Introducing new FTMO Traders

We are here once again with the new portion of our FTMO Traders. How they passed the Challenge? What obstacles did they face? What do they recommend to those who are about to tackle the FTMO Challenge? All of this and more in our new article!

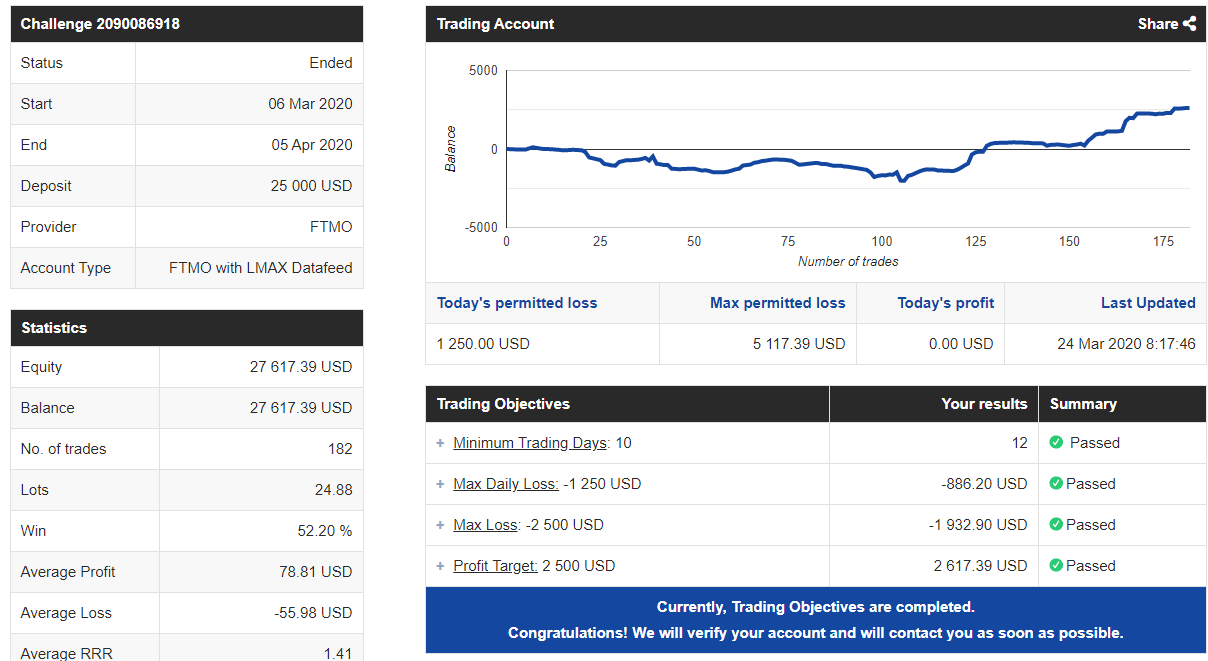

Trader Samuel sharing valuable advice for those starting the FTMO Challenge

What do you think is the key for long term success in trading?

You must operate having a trading plan which must be flexible with minimal modifications, respect the limits of losses that are established, the taking of benefits, have objective weekly and monthly goals, avoid operating when psychologically you are not prepared, greed and fear are two negative feelings that must be controlled, patience is a great ally to be successful in trading.

How does passing the Challenge and Verification changed your life?

I think I am facing a great opportunity for growth and financial freedom, the quality I want to make the most of, I am sure that this opportunity really changes my life.

Describe your best trade.

I think my best job was when I was able to control my emotions 100%, which is difficult, and I managed to leave my operation open until I reached the target price set, I was very pleased to be able to control patience, anxiety that is a great challenge in every operation.

Do you plan to take another FTMO Challenge to manage even bigger capital?

If that's the plan, get the $100,000 account, and if possible, get the maximum capital allowed by FTMO.

What was more difficult than expected during your Challenge or Verification?

