Editorial note: All responses are 100% organic and received from our new FTMO Traders during the contract signing process. All responders agreed to have their feedback published and all their answers are not being edited by FTMO, hence they can include grammatical mistakes or typos.

It is normal to have some losses, trading is not only about wins

Although social media may try to say otherwise, trading is not only about winning trades. Losses and profits play equally important roles and as our FTMO Traders confirm, learning how to deal with losses can be one of the hardest things to attain. Find out more in the second Q&A of the year with traders who have managed to meet the FTMO Challenge and Verification requirements and are now managing their FTMO Accounts.

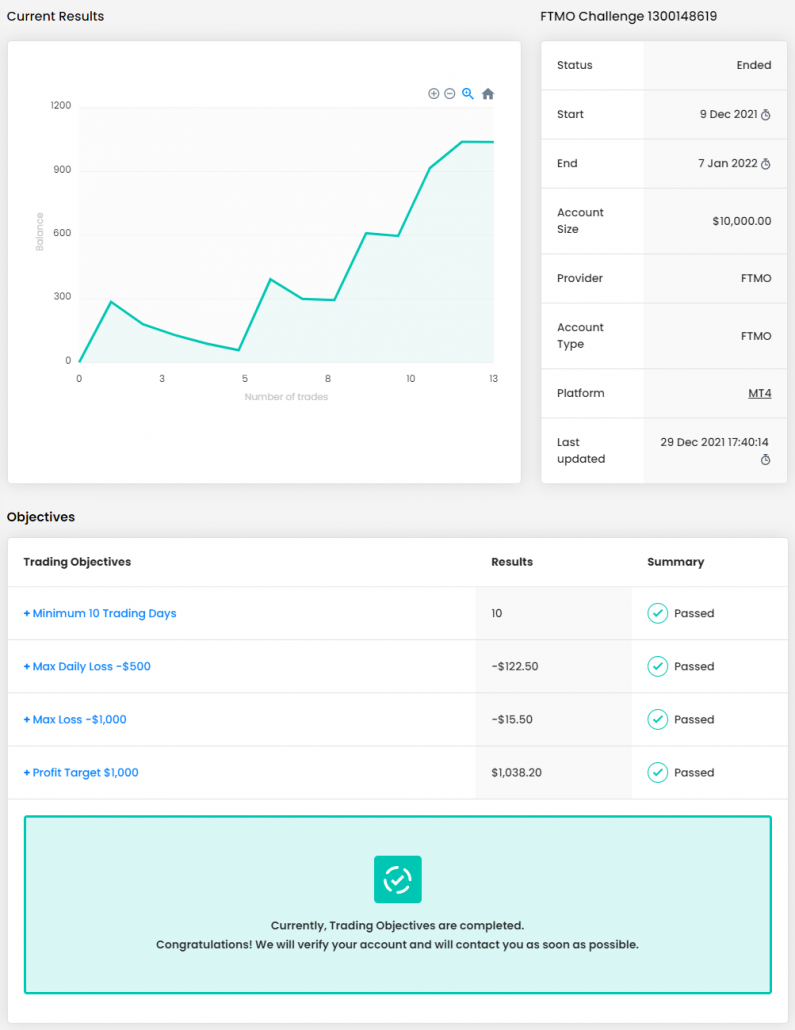

Trader Lia: “Practice your strategy as many times as necessary.”

How did loss limits affect your trading style?

They affected in a positive way because it is another reason why I have to respect my risk management. It helps me calculate how many trading opportunities I have so not to exceed that maximum loss.

What inspires you to pursue trading?

My family. I will soon be a mother and I want to give my daughter another lifestyle.

Describe your best trade.

I would say my best trade would be EURUSD in my stage 2. I had the trading plan ready in an hour I had identified a pattern of reversal and correlation in the currencies that indicated that the euro would be bearish in that session, so I was just waiting for my entry pattern in the one minute timeframe. After gathering a couple of confirmations and waiting for the entry pattern, everything went as expected. I felt more secure since the probabilities of winning the trade were very high then I close it a 1-5 RRR.

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

Regain confidence after making some mistakes in the past that cost me a couple of failed tests.

