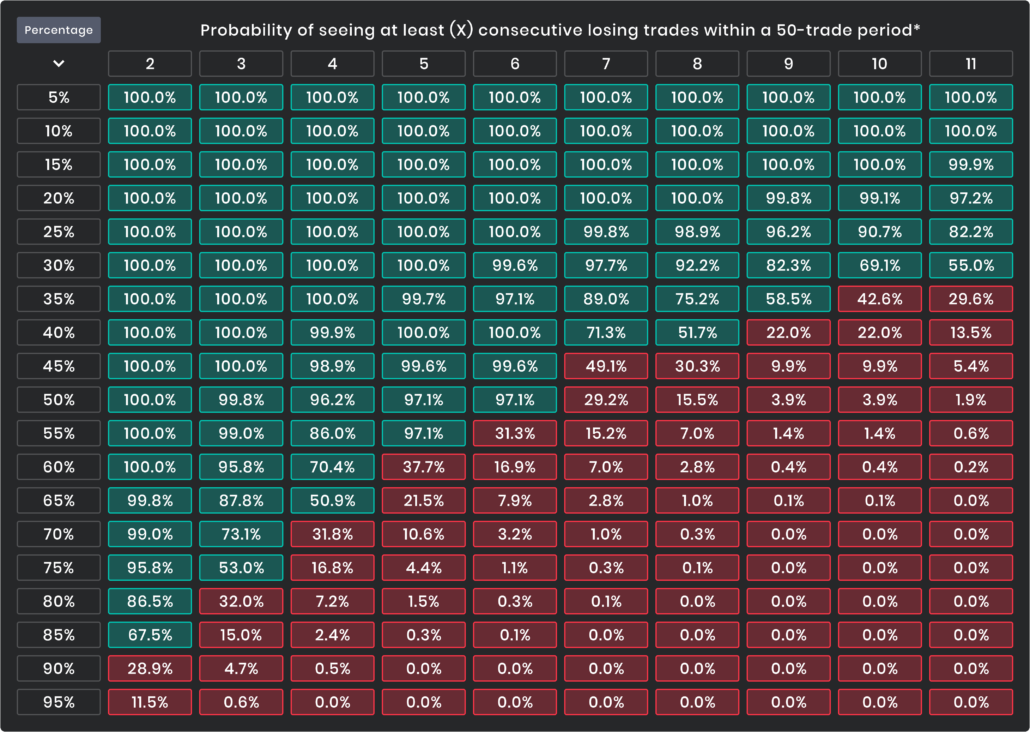

As you can see on the above table, if you have a trading strategy with a 60% probability win rate, there is still a 70% chance you will get four consecutive losses in a row.

But things can be even more drastic if you are the type of trader with a 40% win rate, there is over 50% chance that you will have 8 consecutive losers in a row.

Does that mean you are not profitable? Absolutely not!