Achieve maximum compliance with the daily loss limits established by FTMO, managing the appropriate lottery to achieve the objectives with the best risk management.

One piece of advice for people starting the Challenge now.

You must have a trading plan that must be respected to the maximum, establish daily and weekly objectives that are in harmony with the objectives established by FTMO, do not get carried away by fear and greed, respect the limits of losses drawn and profit objectives, The market always gives good opportunities for which you must be vigilant and patient to make the most of them.

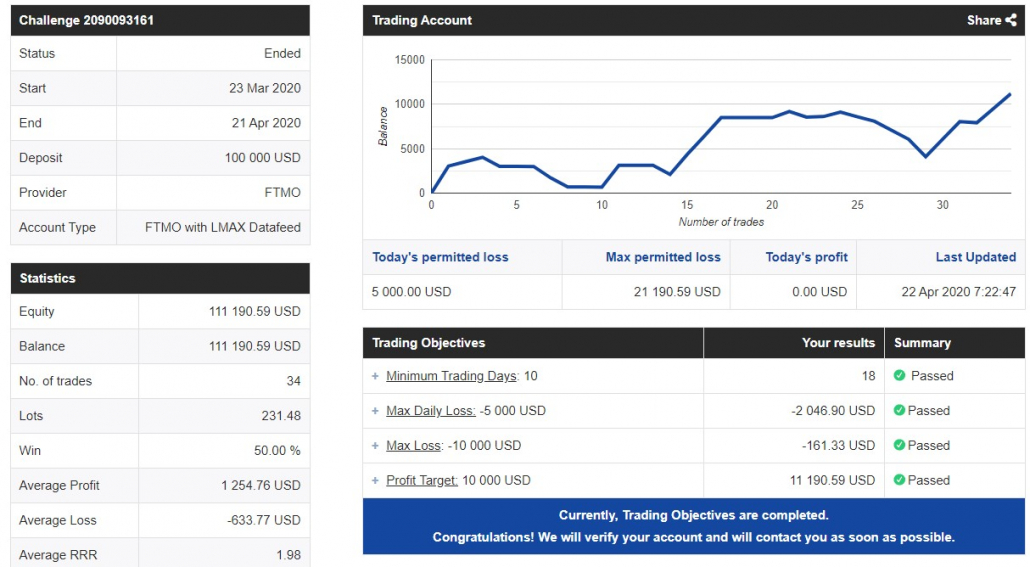

Trader Arnauld putting emphasis on patience and discipline during trading the Challenge

What was more difficult than expected during your Challenge or Verification?

The most difficult than expected during the challenge was the psychologic and my mental part of trading. I was so stressed and I didn't expect that, even though as an Air traffic controller I'm supposed to be familiar with stress but I think stress is something not easy to handle. Things didn't go well for me at the beginning of my Challenge so I had to be strong mentally in order not to make revenge trade and not oversize my positions to cover my losses. I knew that remaining disciplined was the key so I had to remain disciplined and focus in order to make it.

How did Maximum loss limits affect your trading style?

The maximum loss is really fair in my opinion, it was enough for me to trade safely especially as I always use 1% to 2% of my capital available to trade.

Describe your best trade.

My best trade occurred on the day I passed the 1st phase of the evaluation, I woke up that morning and I noticed EURJPY was on the corrective phase, I was able to get some profits before the correction the day before, as the correction was about to end, I was looking for a good entry with a tight stop loss so I could take good advantage from the impulse that was to follow. I finally got a nice entry as I wished with 7 pips stop loss and I was able to get a profit of 8% on that trade. That's how I was able to make it and pass the challenge for the verification phase.

What do you think is the most important characteristic/attribute to become a profitable trader?

To be a profitable trader, one should take into consideration patience and discipline, patience not to jump on any opportunity available without first checking if there is coming news that could severely impact the currency, and checking if the trade that looks like a great opportunity fits our criteria to enter a trade. The reason why we need to have a checklist to enter trades just as pilots use a checklist before starting up of taking off a plane. For Discipline, one should define the percentage he should risk for each trade.