How did you eliminate the factor of luck in your trading?

Practicing my strategy and making sure it is a profitable strategy. Respecting my risk management since I consider that it is the most important thing to achieve profitability without expecting lucky breaks since that only leads to disaster.

What is the number one piece of advice you would give to a new trader?

Practice your strategy as many times as necessary, respect your risk management, and don't take advantage of anything in the world. Never give up those things that are really worth it take time, practice, practice and practice until you achieve it.

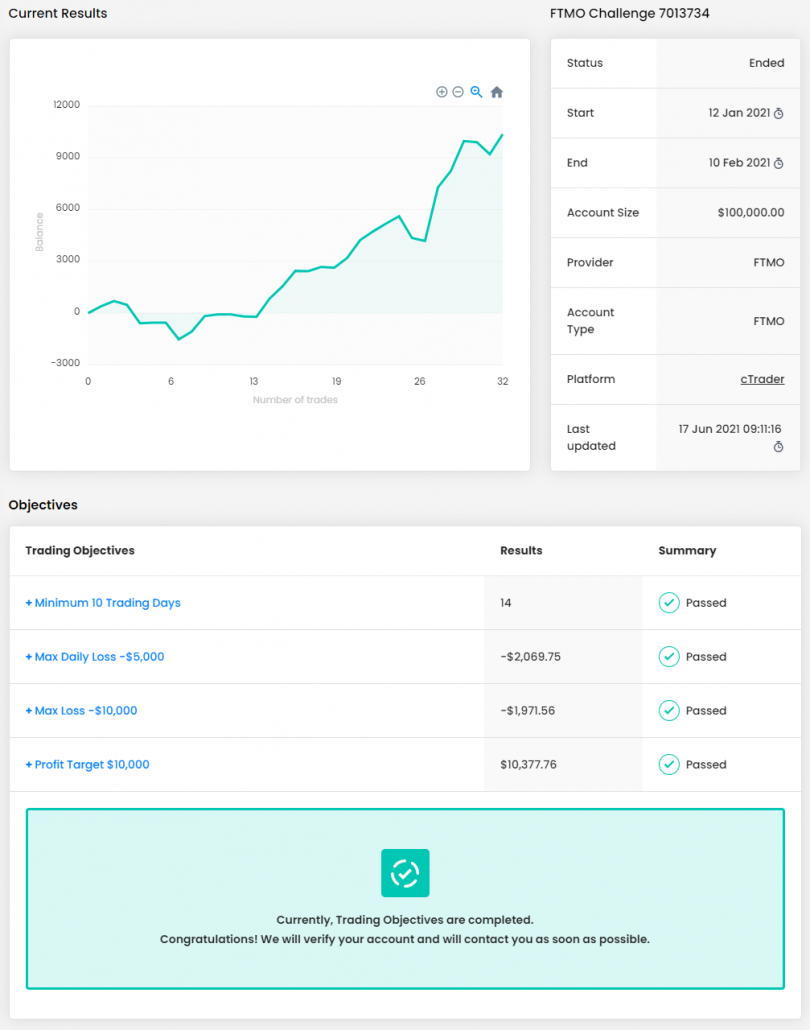

Trader Alessandro: “I always felt that I needed to have perfect trades in order to pass it, which isn't 100% true.”

How would you rate your experience with FTMO?

It has been a great journey working with FTMO, I was a bit confused with some settings and aspects of the different processes at the beginning, but everything turned out clearer with a bit of time, and the help of the support team always there for when you need it. I only once had a problem regarding the Account Metrix not showing the results correctly, but after contacting the support team, in just a day everything was solved, and I got the time that solving issue took back.

Do you plan to take another FTMO Challenge to manage even a larger account?

I am planning to try and get a couple more challenges done, before and during the summer, but I also want to take my time and see how I am doing with just one, it's better to never overdo things.

What was more difficult than expected during your FTMO Challenge or Verification?

Reaching the profit target, especially during the challenge, I always felt that I needed to have perfect trades in order to pass it, which isn't 100% true, I had a couple of losses, and it's always OK to have some, trading can't have only wins. It can be the hardest thing to accept, especially with limited time and objectives to respect, but it's doable.