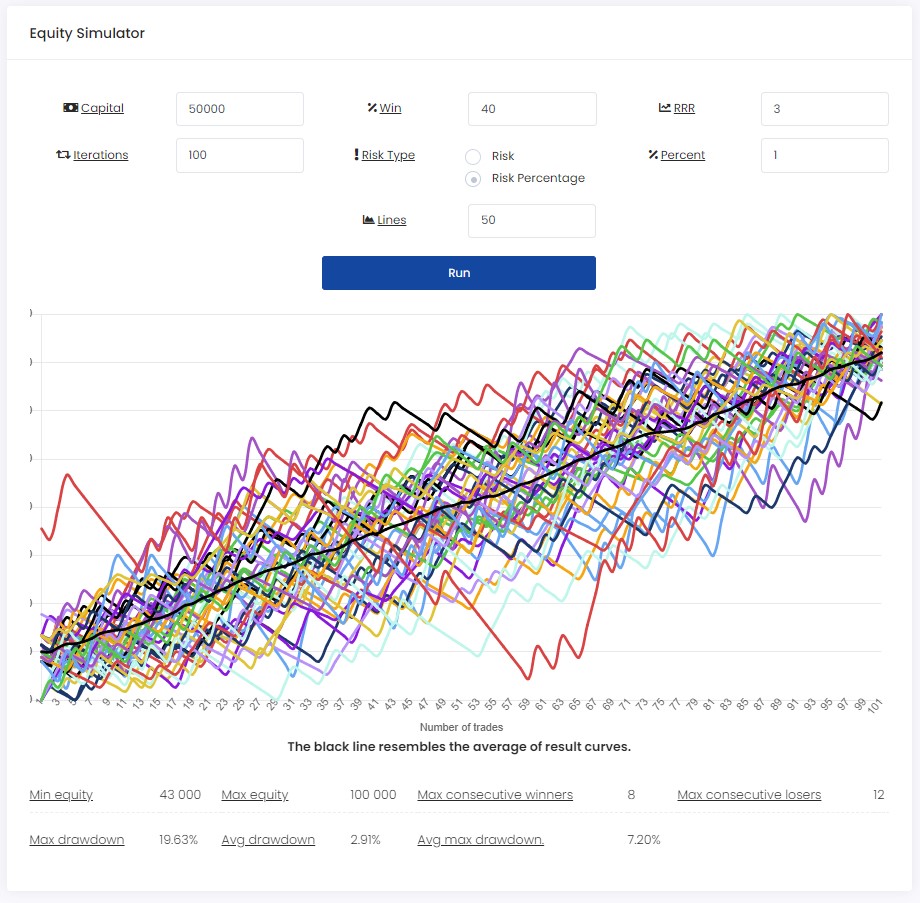

As you can see from our equity simulator, there is no single occasion from 50 different simulations that you would end up with a negative balance after 100 trades.

From all the projected simulations, the highest number of consecutive losses could be 12 and this brings an important question you should ask yourself, are you able to sustain 12 losses in a row?

This is something you have to take into consideration when you are building your trade plan.

It is not an easy process, but once you are done with it, you will know exactly what to expect from your trading strategy.

Dealing with unexpected global events

So now that you have a trading plan with proper risk management, you are covered for 99% of the time.

Unfortunately, in trading, there is this 1% where we as traders have absolutely no control over our trading process.

This is during both planned and unplanned macroeconomic releases which result in liquidity being pulled from orderbooks, so traders oftnen get executed at much worse prices than anticipated.

For events that are planned and known to have a significant market impact, the solution is very easy. You got to be are aware of key news releases such as FOMC, NFP, and others, ahead of time.

All you have to do is check out the economic calendar before each trading session and pull your orders ahead of time, or adjust your exit limits as needed.

This is why we at FTMO implemented the 2-minute restriction of trading before and after the news for FTMO Traders only.

This way we are able to protect our capital and help our FTMO Traders to have long-lasting trading careers with our proprietary trading firm.

If you decide not to trade around major macroeconomic releases, you might miss some volatile move here and there, but you will eliminate a large amount of randomness from your trading.

The last part of the randomness in trading comes in events that are not planned in advance and cause flash crashes in the market.

Unfortunately, there is no way to completely avoid these.

There are several flash crashes you can find in the charts, like this one from January 2019 which was caused by Apple's unexpected revenue loss estimates and outflow into less-risky assets.

Luckily they are not happening often and you can see these maybe once or twice a year and they often affect only a few assets.

Although during these events your stop-loss is very likely to get triggered at a much worse price than you anticipated, it is probably still much better compared to not having stop-loss in the first place.

In general, swing traders who use larger stop-losses are having less chance to experience any devastating damages to their account as they usually use wider stop-losses with smaller position sizes.

For daytraders and scalpers who use bigger sizes with tight stop-loss, these events can have a much worse impact.

Conclusion

Eliminating the factor of luck from trading is not an easy job but can be done.

Build a bulletproof trading plan with proper risk management rules and always expect the unexpected.

That way, you will be prepared for any situation market throws at you and you will be able to react with a calm head.

All information provided on this site is intended solely for the study purposes related to trading on financial markets and does not serve in any way as a specific investment recommendation, business recommendation, investment opportunity, analysis or similar general recommendation regarding the trading of investment instruments. The content, in its entirety or parts, is the sole opinion of FTMO and is intended for educational purposes only. The historical results and/or track record does not imply that the same progress is replicable and does not guarantee profits or future profitable trading records or any promises whatsoever. Trading in financial markets is a high-risk activity and it is advised not to risk more than one can afford to lose!

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.