Do you have a trading plan in place, and do you follow it strictly?

Yes, I have a trading plan that I do my best to follow strictly. And each time I have diverted from my following trading plan, I have paid a heavy price for that.

One piece of advice for people starting the Challenge now.

Never try to rush to achieve the objectives so fast, take your time. be disciplined, have a trading plan and a checklist to enter a trade, always risk a minimum fixed percentage of your capital no matter what.

Trader Odean from the United States

What was the hardest obstacle on your trading journey?

The hardest obstacle on my trading journey had to be the psychology aspect and keeping emotions under control. In trading, you have to learn to regulate your emotions after a win and after a loss. During my journey, it was tough at times because greed kicked in almost interfering with my plan but I stuck with my risk management and trading plan which got me to become a funded trader.

Do you plan to take another FTMO Challenge to manage even bigger capital?

Yes, I plan to take the FTMO Challenge two more times eventually, so I can trade with capital up to $300,000

What do you think is the key for long term success in trading?

I think the key to long-term trading is developing and following your trading system. Setting rules for yourself will prevent detrimental damage to your account, making the chances of blowing the account very slim. Also, setting realistic percentage-based goals, and looking towards the long run because it is not a get rich quick scheme.

How did you eliminate the factor of luck in your trading?

I eliminated the factor of luck in my trading by finding high-quality setups using multiple time frames integrating mainly my break and retest strategy with confluences to increase the probability. If I personally don't see enough to enter into the trade, I will not take it.

What was the most difficult during your Challenge or Verification and how did you overcome it?

I emphasize psychology a lot, it was the most difficult during my Challenge and Verification. There were times where losing trades caused emotions to try and compensate those losses without proper analysis. I overcame this by adjusting my rules specifically to cater to the parameters of the Challenge and Verification that will prevent emotional trading.

What would you like to say to other traders that are attempting the Challenge?

Stay within your trading plan, it is usually not the strategy that is the problem it is the discipline of the trader. Discipline yourself and create a set of rules and you will see how your trading will change.