Describe your best trade.

I don't really have one, every trade needs to respect my setup, what happens next is irrelevant if you have a profitable strategy. But if I had to decide which one is my best, it would be a NZDJPY buy. I like to leave runners after I secured profits when I think it's needed, what happens next depends by the direction of the trend, if you are going with it, you can ride the trade for quite some pips, which is exactly what happened with this particular one.

How did you eliminate the factor of luck in your trading?

I used to believe there's no luck involved in trading, and to some regards I still think so, but especially in this period, there are some unexpected news that can really move the market, and there's very little we can do to avoid them. But they are just a good reminder that having good risk management is crucial.

What would you like to say to other traders that are attempting to pass FTMO Challenge?

I wish everyone the best trades they can get, and to learn as much as possible from it. Keep it simple.

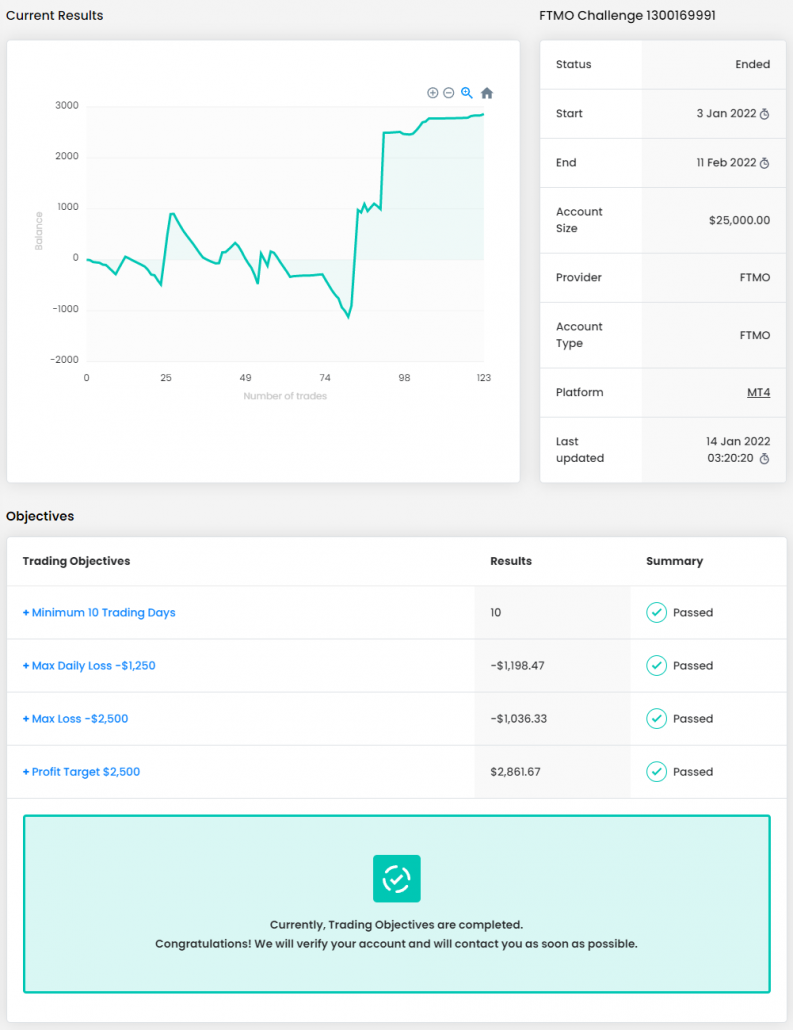

Trader Irene: “There is no point on regretting why your trade hits the SL”

Has your psychology ever affected your trading plan?

Of course, as a trader I will my up and down. During my first year of trader, I got around $60.000 in just 2 weekends (when covid has just started). The market was very bullish for gold, and I thought we should just buy and buy no matter what lot size to put in. But I didn’t know about selling it. Now when the price goes down around 300 pips my account is on MC because of my trading style in the older days (martingale) but lesson learnt.

How would you rate your experience with FTMO?