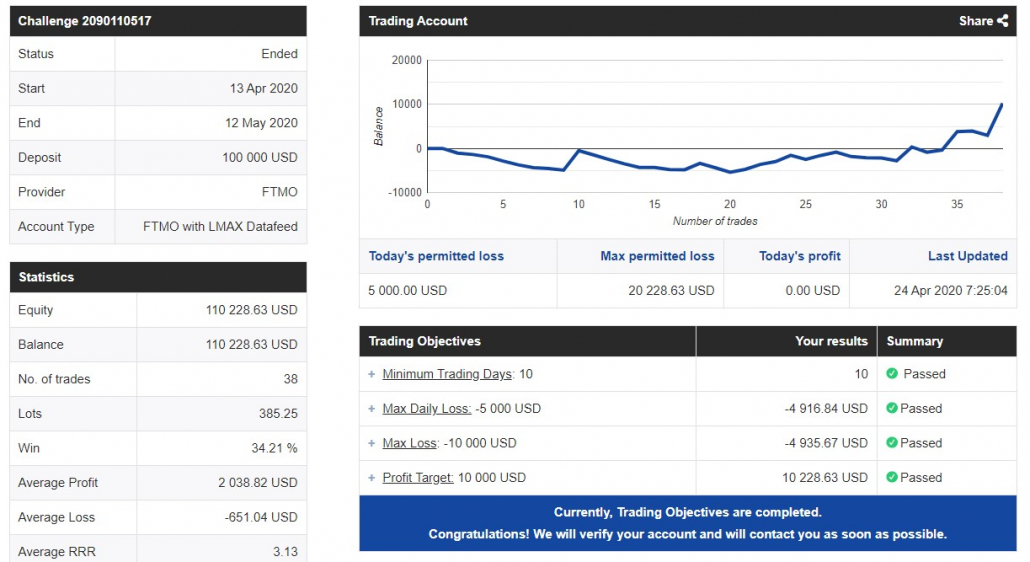

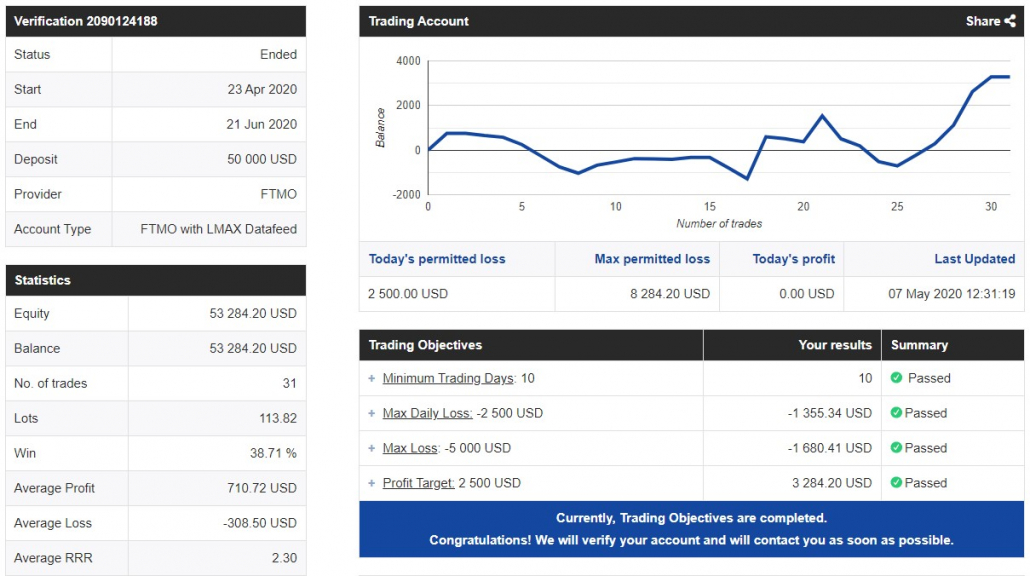

Trader Adam relies on his solid backtested strategy

How does passing the Challenge and Verification changed your life?

Passing both Challenge and Verification has changed my life in regard to being financially independent. This FTMO opportunity will help me support my family, how they have supported me and also build capital for future investments. The FTMO Challenge has helped me become structured and motivated.

What was more difficult than expected during your Challenge or Verification?

I had found the Challenge easy, as I had the time limit and I knew there was an element that If I didn't complete the Challenge in time but still remained in profit I would still be able to do a repeat. Whereas with the Challenge it was the final hurdle and a lot more was at stake though passing the Challenge in four days shows that the attaining of profit was never a problem.

How did Maximum loss limits affect your trading style?

The maximum loss does not affect my trading, as I trade by a particular set of rules that I would not allow myself to get to a position of a maximum loss limit. I have done before and instantly I regretted this and made changed to my approach.

How did you manage your emotions when you were in a losing trade?

After losing trade I see all areas of the market, to see if I went against the trend etc. If this is not the case then, I have full belief in the strategy I use and implement in my daily trading.

How did you eliminate the factor of luck in your trading?

I eliminate the chances of luck due to my strategy, I approach every trade with this same strategy and this has shown me that it is a profitable approach. Also, I backtest my strategy and the fact I only trade one pair and have both wins and losses shows there is no luck. It is just straight strategised approaches that I have taken. Which shows I am profitable as I only trade one pair so I know the patterns and behaviour of my pair.

What would you like to say to other traders that are attempting the Challenge?

To other traders currently undertaking the Challenge don't rush, and most importantly don't force any trades. You have a total of 90 days across both challenges, don't attempt to pass in the first day take it easy. Be disciplined as it won't be 90 days after you have passed, it will your source of income and it won't be targets for a Challenge that you have to meet it will be your personal targets. Good luck.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.