Before FTMO, I used one of the prop companies and I’m not going to mention the name for privacy reason. And compared to FTMO, I am far more impressed with standard that FTMO rules. I guess it’s quite straight forward since you just need to pay careful attention on the daily drawdown and maximum drawdown. Unlike the previous prop company that I joined, they calculated using the equity and I think it can be a bit biased. I would rate FTMO customer service 10/10 because it is so easy for me to chat when there’s some queries.

How did you eliminate the factor of luck in your trading?

Well first and foremost is you have to follow the trend. Keep on doing backtesting. And I did that for many years before being consistent. Feelings doesn’t always work in trading as many traders keep their SL 100 pips and that’s obviously massive. It should always be based on the right technical analysis. Before doing the real account, it is best to do the demo account.

Describe your best trade.

My best trade is when I encountered more than 500 pips with gold because of following a very high time frame setup (weekly and daily).

How did you manage your emotions when you were in a losing trade?

This again will come down to psychology of risk management and also emotions. I’ve had times when I am so eager to trade in the sideways and then once the SL hit, I trade again up to 2 times and that’s totally a big mistake. I learn that sideways is a form of compression that price is moving towards the nearest support and resistance (outside the sideways) 90% of the time. Another example is when I tried to trade on a pair that I’m not used to it which is BTC, the market was so sideways at that time and quite volatile that I ended up losing more that $1.000. However, I did a quick recovery with gold. With this I learnt that it is better to trade on a pair that you are used to it and avoid sideways market. To control my emotion, I will also close the chart for a while and then sleep or watch something. There is no point on regretting why your trade hits the SL. Just learn from it as there will be a better setup and each day might not be a profitable day

What would you like to say to other traders that are attempting to pass FTMO Challenge?

Don’t give up and don’t overtrade once you have hit the target. Don’t be too aggressive even if you join the aggressive account as risk management is still the key to maintain your account. Do finish the challenge smoothly, I would recommend people to do swing trades. Swing trades are the best.

Trader Raul: “Understand your self-destructing behavior, encourage it and use it as fuel to achieve your goals.”

How did loss limits affect your trading style?

It didn't necessarily affect it, it encouraged me to follow my risk management plan flawlessly.

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

Having the patience to wait for the good setups due to the time limit of the challenge. I overcame it by risking very little in the trades that I knew weren't the best ones and risking more (less than 1%) in the good setups.

What inspires you to pursue trading?

To have the freedom to create, travel and build the best performing trading fund in the industry.

Do you have a trading plan in place, and do you follow it strictly?

There is no trading without a plan. Yes, I follow it strictly.

What was the hardest obstacle on your trading journey?

Dealing with the "unknown": Will I ever be consistent? If 90% of traders lose money, how am I going to be any different? I dealt with it by not identifying with every negative thought that emerged while, before and after trading. Doubt in the skill is what kills a trader, confidence in your own ability creates consistency. How do you create confidence? Firstly, to be confident in your trading approach, you need to be confident in all the areas of your life. Muscle building was my way to become more confident as well as studying philosophy, history and psychology to have more clear ideas and to know myself deeply. Lastly, traditional psychology teaches you to overcome or avoid your negative thoughts and emotions. By suppressing them you feed them your energy, potentially making it worse for you to perform. Instead, understand your self-destructing behavior, encourage it, and use it as fuel to achieve your goals. It can be your best ally if you use it wisely.

What is the number one piece of advice you would give to a new trader?

Focus on the process (present), not the money (past and future). You will definitely face your own demons while trading. Use it as fuel not as your enemy. If you are scared it's a clear sign you are about to advance in your craft. If you are frustrated with your performance, use it to work smarter. Your own demons will try to lead you to instant gratification which causes overtrading, taking huge losses or not letting the winners run. If you focus on the present, you focus on the process. If you are overtrading or taking bad trades without risk management, you are living in the past or in the future (which creates frustration). The key is to train yourself to always stay present. When you are exercising your bicep, only center your attention there. Your mind will try to make you think about the homework you have tomorrow or your mistakes from the past. The thoughts will be there, but you don't have to identify with them, keep the attention in the bicep. The same thing applies to washing the kitchen or cleaning the garden. You can do this in any "insignificant" activity you do during your day. This training will make you a consistent trader if you really want it.

__________

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.